- within Corporate/Commercial Law topic(s)

- in United States

- within Corporate/Commercial Law topic(s)

- in United States

- within Law Department Performance and Antitrust/Competition Law topic(s)

Key Points

- This article provides an overview of M&A activity in the healthcare and life sciences sector during 2024 and the outlook for 2025.

- In line with the M&A landscape in Ireland more generally during 2024, the number of life sciences and healthcare deals remained broadly stable compared to 2023.

- 2024 saw a mix of strategic acquisitions by industry alongside acquisitions and investments by financial investors, including a number of private equity houses.

- Ireland remains a key hub for international pharmaceutical companies, but also supports a strong domestic life sciences and healthcare market, including Irish-owned and headquartered pharmaceutical and medical devices companies, and a significant private hospital network.

- The outlook for the rest of 2025 remains cautiously optimistic. Falling interest rates, significant dry powder for deployment by private equity firms, and continued investor pressure on private equity firms to deliver returns on capital investments through divestments should see an increase in deal activity, particularly in areas with significant growth potential. However, risks posed by ongoing global conflict and changes to US trade policy, which have had a material impact on dealmaking in the first half of 2025, are likely to continue in the short term.

M&A Market 2024: Year in Review

Expectations for M&A globally and in the Irish market were high facing into 2024. Irish M&A activity proved robust during the year and broadly comparable with deal volume for 2023 but, while strong, activity did not reach the highs that many had anticipated (or hoped for). Market trends from 2023, including high interest rates, valuation gaps and slow pace of deal cycles, continued to impact deal dynamics for the first half of 2024, before levelling out as the year progressed. That said, Ireland saw modest increases in M&A activity levels in 2024 as a whole, and Ireland was consistent with, if not ahead of, global M&A trends on deal volume. Private equity investment in Irish assets soared during 2024, with an almost 140% increase in PE transactions from 2023, a trend which is anticipated to continue to build in 2025, provided some of the ongoing instability settles.

140%

increase in PE transactions from 2023

2024 Healthcare and Life Sciences M&A

Irish life sciences M&A activity remained strong over the course of 2024. Deal volume in particular was broadly consistent with deal volume in the previous year, aligning with trends in Irish M&A generally in the same period and in healthcare and life sciences M&A trends globally.

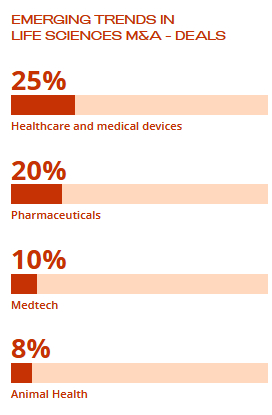

Within Irish life sciences M&A, certain areas continue to perform well but emerging trends can also be seen:

- Deals in healthcare and medical devices sectors each represented around 25% of Irish life sciences M&A last year

- Pharmaceuticals represented approximately 20%

- Medtech represented approximately 10%, which is expected to continue to increase as a growth area

- Animal health is also emerging as a growth area, representing around 8% of life sciences deals

As with Irish M&A generally, private equity activity in the healthcare and life sciences space was a feature of the deal market in 2024, while strategic acquisitions continued to be a pervasive trend in the sector as corporates seek to consolidate and expand, as explored in our Key Trends – Deal Focus section below.

Approximately 70% of Irish life sciences M&A transactions involved industry acquirers or investors, with around 30% involving private equity acquirers.

.jpg)

Key Trends – Deal Focus

|

Key Trend |

Relevant Deals |

|---|---|

|

Strategic acquisitions and investments by significant industry players in the life sciences and pharmaceutical sectors continue to represent the majority of M&A activity in the Irish life sciences sector. |

LetsGetChecked, an Irish-headquartered global healthcare solutions company, acquired US-based Truepill, a digital pharmacy and telehealth platform. Trinity Biotech, an Ireland-based developer of diagnostic tests, acquired Epicapture Limited, a company involved in the development of liquid biopsy tests for the detection of cancer, and Metabolomics Diagnostics, a developer of novel biomarker-based diagnostic solutions, along with a minority investment in Novus Diagnostics, a developer of a rapid sepsis testing platform. UK-based Lloyds Pharmacy Group acquired the McCabes group of pharmacies. This transaction represented a continued strategic interest in the Irish community pharmacy sector and follows the acquisition of the Hickey's group of pharmacies by Uniphar plc in 2020. Lloyds pharmacies in Ireland have rebranded as McCabes, demonstrating the strength of Irish pharma brands. We advised Lloyds on last year's sale and acted for the owners of the Hickey's group on its sale in 2020. |

|

Elsewhere, private equity drove a significant portion of life sciences M&A activity in Ireland, highlighting the attractive opportunities and potential for further growth that exist in the sector in Ireland. This continued private equity activity in the Irish market has seen certain firms, including Exponent, who have been active in the Irish life sciences sector, open Irish offices over the past number of years. |

The sale of Chanelle Pharma, Ireland's largest indigenous manufacturer of generic pharmaceuticals for animal and human health, to Exponent private equity was a milestone transaction for Irish life sciences M&A in 2024. Chanelle Pharma was founded in Loughrea in 1985 and continues to be headquartered there, and employs over 730 people in Ireland, the UK, Europe and Jordan. We acted for the sellers of Chanelle Pharma. Inflexion's investment in Village Vets, an Irish network of veterinary clinics, was one of a number of acquisitions of veterinary clinics in 2024, again highlighting veterinary pharma as a potential growth area. Five Arrows, a UK private equity firm, acquired a stake in Schivo Medical, the Ireland-based manufacturer of medical instruments, from MML Capital Partners LLP, providing an exit for MML. In April 2025, DCC plc announced the sale of its healthcare business, DCC Healthcare, to HealthCo Investment Limited, an investment subsidiary of funds managed by Investindustrial Advisors. The transaction marks a significant private equity investment into the European healthcare sector by Investindustrial, in a deal that values the business at £1.05bn (€1.22bn) on a cash-free, debt-free basis. |

|

Ireland's substantial private hospital network continues to be of interest to investors. This is evident not only from M&A activity but also the return of Aviva to the Irish private health insurance market. |

Macquarie Asset Management acquired the Beacon Hospital from a group of shareholders led by Denis O'Brien, with the management sellers being advised by Arthur Cox on aspects of the transaction. There is clear interest from financial investors in Ireland's private hospitals. Exponent private equity invested in Kingsbridge Healthcare Group, the largest private healthcare provider in Northern Ireland, and which has hospitals and clinics across the island of Ireland. We advised Exponent on its investment. Qualitas, a Spanish private equity firm, invested in Mobile Medical Diagnostics, an Irish company providing services into primary care centres, nursing homes and hospitals, including a mobile radiology service. |

|

Ireland remains a key jurisdiction for global pharmaceutical companies, both in terms of their corporate structure but also as a location for manufacturing facilities. |

Novo Nordisk A/S, a Denmark-based pharmaceutical group, completed its acquisition of a key manufacturing facility in Athlone from Alkermes plc, a global biopharmaceutical company incorporated in Ireland. We acted for Alkermes plc. CVC Capital, a private equity firm, acquired Therakos Inc., a US-based developer of immune technologies, from Mallinckrodt plc, the Irish-incorporated pharmaceutical manufacturer and developer. Earlier this year, Mallinckrodt plc announced its USD 6.7 billion merger with Endo, Inc. Arthur Cox is advising the Irish-incorporated Mallinckrodt plc. |

What's Next?

The outlook for M&A in the Irish healthcare and life sciences sector remains promising, driven by continued innovation, strategic investment, and significant opportunity for growth.

Against this background of opportunities and in line with 2024 trends, private equity interest in the life sciences sector is expected to remain strong. Ireland remains on the private equity sector's focus lists and there continues to be significant levels of undeployed capital and continued investor pressure to deliver returns on investments through divestments. Industry will also continue to assess and pursue strategic opportunities in Ireland, which remain plentiful in a market that has long supported R&D and innovation, and which has a strong start-up culture.

M&A activity in 2025 will continue to face uncertainty and challenges. Ongoing conflict and geopolitical uncertainty in the Middle East and Ukraine will likely have an impact on M&A activity generally. Changes in US trade policy, including the potential for tariffs on the pharma sector, are a particular risk to life sciences M&A, and have led to a slowdown in M&A activity during the first half of the year, with some notable exceptions, e.g. the DCC Healthcare deal. This slowdown is anticipated to continue until the environment is more settled. While the exclusion of pharmaceuticals from the initial tariff announcement in early April was welcomed, the announcement later in April of a Section 232 investigation by the US Department of Commerce into the import of pharmaceuticals and related ingredients will likely lead to a pause until the uncertainty is resolved.

In addition, new and expanding rules on foreign direct investment, which can apply to transactions in the life sciences and pharma sectors, have increased the regulatory burden on acquirers. The Irish FDI regime became operational in January 2025 and now needs to be factored into overall deal timetables. The regime places additional FDI notification obligations on "third country" acquirers (which includes US and UK acquirers). However, to date, the relevant Irish governmental department tasked with reviewing FDI notifications has engaged with parties promptly on notifications and cleared transactions in line with its statutory review timetable.

Notwithstanding the above challenges, the outlook remains positive given the breadth of strategic opportunities in the market, the growth of private capital and falling interest rates, and Ireland's longstanding strong position within the global life sciences and pharmaceuticals sector.

DATE TO NOTE:

The Irish FDI regime became operational in January 2025

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.