Double taxation on royalty fees: customs vs tax authority

There are various types of non-trade outbound remittances with which multinational corporations lawfully retrieve profits from China subsidiaries to their overseas headquarters. The most frequent types of outbound payments are dividends, interests, service fees, and royalty fees – among which, royalty payments are relatively peculiar, as they are dually managed by the tax and customs authorities.

According to the General Administration of Customs in China (GACC) guidelines, royalties refer to fees paid by the buyer of imported goods holding a licence or transfer of patent, trademark, proprietary technology, copyright, distribution right or sales right from the intellectual property right holder and its effective authoriser. From a tax perspective, royalty fees refer to the payments due to the provision of licencing, technical know-how, trademarks, copyrights, etc.

The tax authorities are responsible for reviewing the authenticity and reasonableness of the transactions to determine whether the payments meet the standard of expense deduction before enterprise income tax (EIT). The fee payer, namely the Chinese subsidiary will act as the withholding agent and pay the withholding income tax and value added tax (VAT) on behalf of the foreign party.

*Foreign party refers to the intellectual property right holder and its effective authoriser of the right holder. It may be or may not be the direct supplier.

On the other hand, the GACC requires that the imported goods related to royalties payments shall be included in the imported goods price, and corresponding customs duties and import VAT shall be levied.

It is essential for international companies, especially trading companies, to understand the potential double taxation on royalty payments. This article highlights the risks of double taxation by illustrating a real-life example and provides solutions from the perspective of a corporate service provider.

Case study

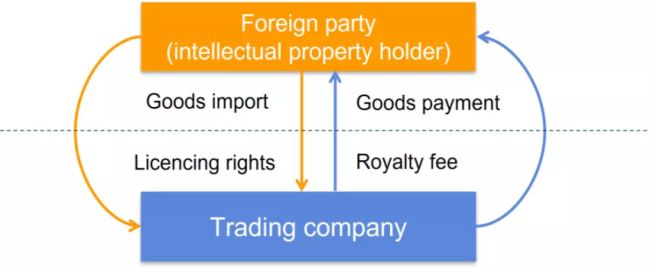

A trading company in China would like to import branded goods from an overseas supplier for domestic sales. The goods are labeled and sole licenced to the trading company for sales after customs declaration. In return, the trading company will remit a royalty fee to the overseas supplier.

The transaction cycle illustrates the taxation relationship between the supplier and the trading company. If the overseas credit of withholding tax and domestic deduction of VAT are disregarded, the tax authority and customs may levy the following taxes on the taxpayers.

| Royalty related to imported goods | ||

| Levying party | Customs | Tax authority |

| Taxpayer | Importer | Foreign Party |

| Tax types | Customs duty, import VAT | VAT, EIT |

Under most circumstances, enterprises would either pay customs duties and import VAT at customs for outbound remittances related to imported goods (trading) or general services (non-trade), or withhold VAT/EIT on behalf of the payee. Companies would not pay double tax to the customs and tax authority for the same taxable item.

Indeed the GACC and the fiscal authorities have different focuses and perspectives towards royalty:

- The GACC focuses on reviewing the royalty's relevance and sales conditions and matches the royalty with the import and export goods to determine whether the royalty generates tax payable.

- The tax authorities focus on the related party relationships, the royalty's natures and fee rates, and whether the remittance would cause an out leak of taxes.

In this specific case double taxation does indeed happen between the tax authority and customs. Customs collects taxes from the importer, whereas the tax authorities collect taxes from the foreign party. There seems to be no double taxation from the perspective of each taxpayer, however, the import of goods and non-trade outbound remittance are both related to royalty fees. Companies only need to pay taxes to either customs or the tax authority. For the outbound remittance of royalties, if both customs and the tax authority require companies to pay taxes, it is obvious that companies would bear more taxes than ordinary transactions, which constitutes double taxation.

How to mitigate risks of double taxation

The relationship between the supplier and the trading company is the key element. Under the related party relationship, the supplier would often export their goods at a lower price without royalty and try to minimise the customs duty and keep larger profit outbound. The trading company would later pay an appropriate percentage of royalty remittance to the supplier, which helps the group company benefit from maximised tax efficiency from an overall perspective.

Given the scrutiny environment of foreign exchange controls in China and the double taxation risks with the customs and tax authorities, the supplier is advised to include royalties in the imported goods and pay tax once, upon its arrival at customs, to ensure they receive the fair amount of return at once, instead of waiting for further remittance of the funds in the form of royalty fees.

In theory, if royalty related goods are taxed at customs during the importation, the tax authorities should not levy the same item again. In fact, such a situation may happen where royalty is remitted overseas and taxed by the tax authorities under a non-trade form, whereas the customs afterwards challenge the imported goods are royalty related and subject to custom duty adjustment. In this case, double taxation is likely to be incurred.

In summary, enterprises are suggested to:

- Recognise the essence of the transactions

- Understand the scope of royalties subject to customs duties

- Consider if royalties should be included in the goods price

- Check if your enterprise is involved in any process which may lead to a value added to the goods

- Clarify the main functions undertaken by each party in the development, promotion, maintenance and protection of intangible assets

- Reasonably apportion the total income and determine the taxable basis

- Assess the indirect tax impact which would probably be caused by the price components of goods and the corresponding royalty payment mode in advance to avoid double taxation

- Properly keep import transaction documents, contracts and other relevant materials in response to customs inspection, if any.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.