- within Finance and Banking topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in Canada

- with readers working within the Banking & Credit industries

On May 15, 2025, changes to the so-called Listed Issuer Financing Exemption (LIFE) came into force in each of the provinces and territories of Canada. These changes, among other things, significantly increased the amount of capital that listed reporting issuers may raise under the LIFE to the greater of $25 million and 20% of an issuer's market capitalization, up to a maximum of $50 million in a 12-month period.

Under the original terms of the LIFE established in 2022, offerings under the LIFE were previously limited to the greater of $5 million and 10% of an issuer's market capitalization, up to a maximum of $10 million in a 12-month period. A 50% dilution limit continues to apply as an additional cap on the use of the LIFE, meaning that offerings under the LIFE cannot increase an issuer's listed equity by more than 50% in a 12-month period.

The changes to the LIFE were implemented by each member of the Canadian Securities Administrators (CSA) through the adoption of Coordinated Blanket Order 45-935 – Exemptions from Certain Conditions of the Listed Issuer Financing Exemption. The expiry date of the blanket orders varies by jurisdiction, with the blanket orders in Alberta, British Columbia and Québec having no specific expiry date and the blanket order in Ontario expiring on November 15, 2026, unless extended. The changes to the LIFE are part of the CSA's ongoing efforts to ensure that Canada's regulatory environment adapts to the evolving needs of businesses, investors and other market participants.

Impact of regulatory changes on LIFE offerings

We examined LIFE offerings1 both before and after the regulatory changes. There was a significant increase in the number of LIFE offerings since the blanket orders were adopted by the CSA.

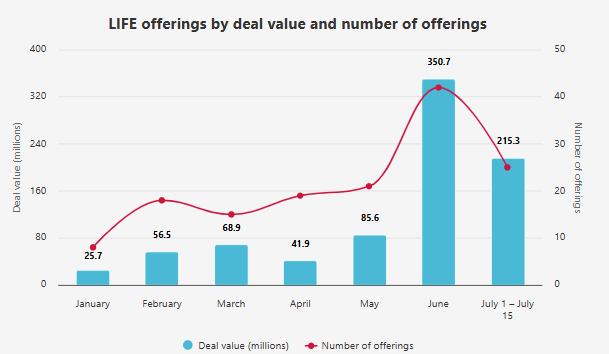

There were a total of 148 LIFE offerings between January 1 and July 15, 2025, with LIFE offerings in the two-month period after the May 15 effective date of the blanket orders representing more than half of all LIFE offerings between January 1 and July 15, 2025.

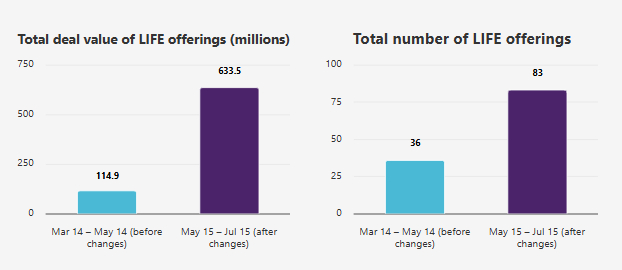

Moreover, the number of LIFE offerings in the two-month period after the adoption of the blanket orders was well more than double the number of LIFE offerings in the two-month period prior to the changes (83 versus 36), with the total deal value of LIFE offerings in the two-month period after the changes being over five times the number of LIFE offerings in the two months prior to the changes ($633.5 million versus $114.9 million).

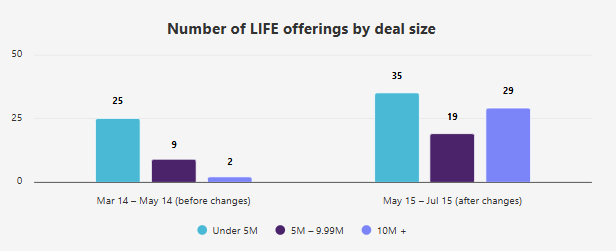

Many issuers took advantage of the increased limits on total capital that can be raised under the LIFE, with 29 deals (35% of LIFE offerings) in the May 15 to July 15 period being above $10 million. Equally notable, however, was the fact that the number of deals under $5 million, or between $5 million and $10 million, was significantly higher after the regulatory changes, showing that the LIFE remains an important means of raising equity capital for deal sizes up to $10 million despite the higher limits under the blanket orders.

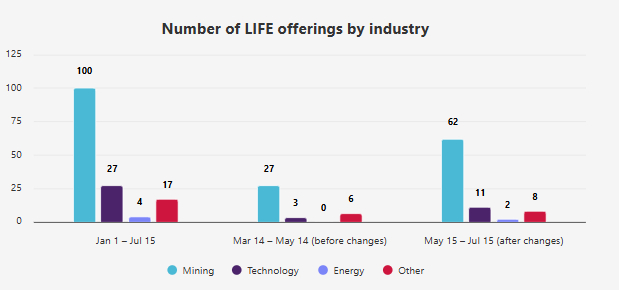

In terms of industry sectors, issuers in the mining space have been the most active users of the LIFE this year, although there was also a pickup in LIFE offerings by technology and other issuers following the regulatory changes.

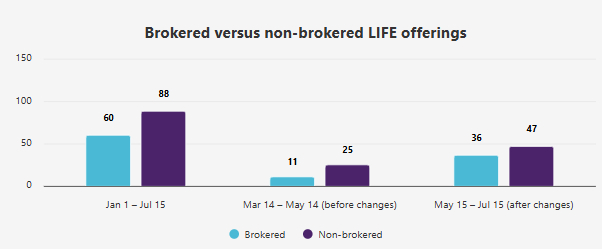

Our review of transactions showed that there was an increase in brokered LIFE offerings after the regulatory changes, although non-brokered LIFE offerings continue to be more common than brokered LIFE offerings. The increased size limits resulting from the regulatory changes may have facilitated greater broker involvement in LIFE offerings, as it can be more difficult for issuers to raise larger amounts of capital on a non-brokered basis

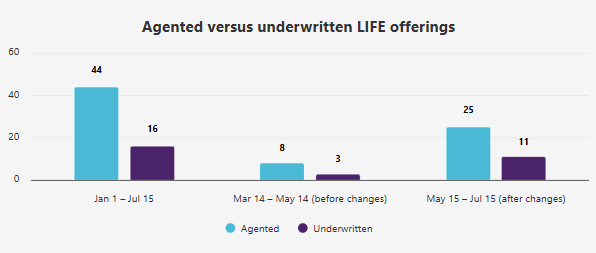

It continues to be the case that agented (best-efforts) LIFE offerings are more common than underwritten LIFE offerings. This may be due to the potential concerns raised by the CSA with respect to bought deal offerings using the LIFE — in particular, the fact that unsold securities retained by the underwriters would be subject to a four-month hold period

Conclusion

The blanket orders adopted by the CSA appear to have had a meaningful impact on the use of the LIFE. We continue to believe that the LIFE is important to junior issuers who wish to avoid the costs of a prospectus offering and who do not intend, or are not able, to access the market for underwritten bought deals. LIFE offerings are particularly useful to junior issuers because the LIFE continues to be available to an issuer as it grows, subject to the size and other limits of the exemption. While issuers in the mining industry have been active users of the LIFE this year, we expect that use of the LIFE by issuers in other industry sectors will increase.

Footnote

1 Includes LIFE offerings between January 1 and July 15, 2025. Includes base offering size only, accounting for any upsizing of the deal size, but excluding any securities sold pursuant to options granted in favour of the agents or underwriters.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.