Making headway on a comprehensive financial instruments standard

The IFRS 9 project continues to lurch towards completion, although convergence with the FASB is only expected in certain areas. Tina Farington looks at where the project is today and what to expect in 2013.

The IASB issued an exposure draft in November 2012 proposing limited amendments to the classification and measurement model of IFRS 9 originally issued two years ago.

Each phase of the IFRS 9 project is now at a different stage of completion. The project is divided into three main 'phases': (1) classification and measurement, (2) impairment, and (3) general hedge accounting. Macro hedging is a separate project.

Phase 1: Classification and measurement

The IASB completed the original phase of the classification and measurement model for financial assets in November 2009. This was followed by financial liabilities and derecognising financial instruments in November 2010. Together, these phases make up IFRS 9 'Financial Instruments (2010)' ('IFRS 9').

In late 2011, the IASB decided to consider limited amendments to the classification and measurement model to:

- address practical application issues raised by constituents that had adopted, or were preparing to adopt, IFRS 9;

- consider interaction with the insurance project given the redeliberations had moved forward substantially; and

- consider reducing differences between the FASB and IASB models.

Since then, the IASB and FASB have been working jointly. The IASB exposure draft issued in November 2012 proposes a broadly converged approach for debt investments although other aspects of the project are not converged (for example, the model for equity investments). The FASB expects to issue an exposure draft in Q1 2013.

Significant proposals in the IASB's exposure draft include:

- the introduction of a third classification category for debt instruments (fair value through other comprehensive income);

- clarification of the business model for the existing amortised cost category;

- clarification of the contractual cash flow test;

- consequential changes as a result of the limited amendments; and

- revised transition guidance.

Other areas of IFRS 9 remain unchanged. Refer to our Practical guide 'Limited amendments to the IFRS 9 classification and measurement model' for additional detail about the proposals and their implications. Comments on the exposure draft are due by 28 March 2013.

Phase 2: Impairment

One of the more significant concerns arising out of the financial crisis is that losses are reflected 'too little, too late'. Although impairment was highlighted as a priority for convergence, in August 2012 the IASB and FASB decided to pursue different solutions to the impairment question. The IASB recently affirmed its approach to finalise the 'three bucket' model. That is:

- 'Bucket one' - financial assets are initially captured here and impairment losses would only be recognised for those assets where there is a probability of loss in the first twelve months.

- 'Buckets two/three' - financial assets are transferred to bucket two (if transferred as a portfolio) or bucket three (if transferred as an individual asset) when credit quality has deteriorated significantly since initial recognition. Full lifetime expected losses are recorded on transfer. Interest is recognised on a net basis for a subset of assets within buckets two/three when the impairment indicators under IAS 39 are met.

Key judgments of the 'three bucket' model include how to determine the probability of loss in the next twelve months and when there is a transfer of assets between buckets (that is, what is a 'significant deterioration'?).

The IASB plans to expose this model in Q1 2013. The FASB has developed a model that effectively would result in full lifetime expected losses recorded on all financial assets when they are initially recognised. Given how this differs from the IASB's current proposals, convergence might not be achieved for impairment.

Phase 3: General hedge accounting

The IASB expects to issue a final standard on the general hedge accounting model in Q1 2013. The IASB published a review draft with an 'extended fatal flaw' period in September 2012, largely to seek feedback on whether the model is operational.

The objective of the current proposals is to reduce the detailed rules that make hedge accounting under IAS 39 complex and costly and to better align hedge accounting to risk management practices. The key proposals include:

- relaxing the requirements for hedge effectiveness and consequently the eligibility for hedge accounting,

- removing certain restrictions around what can be designated as a hedged item; and

- relaxing the rules on using purchased options and non-derivative financial instruments as hedging instruments.

The proposed standard, once final, is expected to be particularly beneficial to corporate entities. Refer to our Straight Away 'IASB issues review draft on hedge accounting' for further details on the proposed model.

Effective date

The effective date of IFRS 9 has already been pushed back to 1 January 2015. It remains to be seen whether the time to finalise the IASB's proposed revisions to IFRS 9 will result in a further delay, particularly as all three phases must be completed before an entity can adopt the revised version of IFRS 9.

The European Union (EU) has not yet endorsed IFRS 9, meaning IFRS reporters in the EU cannot early adopt. The EU has indicated that it will only make a decision on endorsement once the entire financial instruments guidance has been finalised, excluding macro hedging.

The IASB will seek feedback from constituents regarding the effort required to implement the 'new' IFRS 9 and consider whether changes to the effective date are necessary.

Boards make progress on revenue

The IASB and FASB Revenue project takes a step forward with decisions on key aspects of the proposals.

The IASB and FASB (the 'boards') reached tentative decisions at their November and December meetings on variable consideration, collectibility, licences, allocation of the transaction price, bundled arrangements and contract acquisition costs.

What were the key decisions?

Constraint on recognising revenue from variable consideration

The boards clarified the objective of the constraint on when revenue from variable consideration should be recognised. Management should:

- recognise revenue as performance obligations are satisfied only up to the amount that the entity is confident will not be subject to significant reversal in the future; and

- assess its experience with similar types of performance obligations and determine whether, based on that experience, the entity does not expect a significant reversal in the cumulative amount of revenue recognised.

The constraint is now to be assessed in the measurement of the transaction price rather than as a constraint on recognition applied after allocating the transaction price. The boards expect the amount and timing of revenue recognised to be the same regardless of where the constraint is applied.

The boards removed the exception that constrained revenue from licences of intellectual property where payments vary based on the customer's subsequent sales (for example, a sales-based royalty). When consideration is highly susceptible to factors outside the entity's influence, the entity's experience for determining the transaction price might not be predictive.

Highly susceptible factors could include actions of third parties, such as sales by an entity's customers.

Collectibility

Any initial and subsequent impairment of customer receivables should be presented, to the extent material, as an expense in a separate line item on the face of the statement of comprehensive income. The line should be presented below gross margin, not as a line item adjacent to revenue (as proposed in the 2011 exposure draft).

This decision applies to all contracts with customers, irrespective of whether they contain a significant financing component.

The boards confirmed that collectibility should not be a threshold for recognition of revenue, as this is not consistent with the control-based model.

Licences

The boards decided that in some cases a licence is a promise to provide a right, which transfers to the customer at a point in time, and in other cases it is a promise to provide access to an entity's intellectual property, which transfers benefits to the customer over time.

Indicators will be provided to help determine the accounting depending on the nature of the licence and the commercial substance of the agreement. These will provide guidance on when a licence transfers at a point in time and when it provides access. The boards commented that the guidance needs to be operational and result in consistent accounting for similar transactions, although this might be difficult to achieve.

Allocation of transaction price - use of the residual approach

The proposals in the 2011 exposure draft relating to the use of a residual approach to estimate the standalone selling price were retained. This approach can be used when two or more performance obligations in a contract have standalone selling prices that are highly variable or uncertain. In these cases, the transaction price should first be allocated to the performance obligations for which standalone selling prices are determinable. The remaining (residual) transaction price should be allocated between the other performance obligations using another method of estimation.

The boards also clarified that discounts and variable consideration should first be allocated to one or more specific performance obligations using relevant guidance before applying the residual approach.

Bundled arrangements

The boards confirmed that the proposed guidance for allocating the transaction price can be applied to a portfolio of contracts or to performance obligations with similar characteristics, if the entity expects that doing so would not result in materially different outcomes from applying the guidance to an individual contract or performance obligation.

The boards decided not to provide an exception or practical expedient in response to the concerns expressed by the telecommunication industry on the practical challenges of applying the proposals to a large portfolio of contracts with multiple deliverables. The boards were concerned that doing so would be inconsistent with the objectives of the overall revenue recognition model.

Contract acquisition costs

The boards retained the guidance requiring capitalisation of contract acquisition costs if they are incremental and the entity expects to recover the costs. An entity may elect, as a practical expedient, to record these costs as an expense when incurred if the amortisation period is one year or less.

The boards considered alternatives, including expensing all contract acquisition costs or allowing a policy choice to expense or recognise costs as an asset. They concluded that the guidance in the 2011 exposure draft is consistent with the decisions reached to date for the leasing, insurance and financial instruments projects, and the practical expedient would minimise implementation issues.

What's next?

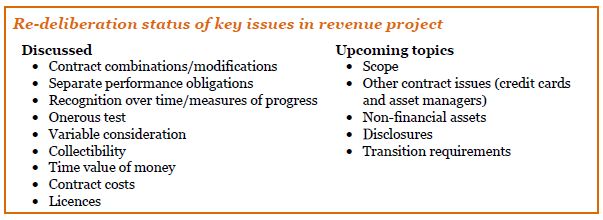

A final standard is likely in the first half of 2013. A number of issues are yet to be re-deliberated (see insert below). Targeted outreach is expected to continue over the next few months on the outstanding areas and more significant changes.

The effective date is unlikely to be earlier than 2016.

IC debates definition of 'high quality'

The IFRS Interpretations Committee (IC) and regulators have responded to questions on whether the current economic climate has changed how entities should determine the discount rate used to measure employee benefit obligations.

The definition of 'high quality' is just the next in a long line of debates arising from the current economic climate.

The Eurozone debt crisis has placed pressure on bond credit ratings. The number of AA rated corporate bonds has decreased, particularly those with longer durations, and some have challenged the interpretation that the 'high quality' rate required by IAS 19 is equivalent to an AA rating or better.

IAS 19 requires that employee benefit obligations are discounted using the market yield on high quality corporate bonds and where no deep market in these bonds exists, the market yield on government bonds.

IC discussions

The IC was asked to provide guidance on the interpretation of 'high quality'. They confirmed that IAS 19 does not specify how to determine the yield on high quality bonds and that judgment is required to determine the discount rate. They noted that predominant practice has been to regard 'high quality' as meaning bonds that receive one of the two highest ratings given by a recognised rating agency. This is consistent with the more specific guidance that exists under both US GAAP and UK GAAP.

The IC did not conclude their deliberations, but noted that they did not expect significant changes in the method used to determine the discount rate from period to period.

Is a rating lower than AA acceptable?

IAS 19 does not define high quality and it might be possible to argue that a definition broader than AA or better could be justified. This judgment should be applied consistently from year to year even where it might not have been explicitly expressed in the past, and most entities have used AA rated to determine the discount rate for many years.

In our view and in the absence of further specific guidance from the IASB or the IC, the reduction in the number of high quality corporate bonds overall or of particular durations in the Eurozone does not justify a change in the definition of what is - or is not - high quality. It might be possible to justify a change in the definition of what is high quality if there has been a systematic change in practice by ratings agencies. We have not seen evidence that the reduction in AA and AAA rated bonds in the Eurozone reflects a tightening of the criteria being applied by rating agencies.

Management might change the way it estimates the yield on AA rated corporate bonds, for example by using information provided by a wider range of rating agencies, if this would provide a better estimate. We do not believe this would be a significant change in method.

The disclosure requirements of IAS 8 should be applied if the method used to estimate the yield on high quality bonds changes, and the impact of the change should be quantified rather than incorporated into the actuarial gain or loss for the period.

Is there a deep market?

Much of the concern in Europe has been driven by a fall in the number of AA and AAA rated corporate bonds, but there has been no suggestion that there is no longer a 'deep market'. Most entities in the Eurozone have used a Europe wide population of Euro denominated bonds to determine the discount rate rather than looking to territory specific markets. We believe that it remains appropriate for these entities to look at the Eurozone as a whole to consider whether or not there is a deep market and to determine discount rates.

The regulator view

ESMA has issued a public statement that entities should not make any change to their approach to determine discount rates until the IC clarifies the guidance in IAS 19. ESMA also emphasised the importance of transparent disclosures in this area.

What is next?

The IC will continue their deliberations in 2013. Management should monitor the developments.

Goodwill and non-current assets remain firmly on regulatory radar

Regulators around the world continue to focus on impairment of non-financial assets, with many highlighting this as a priority area for the current reporting period.

The fall of Lehman Brothers in September 2008 has been pegged by most commentators as the beginning of the financial crisis; although the first rumblings were felt in the derivatives markets in 2007. Volatility continues to plague the equity markets and despite historically low yields on government bonds and high quality corporate debt, investors continue to be sceptical about equities.

The market capitalisation of listed companies continues to descend, on average, towards net asset value of listed companies drawing the attention of regulators. All markets have some companies that are trading at a market capitalisation below net asset value, with some sectors worse than others.

Many regulators around the world have continued to focus on impairment of non-financial assets. Most have announced that they consider this a priority area for the current reporting period. If you're preparing the 2012 financial statements and disclosures, you might find it worthwhile to consider regulatory comments from previous years and areas where regulators have indicated they expect improvements this year.

History

Regulators have widely commented that IAS 36 disclosures are high level, weak and/or boilerplate. Discount rates are frequently the only assumptions disclosed with some reporting entities failing to disclose the more sensitive and critical assumptions embedded in the cash flow model.

The disclosure requirements are now the same for fair value less costs to sell and value in use following recent amendments made to IAS 36.

Last year's findings

Last year, European regulators challenged in more detail the disclosures made by preparers, in particular:

- optimistic projections in both FVLCD (fair value less costs of disposal) and VIU (value in use) cash flow models despite historic experience over the last four years (the valuation hockey stick);

- absence of required sensitivity analysis when there is a 'near miss';

- use of a uniform discount rate for all cash generating units even when there are patently different risks across a group;

- discounting cash flows in foreign currency at the parent company discount rate; and

- specific components of the discount rate, for example market risk premium, cost of debt and debt/equity ratio.

Expectations for this year

Both the European and the US regulators have asked why, in the current environment, the critical estimates used in impairment tests are not included in the critical estimates and judgments disclosures required by IAS 1. They expect to see these this year.

Regulators have further expressed a desire for more granularity of disclosure this year in contrast to the boilerplate of the past. In particular they are looking for:

- why an impairment test was not performed when market capitalisation was below net asset value;

- details of assumptions used rather than the statement that projections are based on management's forecast;

- the period over which detailed projections are made and the growth rate assumed in perpetuity;

- details of uncertainties that could affect the assumptions; and

- sensitivity analysis showing how those uncertainties could affect the outcome.

What do I need to do?

A robust and well documented policy on impairment testing of non-financial assets is the best place to start. Current market volatility makes it increasingly likely that testing may well be required beyond the once a year requirements for goodwill and indefinite lived intangibles. You should document what your indicators are and test when an indicator is triggered.

Cash flow models for VIU and FVLCD should be well defined and the sources for inputs pre-established. There is no requirement in IAS 36 to reconcile VIU to FVLCD. However, if you are relying on VIU to avoid an impairment charge you should be prepared for regulatory challenges to 'explain the difference' as regulators are focused on net asset value in excess of market capitalisation.

Finally, high level or 'standard' disclosures are increasingly at risk of challenge from regulators. You need to ensure that your impairment testing and disclosures can meet the challenge.

Cannon Street Press

IASB publishes feedback statement on agenda consultation

The IASB issued a Feedback Statement in December 2012 that provides an overview of the responses to the public consultation on the future agenda and how the IASB plans to address these responses.

The IASB summarised the feedback from the respondents into five broad themes:

- encouragement to provide a settling period, allowing time to adjust to the new standards issued or to be issued;

- strong support for prioritisation of work on the Conceptual Framework;

- additional guidance to assist first time adopters with application;

- a shift in focus from large projects to increased efforts around implementation and maintenance of current guidance; and

- enhancements to the standard-setting process with a greater emphasis on cost-benefit analysis and earlier recognition of problem areas.

The Feedback Statement described three key initiatives to address the feedback received.

- First, the IASB has taken steps to improve implementation and maintenance of guidance with an emphasis placed on expanding the capabilities and reach of the IC.

- Second, the Conceptual Framework project was restarted in May 2012 with an aggressive goal to publish a Discussion Paper by June 2013.

- Finally, the IASB developed a list of nine research projects to be explored over the next three years, with a focus on up-front efforts to define the problem and establish a path forward for an appropriate solution.

IASB and Advisory Council discuss rate regulated activities

The IASB plans to publish a discussion paper (DP) on accounting for rate-regulated activities by the end of the 2013 and in the meantime develop an interim standard that is expected to apply to first time adopters of IFRS.

The IASB concluded in 2010 that it could not quickly resolve the 'threshold question' of whether regulatory assets and liabilities should be recognised under existing IFRSs and suspended its project. The DP will build on work performed to date plus research undertaken alongside a review of the existing definitions of assets and liabilities in the Conceptual Framework.

The DP will explore how the rights and obligations of rate-regulated entities differ across regulatory jurisdictions, whether those rights and obligations support recognition of assets and liabilities and an analysis of current practice under IFRS by jurisdiction.

The IASB also plans to develop an interim standard in early 2013, which is likely to 'grandfather' existing accounting policies for first time adopters of IFRS until a standard on accounting for rate regulated activities is complete. The interim standard is likely to allow entities that currently recognise assets or liabilities arising from rate regulation to continue to do so on adoption of IFRS. Additional disclosures are likely to be required for entities that apply the interim standard.

Exposure drafts for narrow scope amendments

A number of exposure drafts have been issued to address narrow scope amendments to existing IFRS standards.

IAS 28 - Sales or contributions of assets between an investor and its associate/joint venture

The IASB is proposing to eliminate an inconsistency between the consolidation guidance in IFRS 10 on accounting for the loss of control of a subsidiary and the guidance in IAS 28 (2011) on accounting for contributions of non-monetary assets to an associate or a joint venture.

IFRS 10 requires recognition of both the realised gain on disposal and the unrealised holding gain on the retained interest when control over a subsidiary is lost. On the other hand, IAS 28 (2011) requires gains or losses on the contribution of a non-monetary asset to an associate or a joint venture to be recognised only to the extent of the other party's interest in the associate or joint venture.

The key proposals are as follows:

- If the non-monetary assets sold or contributed constitute a 'business' (as defined in IFRS 3), then the full gain or loss will be recognised;

- If the non-monetary assets sold or contributed do not meet the definition of a business, they will be recognised only to the extent of the other investors' interest in the associate or joint venture; and

- The determination of asset or business should be based on whether the sale or contribution is part of multiple arrangements that should be accounted for as a single transaction.

The proposed amendments will only apply when an investor sells or contributes assets to its associate or a joint venture. They do not cover contribution or sale of assets by an investor to a joint operation.

The comment period ends 23 April 2013.

IAS 28 - Equity method: share of other net asset changes

The IASB is proposing that an investor's share of certain net asset changes in the investee is recognised in the investor's equity, with recycling of the amount recognised when equity accounting ceases.

The following key amendments are proposed:

- the investor's share of other net asset changes in the investee is recognised in the investor's equity; and

- the cumulative amount recognised in equity for other net asset changes is recycled to profit or loss when the investor discontinues the use of the equity method.

The comment period ends 22 March 2013.

IAS 16 and IAS 38 - Clarification of acceptable methods of depreciation and amortisation

An amendment to IAS 16 and IAS 38 is proposed, to clarify that a revenue-based method should not be used to calculate the depreciation or amortisation charge. The rationale is that this method reflects the pattern of economic benefits generated by the asset rather than the consumption of the benefits of the asset itself.

The IASB identified one circumstance, in relation to broadcast rights in the media industry, where a revenue-based method might be appropriate because it would give the same result as the units of production method. The ED proposes to limit this exception to circumstances where there is a linear relationship between viewer numbers and advertising revenue.

The comment period ends 2 April 2013.

Exposure draft on annual improvements

The IASB's ED for the 2011-13 cycle of the annual improvements project amends four standards. On the surface these seem to be minor changes. However, if brought into effect, the impact could be significant.

IFRS 1, 'First-time adoption of IFRS

The amendment to the 'Basis for Conclusions' to IFRS 1 clarifies that, when a new version of a standard has been issued, which is not mandatory but may be early adopted, management can apply either the existing or the new version of the standard. But an entity must apply the same version throughout each period presented in its financial statements.

IFRS 3, 'Business combinations'

The amendment updates the scope exclusion for joint ventures in IFRS 3 to clarify that it applies to all forms of joint arrangements defined in IFRS 11. It also clarifies that the scope exception only applies to the accounting in the financial statements of the joint venture or joint operation itself.

IFRS 13, 'Fair value measurement'

The amendment clarifies that the 'portfolio exception' applies to all contracts within the scope of IAS 39 or IFRS 9, including those that do not meet the definition of financial assets or liabilities in IAS 32. These include certain contracts to buy and sell non-financial items that can be settled net in cash or another financial instrument. The 'portfolio exception' permits an entity to measure the fair value of a group of financial assets and financial liabilities on a net basis if the entity manages that group on the basis of its net exposure to either market risk or credit risk.

IAS 40, 'Investment property'

The amendment clarifies that judgment is required to determine whether the acquisition of investment property is the acquisition of an asset, a group of assets or a business combination in the scope of IFRS 3. The judgment is based on the guidance in IFRS 3 rather than IAS 40, which provides guidance to determine whether a property is investment property or owner-occupied .

The proposed amendments are expected to apply for annual periods beginning on or after 1 January 2014. The deadline for comment is 18 February 2013.

ED on acquisitions of interests in joint operations The IASB is proposing amendments to IFRS 11 to address the diversity in approach on accounting for the acquisition of interests in joint operations. The proposals in the exposure draft (ED) will have the most significant effect on industries that are regular participants in joint operations and on entities that currently use the 'cost' or 'combination' approach.

Background

Specific guidance is proposed on accounting for the acquisition of an interest in a joint operation that is a business, which neither IFRS 11 nor IAS 31 explicitly address. This type of transaction occurs frequently in upstream oil and gas as well as mining.

Three approaches have developed in practice:

1. IFRS 3 approach - preparers apply the guidance in IFRS 3 'Business combinations';

2. Cost approach - preparers allocate the total cost of acquiring the interest to the identifiable assets; and

3. Combination approach - preparers measure identifiable assets and liabilities at fair value and recognise the residual as a separate asset.

These approaches result in different accounting for:

- the premium paid for the acquisition;

- deferred tax assets and liabilities; and

- acquisition-related costs.

Key amendments

The proposed guidance clarifies that the acquisition of an interest in a joint operation that meets the definition of a business in IFRS 3 is not a business combination as the acquiring party does not obtain control. However, the ED proposes that business combination accounting should be applied. This will include:

- measuring identifiable assets and liabilities at fair value;

- expensing acquisition-related costs;

- recognising deferred tax; and

- recognising the residual as goodwill.

The amendments also require the disclosure of information specified in IFRS 3 and other IFRSs for business combinations.

Scope

The amendments in the ED will only apply when the acquired interest is in an existing joint operation that is a business or when a joint operation is formed and an existing business is contributed. They are not intended to address accounting for an interest where a joint operation is formed and this coincides with the formation of a business.

Transition

The ED proposes the amendments to IFRS 11 be prospective and only applied to acquisitions that take place after the start of the first period of adoption.

A proposed effective date has not been provided in the ED. The comment period ends on 23 April 2013.

Know your IFRS 'ABC': B is for 'business'

Erwin Prosen from PwC's Accounting Consulting Services Central team gives practical guidance on common challenges arising from defining a 'business'.

A 'business' is defined in IFRS 3 (2008) as 'an integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing a return in the form of dividends, lower costs, or other economic benefits directly to investors or other owners, members, or participants'.

This definition is similar to the previous standard, except for the addition of the words 'capable of being'. Although only three words were added, the effect was significant. Numerous transactions that were previously considered asset transactions should be accounted for as business combinations under the revised standard.

The assessment of whether a transaction is a business combination or an asset transaction has significant effect on the accounting for the transaction. The assessment might be a simple task but for many transactions it requires judgment.

The accounting for business combinations is more complex; it requires the calculation of the fair value of all the assets, liabilities and contingent liabilities, recognition of goodwill and consideration of the treatment of transaction costs, contingent consideration and deferred tax consequences.

What is a business?

A business consists of inputs and processes applied to inputs that have the ability to generate outputs. These three elements are defined as:

- Input: Any economic resource that creates, or has the ability to create, outputs when one or more processes are applied to it.

- Process: Any system, standard, protocol, convention or rule that when applied to an input or inputs, creates or has the ability to create outputs.

- Output: The result of inputs and processes applied to those inputs that provide or have the ability to provide a return in the form of dividends, lower costs or other economic benefits directly to investors or other owners, members or participants.

A group of assets does need to include all the inputs or processes that the previous owner used to operate the business. If a market participant would be able to easily acquire any missing input or process or could integrate the acquired assets with its own inputs and processes, then the group of assets could still be considered to be a business.

Key message

The standard is silent on whether at least one process should be acquired or whether it is possible to acquire no processes and still consider the transaction a business combination. If no processes are acquired, significant judgment is required to conclude there is a business combination.

Key considerations

In order to determine whether a transaction is a business combination or an asset transaction, the following questions should be considered:

- What did the acquirer buy?

- What did the acquirer get, and want to get, out of the acquisition?

- Are any existing processes transferred to the acquirer to produce the output?

- Are there sufficient inputs and processes to produce outputs?

- If there are missing inputs or processes, are market participants capable of continuing to produce outputs?

For more details on the key considerations see our Practical Guide 'Business combinations: determining what a business is under IFRS 3 (2008)'.

Examples

Example 1 - Acquisition of a business

Facts: Phone Company A acquires 100% of the shares of Phone Company B.

Analysis: The elements in the acquisition contain inputs, processes and outputs.

The inputs are: land, buildings, infrastructure, furniture, software, customer and supplier relationships, reputation, customer contracts, brand, market share, market knowledge, experienced staff and management expertise.

The processes are: management processes, corporate governance, organisational structures, strategic goal setting, operational processes, human and financial resource management.

The outputs are: revenue from customers, access to new markets, increased efficiency, synergies, customer satisfaction and reputation.

A business has been acquired because all the assets and activities to provide a return are included.

Example 2 - Acquired assets and operations without outputs

Facts: Computer Company A acquires Software Development Company B. Company B has been formed to make handheld device applications. The current activities of Company B include research and development of its first product and creation of a market for the product. Company B has not generated any revenues and has no existing customers. Company B's workforce is composed primarily of programmers. Company B has the intellectual property, software and fixed assets required to develop applications.

Analysis: The elements in the acquisition contain both inputs and processes.

The inputs are: intellectual property, fixed assets and employees.

The processes are: strategic and operational processes for developing the applications.

It is likely a business has been acquired because Company B has the inputs and processes necessary to manage and produce outputs.

Key message

The lack of outputs, such as revenue and a product, does not prevent an entity from being considered a business.

2012 - a year of prophecies

The year is nearly over and if you are reading this it's unlikely that Nostradamus' prediction that "the world will end" will come true. Here are a few more prophecies about the year 2012.

The IASB Agenda Consultation document published in July 2011 planned for a feedback statement to be issued in 2012.

Facebook was predicted to exceed its expected valuation in the first few days of trading. The shares opened for trading at $38 on 18 May.

Almost everyone predicted that Prince William and Princess Kate would be pregnant by the end of the year.

IASB and FASB report in April 2012 that they expect to release publications on the Lease and

Insurance projects and finish redeliberations on the Revenue project by the end of the year.

German sausage dog 'Sissi' predicted Bayern Munich to win the Champions League title against Chelsea Football Club.

Luciano Barra, 'Olympic prophet', used mathematics to forecast that China will top the medal tally at the 2012 London Olympics.

2012 is the year of the BlackWater Dragon in the Chinese calendar and was forecasted to be a year of change, hopefully from bad to good.

We got a couple right... on 3 December, Prince William and Princess Kate announced they are expecting a baby and the future of the IASB's agenda was revealed in the nick of time (see page 8). The rest were false expectations.

- The US topped the medals tables with 104 total medals and 46 golds.

- As we go to press, Facebook shares are trading at around $28 per share.

- Chelsea won the Champions league on penalties 1-1 (4-3).

On the accounting front...the redeliberations on Revenue are ongoing and the next publications on the Lease and Insurance projects are expected in the first half of 2013.

And only you know whether the Black Water Dragon treated you well this year. Have a good holiday and we will see you in the New Year.