In the near future, due to new legal obligations or the expectations of their business partners, companies will increasingly have to prepare their own sustainability reports and publish them in some form. In the context of transactions, due diligence checklists often include questions on sustainability issues. Consequently, many companies are currently faced with the question of how to approach the preparation of their first sustainability report. The law offers little assistance to companies for tackling this challenge. Therefore, this article will give you an overview of why sustainability reports are becoming important for companies, to what extent there are already market standards for the structure of a sustainability report and how the first sustainability report can ultimately come into being.

1. Why do we even need a sustainability report?

Sustainability is a hot topic. If companies already have a sustainable self-image, such as in the green tech and renewables sectors, they have always been happy to report on the sustainability of their own business activities on various channels for marketing reasons, regardless of the size of the company. Many other companies have not yet dealt with their own sustainability in detail but they will be advised to do so in the future.

1.1 Extension of statutory reporting obligations

A new EU directive, the CSRD (= Corporate Sustainability Reporting Directive), was approved by the European Council at the end of November and has thus been adopted. Once in force, the new regulations must be implemented by the member states 18 months later.

Some companies in Germany are already legally obliged to prepare and publish an annual report on their sustainability. 550 so-called "large public interest entities" in Germany, for example, have had to publish a non-financial statement annually since 2017 in accordance with the CSR Directive Implementation Act, the content of which can already be inferred from the title of the law (CSR = Corporate Social Responsibility). Since 2022, companies within the scope of the CSR Directive Implementation Act must also fulfil the supplementary reporting obligations of the EU Taxonomy Regulation in their non-financial statement. For this purpose, these companies must review their business activities and determine the extent to which they contribute substantially to six specified EU environmental goals. Further sustainability-related reporting obligations follow from the Supply Chain Due Diligence Act, from 2023 for companies with more than 3,000 employees, and from 2024 for companies with more than 1,000 employees.

The aforementioned sustainability reporting obligations will soon be significantly expanded. A new EU Directive, the CSRD (= Corporate Sustainability Reporting Directive), is in the final stages of the legislative process. According to the CSRD, "large" companies within the meaning of the German Commercial Code size classes must publish their own sustainability report for the first time for their 2025 financial year, whilst stock exchange listed "medium-sized" and "small" companies according to the size classes must publish their own sustainability report for the first time for their 2026 financial year. The regulations of the new CSRD will cover approximately 50,000 companies in Europe with more than 15,000 of them in Germany. An EU supply chain law is also currently being drafted, which will include additional reporting obligations on due diligence compliance in the supply chain.

1.2 Emergence of de facto reporting obligations

In addition to the aforementioned legal obligations for sustainability reporting, which so far only affect larger companies, the importance of a de facto reporting obligation is growing steadily - particularly for small and medium-sized companies. This is especially true for German SMEs. Factual reporting obligations are based on the fact that larger companies, which are already subject to legal reporting obligations, usually also have to report on the sustainability efforts of their (smaller) suppliers and business partners as part of these reporting obligations. As a result, companies that are suppliers or customers of a larger company are increasingly being asked by their larger contractual partner to submit a report on their own sustainability efforts. If they refuse to do so, the larger business partner might threaten to terminate the business relationship. This is triggered by the fact that the larger company cannot fulfil its own legal reporting obligations if its suppliers and business partners do not provide appropriate reports.

However, such a de facto reporting obligation arises not only within traditional supply chains, but also in the context of other contractual relationships for small or medium-sized enterprises. Commercial borrowers, for example, are regularly requested by their house banks to submit sustainability information when applying for a loan. The same applies, for example, to start-up companies whose business shares are in the hands of a financial investor. Financial investors in particular demand sustainable action from their investment companies. For these reasons, more and more companies are confronted with the task of introducing sustainability structures in their company. This introduction of sustainability structures is often pursued by the companies under the working title ESG (Environmental, Social & Governance).

2. Are there standards for the structure of a sustainability report?

Once a company has decided to produce a sustainability report, it is faced with the challenge of deciding how to structure the content of the report. There is no generally applicable guideline for the structure of a sustainability report. A small company that only prepares a sustainability report as a result of de facto obligations sets different priorities than a large listed company such as Volkswagen AG, whose Sustainability Report 2021 comprised 111 A4 pages. In the medium term, however, sustainability reporting will become a core topic of corporate communication everywhere and will be on a par with financial reporting.

Initial indications for the structure of the sustainability report of each company can be found in the CSRD. According to this, a sustainability report could include the following information:

- How are sustainability-relevant impacts of the activity taken into account in the business model and corporate strategy?

- What are the company's sustainability goals and what progress is being made?

- What role do the administrative, management and supervisory bodies play in connection with sustainability efforts? Is there an incentive system for them?

- How does the company intend to ensure that its business model and strategy are compatible with the transition to a sustainable economy and limiting global warming to 1.5°C in line with the Paris Agreement and the goal of climate neutrality by 2050 under the European Climate Change Act?

- What opportunities exist for companies in connection with sustainability concerns? What sustainability risks affect the company's operations?

- What actual or potential negative impacts are associated with the company's business activities and value chain?

- Has a risk analysis or due diligence been carried out in relation to sustainability issues?

- What measures have been taken to prevent or minimise adverse impacts and what is their impact? What policies are in place regarding sustainability issues?

On this basis, the European Financial Reporting Advisory Group (EFRAG) developed the European Sustainability Reporting Standards (ESRS), a set of rules that contains detailed specifications on the reporting content of the CSRD. The ESRS drafts have now been handed over to the EU Commission. The first set of the European Sustainability Reporting Standards (ESRS) drafts has now been submitted by EFRAG to the EU Commission. The final drafts can be found here: www.efrag.org

Other standards for corporate sustainability reporting have already been completed and are being used in practice. Of particular importance is the Global Reporting Initiative (GRI), a Dutch provider of an internationally disseminated, free guideline standard for the preparation of sustainability reports, but also the German Sustainability Code, which standardises a cross-industry transparency standard of national importance for the reporting of corporate sustainability performance. In addition, a commission of experts from the Frankfurt School of Finance & Management is currently working on sustainable governance principles for SMEs in Germany. By spring 2023, scientifically sound and application-oriented recommendations for action are to be made available to SMEs in the form of principles and best-practice examples that companies can use to establish sustainable governance, which also includes reporting.

3. What are the first steps towards the ESG structure?

Regardless of all standards, it will ultimately be a decision of the companies as to how their ESG structure and also their sustainability reporting should be designed. Therefore, the first step is a review of the existing structures with a subsequent analysis of what is missing. Ideally, although not every company can afford and/or wants to do this, such analysis should be coupled with a risk analysis to determine which particular risks exist in the company with regard to ESG issues. Based on this, the ESG targets in a company as well as the measures to achieve them should be defined and implemented.

The following three questions can be chosen as the basis for such an examination:

- What ecological sustainability goals are being pursued in the company?

- How does the company deal with the issue of social responsibility?

- How does the company deal with the issue of social responsibility?

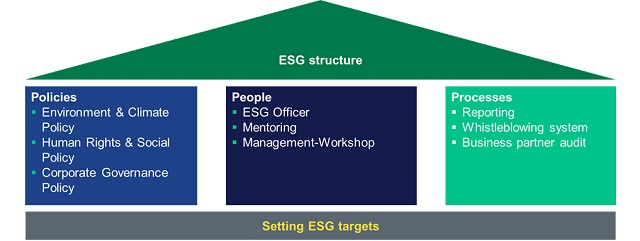

In the next step, these basic questions can be used to define various ESG targets, which can be very general or individually tailored to the company. Experience shows, however, that compiling the "right" questions and deriving the appropriate targets and measures from them is a great challenge for many companies. In the course of this process, it is usually forgotten that right now, no company can conclusively assess what is "right" and what is "wrong" from an ESG perspective. All companies face the same challenges. The only difference is that one company can afford to set up a large ESG department internally or hire an external consulting team whilst the other can only provide smaller resources for this purpose. Therefore, our advice is to start with a basic set-up when introducing ESG structures and then add to it gradually as it develops. Such a basic structure could be based on three pillars and be organised as follows:

4. What are concrete ESG goals and measures?

Even though the ESG targets and measures must always be adapted individually for each company, the following examples are intended to provide an initial overview of which targets could be achieved with which measures. These measures could then also be used to generate content for the first sustainability report.

4.1 Environmental Area

- Reducing emissions: ban short-haul air travel; promote rail travel, carpooling or bicycle use.

- Resource-saving working practices: use environmentally friendly paper; consistent waste separation; clear instruction on printing.

- Saving energy: use of green energy sources; instruction to switch off lights in unoccupied rooms; use of energy-saving light bulbs

- Sustainable production: investment in new and low-energy production processes and technologies; production of sustainable products in the sense of a circular economy

4.2 Social Area

- Equal opportunities: no differentiation of employees based on gender, race, religion or origin (equal recognition, career opportunities and remuneration models); implementation of a concept for hiring people with disabilities.

- Employee protection and satisfaction: offer health days, ergonomic office furniture, fitness programmes (internal/external); offer home office and provide necessary equipment; offer further education and training opportunities; offer flexible working time models; educate on the issue of mobbing; ensure freedom of association and trade union membership.

- Social commitment: taking on social projects; donating to charitable organisations

- Compliance with human rights: checking that there is no child or forced labour; avoiding cooperation with authoritarian regimes

4.3 Governance Area

- Corporate ethics: establishment of a code of conduct on corporate values including ESG goals; review of lobbying activities and avoidance of conflicts of interest; establishment of sustainability goals in executive board remuneration.

- Transparency: establishment of an internal sustainability reporting system

- Compliance with laws and regulations, in particular to prevent corruption, bribery and money laundering: introduction/review of corresponding compliance measures; conduct of a risk analysis; establishment of a control and risk management system

- Tone from the Top: commitment of the members of the administrative, management and supervisory bodies to the sustainability goals; establishment of sustainability goals in the remuneration of the board of directors

5. Lessons Learned

Many companies are currently facing the challenge of preparing their first sustainability report. This can be triggered either by the increasing legal obligations or simply by a de facto obligation as a result of market expectations. There are already initial standards in the market on how a sustainability report can be structured, although companies still have a great deal of creative freedom.

A prerequisite for the preparation of a sustainability report is a corresponding reporting system in the company, which should not be isolated. The sustainability reporting system should instead be just one of several new sustainability instruments to be created, the totality of which reflects the ESG structure of the company. On the basis of an individual determination of one's own ESG targets, a suitable package of measures can always be identified, irrespective of industry affiliation and company size. Such a package of ESG measures can be introduced with reasonable effort and represents the basis for a modern, sustainable and adaptable ESG structure, which at the same time facilitates the regular and efficient preparation of sustainability reports.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.