- within Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in Canada

- with readers working within the Accounting & Consultancy, Banking & Credit and Insurance industries

On September 26, 2024, the Canadian Securities Administrators ("CSA") announced a further extension of the deadline by when they expect registered crypto asset trading platforms ("CTPs") or CTPs operating in Canada pursuant to a pre-registration undertaking ("PRU") to no longer allow Canadian clients to buy or deposit (or enter into "crypto contracts" to buy or deposit) value-referenced crypto assets ("VRCAs") that do not comply with the previously enumerated terms and conditions mandated by the regulators (the "VRCA Terms and Conditions"). The CSA's original deadline of April 30, 2024 was first extended to October 31, 2024, and has now been further extended to December 31, 2024. For details on the VRCA Terms and Conditions, please see our bulletin here. For more general background information on the regulation of CTPs, please see our bulletin here.

The CSA define a VRCA as a "crypto asset that is designed to maintain a stable value over time by referencing the value of a fiat currency or any other value or right, or combination thereof". The CSA definition captures crypto assets commonly referred to as "stablecoins" (USDC, Tether, etc.) as well as other digital assets, including "wrapped tokens" (WBTC, WETH, etc.).

A significant requirement of the VRCA Terms and Conditions is that CTPs may only list a VRCA if the issuer of such VRCA has filed an undertaking substantially in the form provided by the CSA. Concerningly for the Canadian crypto industry, no VRCA is currently in compliance with the VRCA Terms and Conditions and no issuer of a VRCA has: (i) filed the required undertaking; or (ii) made any public filings or announcements indicating their intention to file the required undertaking or otherwise operate in compliance with the VRCA Terms and Conditions. Stablecoins are important to the operations of CTPs and the crypto market because they provide a degree of price stability that other crypto and digital assets generally do not. The delisting of all VRCAs that do not meet the prescribed requirements is likely to be notably disruptive to CTPs and the Canadian crypto industry.

However, extending the deadline for the second time suggests the CSA is aware of the disruption that a forced de-listing of VRCAs would have on the crypto industry in Canada. The CSA has included in its announcements that they are committed to actively engaging with CTPs and crypto industry participants on this matter and are open to discussions on alternative regulatory approaches to the regulation of VRCAs and to considering proposed exemptions relating to specific use cases for VRCAs, including case-specific exemptions for VRCAs that do not raise investor protection concerns.

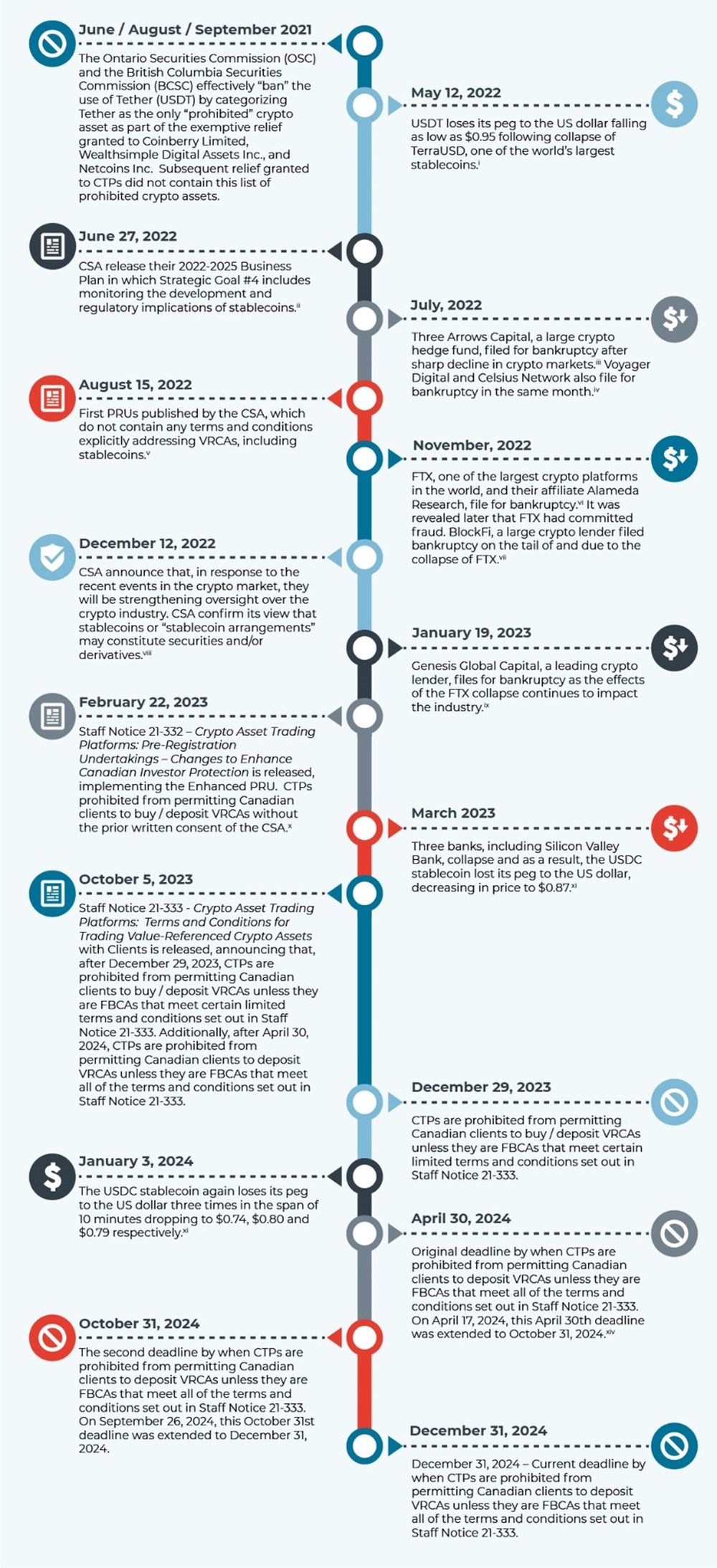

The extension of the deadline to December 31, 2024 is the latest update in a series of developments over the last two years applicable to regulation of VRCAS by the Canadian securities regulators. When considering the current state of VRCA regulation, it may be helpful to look at the historical development of VRCA regulation in Canada. These developments are summarized in the below timeline, which describes certain key developments in the CSA's regulatory approach to VRCAs in Canada, including several bankruptcies that led to CSA's increased attention to and oversight of CTPs. Also below is a glossary of certain terms used by the CSA.

Notes to Timeline

- Thomson Reuters, "Crypto collapse intensifies as stablecoin Tether slides below dollar peg" (May 12, 2022).

- Canadian Securities Administrators, "CSA Business Plan" (2022).

- Thomson Reuters, "Crypto Hedge Fund Three Arrows Files for Chapter 15 Bankruptcy" (July 1, 2022)

- Thomson Reuters, "Crypto lender Voyager Digital files for bankruptcy" (July 5, 2022); Thomson Reuters, "Crypto lender Celsius Network reveals $1.19 bln hole in bankruptcy filing"

- Canadian Securities Administrators, "Canadian securities regulators expect commitments from crypto trading platforms pursuing registration" (August 15, 2022).

- Thomson Reuters, "Crypto exchange FTX files for bankruptcy as wunderkind CEO exits" (November 11, 2022)

- Thomson Reuters, "Crypto lender BlockFi files for bankruptcy, cites FTX exposure" (November 29, 2022).

- Canadian Securities Administrators, "CSA provides update to crypto trading platforms operating in Canada" (December 12, 2022).

- Thomson Reuters, "Crypto lending unit of Genesis files for U.S. bankruptcy" (January 20, 2023).

- Canadian Securities Administrators, "CSA Staff Notice 21-332 – Crypto Asset Trading Platforms: Pre-Registration Undertakings – Changes to Enhance Canadian Investor Protection" (February 22, 2023) ("SN 21-332").

- Thomson Reuters "Major crypto coins stabilise after U.S. intervenes on SVB collapse" (March 13, 2023)

- Canadian Securities Administrators, "CSA Staff Notice 21-333 Crypto Asset Trading Platforms: Terms and Conditions for Trading Value-Referenced Crypto Assets with Clients" (October 5, 2023) ("SN 21-333"). Appendix A of SN 21-333 states the terms and conditions that CTPs must abide by to obtain consent from the CSA to allow the purchase or deposit of FBCAs. Appendix B contains an undertaking the CTP must take. For more information on SN 21-333 and including a summary on how to obtain consent, and the VRCA Terms and Conditions, see: CSA Provide Further Guidance on the Regulation of Stablecoins – McMillan LLP.

- Coindesk, "USDC Stablecoin Momentarily Depegs to $0.74 on Binance" (January 3, 2024)

- Canadian Securities Administrators, "Canadian securities regulators provide update on interim approach to value-referenced crypto assets" (April 17, 2024).

| "CTP" | Online applications or systems that bring buyers and sellers together to facilitate transactions or trades. |

| "Enhanced PRU" | An updated form of PRU that includes enhanced commitments for CTPs that relate to several areas, including commitments on pledging, custody offering margin or credit, corporate governance, offering VRCAs and proprietary tokens. |

| "FBCA" or "fiat-backed crypto asset" | A subset of VRCAs that seek to replicate the value of a single fiat currency, such as the U.S. or Canadian dollar, where the issuer has set aside an adequate reserve of assets in that fiat currency. |

| "PRU" | An undertaking filed by the CTP with the principal regulator to commit to certain investor-protection conditions while CTP registration is being processed. |

As the December 31st deadline looms, it is clear that we can expect further developments in this space. We will continue to keep industry participants apprised of further developments.

The foregoing provides only an overview and does not constitute legal advice. Readers are cautioned against making any decisions based on this material alone. Rather, specific legal advice should be obtained.

© McMillan LLP 2024