- within International Law topic(s)

- in European Union

- within International Law topic(s)

- in European Union

- in European Union

- in European Union

- in European Union

- within International Law, Strategy and Employment and HR topic(s)

- with readers working within the Media & Information and Retail & Leisure industries

China has tightened export controls on rare earths. In April 2025, China's Ministry of Commerce (MOFCOM) and General Administration of Customs (GACC) issued announcements to regulate 7 categories of medium and heavy rare earths (MHREs) by clarifying their control codes, HS codes and scope of control. On October 9, 2025, 5 additional MHRE elements were added to the control list—achieving full coverage of export controls for raw materials critical to military and semiconductor sectors.

Following this upgrade, the U.S. responded strongly: on October 10 (local time), U.S. President Trump stated on social media that the U.S. would significantly raise tariffs on Chinese goods (imposing a 100% tariff starting November) and introduce new export controls on key software.

This article addresses core questions for foreign businesses: How to understand China's rare earth export control system? How to comply with export rules? What penalties apply to illegal exports? It draws on recent policy developments and practical experience in handling smuggling cases.

I. China's Rare Earth Export Control Framework: How It Works

China has regulated rare earth exports through a clear legal system. The framework is supported by two core laws: the "Export Control Law" and the "Foreign Trade Law".

Under this framework, the "Regulations on the Export Control of Dual-Use Items" (the "Dual-Use Regulations") details licensing procedures, customs inspection requirements, and end-user/end-use management.

Key 2025 updates from official announcements include:

- Full coverage of MHREs: 7 MHRE categories (e.g., samarium, gadolinium, terbium) were controlled in April; 5 more (e.g., holmium, erbium, thulium) were added in October.

- Expanded scope: 26 types of equipment (e.g., centrifugal extraction machines for rare earth processing) and raw materials (e.g., rare earth ores) are now controlled.

- Extraterritorial jurisdiction (a key focus for foreign businesses): MOFCOM Announcement No. 61 (2025) for the first time applies the Dual-Use Regulations to foreign-produced items: Items made outside China that use Chinese-origin rare earths, or rare earth processing technologies, or foreign-produced items containing ≥0.1% (by value) of Chinese-origin rare earths.

- Additional controls apply to rare earth technologies. MOFCOM Announcement No. 62 (2025) further controls technologies for rare earth mining, smelting, and production line maintenance (Control Codes: 1E902.a and 1E902.b).

II. How Foreign Businesses Can Determine if Their Products Are Controlled

To check if a rare earth-containing product is controlled, refer to the "Catalogue of Dual-Use Items Subject to Export Control" and MOFCOM announcements. A key distinction for processed products:

- Controlled items: According to MOFCOM's FAQs on Dual-Use Items (Rare Earths) – No.4, primary processed products derived from three specific permanent magnet materials are subject to control. These materials include samarium-cobalt permanent magnets, neodymium-iron-boron permanent magnets containing terbium, and neodymium-iron-boron permanent magnets containing dysprosium. Examples of such primary processed products include sheets, tiles, rings, and related magnetic components, which may also be referred to by other names such as magnetic steel, magnetic rings, or magnets.

- Typically non-controlled items: Deeply processed products made from the above materials—such as electronic components (e.g., motors) or electronic products (e.g., speakers, headphones)—are generally not subject to export control, per the same MOFCOM FAQs.

It is important to note that MOFCOM's clarification on primary vs. deep processing currently only applies to the three permanent magnet materials mentioned above (not all rare earth-containing products). For other rare earth products, reference must also be made to Paragraph 1 of the "General Notes" in the Catalogue of Dual-Use Items Subject to Export Control, which specifies that the Catalogue covers: Items integrated into other products as key components, provided such components can be disassembled and repurposed.

In our view, this means: "Intermediate" products (e.g., magnetic sheets, rings, steel, or powder) formed by preliminary processing of rare earth metals or alloys are likely controlled. This is because these components can be disassembled, recycled, or repurposed—posing potential risks to China's oversight of the rare earth supply chain. By contrast, finished products (e.g., electronic components) where rare earths are fully integrated and cannot be disassembled or separated from the final product are usually not subject to special control. Such products typically no longer serve military or national defense-related purposes, which aligns with the intent of China's export control rules.

Practical advice: If unsure, consult MOFCOM or customs in advance.

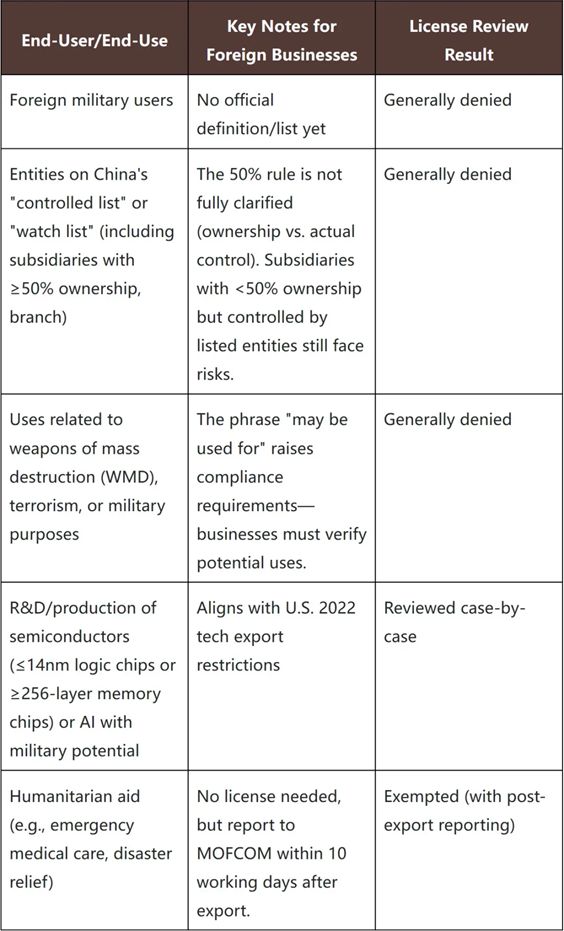

III. End-User and End-Use Approval Policies

When applying for an export license for controlled rare earths, foreign businesses must provide detailed end-user information (name, registered address, business scope, end-use). MOFCOM Announcement No. 61 (2025) sets clear review standards:

Foreign importers must provide an "End-User and End-Use Certificate", committing to:

- Use the items only for the declared purpose;

- Not transfer to third parties without Chinese government approval;

- For U.S. importers: Not provide the items to U.S. military users.

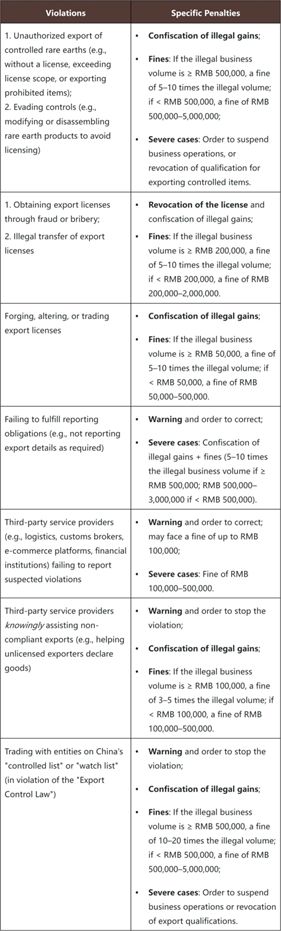

IV. Penalties for Non-Compliance

Non-compliance with China's rare earth export control rules may result in administrative penalties (fines, license revocation, etc.) or even criminal liability (imprisonment, fines), depending on the severity of the violation. Below is a detailed breakdown of common violations and corresponding penalties—critical for foreign businesses to assess risk exposure:

1. Administrative Penalties

Key violation scenarios and penalties are as follows:

Practical Enforcement Notes:

- For violations occurring after December 1, 2020 (when the "Export Control Law" took effect), Customs typically imposes penalties under the "Export Control Law" (e.g., Article 34 for unlicensed exports). In rare cases, the "Regulations on Customs Administrative Penalties" (Article 14) may apply.

- For violations before December 1, 2020, penalties are usually based on the "Regulations on Customs Administrative Penalties" (Article 15) (e.g., for misdeclaring product names/H.S. codes to avoid license checks).

- All violations will be recorded in the enterprise's credit file, which may affect future license applications or cross-border trade activities.

- Equipment for rare earth production and processing, rare earth raw materials and auxiliary materials, and relevant technologies, as defined in recent announcements, all fall under the category of controlled items under the "Export Control Law" and the "Regulations on the Export Control of Dual-Use Items". Activities such as the export, transfer, and provision of these items must strictly comply with the licensing management rules for dual-use items. Failure to obtain the required approval or non-compliance with the terms of the approval when conducting the aforementioned activities shall also result in corresponding legal liabilities.

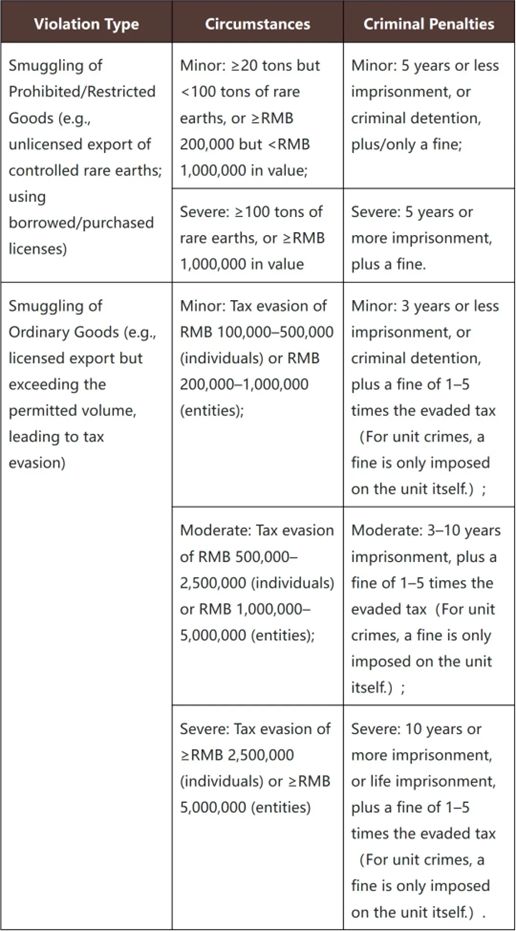

2. Criminal Penalties

Common smuggling tactics include:

- False declaration: Misclassifying rare earths as non-controlled goods (e.g., "pigments," "iron oxide," "magnesium powder") and exporting via mail/express;

- Concealment: Hiding rare earths in daily goods and exporting via consolidated sea shipments without proper declaration;

- Underreporting value: Understating the transaction price of rare earths subject to export tariffs (e.g., 20% tariff on antimony, tungsten) to evade taxes.

Criminal penalties are graded by the volume of rare earths or the amount of evaded taxes:

Key Legal Principle:

If an act constitutes both "smuggling of prohibited/restricted goods" and "smuggling of ordinary goods," the more severe charge will apply to determine liability.

V. Effective Defense Strategies for Alleged Export Control Violations/Smuggling of Rare Earths

Based on our team's case-handling experience, we have summarized the key focus areas and difficulties in dispute defense as follows:

1. Was the product controlled at the time of export?

If the Catalogue of Dual-Use Items Subject to Export Control and the License Management Catalogue, and relevant announcements in effect at the time of the export did not classify the alleged rare earths or related items as controlled, such items exported during that period shall not be counted as part of the alleged illegal goods.

When defending, clarify the regulatory provisions in force at the time of customs declaration and request the exclusion of items that do not align with these provisions.

Additionally, given the complex and varied in form of rare earths and related dual-use items, case-specific disputes in identification may arise. It is advisable to carefully review expert identification opinions; if there are doubts about such opinions, communicate fully with the case-handling authorities and apply for re-identification by a professional authentication institution.

2. Was there intent to violate rules?

In criminal cases, subjective intent is a necessary condition for convicting someone of rare earth smuggling. As such, the determination of subjective intent is often a core dispute between the prosecution and the defense. The authorities will presume subjective intent based on factors such as the actor's understanding of whether the goods required a license and their actual conduct.

When defending, key points to emphasize include: The actor's educational background, work experience, and whether they specialized in rare earth-related businesses; Whether the actor had the ability and means to verify the accuracy of the declaration information.

3. Accuracy of alleged volume/value:

Anti-smuggling authorities typically cross-verify documents from multiple involved parties (e.g., statements of account, payment records) with export declaration data, then compile a statistical table of the alleged goods for the parties to confirm and sign. Due to the large variety of items involved in practice, discrepancies may exist between records and physical goods. It is recommended to: check for duplicate entries or unmatchable records; promptly raise objections and request anti-smuggling authorities to re-review and adjust the table to avoid overcounting (which could lead to harsher penalties).

Conclusion

The upgraded rare earth control measures will take effect after the expected China-U.S. economic and trade negotiations, and uncertainties remain regarding the negotiation outcomes. Exporters should therefore promptly track updates to rare earth export control policies and regulatory requirements, establish or update internal item management lists based on their business's products, and ensure compliance with legal provisions in all aspects of export management to safeguard the legality of their export activities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.