- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Banking & Credit, Insurance and Healthcare industries

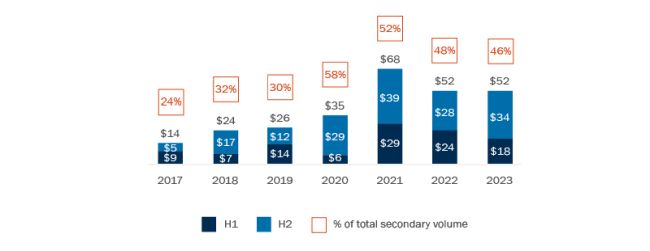

The second half of 2023 saw increased momentum for GP-led secondary deals, with outsized acceleration in the space making up for a relatively slow period to start the year compared to 2021 and 2022.

For H2 2023, transaction volume in global GP-led markets climbed 88% compared to the first half of the year, according to Jefferies, with $34 billion of the total $52 billion in deal volume (approximately 65%) estimated to have resulted from transactions closed in the second half of 2023.

This $52 billion in total GP-led secondaries volume in 2023 is estimated to have come from $46 billion in asset sales (i.e., continuation funds and tender offers) and $6 billion in structured equity and fund finance deals. Notably, approximately 75% of GP-led deals in 2023 were in the buyout space, signaling substantial room to run in the use of these deals in other core strategies like venture, real estate and credit1.

GP-led annual transaction volume ($B)

Source: Jefferies, Global Secondary Market Review, January 2024.

How will private equity perform in 2024?

We canvassed industry leaders to get their insights and predictions. Find out what they said.

Demand for secondaries activity increases

Secondaries fundraising represented a bright spot in a weak fundraising year. For the full 2023 calendar year, fundraising in the space finished at a record high, totaling approximately $84 billion—and exceeded secondaries fundraising in 2021 and 2022 combined. This accumulation of dry powder has accelerated demand for deal flow in the space.

When viewed in light of a difficult year for M&A and IPO activity, which were down from the peaks of 2021, approximately 61% and 80%, respectively, the GP-led markets have remained relatively resilient (down only approximately 24% from the record volume of 2021)2. We note, however, a potential alternative perspective: that GP-led secondaries markets have not to date been as vibrant as might be expected given the substantial accumulation of dry powder in the space.

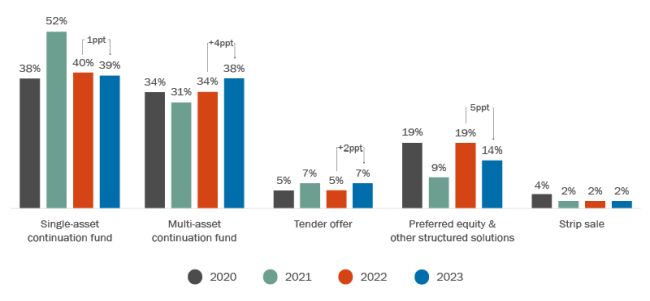

Capital deployment by transaction type (% completed by total volume)

Source: Lazard, Secondary Market Report 2023, February 2024.

Continuation funds and structured solutions

Both single and multi-asset continuation funds continue to dominate the GP-led secondary markets, particularly for top-tier assets where sponsors are seeking to extend their hold period.

In 2023, continuation funds represented 12% of global sponsor-backed exit volume, compared to only 5% in 2021. Multi-asset continuation funds in particular have experienced significant growth in recent years (rising to nearly 59% of overall continuation fund volume in 2023), due to their ability to deliver more expansive liquidity solutions to fund investors3. Despite this growth, a significant proportion of GP-led secondary transactions are reported to have failed in 20234. Potential reasons for transactions failing include both a mismatch in pricing and asset quality and performance issues. While these factors could present significant short-term hurdles to increased growth in the continuation fund space, the buildup of dry powder and demand for secondaries deals may instead prompt sponsors and secondaries investors to pursue alternatives like preferred equity and other GP-led structured solutions. For example, to help shift performance risk, secondaries investors may look for preferred positions structured as a priority return on existing fund interests or targeted portfolio assets. Given the difficult exit environment for sponsor-backed portfolio companies and investor demand for liquidity in a market where private equity distributions have fallen 49% in two years5, the need to pursue more creative solutions could rise as investors continue to focus on distributed to paid-in capital as a key metric with respect to their existing fund positions.

The robust finish to 2023 has led to optimism in the market for a strong 2024 in the GP-led secondaries space. Moreover, market chatter to start the year suggests that the momentum from the second half of 2023 has continued into the initial months of 2024. There is an expectation among many market participants that an increasing number of high-quality assets will see realizations in the form of GP-led secondary transactions in the coming year6. Coupled with record dry powder and another expected year of strong fundraising, the GP-led secondary markets seem well primed to have one of their strongest years on record in 2024.

Footnotes

1. Jefferies, Global Secondary Market Review, January 2024.

2. Jefferies, Global Secondary Market Review, January 2024.

3. Jefferies, Global Secondary Market Review, January 2024.

4. Lazard, Secondary Market Report 2023, February 2024.

5. https://www.bloomberg.com/news/articles/2024-02-21/private-equity-payouts-at-major-firms-plummet-49-in-two-years

6. Lazard, Secondary Market Report 2023, February 2024.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.