- within Finance and Banking topic(s)

- in Asia

A Lei Estadual nº 11.331/2021 instituiu o Programa de Parcelamento Incentivado de Débitos Fiscais ("REFIS 2021") no Estado do Espírito Santo, e permite que os contribuintes regularizem débitos de ICMS, multas e juros para fatos geradores ocorridos até 31/12/2020, constituídos ou não, inscritos ou não em dívida ativa, inclusive ajuizados ou protestados.

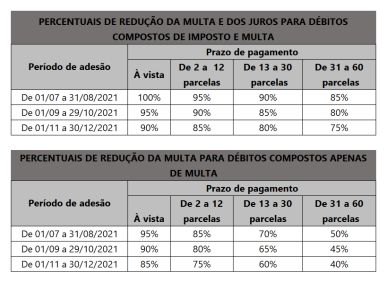

A adesão ao REFIS ES poderá ocorrer até 30/12/2021 e as condições de pagamento dependem (i) da data da adesão, (ii) do número de parcelas para pagamento e (iii) da formação do débito (principal e multa ou apenas multa), conforme sintetizado abaixo:

O valor mínimo de cada parcela é de R$ 729,18 para débitos superiores a R$ 7.291,80, e de R$ 182,30 para débitos cujo valor for inferior a R$ 7.291,80.

A adesão ao REFIS 2021 implica no reconhecimento dos débitos nele incluídos e a desistência de ações judiciais e defesas administrativas relacionadas, bem como está condicionada ao pagamento de custas processuais e/ou honorários advocatícios em casos em que tenha sido proposta ação para cobrança judicial ou a certidão de dívida ativa estiver protestada.

Visit us at Tauil & Chequer

Founded in 2001, Tauil & Chequer Advogados is a full service law firm with approximately 90 lawyers and offices in Rio de Janeiro, São Paulo and Vitória. T&C represents local and international businesses on their domestic and cross-border activities and offers clients the full range of legal services including: corporate and M&A; debt and equity capital markets; banking and finance; employment and benefits; environmental; intellectual property; litigation and dispute resolution; restructuring, bankruptcy and insolvency; tax; and real estate. The firm has a particularly strong and longstanding presence in the energy, oil and gas and infrastructure industries as well as with pension and investment funds. In December 2009, T&C entered into an agreement to operate in association with Mayer Brown LLP and become "Tauil & Chequer Advogados in association with Mayer Brown LLP."

© Copyright 2020. Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. All rights reserved.

This article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.

[View Source]