- within Insolvency/Bankruptcy/Re-Structuring and Cannabis & Hemp topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Banking & Credit and Insurance industries

WELCOME TO STRAIGHT TALK

The first quarter of 2022 brought new global challenges, including the war in Ukraine, as well as economic stagnation and rising inflation. While the short term impact on the public markets has already been felt by these developments, the full impact through 2022 remains to be seen.

On the deal front, however, even in light of the aforementioned, deal activity, although down from the record highs of 2021, remained strong through Q1/22, as buyers and investors continued to pursue attractive targets. In this issue, Toronto and London-based Partners, Michael Caruso and Aaron Atcheson discuss their outlook for 2022, particularly as it relates to the automotive industry, drawing on their extensive domestic and cross-border deal experience, and sharing insights on deal structure, trends, and sector-specific activity and the ongoing impacts of COVID-19, the further electrification of the automotive industry and global events on the automotive sector.

Please don't hesitate to reach out if you would like to learn more about our advisory expertise in the Canadian mid-market, or to discuss this publication. We are always happy to have a conversation

Regards,

Jay Hoffman | Practice Chair, Business Law and M&A

Q1 2022 MARKET INSIGHTS

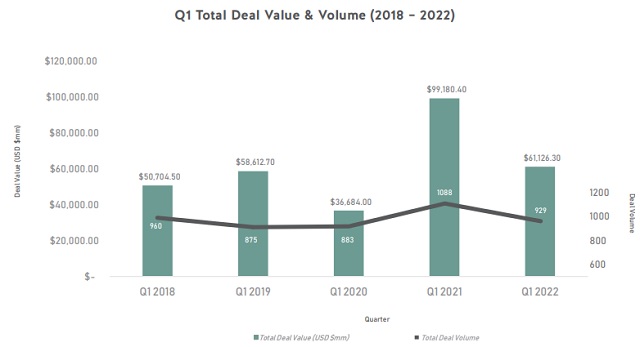

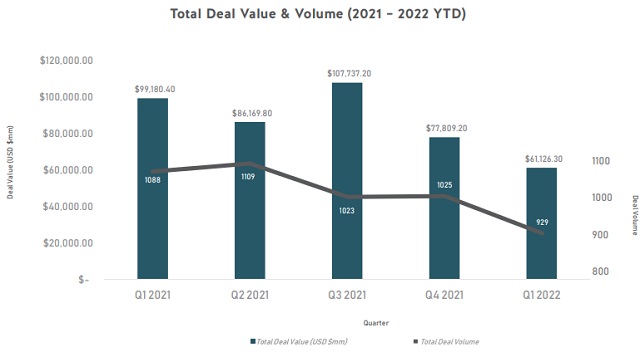

Canadian M&A activity experienced a slower start in 2022, in contrast to the record high set in 2021. The number of announced deals this quarter declined compared to Q1/21, while dropping off slightly from Q4/21. Despite the decrease in deal flow, Q1/22 M&A activity remained strong relative to pre-COVID years, as did inbound and outbound cross-border activity. Across Canada, M&A activity in most provinces decreased compared to Q1/21 and Q4/21.

Note: Dollar values are in USD.

Source: Capital IQ April 11, 2022

Source: Capital IQ April 11, 2022

DEAL ACTIVITY

It is no secret that Canadian M&A activity broke prior records by a landslide in 2021. Deal volume cooled off in the first quarter of 2022 with 929 announced deals, down from 1,088 deals announced in Q1/21 and 1,025 deals announced from Q4/21.

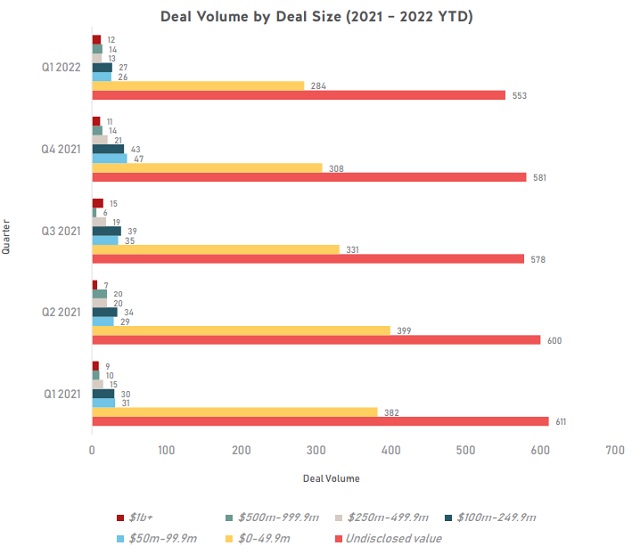

Deal value decreased significantly as well in Q1/22, to approximately $61 billion, down from almost $100 billion in Q1/21, reflecting a decline in the value of mega-deals in the quarter1 . This decline offset the increase in deal value and activity in the $500-999 million category, which was up 36% in deal value and 40% in volume over Q1/21.

Canada's Mid-Market

Deal activity was down across Canada's mid- and lower mid-market2 . Sub-$50 million deal volume declined by 25% from Q1/21 to Q1/22, while volume in the $50 - $100 million and $100 million - $250 million ranges declined at lower rates of 16% and 10% respectively as compared to Q1/21.

Source: Capital IQ April 11, 2022

Footnotes

1 The $13.4 billion acquisition by TD Bank Group of First Horizon registered as the largest mega-deal in Q1/22. Average mega-deal value declined, however, from $8.5 billion in Q1/21 to $3.2 billion in Q1/22.

2 We define the mid-and lower mid-market as deals of less than $250 million in enterprise value.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.