- within Finance and Banking topic(s)

- in United States

- within Finance and Banking topic(s)

- in United States

- with readers working within the Securities & Investment industries

- within Finance and Banking, International Law and Corporate/Commercial Law topic(s)

On 6 January 2025, the National Financial Regulatory Administration ("NFRA") issued the Administrative Measures on Margin Requirements for Non-centrally Cleared Derivatives Transactions of Financial Institutions (hereinafter referred to as the "Measures"). This marks another key step in the regulation of the financial derivatives market in China, following the release of the PRC Futures and Derivatives Law on 1 August 2022. The Measures aim to effectively reduce counterparty credit risks in non-centrally cleared derivatives transactions of financial institutions, promote the sound development of the derivatives businesses of financial institutions, and enhance the internationalisation and specialisation of China's derivatives market.

The Measures introduce mandatory margin requirements for applicable non-centrally cleared derivative transactions in mainland China, including initial margin ("IM") and variation margin ("VM"), and set out certain exemptions. These requirements align closely with the international standards published by the Basel Committee on Banking Supervision and the International Organisation of Securities Commissions.

In this article, we outline the key takeaways of the Measures and discuss their potential implications.

1. In-Scope Entities and Transactions

In-Scope Entities

The Measures apply to banking financial institutions (including foreign-invested banks and domestic branches of foreign banks), insurance financial institutions and financial holding companies that are regulated by the NFRA, as well as the asset management products issued by the above financial institutions (collectively referred to as the "In-Scope Financial Institutions").

Notably, the Measures, issued by the NFRA, are intended to regulate the non-centrally cleared derivative transactions conducted by the financial institutions regulated by the NFRA. The entities regulated by the China Securities Regulatory Commission ("CSRC"), such as fund management companies, securities companies and futures companies, are not subject to the margin requirements under the Measures. However, if such CSRC regulated entities act as counterparties in the in-scope transactions as discussed below, they may still be impacted by the Measures. We also anticipate that CSRC (or self-regulatory organisations overseen by it) will issue margin rules applicable to the CSRC-regulated entities in the future.

In-Scope Transactions

The Measures will apply to non-centrally cleared derivatives transactions where one or both parties are In-Scope Financial Institutions. The types of transactions include but are not limited to, forwards, swaps, options, and the combinations of the above.

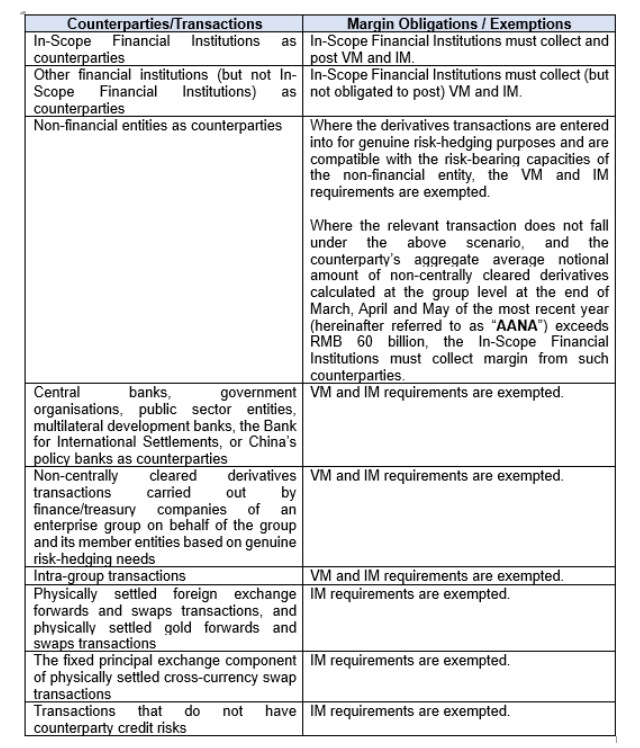

Post and/or Collect Margin Obligations & Exemptions

The Measures provide different margin requirements for different scenarios depending on the counterparties and transaction types.

2. Margin Requirements

Internal Control

According to the Measures, the board of directors of the In-Scope Financial Institutions shall be ultimately responsible for margin management in respect of the non-centrally cleared derivatives transactions. The senior management shall be responsible for formulating and implementing margin management policies and procedures. The In-Scope Financial Institutions shall also incorporate margin management into their overall risk management systems to ensure consistency with group risk appetite and capital management requirements.

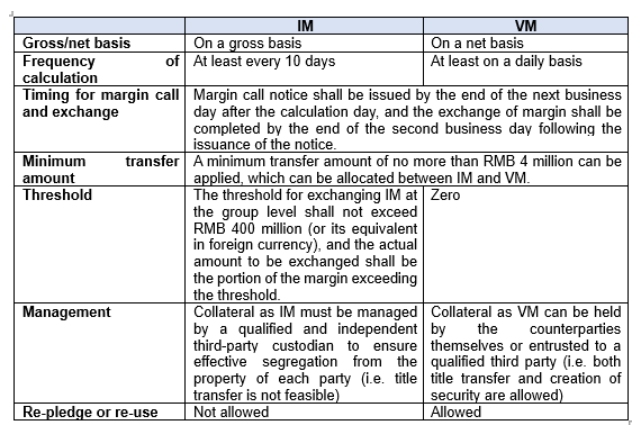

Initial Margin and Variation Margin

IM is used to mitigate against potential risk exposure of the In-Scope Financial Institution following the default of such counterparty in a derivatives transaction, while VM is used to mitigate the current risk exposure associated with the daily mark-to-market value of the netting set of existing derivatives transactions.

The key requirements for IM and VM under the Measures are summarised as follows:

3. Eligible Collateral and Haircut

Eligible collateral used as margin should be highly liquid and provide sufficient risk mitigation to protect both parties to the transaction from losses arising from counterparty defaults, and be able to hold their value in market stress scenarios after applying a haircut factor.

Eligible collateral recognised by the Measures includes: (1) cash; (2) government bonds issued by China's Ministry of Finance, bills issued by the People's Bank of China, and bonds and bills issued by China's policy banks; (3) bonds issued by China's provincial people's governments (including autonomous regions and direct-administered municipalities) and cities under separate state planning; (4) high-quality bonds issued by other national or regional governments and their central banks, sovereign-equivalent public sector entities, the Bank for International Settlements, the International Monetary Fund, the European Central Bank, the European Union, the European Stability Mechanism and the European Financial Stability Mechanism, and multilateral development banks; (5) high-quality corporate credit bonds; (6) high-quality financial bonds; (7) gold; (8) other eligible collateral recognised by the NFRA.

In determining the haircut factor of collateral, the In-Scope Financial Institutions may use the Standardised Haircut Schedule provided by the Measures, or an internal or third-party model. Where an internal or third-party model is used, it shall be subject to prior inspection of the NFRA. Besides, the In-Scope Financial Institutions shall apply a uniform method for calculating haircut factors for collateral of the same asset class. In-Scope Financial Institutions are also required to take measures to address foreign exchange risk, concentration risk and wrong-way risk associated with collateral, and the Measures elaborates on each of these scenarios.

4. Dispute Resolution

The parties to a transaction shall agree in advance on a dispute resolution procedure for margin disputes and the threshold value for triggering disputes. Disputes can be resolved by the parties themselves or through a qualified third-party platform. In the event of a margin dispute, the parties shall still complete the exchange of the undisputed portion of the margin within the originally agreed timeframe.

Furthermore, the In-Scope Financial Institutions shall record the duration of margin disputes, the counterparties and the disputed amount. If a margin dispute with a single counterparty cannot be resolved for more than 15 business days, and the disputed amount exceeds RMB 100 million, the reporting approach shall be clarified through internal management rules.

5. Cross-border Transactions

According to the Measures, in cross-border non-centrally cleared derivatives transactions, if an In-Scope Financial Institution needs to satisfy the margin requirements of a foreign jurisdiction, it may choose to apply the margin requirements of that foreign jurisdiction, provided that: (1) such margin requirements are consistent with the Basel margin requirements, and (2) such margin requirements are equivalent to, or are more prudent than, the Measures.

A foreign branch of an In-Scope Financial Institution conducting non-centrally cleared derivatives transactions may apply the margin requirements of the country where the branch is based.

However, if a netting agreement or collateral agreement is not legally enforceable in the jurisdiction of the foreign counterparty, the In-Scope Financial Institution could choose not to exchange margin with counterparties in that jurisdiction. The outstanding notional amount of derivatives transactions without exchange of margin between the In-Scope Financial Institution's group and counterparties from such jurisdiction shall, in principle, not exceed 2.5% of the total outstanding notional amount of derivatives transactions carried out by the In-Scope Financial Institution's group.

Additionally, foreign institutions conducting non-centrally cleared derivatives transactions directly in the China domestic financial market shall also comply with the relevant requirements for onshore transactions.

6. Effective Dates of Margin Requirements

The Measures are not effective immediately from the date of issue, a transitional period has been given.

While the Measures will be generally in force from 1 January 2026, the VM requirements will be effective from 1 September 2026 onwards, and the IM requirements will be implemented in three phases depending on the AANA of the In-Scope Financial Institutions and their counterparties:

- For those where the AANA exceeds RMB 500 billion, the IM requirements will be implemented from 1 September 2027;

- For those where the AANA exceeds RMB 300 billion, the IM requirements will be implemented from 1 September 2028; and

- For those where the AANA exceeds RMB 60 billion, the IM requirements will be implemented from 1 September 2029.

The IM and VM requirements apply to new derivative transactions after implementation of respective requirements. Existing non-centrally cleared derivatives transactions, their confirmations and immaterial amendments to existing non-centrally cleared derivatives transactions are not regarded as new transactions. Material amendments to non-centrally cleared derivatives transactions or amendments intending to extend the term of the existing transactions to circumvent margin management shall be regarded as new transactions. However, the current Measures do not specify what will constitute a "material amendment".

7. Implications

To comply with the requirements under the Measures, both the In-Scope Financial Institutions and the relevant counterparties must have a clear understanding of the margin requirements. It is expected that the In-Scope Financial Institutions will also need to: (i) formulate relevant margin policies and procedures in accordance with the Measures; (ii) prepare/review/negotiate various IM and VM documents; (iii) be prepared for the custody arrangements for IM. The relevant industry associations, such as NAFMII and ISDA, are in the process of preparing standard VM and IM documents to align with the requirements outlined in the Measures. The publication of such documents would help streamline the implementation process and provide a unified approach for In-Scope Financial Institutions and their counterparties to meet the regulatory expectations.

8. Conclusion

In conclusion, the issuance of the Measures represents a significant progress in strengthening the regulatory framework for non-centrally cleared derivatives transactions in China. By addressing key aspects mentioned above, the Measures align with international standards while tailoring to the specific needs of the Chinese financial market. With the gradual implementation of the Measures, it will be critical for market participants to ensure full compliance and actively engage in the transition.

Originally published 17 January 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.