- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Banking & Credit and Insurance industries

The combination of Distributed Ledger Technology ("DLT") and smart contracts, promises to modernize trade finance globally. Recent announcements of lenders using DLT and blockchain to facilitate trade finance1 will continue to grow as lenders continue to invest and develop DLT platforms, specifically designed for trade finance2.

The implementation of DLT's fully digital, distributed ledger allows all parties to upload and encrypt the physical documents typically involved in a trade financing transaction, enabling all stakeholders to view such documents simultaneously and securely. This eliminates the need for stakeholders to manage and reconcile physical documents which will dramatically reduce costs and increase the speed in which a trade financing transaction can be completed.

As is the case with the introduction of all new technologies, regulators and industry commentators are now alerting the business community to the potential legal and business risks associated with the use of DLT in trade finance. Therefore, it is critical for all stakeholders to both understand and properly manage such risks.

What is DLT?

At a high level, DLT is a software platform that connects multiple parties in a trade financing transaction by allowing the affected parties to securely exchange documents, submit required approvals, and view a transaction's progress in real-time. Essentially, it is a technology that allows for a shared database by enabling information to be shared and synchronized in a secure manner across multiple independent computers.

This shared database is known as a "ledger" and is deemed to be distributed as the responsibility of managing the contents and security of the ledger and the transactions carried out thereon, is distributed amongst multiple users as opposed to a single entity. This type of ledger has an infinite number of use cases, including the facilitation of international trade finance.

A typical trade financing transaction involves multiple stakeholders, including importers, banks, insurance companies, customs officials, and exporters who are located in multiple jurisdictions. Each of these stakeholders will have different "deliverables" that need to be completed in furtherance of a specific trade financing transaction and will use their own independent computer systems to verify the completion of a deliverable. With stakeholders using independent systems, a considerable amount of time and money is spent by other stakeholders to manually verify the completion and authenticity of each deliverable.

To further complicate matters, many deliverables are paper based, thereby necessitating their physical delivery amongst multiple parties, which takes a substantial amount of time to complete due to the complexity of coordinating with multiple stakeholders situated around the world. Various stakeholders have little visibility surrounding the progress of each deliverable and the overall status of the trade financing transaction because paper-based deliverables are not tracked by a common electronic ledger.

Why DLT is more secure than conventional databases?

Firstly, DLT ledgers are decentralized and therefore do not operate and store information on a single computer or server system. Instead, DLT replicates and stores all of its encrypted data across all computers (i.e. nodes) connected to the specific ledger, which ensures that there is no longer one central point of failure. If one node is compromised, the ledger's information still exists on the remaining computers. To improperly alter the information within a DLT system, each node connected to the ledger would need to be hacked.

Secondly, DLT uses a consensus-based system to validate any information posted on the ledger. At a high level, DLT's consensus mechanism (which, for clarity, will differ for each ledger), requires approval by pre-determined parties prior to the system executing users' actions (i.e. recording a transaction on the ledger and/or executing a smart contract programmed onto the ledger). Within the context of a trade financing transaction, before an importer can upload a purchase order to the applicable DLT, the consensus mechanism would require certain pre-selected stakeholders to validate the authenticity of the purchase order.

Finally, for trade financing transactions, financial institutions are typically operating on a "permissioned" based DLT ledger, whereby the system restricts the users who can contribute to the consensus and validation of the transactions and information on the ledger. This provides financial institutions with additional comfort as they can control which parties are allowed to validate transactions and/or upload documents onto the ledger.

How does it work?

A DLT ledger does not contain a central repository of information; instead, updating the distributed ledger requires a network's nodes to validate the authenticity of each transaction and/or document uploaded to the ledger.

The specific validation requirements are customized and therefore unique to each DLT platform. For example, in a trade financing transaction a user, using its computer, would upload a trade financing document onto the ledger. All users within the ledger, through their own computers, would have immediate access to the trade financing document. However, assuming that the DLT platform is "permitted" only a pre-determined subset of these users would be permitted to authorize and validate the trade financing document. If the document is validated, the trade financing document is then recorded on the ledger.

DLT and smart contracts

The ongoing development of smart contracts is one notable application of DLT that is being leveraged by financial institutions to further streamline the completion of trade finance transactions. Currently, trade finance transactions are governed by paper-based, manual contracts which are individually shared with various stakeholders involved in a transaction. Paper-based contracts lack transparency among all stakeholders, increase costs and closing times, introduce inefficiencies and raise the risk of fraud. Conversely, a smart contract is a self-executing contract with certain portions of the agreement between the contracting parties being directly written into lines of computer code and uploaded to the DLT ledger.

It is important to note that smart contracts are not digital versions of lengthy physical contracts. Instead, only the portions of a physical contract that comprise if/then conditions are (i) able to be converted into computer code; (ii) uploaded to the DLT ledger; and (iii) executed upon the occurrence and confirmation of certain pre-defined events.

For example, an exporter and its bank may enter into a loan agreement whereby the exporter receives a trade financing facility pursuant to which the bank provides the exporter with credit to facilitate the exporter's production and export of goods. The loan agreement may contain a condition that the lender, upon receipt of a purchase order in favour of the exporter would extend credit to the exporter. This conditionality would be converted into computer code ("If bank receives purchase order, bank loans funds to the exporter") and uploaded onto the DLT ledger.

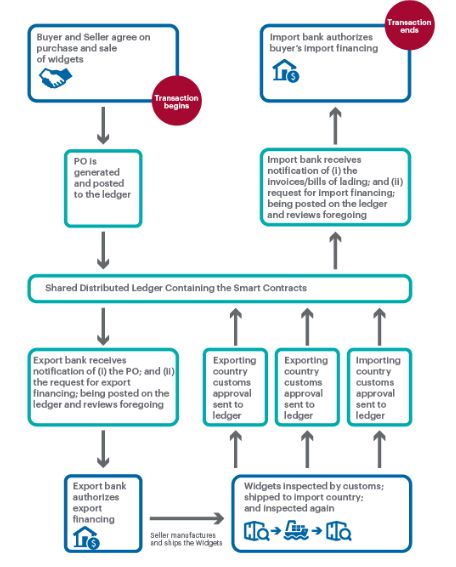

The execution of each smart contract is recorded on the distributed ledger and is instantly shared between all parties to the transaction allowing each party to refer to one immutable, synchronized ledger to track the progress of a transaction (see Figure 2 below).

A smart contract automatically self-executes when certain predetermined events occur. Self-execution allows smart contracts to operate through the direction of computer code, thereby eliminating the need for intermediaries to confirm the satisfaction of conditions. Once the completion of a certain condition is validated through some form of consensus (i.e. approved by the pre-determined parties within the DLT network), the event is recorded on the ledger and will at that time trigger the execution of the smart contract.

Before parties can execute transactions using smart contracts, each of the transacting parties (i.e. banks, customs agencies, buyers, sellers, logistics companies etc.) need to connect to the same shared distributed ledger. At present, many lenders are jointly developing DLT ledgers using existing product offerings like Corda (R3) or Hyperledger Fabric (IBM). Once the parties access the ledger, they then need to translate certain portions of the smart contract (if/then language discussed below) into computer code and upload such computer code onto the ledger.

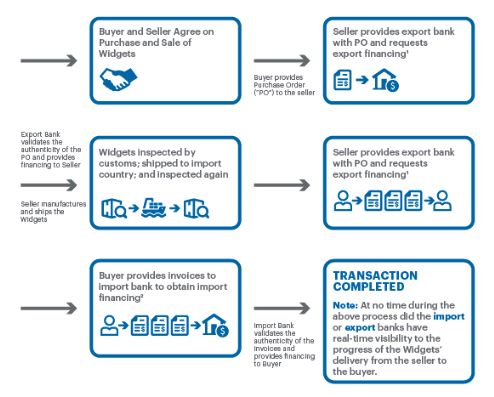

Figure 1 and Figure 2 below compare the differences in completing a trade financing transaction using the traditional method (Figure 1) as opposed to using DLT (Figure 2).

Figure 1: Current trade finance transaction process

Adapted from: The Hong Kong Monetary Authority

1) Export financing: Obtained by the seller to finance the production cost of goods ordered by the buyer.

2) Import financing: Obtained by the buyer to finance the purchase of goods from the seller.

Figure 2: Example of a trade finance transaction using smart contracts embedded on a DLT Ledger

Adapted From: The Hong Kong Monetary Authority

DLT's use in trade finance: key legal and compliance risks

Lenders have demonstrated their commitment to developing and using DLT to modernize their trade finance platforms, however, as is the case with all new technologies, it is imperative that stakeholders are equally focused on ensuring that this evolving technology properly addresses all legal and operational risks and is compliant with all applicable regulatory frameworks.

Due to the rapid and constant evolution of this technology, governing bodies are struggling to update regulatory frameworks to reflect the impact of such changing technology. In a report released in early July 2018, the European Banking Authority, the European Union's banking regulator, highlighted a number of risks associated with the adoption of DLT. Set out below are a few of these risks.

A. Conflict of laws

It is critical to establish the applicable governing laws for a smart contract. In many cases, smart contracts will consist of nodes spread across multiple jurisdictions where laws may conflict or render certain portions of an agreement invalid. Even if smart contracts state the applicable governing laws, it must be determined how separate agreements contained within the same DLT ledger are regulated.

B. Lack of central governing authority

The decentralized nature of DLT platforms means that participants must agree on how a network is governed. Rules that should be determined include criteria for admitting parties to a network, and how compliance with a platform's governing rules should be enforced.

When a DLT ledger is public and is comprised of thousands or millions of nodes around the world, there are many questions that can arise when trying to determine how the network will be governed and who will be the governing authority. In the trade finance space, this is less of a concern as lenders are in most cases using a permission based or private ledger, whereby only certain stakeholders can join the ledger and there is a central governing authority, making it easier to create and enforce rules which govern the ledger.

C. Data security and privacy

As explained above, the distributed ledger replicates all of its data within each of its network's nodes. This synchronization helps ensure that the information contained within one node cannot be altered, since all nodes must contain identical information. However, each node also represents an access point into the DLT system, and therefore one or more node(s) could become compromised, allowing an unauthorized person to enter a DLT network.

Implementing DLT: what's next?

DLT and smart contracts promise to revolutionize how global trade is financed. If implemented correctly, DLT systems will allow financial institutions to fund trade financing transactions more quickly, with less risk and at a lower cost. However, because this technology is constantly evolving and the regulatory regime is having a hard time keeping up with such evolution, coupled with the inherent risks of using any new technology, stakeholders will need to consider the various issues that may arise from the adoption of these systems and implement safeguards and dispute mechanisms to handle such potential issues.

This article was co-authored by Jesse Collins-Swartz, a summer law student in the Toronto office.

Footnotes

1. CoinDesk, "Banks Take Sides as Blockchain Trade Finance Race Heats Up" (17 July 2018), online: HSBC, "HSBC and ING execute groundbreaking live trade finance transaction on R3's Corda Blockchain platform" (14 May 2018), online: TechCrunch, " Bank-based blockchain projects are going to transform the financial services industry" (28 January 2018), online:

2. Current platforms include We.Trade, TrustChain, Batavia, and Marco Polo

About Dentons

Dentons is the world's first polycentric global law firm. A top 20 firm on the Acritas 2015 Global Elite Brand Index, the Firm is committed to challenging the status quo in delivering consistent and uncompromising quality and value in new and inventive ways. Driven to provide clients a competitive edge, and connected to the communities where its clients want to do business, Dentons knows that understanding local cultures is crucial to successfully completing a deal, resolving a dispute or solving a business challenge. Now the world's largest law firm, Dentons' global team builds agile, tailored solutions to meet the local, national and global needs of private and public clients of any size in more than 125 locations serving 50-plus countries. www.dentons.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances. Specific Questions relating to this article should be addressed directly to the author.