- within Finance and Banking topic(s)

- in United States

- within Finance and Banking topic(s)

- in United States

- with readers working within the Media & Information industries

- within Finance and Banking, Insurance and Corporate/Commercial Law topic(s)

2023 REGULATORY MAINLINE REVIEW

1. Significant regulatory breakthroughs in peak carbon and carbon neutrality; interplay of legislative initiatives and changes respond to market needs

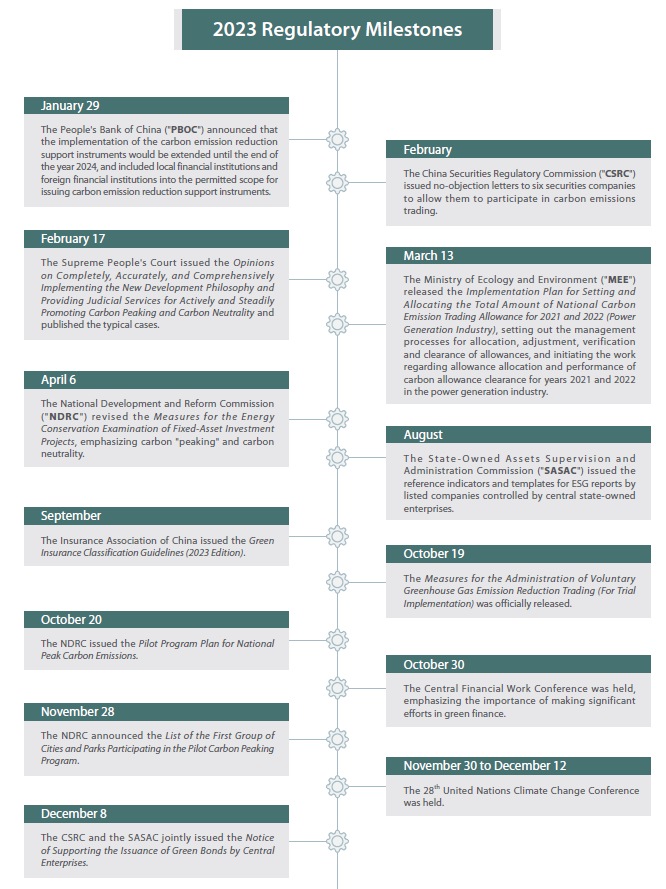

In 2023, a number of regulations, documents or consultation drafts in relation to climate change and "Carbon Peaking and Carbon Neutrality" were introduced to provide legislative support for sustainable development. The measures taken were:

- firstly, the legislative hierarchy has been improved. After continuous refinement of the draft in 2023, the Interim Regulation on the Administration of Carbon Emission Trading was formally adopted at the executive meeting of the State Council on January 5, 2024. This is the first domestic administrative regulation for administration of carbon emission trading and addresses the issues that had arisen from existing regulations and rules for carbon emissions trading (i.e. the goals of regulating trading activities, guaranteeing trading data quality and punishing illegal behaviors were only somewhat erratically supervised by the relatively low-level (i.e. not central level) legislative hierarchy of such existing regulations and rules).

- secondly, on October 19, 2023, the long-awaited Measures for the Administration of Voluntary Greenhouse Gas Emission Reduction Trading (For Trial Implementation) (the "New CCER Regulation") was officially released, as the basis and guideline for the systems of the restarted national greenhouse gas voluntary emissions reduction trading market (the "CCER Market").

- thirdly, in April 2023, the NDRC revised the Measures for the Energy Conservation Examination of Fixed-Asset Investment Projects, emphasizing the integration of energy conservation with the goal of "Carbon Peaking and Carbon Neutrality"; on March 16, 2023, the NDRC issued a consultation draft of the revised Guiding Catalog of Green Industries, which is expected to be formally promulgated and implemented in 2024; moreover, the NDRC issued a revised version of the Catalogue for Guiding Industry Restructuring at the end of 2023, which became effective on February 1, 2024 and emphasized the energy saving, carbon emission reduction and green transition.

The promulgation or update of the foregoing regulations and documents not only responds to the development and practice of the goal of "Carbon Peaking and Carbon Neutrality", but also provides strong support for achievement of such goal.

According to the legislative plan released by the Standing Committee of the 14th National People's Congress in September 2023, the legislation with aims of addressing climate change and achieving Carbon Peaking and Carbon Neutrality is still considered as a legislative project which lacks certain legislative conditions and requires further research. Therefore, the enactment of laws to be promulgated by the National People's Congress such as Climate Change Law, Carbon Emission Reduction Law or Carbon Financial Inclusion Law may take more time; while the revisions to be made on some other laws such as the Energy Law, the Renewable Energy Law, and the Marine Environmental Protection Law have been put on the agenda, with the expectation of incorporating the applicable contents to address climate change and ensure the realization of the goal of "Carbon Peaking and Carbon Neutrality".

2. "1+N" Policy Framework Upgraded; Transition Finance and Inclusive Carbon Financeng

The policies and guidelines issued by applicable authorities and central and local governments remain as the important tools for addressing climate change and achieving the goal of "Carbon Peaking and Carbon Neutrality".

In 2023, under the established "1+N" policy framework for Carbon Peaking and Carbon Neutrality, the supporting policies were further refined by the appropriate regulatory authorities :

- following the promulgation of provincial-level implementation plans for Carbon Peaking in many provinces in 2022, some sector-specific Carbon Peaking implementation plans were further introduced in 2023 in some provinces/municipalities (e.g. those issued in Hebei, Inner Mongolia, Zhejiang, Fujian, Chongqing, Tibet, Shaanxi and Qinghai, and the Carbon Peaking implementation plans for the urban-and-rural construction sector issued in Hebei, Shanxi, Jiangsu, Fujian, Shandong, Henan, Hubei, Hunan, Chongqing, Guizhou, Qinghai and Xinjiang);

- at the end of October, the NDRC issued the Pilot Program Plan for National Peak Carbon Emissions, proposing that "financial institutions shall be encouraged to support the construction of cities and industrial parks implementing the peak carbon dioxide emissions pilot program, comprehensively use financial tools such as green credit, green bonds and green funds, and increase support for relevant green and low-carbon projects in a market-oriented manner", and also announced the list of first group of national "carbon peaking" pilots at the end of November;

- on December 8, the CSRC and the SASAC jointly issued the Notice of Supporting the Issuance of Green Bonds by Central Enterprises, guiding and supporting the central enterprises to raise funds through the green bonds market, and boosting the development of the green industry.

Climate finance is an important policy instrument in achieving the goal of "Carbon Peaking and Carbon Neutrality". After the jointly announced list of climate finance pilots (i.e. a total of 23 approved pilot cities/areas) by MEE and eight other applicable authorities in August 2022, these pilot cities/areas have issued a series of policies to promote the implementation of the pilot programs, the majority of which have already established the climate finance project databases and platforms to match governments, banks and enterprises in 2023. Certain pilots such as Nansha District in Guangzhou, have put in place specific and quantitative financial incentive policies for enterprises, projects and talented persons.

In addition to climate finance, the promulgation of G20 Transition Finance Framework issued in the end of 2022, which was led by the PBOC (as one of the co-chairs of the G20 Sustainable Finance Working Group), marks the first international consensus reached between major countries on the development of transition finance. In March 2023, the government work report of the 14th National People's Congress emphasized the importance of the role of finance in bringing about green transition. At the end of March, the vice-governor of the PBOC was also quoted as saying that the PBOC would actively promote the promulgation and implementation of transition finance standards as soon as practicable. The PBOC has taken the lead in drafting transition finance standards for four industries (i.e. the industries of coal and electricity, iron and steel, building materials and agriculture) and would publish consultation drafts in due course. The finance work plans and green finance policies by local regulatory authorities also mentioned the promotion of the linkage between green finance and transition finance. As for the market practice, the Bank of China issued the first steel transition finance bond (the first in the world) on October 12 with all the funds raised being used to support the green transition projects of the iron and steel industry in Hebei province.

In 2023, the local governments actively explored policies of carbon financial inclusion. For example:

- the Key Tasks List for the 2023 Municipal Government Work Report of Beijing proposed improving incentives for carbon financial inclusion and incorporating low-carbon travel scenarios such as replacing fuel-powered motor vehicles with electric ones into the scope of carbon financial inclusion incentives;

- several work plans (or drafts) to create a carbon financial inclusion system were published in some provinces, such as Shandong and Anhui, proposing the establishment of personal carbon accounts and offset channels for certified emission reduction of carbon financial inclusion, the formation of expert committees for carbon financial inclusion, and the development of appropriate institutional standards and methodologies;

- the authorities in Hainan and Guangzhou issued implementation/administration measures on carbon financial inclusion;

- the Cooperation Framework Agreement for the Construction of the Carbon Financial Inclusion Platform in the Greater Bay Area was entered into by two organizations in Guangdong Province and the Macau Special Administrative Region, aiming to cooperate in the exploration of carbon financial inclusion;

- the Shanghai Municipal Bureau of Ecology and Environment issued the Administration Measures for Carbon Financial Inclusion in Shanghai Municipality (for Trial Implementation) in November, and also published a series of ancillary guidelines such as the development and application guidelines for methodologies, and carbon financial inclusion projects and carbon emission reduction scenarios, as well as the guidelines on the use of carbon financial inclusion credits. These efforts have laid the foundation for establishing a local carbon financial inclusion system.

3. New Green Finance Policies Open Up to New Participants and Products

In 2023, more regulations and policies related to green finance were implemented:

- with the expiration of the one-year transition period in May 2023 as provided in the Guidelines on Green Finance for the Banking Industry and the Insurance Industry, the banking and insurance institutions have set up and refined their internal green finance-related management systems and processes;

- in September, the Insurance Association of China issued the Green Insurance Classification Guidelines (2023 Edition), which provides self-regulation in three aspects: green insurance products; green investment of insurance funds; and green operation of insurance companies;

- The central and local regulators issued policies to encourage and support the local development of green finance and carbon finance. For example, (i) the former CBIRC, the CSRC and the State Administration of Foreign Exchange ("SAFE") and some other authorities, together with the Guangdong Province Government, jointly issued the policy to support the development of green finance in Guangdong-Macao In-Depth Cooperation Zone in Hengqin and Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone and strengthen the green finance cooperation in the GBA; (ii) the financial regulators in a number of provinces/municipalities such as Shanghai, Beijing, Tianjin, and Hebei introduced policies to actively promote the healthy development of the local green finance market; and (iii) the Shandong Province Government launched a three-year action plan to promote the development of carbon finance.

It is expected that the green finance related regulations will be further revised and refined under the existing institutional framework in the coming period.

With the ongoing development of the domestic sustainable finance market, the policies have become increasingly open to attract various types of market participants to participate in sustainable finance. For example, at the end of January 2023, the PBOC not only decided to extend the effective period for the implementation of the carbon emission reduction support instruments to the end of 2024, but also extended the scope of institutions permitted to issue such instruments to include local financial institutions and foreign financial institutions, as well as national financial institutions, aiming at encouraging more financial institutions to participate in the financing of such areas as clean energy, energy conservation and environmental protection, and carbon emission reduction technologies by using monetary policy tools.

In terms of the carbon market, in February 2023, six securities company announced that they had received no-objection letters from the CSRC to allow them to participate on their own account in carbon emissions trading. To date, eight securities company have successfully obtained such official no-objection letters and are permitted to carry out proprietary trading in the carbon emissions trading market.

While the market for single green-themed financial products has become more mature, there is more activity when it comes to exploring new products which combine greenness with something else. For example, the first domestic green and energy supply dual-themed asset-backed security ("ABS") was issued in April 2023, followed by the issuance of the first domestic green and low-carbon transition-linked ABS in June. Green financial products have also been developed to cover sectors such as rural revitalization: for example, in March, the Agricultural Bank of China took the lead in underwriting the first domestic carbon emission right asset-backed bond with four themes (i.e. carbon neutrality, carbon assets, rural revitalization and old revolutionary base areas). Currently, innovations in the green finance market are still mainly about investments, i.e., incorporating green investment targets and sustainable elements such as green and/or low-carbon performance indicators into more traditional and mature transaction and product structures. We expect that innovations in product structures will gradually emerge as the market deepens its understanding of green finance in the future.

4. Carbon Quotas: Stable Nationwide Market with Continued Regional Growth

In terms of the "top-level" legal framework, the Interim Regulation on the Administration of Carbon Emission Trading ("Interim Regulation") was formally adopted at the executive meeting of the State Council on January 5, 2024, laying out the basis of the institutional framework for administration of the carbon emission trading in the mandatory National Carbon Market. The Interim Regulation clarified the trading system of the national carbon market for the first time in the form of the administrative regulation. This addresses defects in the existing regulations and rules (such as the Measures for the Administration of Carbon Emissions Trading (for Trial Implementation)) but also coordinates the efforts of multiple applicable authorities (including ecological and environmental departments) to promote the development of the trading and management of carbon emissions trading. Another highlight of the Interim Regulation is that compared with the existing regulations, it strengthens the processes for punishing those acting illegally (such as falsifying carbon emission data) in order to safeguard quality of carbon emission data.

The second performance period of the national carbon emissions trading market (the "National Carbon Market") has finished. On July 17, the General Office of the MEE issued the Notice on the Work Related to the Clearance of Carbon Emission Allowances for the Years 2021 and 2022 in the National Carbon Market, according to which the second performance period of the National Carbon Market was two years (i.e. the relevant key emission entities were required to complete the settlement and clearance of carbon emission allowance allocated respectively for the years of 2021 and 2022 before December 31, 2023). The policies for the second performance period will introduce differentiated allowance allocation and performance and also introduces flexibility when it comes to allocations of carbon emission allowances, to make adjustments for those with allocation shortfalls or facing clearance difficulties.

Regional carbon markets continued to play a role in 2023. Some regional carbon markets have made significant adjustments, for example lowering the entry threshold for market participants, expanding the scope of industries affected and introducing innovative products. The current version of the Interim Regulation does not require existing regional carbon markets to be incorporated into the National Carbon Market. These regional carbon markets must be aligned with the Interim Regulation. Although regional carbon markets will gradually be phased out as the national carbon market takes over, they can still serve as useful policy testing grounds.

5. Voluntary Carbon Market: CCER Market Relaunched with Regulatory Framework Beginning to Take Shape

The voluntary greenhouse gas emission reduction trading market ("CCER Market") and the National Carbon Market complement each other. Together, they are the two basic pillars of the carbon market in China. On October 19, 2023, the long-awaited New CCER Regulation was formally released, serving as the foundation and guidance for the regulatory framework of the relaunched CCER Market. Based on that, the applicable regulatory authorities issued ancillary rules (such as the four methodologies for CCER projects in the categories of forestation carbon sinks, mangrove vegetation, grid-connected solar thermal power generation, and grid-connected offshore wind power generation; the guidelines for the design and implementation of CCER projects; the registration and trading settlement rules for CCER projects; and the implementation rules of approval and carbon emission reduction verification of CCER projects). All of this means that the preliminary regulatory framework of the national CCER Market has been set up.

Benefiting from the relaunch of the CCER Market, loan products linked to the registration or development progress of CCER projects have emerged. The Industrial Bank issued the first loan product linked to approval and verification of CCER projects. So far as the carbon sink market is concerned, the CPC Central Committee and the State Council proposed the inclusion of certified voluntary emission reductions from carbon sinks in relation to conservation of water and soil and forest resources in the voluntary carbon market in the Opinions on Strengthening the Water and Soil Conservation Work in the New Era and the Reform Program on Deepening the Collective Forest Right System. This points to the integration of the carbon sink market and carbon market.

6. Towards a Standardized System for Carbon Reduction; Carbon Footprint Regulatory Framework Taking Shape

In April 2023, the Standardization Administration and other 10 departments jointly issued the Guideline for Establishing a System of Standards for Carbon Peaking and Carbon Neutrality, which sets out a series of standardization construction work and objectives related to "Carbon Peaking and Carbon Neutrality" (including green finance product and service standards and green finance evaluation and assessment standards). In July, the National Technical Committee of Carbon Peaking and Carbon Neutrality Measurement and its technical sub-committees were set up, and one of their core tasks is to strengthen the requirements for measuring data on carbon emissions and carbon monitoring, and to research and formulate technical specifications. The objective is to ensure robust measurement of carbon trading and carbon verification. Standards for environmental assessment, carbon emissions and energy consumption for various industries are gradually being formulated and released.

In 2023, the applicable authorities outlined the framework for how the carbon footprint in China is managed. On October 12, 2023, the State Administration for Market Regulation issued the Implementation Opinions of the State Administration for Market Regulation on Coordinating the Use of Quality Certification to Serve the Work of Achieving Carbon Dioxide Peaking and Carbon Neutrality, which requires that carbon identification certification (such as the product carbon footprints) to be carried out gradually. On October 20, the NDRC issued the Pilot Program Plan for National Peak Carbon Emissions, proposing to explore the ancillary policies such as product carbon footprint management. On November 13, the NDRC and other four departments jointly issued the document guiding the establishment of the domestic product carbon footprint management system, (Opinions on Accelerating the Establishment of a Product Carbon Footprint Management System). The document clarifies the overall requirements, key tasks, safeguard measures and organizational implementation requirements for enhancing the management level of key product carbon footprint in China, builds up the overall framework of the product carbon footprint management system, and expressly supports enterprises to voluntarily carry out product carbon footprint certification, as required by the market. In terms of general standards, in November 2023, the applicable departments issued the consultation draft of the recommended national standard of Requirements and Guidelines for Quantification on the Greenhouse Gases Carbon Footprint of Products. In addition, the China National Accreditation Service for Conformity Assessment issued the consultation draft of the Accreditation Scheme for Product Carbon Footprint Validation and Verification Bodies on January 4, 2024.

7. ESG Disclosure Brought in Line with International Standards

In recent years, although China's companies have made progress in their ESG development and the scope and quality of ESG disclosure, the lack of unified, standardized and localized rules has long been a pain point hindering their development of ESG. In response to the requirements of the Work Plan for Improving the Quality of Listed Companies Controlled by Central SOEs issued by the SASAC of the State Council in 2022, the General Office of the SASAC issued the Notice on Research on the Preparation of ESG Special Reports of Listed Companies Controlled by Central SOEs in August 2023, in order to facilitate the preparation of ESG special reports by listed companies controlled by central state-owned enterprises (SOEs). This is the first time that the Chinese government has provided specific and systematic interpretations of ESG disclosure standards. The appendix includes the Reference Indicator System for ESG Special Reports of Listed Companies Controlled by Central SOEs and the Reference Template for ESG Special Reports of Listed Companies Controlled by Central SOEs, which provide basic references for state-owned listed companies in the preparation of ESG special reports. The selected ESG indicators align with the international common standards such as GRI, TCFD, SDGs (United Nations Sustainable Development Goals) and ISO, and are conceptually consistent with the new ISSB standards.

In terms of industries, the Insurance Association of China issued the Guideline on Disclosure of Environmental, Social and Governance (ESG) Information for Insurance Institutions on December 13, 2023. The guideline is the first domestic industrial self-regulatory document focusing on the framework and content of ESG disclosure in the insurance sector, which combines China's particular circumstances with international advanced practice, with special emphasis on disclosure requirements related to rural revitalization and financial inclusion. The Beijing Private Equity Association released the General Principles for Disclosure of Sustainable Investment Information for Private Investment Fund Managers on September 4, 2023, which became the world's first group standard in the private investment fund sector in terms of sustainable investment/ESG.

8. Judicial Practice In Step with the Times

As the goal of "Carbon Peaking and Carbon Neutrality" continues to advance, the judicial practice in China related to green finance and the carbon market is also keeping up. In February 2023, the Supreme People's Court issued the Opinions on Completely, Accurately, and Comprehensively Implementing the New Development Philosophy and Providing Judicial Services for Actively and Steadily Promoting Carbon Peaking and Carbon Neutrality. This document requires China's judicial systems to "adjudicate the cases related to energy conservation and emission reduction, low-carbon technologies, carbon trading, green finance and other related matters in accordance with the law; to promote climate change mitigation and adaptation", emphasizes the "establishment and improvement of the trial mechanism for carbon-related cases", and puts forward specific opinions on the trial methods and key points of the 17 types of cases closely related to the goal of "Carbon Peaking and Carbon Neutrality" (such as the cases relating to economic and social green transition, industrial restructuring, low-carbon energy system construction, and carbon market trading). On the same day, the Supreme People's Court also released new types of cases in relation to environmental resource trials in recent years, involving (among others) environmental infringement cases arising from greenhouse gas emissions, disputes over carbon emission allowances transfer contracts, disputes over CCER technical service contracts, enforcement of administrative penalties for the settlement of carbon emission allowances, and enforcement of carbon emission allowances. Such cases reflect the active exploration and practice of the judicial system on the protection of new types of environmental rights and interests, and will provide important reference for the subsequent relevant cases across the country.

In terms of the criminal cases, the Interpretation of Several Issues Concerning the Application of Law in Handling Criminal Cases Involving Environmental Pollution issued by the Supreme People's Court and the Supreme People's Procuratorate on August 8, 2023, mentioned the issue of criminal liability for the authenticity of information related to carbon emissions, and stated that "where any employee of an intermediary organization charged with the duty of inspection and testing of greenhouse gas emissions, or preparation or inspection of emission reports intentionally provides a false supporting document" may be liable for the crime of providing false supporting documents.

So far as enforcement goes, in September 2023, China's first judicial case connected with CCER was completed in Sichuan province. The case marked the first attempt to extend the judicial enforcement of carbon assets to voluntary carbon emission reduction, based on the previous enforcement cases related to carbon emission allowances. The effectiveness of pledging carbon assets such as carbon emission allowances and CCER has long been a major concern preventing financial institutions from participating in carbon financial transactions and developing related products. Although the reasons for the enforcement of the abovementioned CCER were not disclosed publicly, this case not only provides useful experience for the enforcement of carbon assets in the future, but also boosts market confidence in the liquidity and enforceability of CCER in the context of the relaunch of the CCER market. It should also provide a judicial basis for the further development of the financial business of carbon asset pledge by Chinese financial institutions in the future.

2024 REGULATORY OUTLOOK

1. With the Regulatory Framework in Place, Detailed Regulations Will Follow

The promulgation of the Interim Regulation fills the gap in the high-level legislation on carbon emission trading. We expect that the applicable authorities will engage in the formulation and updates of applicable ancillary regulations, measures, standards and other specific rules (e.g., the coordination process between the authorities, mechanisms for integrating with the green power system, the rules related to data quality, the formulation of lists of key emission entities in specific industries, the allocation and settlement of carbon emission allowances, the rules for statistical accounting of greenhouse gas emission data, and the rules for submission and verification of annual emission reports, and so on), and further consolidate the institutional framework content of carbon market under the regulatory framework of the Interim Regulation .

Although local regulatory authorities are actively exploring carbon financial inclusion policies, currently no national-level policy for carbon financial inclusion exists. On August 31, 2023, the MEE published its Reply to Proposal No. 5859 of the First Session of the 14th National People's Congress, to which, regarding the proposal to formulate the Carbon Financial Inclusion Promotion Law (Draft) and set up the pilots of carbon financial inclusion, the MEE replied that "it would collaborate with the other relevant authorities to conduct researches on the standardized construction, operation and management of carbon financial inclusion system, in conjunction with the construction of the greenhouse gas voluntary emission reduction trading market, and provide useful guidance for the healthy development of local carbon financial inclusion systems".

With respect to the establishment of ancillary rules and standards of carbon financial inclusion, the MEE said that it would apply the international standard ISO 14067:2018 (i.e. Greenhouse gases — Carbon footprint of products — Requirements and guidelines for quantification) as the common basic standard, and would work with relevant authorities to improve the measurement and standard systems for "Carbon Peaking and Carbon Neutrality", and conduct in-depth studies about the unified carbon financial inclusion platform and the necessity and feasibility of setting up a national carbon financial inclusion management and operation institution. In the Opinions of the CPC Central Committee and the State Council on Comprehensively Promoting the Construction of Beautiful China issued on January 11, 2024, there is explicit mention for the first time of "the exploration of establishing of public participation mechanisms such as Carbon Financial Inclusion" in such a central level policy. We therefore expect that the top regulatory framework on carbon financial inclusion will be introduced at some point.

2. Expansion of the National Carbon Market and Regulatory Innovation On Course

Although the current National Carbon Market only covers the power generation industry, we fully expect the industry coverage of the National Carbon Market to expand. The regulatory authorities have made this clear through frequent announcements. On October 27, 2023, Xia Yingxian, the head of the Department of Climate Change of the MEE, mentioned in a press conference that the next step is to include more eligible industries into the National Carbon Market. The MEE carries out annual verification of annual carbon emission accounting reports for industries such as petrochemicals, chemicals, building materials, iron and steel, non-ferrous metals, paper-making, civil aviation and other industries and will prioritize the inclusion of industries that contribute significantly to achieving the goal of "Carbon Peaking and Carbon Neutrality", have overcapacity, exhibit significant potential for pollution reduction and carbon reduction synergy, and have good data quality foundations. In November 2023, Zhao Yingmin, the vice-minister of the MEE, also publicly stated the intention to "actively and prudently" include more high-carbon industries in the National Carbon Market.

Also noteworthy is the approach being taken which involves enterprises bidding for carbon emission allowances. Since 2015, pilot regional carbon markets have been trying to organize paid bidding for carbon emission allowances. The regulatory provisions on paid allocation of carbon emission allowances have evolved from the previous provision of "paid allocation may be introduced in due time" as set out in the Measures for the Administration of Carbon Emissions Trading (for Trial Implementation) to the current provision of "a method combining free with paid allocation will be gradually promoted" as provided in the Interim Regulation. In December 2023, a seminar on paid allocation of carbon emission allocation in carbon market was held in Beijing, in which more than 30 experts from the MEE's Department of Climate Change, universities and research institutes, exchanges, certification agencies, and industries (such as power generation, iron and steel, petrochemicals, building materials, and nonferrous metals) discussed the necessity, urgency and feasibility of paid allocation of carbon emission allowances, design of paid allocation schemes, and the raising and use of paid allocation revenues, among other topics. This may lead to the development of a paid allocation scheme for carbon emission allowances in the National Carbon Market in the near future.

3. Carbon Markets to Gradually Link Up with Other Green Energy Regimes and Policy Tools

With the development of the carbon market, the connection between the carbon market and other green resource framework and policy tools is gradually happening. In September 2023, the Central Committee of the Communist Party of China and the State Council issued the Reform Program on Deepening the Collective Forest Right System, which emphasizes the connection between the reform of China's collective forest rights and the green finance and the carbon market. The document not only proposes giving full play to the leading role of green finance, studying the inclusion of eligible forest rights trading services and deep processing of forest products into the scope of green finance, and increasing financial support, but also mentions the possibilities of forestry carbon credit, supporting qualified forestry carbon sink projects to be developed into greenhouse gas voluntary emission reduction projects and to participate in market trading, and the creation of an ecological protection compensation system reflecting the value of carbon sinks. Although forestry carbon credits have not yet been included in the trading products of the National Carbon Market or include allowance for offset by key emission entities, we will watch out for integration of forestry carbon credits with green finance, carbon financial products and market mechanisms before too long.

The connection between the green power market, the carbon market and the green finance market is also worth watching. In early December 2023, Hubei Province took the lead in trying out a trading scheme that links the electricity, carbon and finance markets. In this scheme, enterprises can obtain low-interest green loans by pledging carbon emission allowances and using the funds to purchase green electricity, which in turn can be used to offset a certain amount of carbon emission allowances. In 2023, policies and programs for the connection between green electricity and the carbon market were issued in Beijing, Tianjin and Shanghai. Although these policies are currently only piloted in certain enterprises with limited coverage, they serve as a good demonstration of how the electricity and carbon markets can work together.

4. Unified ESG Disclosure Standards to Spur Regulation of ESG Rating Agencies

Although the establishment of unified ESG disclosure standards has been a long-standing topic, the release of the Reference Indicator System for ESG Special Reports of Listed Companies Controlled by Central SOEs and the Reference Template for ESG Special Reports of Listed Companies Controlled by Central SOEs by the General Office of the SASAC signifies a solid first step taken by top-level regulators towards applicable unified ESG disclosure standards for enterprises in different industries and sectors. Although these documents still only apply in scope to state-owned enterprises, with the accumulation of practical experience and feedback, it is certain that the authorities will further introduce ESG disclosure standards with a broader scope of application.

In addition to the lack of unified actions and disclosure standards, the inconsistency and lack of transparency in the evaluation standards of ESG rating agencies is also one of the reasons that makes it difficult for enterprises to engage in ESG development. Some other jurisdictions have already explored the regulation of ESG rating agencies in 2023. For example, the HM Treasury in the UK has launched a consultation on regulations to bring all ESG-related data and rating products (regardless of whether they are identified as ESG ratings) under the oversight of the Financial Conduct Authority ("FCA"); the European Commission has also followed suit by proposing regulation rules for ESG rating agencies that are roughly consistent with the EU's Benchmarks Regulation ("BMR") system; and the Monetary Authority of Singapore ("MAS") released an official version of Code of Conduct for ESG Ratings and Data Product Providers on December 7 and encourages ESG rating agencies to disclose how much their voluntary codes of conduct are being adopted locally. Given that the ESG-related regulatory framework for domestic enterprises has taken shape, at least in preliminary form, we expect that domestic regulatory authorities will explore the regulatory rules for ESG rating agencies in due course.

5. Perservering with Globalization of Standards amidst International Cooperation and Challenges

In 2023, China continued to promote international cooperation on sustainable finance. For example, the Monetary Authority of Singapore ("MAS") and the PBOC jointly set up the China-Singapore Green Finance Taskforce ("GFTF"); China and the United States, despite complicated international politics and diplomacy, still carried out the Track II Dialogue on Climate Finance and exchanges on climate change legislation, and after two meetings of the China-U.S. special envoy for climate change, China and the U.S. jointly issued the Sunnylands Statement on Enhancing Cooperation to Address the Climate Crisis and launched the Working Group on Enhancing Climate Action in the 2020s in November 2023. Following the 28th session of the Conference of the Parties ("COP 28") to the UN Framework Convention on Climate Change ("UNFCCC"), the Chinese government stated that it would continue to firmly promote green and sustainable development and "do its best part" in the global response to climate change. We also expect China will be more active in the arena of international cooperation on sustainable finance policies, standards and market practices.

In addition, as the international influence of sustainable finance, carbon emission reduction, and ESG concepts grows stronger, the impact of foreign legislation on domestic enterprises is increasingly significant. For example, the EU's Carbon Border Adjustment Mechanism (CBAM), known as the "carbon tariff", took effect as EU law in May 2023, which means that before the end of the transition period (i.e. the end of 2025), Chinese enterprises may face additional carbon tariffs if they are unable to effectively control the carbon emissions of their products - leading to a possible decline in the competitiveness of their products in the EU market. The environmental and sustainability requirements in the new version of the Regulation Concerning Batteries and Waste Batteries in EU, which entered into force in July 2023, also brings additional costs and challenges to the export of products from China's booming new energy enterprises. We will watch out to see whether China will introduce response policies and countermeasures.

The release of the New CCER Regulation and the relaunch of the CCER Market have left room for speculation about cross-border carbon trading, and businesses are looking forward to the authorities issuing policies to allow the mutual conversion between projects under other greenhouse gas emission reduction programs and CCER projects. During the COP28, an official from the MEE expressed "the emphasis on the importance of the internationalization of the carbon market for accelerating global climate action, and the willingness to explore feasible implementation paths and policy tools to promote greenhouse gas emission reduction jointly with various carbon market mechanisms", but also emphasized that "engaging in cross-border carbon trading involves aligning with applicable international rules, which will have an impact on China's fulfilment of its goal of nationally determined contributions (NDCs) and requires coordinated national management. " In terms of the regulatory framework design of the future cross-border carbon market, how to achieve a balance between aligning with international standards to meet market expectations and coordinating national management to safeguard national interests, will become a recurring topic for both policymakers and the market.

In recent years, there have been ongoing updates in sustainable finance-related standards in the international market, some of which have been incorporated into China's policies and standards, as appropriate. For example, on June 26, 2023, the International Sustainability Standards Board (ISSB) issued the final versions of two standards, i.e. IFRS Sustainability Disclosure Standard: General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) and IFRS Sustainability Disclosure Standard: Climate-related Disclosure (IFRS S2), and the abovementioned ESG information disclosure rules for listed companies controlled by central SOEs and the private investment fund sector explicitly state that these international standards will be taken into consideration. How to better align international standards with China's national conditions, so as to integrate into the international market and attract international investors within a safe and controllable scope, will be a long-term issue for domestic policymakers.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.