In 2021, the United Kingdom's Financial Conduct Authority announced several changes to the benchmark settings currently published by the ICE Benchmark Administration, including the cessation of the publication of EUR LIBOR settings, as well as the 1-week and 2-month USD LIBOR settings after 31 December 2021. The Financial Conduct Authority also decided to continue to determine and publish the 6-month USD LIBOR settings at least until the end of June 2023. These changes may have a direct impact on TP calculations performed for loans granted by and to Brazilian legal entities.

The transactions involving interest carried out by Brazilian legal entities with foreign related parties (as defined under Brazilian TP legislation), related or unrelated parties domiciled in tax havens or non-residents subject to privileged tax regimes must follow Brazilian TP rules and the thin capitalisation rules.

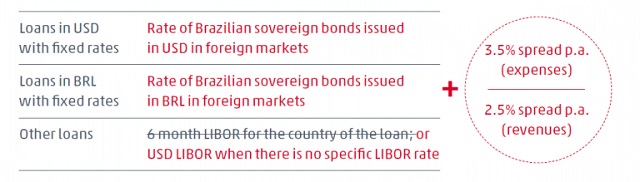

In accordance with Brazilian TP rules, the interest expenses incurred by a Brazilian legal entity shall be considered deductible up to the amount that does not exceed the rates determined based on the following rules (the minimum interest revenues recorded by Brazilian companies shall be calculated based on the same rules):

As a result, after the changes announced by the Financial Conduct Authority, the Brazilian companies that used to apply EUR LIBOR to comply with the TP rules to calculate the benchmark for interest expenses (or revenues) will be forced to use the 6-month USD LIBOR ("USD LIBOR 6M").

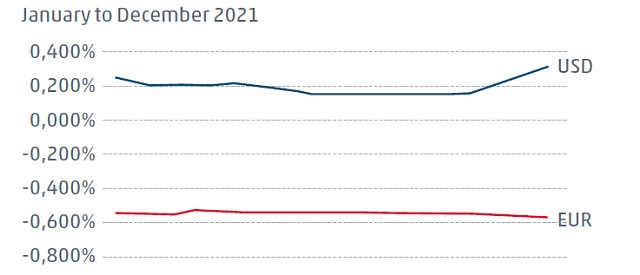

The impact that could arise for Brazilian companies may be verified by the comparable analysis of the historical variation of EUR LIBOR 6M versus USD LIBOR 6M during 2021:

Whilst the EUR LIBOR 6M was negative and relatively constant for 2021, the USD LIBOR 6M was positive and had a slight fluctuation. In view of this situation, the replacement of the EUR LIBOR 6M rate for the USD LIBOR 6M rate could result in two different scenarios: (i) if the borrower is a Brazilian company, this change could, in principle, increase the maximum amount of interest to be deducted from the Corporate Income Tax (IRPJ) and Social Contribution on Net Profit (CSLL) basis; and (ii) if the lender is a Brazilian company, this replacement could result in a corresponding increase of the minimum interest revenue to be considered by the Brazilian company for IRPJ and CSLL purposes.

The Brazilian Federal Revenue Service has not announced any changes to the rules currently in place in view of these changes.

As such, Brazilian companies should evaluate whether adjustments are necessary to loan agreements currently in place, if based on EUR LIBOR settings, and verify whether additional adjustments to the loans are advisable to use other methodologies provided by TP legislation.

It is recommended that Brazilian legal entities and multinationals with loans with Brazilian companies keep these changes in mind for future transactions.

Originally Published 06 April 2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.