- within Immigration topic(s)

- within Immigration, Government, Public Sector and Strategy topic(s)

- in Turkey

Ukraine businesses express interest in moving their Headquarters to Cyprus, Some of them have presence in Cyprus while others show big interest to relocate their HeadQuarters and Families here.

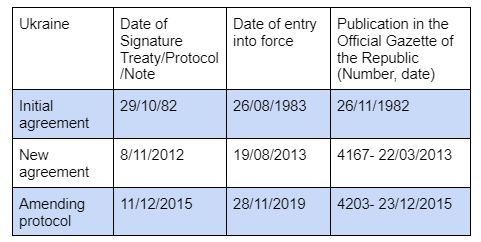

Cyprus earlier this year announced their action plan to attract International Business in Cyprus. However, the Cyprus plan didn't forecast the urgent need for Ukrainian companies to relocate. Ukraine and Cyprus have had a double tax treaty in place between Cyprus and the USSR since 1983. The last few days Ukraine Companies show big interest in relocating their HeadQuarters to the safest country in Europe.

In order for a Ukrainian company to relocate in Cyprus must meet the following criteria:

1. Company creation (company registration, name approval, registration in the Social

Insurance register, Registration in the VAT register and in the Income Tax)

2. Guidance for relevant permits for activation in Cyprus

3. Acceleration in the issuance and renewal of residence and employment permits

New Policy for employing 3rd Country Nationals:

Which Companies are Eligible?

1. Cyprus Companies owned by Ukranians

Companies of foreign interests /Ukrainian shareholders operating in the Republic of Cyprus or companies / companies of foreign interests that intend to operate in Cyprus with independent offices in Cyprus that are renting or acquiring here. Their office should be separated from their home.

Example:

a) An existing Ukrainian company will set up (easy and fast process) a Cyprus company, rent premises and relocate its employees to Cyprus. The company takes advantage of Cyprus' low corporation tax rate of 12.5% and Cyprus double tax treaty with Ukraine.

b) A Ukrainian headquarter relocates to Cyprus, rents premises and hires Ukrainian or local staff. The Ukrainian headquarter enjoys fully zero tax on dividend income from its associates (at Cyprus level) and takes advantage of Cyprus double tax treaty with Ukraine.

2. Cyprus shipping companies

Cyprus shipping companies enjoy additional tax benefits which can be provided on request.

3. Cypriot high technology / innovation companies

Cyprus technology and innovation companies enjoy additional tax benefits which can be provided upon request

4. Cypriot pharmaceutical companies or Cypriot companies their area of interest should be in genetics and biotechnology sectors.

Besides Tax and Legal Advance, what Else?

Cyprus has significant subsidies at local and EU level which aim to provide financial assistance to new or existing companies. Such subsidies could reach up to 300k per application and cover Company operational or infrastructure acquisitions and development.

Cyprus also offers subsidies for new hires making the payroll costs significantly lower especially for the first year of operations.

Subsidies and government funds are areas we specialize so feel free to contact us for further assistance.

More information can be obtained on this page of our website.

Family Unification of 3rd Country Nationals:

Family members of 3rd Country Nationals will be allowed to relocate together under one condition their salaries should be at least €2,500.

Ukrainian War Refugees that seek protection in Cyprus can also work here and benefit from the Tax System of Cyprus. Ukrainian's seeking a temporary home can benefit from the simplification of Category E work permit.

Digital Nomad Visa:

Cyprus introduced the Digital Nomad Visa, a new type of residence visa, which is also available to 3rd country nationals. In order to obtain the visa you need to be a self-employed or salary employee, working remotely with Clients / Employers outside Cyprus. It gives the right to stay in Cyprus up to one year, and with a possibility to renew this visa for two more years. Applicants can be accompanied by family members with a residence permit. The family members spouse should not take any economic activity. For Ukrainians you can check herewhat is the procedure to enter the island under the protection directive that Europe activated to help the war refugees.

More details on the new Visa Incentives can be found here.

In general all the procedures with the introduction of the Cyprus Strategy are simplified and most of them are digitalised. We anticipate that for Ukrainian Companies the Cyprus Government should implement more relaxing terms to encourage their relocation of their HeadQuarters in Cyprus.

Cyprus- Ukraine Double Tax Treaty:

The updated Double Tax Treaty (DTT) has been effective since January 1st, 2020. Ukraine and Cyprus DTT covers the following to the latest directive:

Withholding Tax :

- 5% Withholding Tax. The recipient of the dividend must be a company holding at least 20% of the share capital of the dividend paying company, and this recipient company has invested at least €100,000.

- 0% WHT on dividend payments to non-Cyprus tax residents.

Interest:

- 5% WHT.

- 0% WHT on interest payments to non-Cyprus tax residents.

Originally published 22 March, 2022

About Us

CYAUSE Audit Services has extensive experience in the insurance industry has helped tens of insurance brokers and agents register and get licensed by the local Cyprus regulator granting them passporting access to the rest of the European Union.

CYAUSE Audit Services is an Audit & Assurance firm with offices in Cyprus and the UAE. During 2015 we have been awarded by I.C.P.A.C and the A.C.C.A (local and international association of Chartered Certified Accountants) for the Quality of our Audit Services and our Office's Procedures.

Being a Truly International Audit & Assurance firm, we have associates from all over the world and we are constantly looking for new associates to expand our network further. At present, CYAUSE Audit Services operates internationally through its membership with BKR International amongst the largest American associations in the world, Accace Circle, a co-created business community of like-minded BPO providers and advisors who deliver outstanding services with elevated customer experience. Our network covers almost 40 jurisdictions with over 2,000 professionals, it supports more than 10,000 customers, mostly mid-size and international Fortune 500 companies from various sectors, and processes at least 170,000 payslips globally.

CYAUSE Audit Services Ltd is also a member of BKR International one of the biggest US Accounting Associations of the word and the 3E Accounting Network, an international accounting network which originates from Hong Kong and has more than 80 members from all over the world.

Learn More about Cyprus Corporate Environment

Information about CYAUSE Audit Services and the Cyprus Corporate & Tax System can be obtained from our Website or our YouTube channel which provides valuable information about the Corporate & Tax Environment of Cyprus.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.