- in United States

- with readers working within the Oil & Gas industries

- within Energy and Natural Resources, Intellectual Property and International Law topic(s)

In 2021, the world economies were struggling to overcome the damages caused by the Covid-19 pandemic that created inconveniences, inter alia, in the supply chain. At the same time, 2021 will be remembered as the year in which the material reflections of the climate crisis were witnessed in almost every part of the world. Quoting from the Guardian, "The continent of Africa had its warmest January on record, while torrential rains fell in Malaysia, leading to the evacuation of 50,000 people and the death of at least six. Meanwhile, there were fears that Istanbul would run out of water following the most severe drought in a decade in Turkey."1

Consequently, in 2021 combating the climate crisis2 was again one of the hot topics worldwide. Economic activities started to warm up around the world last year after the stagnation during the Covid-19 pandemic. The demand for energy and electricity has increased in the industrial users, households, and services. Furthermore, severe droughts in certain parts of the world extreme weather conditions such as unexpected cold air, and heatwaves escalated the energy demand for fossil fuels3. In its World Energy Outlook, International Energy Agency ("IEA") states that "upswing in demand for all fuels and technologies are overshadowing the signs of more structural changes in the energy sector, notably the rise of renewables for power generation and electric vehicles for personal mobility"4.

Against this background, as we are at the beginning of a new year, we would like to take the opportunity to wrap up the developments in the energy sector from a domestic perspective. Consequently, in this paper, the recent developments that the Turkish energy sector faced during 2021 will be brought to the readers' attention. As a caveat, we limited the scope of this article with the ratification of the Paris Agreement, the developments in electricity, natural gas, and petroleum, and finally, Akkuyu Nuclear Power Plant.

- Turkey Ratified the Paris Agreement

Although in 2016 Turkey signed the Paris Agreement5, which was adopted by 196 Parties at COP21 (Conference of the Parties) in Paris intending to limit global warming to below 2 degrees Celsius on December 12, 2015, and entered into force on November 4, 2016, Turkey finally6 ratified it on October 6, 2021. Turkey became the last G20 country to ratify the agreement before the COP26 Climate Change Conference meeting in Glasgow. By doing so, Turkey has set a net-zero carbon target by 20537.

Parties to the Paris Agreement had established an enhanced transparency framework ("ETF"). As of 2024, countries will report their progress in climate change mitigation and take their actions and measures. International procedures will review submitted reports, and the Intergovernmental Panel will announce the findings on Climate Change ("IPCC"), the United Nations body for assessing the science related to climate change8.

Although climate change action needs to be massively increased to achieve the goals of the Paris Agreement, the years since its entry into force have already sparked low-carbon solutions and new markets. Zero-carbon solutions are becoming apparent in the power and transport sectors to achieve the targets. By 2030, it is expected that zero-carbon solutions to be competitive in sectors representing over 70% of global emissions9. However, the world "is also seeing the second-largest annual increase in CO2 emissions in history"10. According to IEA, "the rapid but uneven economic recovery from last year's Covid-induced recession is putting major strains on parts of today's energy system, sparking sharp price rises in natural gas, coal and electricity markets"11.

- Developments in the Electricity Sector

Electric vehicles and charging stations12

According to the figures published by the Electric & Hybrid Vehicles Association ("TEHAD"), the total electric car market in 2021 was 284913. It is supposed that the number of EVs on the Turkish highways will escalate with the launch of domestic electric vehicle production (TOGG) in the near future.

The issue of "EVs and charging stations" in the Electricity Market Law No. 6446 ("Law No. 6446"), which is a special law regarding the electricity market, was regulated with the amendment made in December 2021. First, definitions of EVs and charging stations were added to Law No. 6446, and then the term "charging service" was regulated. Law No.6446 defines EV as "a motor vehicle that uses an electric motor alone or as an ancillary and can be charged externally with electric energy". Consequently, it covers both "all-electric vehicles" and "plug-in hybrid vehicles". Law No. 6446 foresees three months for the Energy Market Regulatory Authority ("EMRA") to enact the relevant secondary regulations as a sectoral regulatory body. EMRA released Draft Charging Service Regulation to the public and awaits the opinions until February 4, 202214. Moreover, a relatively short period of four months is given for those currently providing charging services to adjust their situation to the amendments.

While determining the charging service price, the amendment sets forth rules that must be considered. The charging service fee will be calculated in accordance with the following criteria: i) investment and operating costs for establishing a charging station and establishing a charging network, ii) electrical energy purchase costs and similar costs iii) legal obligations such as taxes, shares, funds iv) reasonable profit. Herein, it is criticized that the preceding criteria and rules contain certain uncertainties, but they can be further explained with prospective EMRA regulations.

It draws the attention that in the Draft Charging Service Regulation, the charging service is designed as a "universal service". Pursuant to our close analysis, we have come to the conclusion that the provisions outlined below are rather interventionist and likely to have a negative impact on the development of the market and it would be difficult to attract investors, if not amended:

- Restricting the freedom of price determination (ex: Article 15, 16, 25, 26, 30, 31)

- Creating market entry barriers (ex: Article 6, 15)

- Restrictions on business models that can be adopted by operators (ex: Article 16, 27, 29)

- Legally ambiguous conditions (ex: Article 9, 11, 13, 16, 20)

- Interfering with the investment preferences of the operators (ex: Article 15, 16, 17)

Gradual electricity tariffs

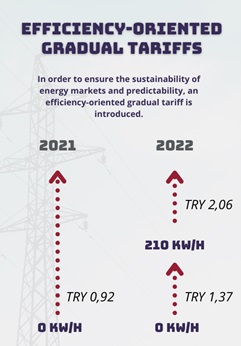

According to Electricity Market Law, different consumer groups according to consumer characteristics or separate tariffs to support renewable energy sources can be determined by EMRA. Consumers, upon their demand, can benefit from the tariffs determined to support renewable energy sources. On December 21, 2021, the relevant provision in Electricity Market Law was amended, and an additional criterion for separate tariffs was introduced. Accordingly, different tariffs can be determined for consumer groups in accordance with the amount of electricity consumption. In this context, consumers' electricity consumption is calculated in two categories as below and above the limit. Although it is possible to opt out from gradual tariffs, the different tariffs enable consumers with low electricity consumption to pay less.

Considering the increase in raw material prices due to the Covid-19 conditions, there has been a vast increase in energy costs. Consequently, the Turkish energy sector was also affected by the exceptional cost increases that emerged globally in this process. In order to ensure the sustainability of energy markets and predictability, the efficiency-oriented gradual tariff was introduced. Pursuant to the EMRA decision15 dated December 31, 2021, it was decided that as of January 1, for residential groups, the final price will be 1 TL 37 cents per kilowatt-hour for consumption amounts up to 150 kilowatt-hours per month, and 2 TL 6 cents per kilowatt-hour over 150 kilowatt-hours. However, as of February 1, 2022, the limit of 150 kilowatt-hours per month has been raised to 210 kilowatt-hours per month16.

Increase in distribution system fees

According to the EMRA decision17, the 75% discount applied to unlicensed electricity generation distribution fees commissioned on or before December 31, 2017, was canceled. With this decision, EMRA backed down from its commitment not to increase the distribution fees for 10 years and increased it approximately 4 times. Furthermore, EMRA also increased the distribution system fees for licensed electricity generation.

Energy supply security

To ensure a stable supply of energy, the Ministry of Energy and Natural Resources ("Ministry of Energy") is responsible for monitoring the supply security of electrical energy and adopting measures concerning supply security. According to the amendment made on December 21, 2021, the following provisions have been introduced:

- All licensed legal entities operating in the electricity market are obliged to comply with the measures specified by the Ministry of Energy for the security of supply, contribute to the transactions to be made, and submit the information and documents needed within the specified time.

- A long-term Turkey National Energy Plan will be prepared by the Ministry of Energy every five years, the first of which is within one year from the effective date of this article.

- The Ministry of Energy may organize capacity allocation competitions in order to ensure supply security in the medium-long term, taking into account the Turkish National Energy Plan.

- For the power generation facilities to be established within the scope of capacity allocation competitions, the lowest price to be offered will be applied within the Renewable Energy Resources Support Mechanism ("YEKDEM") for the period to be determined.

- Turkish Electricity Transmission Company ("TEİAŞ") may lodge a tender to establish a new power generation facility or lease the capacities of existing production facilities within the scope of ancillary services agreements to maintain the system reliability and meet the regional system needs that may occur due to insufficient capacity.

Capacity mechanism

To ensure the electricity supply security and increase the electricity generated through renewable energy resources, there are certain incentive mechanisms both for fossil fuels and renewable energy resources in Turkey. These incentives include the capacity mechanism and YEKDEM and Renewable Energy Resource Area ("YEKA").

The drastic decrease in electricity demand during the Covid-19 pandemic negatively affected many power plants with large installed power and high capacity18. However, especially after June 2021, the demand for electrical energy in Turkey has increased, causing supply difficulties to meet the demand. Furthermore, due to global economic conditions, the commodity prices used as a source in electrical energy generation have rapidly increased. This increase also adversely altered the electricity energy generation costs in Turkey. In this context, EMRA decided that the capacity mechanism in the electricity market was required to be rearranged to ensure that the baseload power plants can operate effectively in the electricity market again, considering that they have a large installed capacity and a higher capacity utilization rate than other power plants19.

The former Electricity Market Capacity Mechanism Regulation ("Capacity Mechanism Regulation") also entered into force in 2018 with similar intentions. It aimed to support the license owners of electricity generation facilities against the financial difficulties faced.

Power plants that are not considered within the scope of the Capacity Mechanism Regulation are determined pursuant to the pre-defined criteria. Accordingly, power plants that meet at least one of the following criteria fall outside the scope of capacity mechanism:

- Power plants based on wind, solar and nuclear energy.

- Power plants that are within the scope of YEKDEM or have the right to be so.

- Power plants operating or operated within the scope of a Build-Operate-Transfer agreement.

- Power plants whose public share exceeds 50% (mobile trailer power plants owned by electricity Generation companies (EÜAŞ) are excluded).

- Power plants established through successful bidding in a privatization tender within the scope of the Electricity Market Law.

- Power plants for which privatization tenders were made after January 20, 2018.

- Power plants are based on domestic resources with an installed electricity capacity of less than 50 MWe and other power plants with less than 100 MWe.

- Power plants which are not based on domestic resources and with an efficiency ratio below 50%.

In 2021 EMRA set the capacity mechanism budget as 2.6 billion TL, and 46 power plants20 benefit from the support21.

- Developments in The Natural Gas Sector

Gradual natural gas tariff

Since 2021, consumers around the globe will be exposed to exorbitant energy prices due to the unusual and extraordinary fluctuations in the energy markets. Petroleum Pipeline Company ("BOTAŞ")22 announced that the increase in energy prices had not been reflected in Turkish consumers at the same rate until the end of 2021. In October 2021, BOTAŞ switched to gradual pricing in the tariff applied for customers operating in distribution companies' petroleum/petrochemistry/chemistry, fertilizer, nonmetal and metal group sectors. Tier 1 refers to eligible consumers with an annual consumption of 300,000 Sm³ and below, whereas Tier 2 refers to eligible consumers with an annual draft of 300,001 Sm³ and above. The price per 1 Sm³ for Tier 1 is approximately 1.49 TL and for Tier 2 is 3.5 TL.

Furthermore, BOTAŞ has limited the daily consumption of industrial establishments that use large amounts of gas23. The reason for the BOTAŞ restriction decision was explained as the cuts of overseas suppliers due to the increase in demand due to winter24.

BOTAŞ also declared that it has become obligatory to make adjustments in natural gas sales prices with the possible minimum effect on the consumers25. As of January 1, 2022, the prices were increased at the following rates:

- 25% in the price of natural gas used in residences

- 15% in the price of natural gas used for electricity generation

- 50% in the price of natural gas used other than electricity generation

Debt cancellation for BOTAŞ

In Turkey, natural gas is supplied to households on a subsidized basis. BOTAŞ's loss from the subsidy was growing enormously due to the increase in prices in natural gas and the contracts expected to be renewed at higher prices. Since the Covid pandemic, consumers have been exposed to high energy prices due to the unusual fluctuations in the energy markets. Pursuant to the Temporary Article 6 added to the Natural Gas Market Law No. 4646 ("Natural Gas Law") on December 22, 2021, the duty loss arising from the gas sold at low prices by Petroleum Pipeline Company ("BOTAŞ") for residential consumers will be covered by the Treasury.

- Developments in the Downstream Petroleum Markets

Changes in market entry conditions

As per the amendments introduced on April 29, 2021, the requests for license application, license amendment or license period extension regarding distributor, bunker delivery and dealership licenses and other license types determined by the Authority are subject to conditions below:

- No overdue premium and administrative fine debt to the Social Security Institution

- No overdue debt to tax offices within the scope of Article 22/A of Law No. 6183

EMRA may set conditions for establishing a dealership organization and providing minimum sales volume for licensees. Furthermore, technical, economic, and special criteria regarding technology, quality, safety, service, and sustainability of the company can also be foreseen by EMRA.

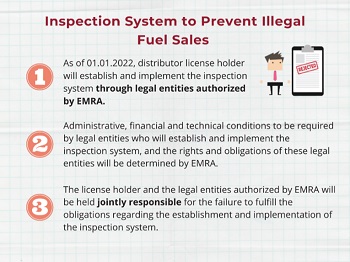

Pursuant to the Petroleum Market Law, distributor license holders are obliged to establish and implement an inspection system including technological methods that prevent illegal fuel sales at their dealers in accordance with the principles determined by EMRA. The distributor license holders will establish and implement the inspection system through legal entities authorized by EMRA. Administrative, financial, and technical conditions to be required by legal entities who will establish and implement the inspection system, and EMRA will determine the rights and obligations of these legal entities. Last but not least, the license holders and the legal entities authorized by EMRA will be held jointly responsible for the failure to fulfill the obligations regarding the establishment and implementation of the inspection system.

The rationale behind the amendment goes back to the operation26 carried out in many provinces simultaneously regarding the criminal organization engaged in tax evasion and qualified fraud within the scope of the investigation initiated by the Istanbul Chief Public Prosecutor's Office. The investigation started after it was determined that smugglers established their fuel stations by obtaining EMRA dealer licenses, made huge profits by deleting the fuel sales data, and then revoked their licenses for certain periods to lose their traces.

As is known, the license is cancelled if it is determined that there is fraud or misleading declarations against the law. The amendment states that those whose licenses have been cancelled pursuant to fraud or misleading declarations will not be re-licensed. In case the license holder was a legal person, licenses will also not be granted to:

- shareholders holding more than ten percent of the shares,

- the chairman and members of the board of directors and those authorized to represent and bind,

- legal entities where these persons are partners, chairman, or members of the board of directors or authorized to represent and bind

New EMRA decision regarding the dealer profit

EMRA adopted a new decision after the Council of State's annulment27 of the provision regarding the free determination of the margin between the distributor, and the dealer subject to dealer margin's to be at least 55%. With the new decision dated December 31, 2021, the profit share, including the cost of blending, will be determined freely between the distributor and the dealer, not less than the difference between the nearest refinery issue price and the Fuel Distribution Price. In other words, the dealer's profit share cannot be less than 50%the total margin.

- Third unit of Akkuyu Nuclear Power Plant

Following the foundation of the first two units of Akkuyu Nuclear Power Plant, which will be Turkey's first nuclear power plant, the construction of the third unit of the plant was commenced with an online ceremony on March 10, 2021. On May 12, 2010, Russia and Turkey had signed a Cooperation Agreement providing for the construction of the foregoing power plant. The power plant will consist of 4 reactors with a total installed power of 4,800 megawatts. The first unit is aimed to be commissioned in 2023. By 2026, the remaining units are projected to become active. It is calculated that when the power plant's full capacity is operational, it will meet 10% of Turkey's electricity demand.

Nuclear power plants generate electricity like other steam turbine power plants; however, the heat comes from a self-sustaining chain reaction in nuclear power plants. Coal, oil, or gas is burned to heat the water in other power plants. While referring to traditional nuclear power plant models, it is necessary to make some reservations arising from historical experiences. Besides the use for non-peaceful purposes, nuclear power entails risks such as radiological accidents and radioactive waste management requiring appropriate assessment and precautions. In this direction, some countries cannot ignore the risks of nuclear incidents and accidents and do not prefer nuclear energy due to long-term problems related to radioactive waste disposal.

Conclusion

This article tried to present the selected recent developments in the Turkish energy sector. We tried to focus on the ones with practical importance. Although it had its ups and downs, we believe that to keep our promises and achieve our ambitious goals, the Turkish energy sector is at the beginning of a much-needed transformation. In parallel with the recent developments, Turkey is taking radical steps to prioritize climate-related issues in its energy agenda compared to previous years. As we are witnessing an increased demand for energy, prices are also showing an upward trend, as the supply side is not increasing at a similar pace. Consequently, it is anticipated that one of the most argued topics in the energy sector in 2022 will be the increases in energy prices.

Footnotes

1 https://www.theguardian.com/environment/2021/dec/31/2021-a-year-of-climate-crisis-in-review Access Date: 20.01.2022

2 https://www.rekabetregulasyon.com/abde-iklim-kanunu-yasalasma-surecindeyken-turkiye-ne-yapiyor/ Access Date: 20.01.2022

3 Energy Outlook 2021, TSKB, p.1, https://www.tskb.com.tr/i/assets/document/pdf/energy_outlook_2021.pdf Access Date: 12.01.2022

4 World Energy Outlook 2021, International Energy Agency, p. 88, https://iea.blob.core.windows.net/assets/4ed140c1-c3f3-4fd9-acae-789a4e14a23c/WorldEnergyOutlook2021.pdf Access Date: 12.01.2022

5 For an evaluation on the Paris Agreement and Turkey's situation please see: Ardiyok, S. and Koksal, E., Turkey: Climate Change Mitigation – The Paris Agreement, Turkey's Ambiguous Position, And Need For Policy Change In Various Areas, https://www.mondaq.com/turkey/climate-change/1032078/climate-change-mitigation-the-paris-agreement-turkey39s-ambiguous-position-and-need-for-policy-change-in-various-areas Access Date: 20.01.2022

6 The main reason behind the rather late ratification is the argument that since Turkey is historically responsible for a very small share of carbon emissions, it should not be considered as a developed country as part of the Paris Agreement, which gives it more responsibility. https://www.reuters.com/business/environment/turkey-ratifies-paris-climate-agreement-last-g20-country-do-so-2021-10-06/ Access Date: 20.01.2022

7 https://www.rekabetregulasyon.com/yesil-mutabakat-dunya-ticaretini-sekillendirirken-turkiye-ne-yapacak/ Access Date: 20.01.2022

8 https://unfccc.int/process-and-meetings/transparency-and-reporting/reporting-and-review-under-the-paris-agreement Access Date: 21.01.2022

9 https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement Access Date: 12.01.2022

10 World Energy Outlook 2021, International Energy Agency, p. 15, https://iea.blob.core.windows.net/assets/4ed140c1-c3f3-4fd9-acae-789a4e14a23c/WorldEnergyOutlook2021.pdf Access Date: 21.01.2022

11 World Energy Outlook 2021, International Energy Agency, p. 15, https://iea.blob.core.windows.net/assets/4ed140c1-c3f3-4fd9-acae-789a4e14a23c/WorldEnergyOutlook2021.pdf Access Date: 21.01.2022

12 For further insight please see: https://www.rekabetregulasyon.com/elektrikli-arac-sarj-istasyonlari-mevzuatina-kavustu/ Access Date: 20.01.2022

13 https://www.tehad.org/2022/01/16/2021-yili-elektrikli-ve-hibrid-satis-rakamlari-belli-oldu/ Access Date: 20.01.2022

14 https://www.epdk.gov.tr/Detay/Icerik/5-12571/sarj-hizmeti-yonetmeligi-taslaginin-goruse-acilma Access Date: 21.01.2022 Access Date: 21.01.2022

15 https://www.resmigazete.gov.tr/eskiler/2021/12/20211231M6-6.pdf Access Date: 20.01.2022

16 https://www.ntv.com.tr/ekonomi/kademeli-elektrik-tarifesine-duzenleme-resmi-gazetede-yayimlandi,eKH3C-N-5ki_Zb_BOWzBJQ Access Date: 04.02.2022

17 EMRA Decision dated 30.12.2021 numbered 10700.

18 EMRA, Preamble to the Draft Regulation, https://www.epdk.gov.tr/Detay/Icerik/5-11487/elektrik-piyasasi-kapasite-mekanizmasi-yonetmelik Access Date: 12.01.2022

19 EMRA, Preamble to the Draft Regulation, https://www.epdk.gov.tr/Detay/Icerik/5-11487/elektrik-piyasasi-kapasite-mekanizmasi-yonetmelik Access Date: 12.01.2022.

20 From the total 46 power plants, 22 of them are coal-powered thermal power plants, 15 of them are based on domestic coal and the rest on imported/domestic resources.

21 Energy Outlook 2021, TSKB, p.14, https://www.tskb.com.tr/i/assets/document/pdf/energy_outlook_2021.pdf Access Date: 12.01.2022.

22 An Economic Public Institution (İktisadi Kamu Kuruluşu) established on August 15, 1974 and actively engages in the construction and operation of oil and gas pipelines, natural gas and LNG storage and trading, port services and international natural gas transportation projects.

23 https://www.dunya.com/sektorler/enerji/botas-bazi-tesislerin-gaz-tuketimini-sinirladi-haberi-646400 Access Date: 21.01.2022

24 https://www.dunya.com/sektorler/enerji/botas-bazi-tesislerin-gaz-tuketimini-sinirladi-haberi-646400 Access Date: 21.01.2022

25 https://www.botas.gov.tr/Sayfa/2022-yili-ocak-ayi-dogal-gaz-toptan-satis-fiyat-tarifesi/612 Access Date: 21.01.2022

26 https://www.aa.com.tr/tr/turkiye/36-ilde-akaryakitta-vergi-kacakciligi-operasyonu-120-gozalti/2157581 Access Date: 21.01.2022

27 https://www.puis.org.tr/bayi-kari-toplam-kar-payinin-yuzde-50-sinden-az-olamayacak

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.