- within Corporate/Commercial Law and Environment topic(s)

1. For input valued-added tax ("VAT") refund claims filed prior to 2018, is the 120-day period for the Bureau of Internal Revenue ("BIR") to decide a claim for refund of excess unutilized input VAT attributable to zero-rated sales counted from the taxpayer's submission of complete documents as enumerated in Revenue Memorandum Order ("RMO") No. 53-98?

No. In Commissioner of Internal Revenue ("CIR") v. CE Casecnan Water and Energy Company ("Casecnan") (G.R. No. 212727, February 1, 2013), the Supreme Court ("SC") held that the 120-day period should be reckoned from the filing of the application for refund, regardless of the sufficiency of the supporting documents submitted by the taxpayer.

In Casecnan, Casecnan filed administrative claims for refund/tax credit with the BIR under Sec. 112(C) of the Tax Code for unutilized input VAT attributable to its zero-rated sales for the year 2008. Due to inaction by the CIR despite the lapse of 120 days, Casecnan filed petitions for review with the Court of Tax Appeals ("CTA"). The CTA Division partially granted the petition and ordered the CIR to refund or issue a tax credit certificate to Casecnan. The CTA En Banc affirmed the CTA Division's decision in toto.

The CIR filed a Petition for Review on Certiorari before the SC arguing that the judicial claim was prematurely filed because the 120-day period under Sec. 112(C) of the Tax Code had not yet commenced to run due to the insufficiency of supporting documents in Casecnan's application for tax refund/credit before the BIR. The CIR contended that the 120-day period should be counted from the time the taxpayer submits all the supporting documents stated in RMO No. 53-98. The CIR further claimed that since Casecnan failed to submit the complete required documents under RMO No. 53-98, then the 120-day waiting period did not commence, and thus, Casecnan's judicial claim was premature.

The SC said that the completeness of the documents to support a claim for refund/tax credit under Sec. 112(C) of the Tax Code should be determined by the taxpayer, and not by the BIR. Should the taxpayer decide to submit only certain documents, or should the taxpayer fail, or opt not to submit any document at all, in support of its application for refund under Sec. 112(C) of the Tax Code, then the 120-day period should be reckoned from the filing of the said application. Otherwise, taxpayers will be at the mercy of the BIR and the period within which they can elevate their case to the CTA will never run, to their extreme prejudice.

The BIR's reliance on the completion of requirements under RMO No. 53-98 in commencing the 120-day period should not be countenanced since the said order merely provides for the guidelines to be observed by BIR examiners of the documents to be requested from taxpayers during the conduct of an audit related to input VAT refund applications. It is not a directive addressed to taxpayers.

SyCipLaw TIP 1:

The completeness of the documents to support a claim for

refund (filed prior to 2018) under Sec.112(C) of the Tax Code is

determined by the taxpayer, not the BIR. Thus, should the taxpayer

submit only certain documents, or should he opt not to submit any

document at all, in support of its application for refund under

Sec. 112(C) of the Tax Code, the 120-day waiting period should be

reckoned from the date of filing of the said application. Should

there be inaction on the part of the CIR, a taxpayer thereafter has

30 days to avail of its judicial remedy before the CTA. Note that

with the amendment of the Tax Code by the Tax Reform for

Acceleration and Inclusion

("TRAIN") Law for input VAT

claims for refund filed starting January 1, 2018, the BIR has

ninety (90) days to grant the refund of creditable input VAT from

the date of submission of the official receipts, invoices, or other

documents in support of the application filed, and the taxpayer

affected may, within thirty (30) days from the receipt of the

decision denying the claim, appeal with the CTA.

2. Is the CTA empowered to decide issues beyond the stipulation of the parties?

Yes. In Tanduay Distillers, Inc. ("Tanduay") v. CIR (G.R. No. 256740, February 13, 2023), the SC held that the CTA is not bound strictly by the issues raised by the parties. Quoting Sec. 1, Rule 14 of the Revised Rules of the CTA, the CTA is not limited to "issues stipulated by the parties, but may also rule upon related issues necessary to achieve an orderly disposition of the case."

In Tanduay v. CIR, Tanduay filed two administrative requests for a refund of excise taxes it erroneously paid. Thereafter, two separate judicial claims for refund were filed with the CTA Division which consolidated the petitions. During the CTA Division proceedings, the counsels of the parties stipulated (a) that the CIR's denial of the refund claim was purely based on legal issues and (b) that there is no issue as to the amount of the excise taxes paid by Tanduay.

The CTA Division denied the claim for Tanduay's failure to prove its entitlement to a tax refund due to the insufficiency of evidence presented. The CTA En Banc affirmed the denial of the claim.

Tanduay went up to the SC and argued that the CTA erred when it delved into the facts despite the stipulation of the parties. Tanduay insisted that their stipulation was in the nature of a judicial admission, which should bind not only the hands of the parties but also the court.

Disagreeing, the SC said that whether considered a judicial admission or not, the parties' stipulation that the basis for the denial of Tanduay's claim for refund is purely legal shall not deprive the CTA from making its own determination of facts at the judicial level, in consideration of the CTA's power to receive evidence in the exercise of its original jurisdiction. In fact, the scope of CTA's review power covers factual findings, and the claim for refund is litigated anew at the CTA level. It is incumbent upon Tanduay to prove that it was, in fact, entitled to a refund. The taxpayer claimant has the burden of proof to establish strict compliance with the conditions for the grant of a tax refund or credit. Ultimately, it is Tanduay's failure to prove its compliance with the documentary and evidentiary requirements for its refund claim that was fatal to its case.

Tax refunds are construed strictly against the taxpayer and liberally in favor of the State. As such, it is incumbent upon the taxpayer-claimant to establish the factual basis of its claim for tax refund or credit, which Tanduay failed to do.

SyCipLaw TIP 2:

Especially in a case for tax refund (which is strictly

construed against the taxpayer), it would be more prudent to prove

strict compliance with the conditions for granting a refund rather

than rely on judicial admissions. The scope of the CTA's power

to review covers factual findings and a claim for refund is

litigated de novo at the CTA level. To prove its entitlement to a

tax refund before the CTA, a taxpayer must sufficiently establish

the factual basis of his claim through compliance with the

documentary and evidentiary requirements for its refund claim. Note

that Tanduay v. CIR is a minute resolution (which does not

set any precedent), but the general principles discussed therein

are based on existing jurisprudence.

3. Does an administrative regulation that substantially changes or increases the burden of those governed require prior notice and hearing for its validity?

Yes. In Philippine Stock Exchange, et. al. ("PSE, et. al.") v. Secretary of Finance, et. al. ("SOF") (GR No. 213860, July 5, 2022), the SC nullified Revenue Regulations ("RR") No. 1- 2014, Revenue Memorandum Circular ("RMC") No. 5-2014, and SEC Memorandum Circular ("MC") No. 10-24 ("Assailed Regulations") for violating due process requirements.

In PSE, et. al. v. SOF, et. al., PSE, et. al. filed a Petition for Certiorari and Prohibition to question the constitutionality of the Assailed Regulations for being issued without complying with the requirements of notice and hearing. SOF, et. al. refuted this argument by saying that the BIR, in the exercise of its legislative functions, had issued several BIR issuances to amend the reportorial requirements of payor-corporations and these issuances do not need to comply with the notice and hearing requirement.

The SC differentiated legislative rules from interpretative rules. Legislative rules are a form of subordinate legislation where the agency is acting in a legislative capacity, supplementing the statute, filling in the details, pursuant to a specific delegation of legislative power. They impose additional obligations pursuant to authority from Congress and affect individual rights and obligations. Interpretative rules, on the other hand, are merely intended to interpret, clarify, or explain existing statutory regulations under which the administrative body operates.

The gauge in determining whether a regulation requires prior notice and hearing is its substance or content. Prior notice and hearing are required for its validity if the regulation increases the burden of those governed. On the other hand, if they are merely interpretative rules, notice and hearing are not essential for their validity.

In PSE, et. al. v. SOF, et al., the SC held that the Assailed Regulations were not mere interpretative issuances but were legislative in nature that changed, if not increased, the burden of those governed. The Assailed Regulations, particularly SEC MC No. 10-2014, substantially changed the procedure currently observed by the market participants by imposing a new obligation to various bodies of transmitting the alphalist of payees and their corresponding personal information. The Assailed Regulations upended long-established practices and changed a long-standing rule in imposing this new burden. Furthermore, the Assailed Regulations imposed penalties for non-compliance. Hence, the SC declared as void the Assailed Regulations for failure to conduct notice and hearing prior to issuance and publication.

The SC also said that the Assailed Regulations violated the right to privacy, which rendered them unconstitutional and therefore void. Where government action is violative of a fundamental right, such as the right to privacy, such action will be subject to strict scrutiny and the government bears the burden to show and prove that such action (i) serves a compelling state purpose and (ii) is narrowly drawn to prevent abuses. The SC held that while it may be argued that the Assailed Regulations serve a compelling state interest, the Assailed Regulations were not narrowly drawn to prevent abuses. The respondents failed to present any evidence to show and prove that the Assailed Regulations were the least restrictive, or the sole effective, means for effecting the invoked interest.

SyCipLaw TIP 3:

Administrative regulations that substantially change or increase

the burden of those governed need to comply with the prior notice

and hearing requirement for their validity. Administrative agencies

should ensure that in issuing administrative regulations that

substantially change or increase the burden on those affected, they

must comply with the requirement on prior notice and hearing. In

addition, according to the opinion of J. Lazaro-Javier, there must

also be compliance with the filing or registration and publication

requirement, in accordance with the Administrative Code of 1987.

Taxpayers must know how to distinguish between legislative rules

and interpretative rules to know whether an administrative

regulation affecting them may be nullified for lack of compliance

with procedural due process requirements.

4. Does the presentation of the Certificate of Non-Registration and the Articles of Incorporation of a foreign corporation constitute conclusive proof that the foreign corporation is not engaged in trade or business in the Philippines?

No. In Amadeus Marketing Philippines, Inc. v. CIR (CTA E.B. No. 2496, March 16, 2023), the CTA En Banc ruled "that the presentation of both Foreign Articles/Certificate of Incorporation and [Securities and Exchange Commission] Certificate of Non-Registration will ordinarily prove that an entity is a foreign corporation not doing business in the Philippines. However, an exception to this rule is when there is clear and convincing evidence that would prove otherwise."

In this case, the taxpayer filed with the BIR a claim for refund of its excess input VAT attributable to its zero-rated sales. The taxpayer derived these sales from rendering marketing services for its client, Amadeus IT Group S.A. ("AGSA"), a foreign corporation. Specifically, the taxpayer was engaged in the marketing of the Amadeus Global Travel Distribution, a computerized reservation system for airlines seats, package tours, car rentals, and hotel services.

The BIR denied the input VAT refund, as it found that the taxpayer's services are not zero-rated because AGSA is a foreign corporation doing business in the Philippines. The taxpayer challenged the denial of its claim for refund before the CTA. During trial, the taxpayer submitted AGSA's Articles of Incorporation and a Certificate of Non-Registration to prove that AGSA is a foreign corporation not doing business in the Philippines. The CTA affirmed the BIR's decision, prompting the taxpayer to appeal the case with the CTA En Banc.

The CTA En Banc denied the appeal and ruled that in order to qualify for VAT zero-rating under Section 108(B)(2) of the Tax Code, the taxpayer must show that the recipient of the services must be a foreign corporation doing business outside the Philippines.

Here, in determining whether AGSA is doing business in the Philippines, the CTA En Banc relied on MR Holdings, Ltd. v. Sheriff Carlos P. Bajar (G.R. No. 138104, April 11, 2002) and CIR v. British Airways Corporation (G.R. Nos. L-65773-74, April 30, 1987), where the SC ruled that the test to determine if a foreign corporation is engaged in trade or business in the Philippines is whether the foreign corporation is performing acts in the Philippines that imply a continuity of its commercial dealings. In turn, continuity is shown by the exercise of functions that are incidental to or in progressive prosecution of the purpose and object of the foreign corporation's business. Moreover, under the provisions of the Foreign Investment Act of 1991, doing business includes the appointment of representatives or distributors domiciled in the Philippines. The continuity of commercial dealings, according to the CTA En Banc, is exemplified by the appointment of a local agent in the Philippines.

Here, the CTA En Banc found that the taxpayer and AGSA entered into a Travel Agency Management Agreement Systems Distribution Agreement ("Distribution Agreement"), where AGSA appointed the taxpayer, a Philippine resident, to be the sole distributor of its products in the Philippines and granted the taxpayer the authority to grant non-exclusive licenses to subscribers for the use of its products. As shown in the Distribution Agreement, AGSA appointed the taxpayer as its agent for the continued pursuit of AGSA's business in the Philippines. Thus, AGSA was considered to be doing business in the Philippines through the taxpayer.

SyCipLaw TIP 4:

One of the requisites for VAT zero-rating under Section 108(B)(2)

of the Tax Code, which would entitle a taxpayer to claim an input

VAT refund, is that the recipient of the service rendered by the

taxpayer must be a foreign corporation doing business outside the

Philippines. If the CIR presents evidence showing that the foreign

corporation is actually doing business in the Philippines, then it

is not enough for the taxpayer to rely solely on the foreign

corporation's Articles of Incorporation and the Certificate of

Non-Registration. The taxpayer must refute the controverting

evidence by providing additional proof that the foreign corporation

is indeed not doing business in the Philippines.

A motion for reconsideration of the decision is currently pending.

CTA decisions, while persuasive, do not become part of the law of the land, unlike decisions of the SC.

5. Do taxpayers need to prove actual remittance of tax to be entitled to a refund of excess creditable withholding tax?

No. In CIR v. Tullet Prebon (Philippines), Inc. (CTA E.B. Case No. 2576, February 16, 2023), the CTA En Banc upheld the taxpayer's tax refund claim for its excess creditable withholding taxes ("CWT") and ordered the CIR to issue the corresponding tax certificates in favor of the taxpayer despite the lack of proof of actual remittance to the BIR of the taxes withheld.

In this case, the taxpayer sought a refund of its excess CWT for the taxable year 2014 and requested the CIR to issue a tax credit certificate in the taxpayer's favor. However, due to the CIR's inaction, the taxpayer elevated its claim to the CTA. During trial, the taxpayer submitted supporting documents, which included its Annual Income Tax Return for 2014, its Audited Financial Statements for 2014, its Books of Accounts, its Schedule of Creditable Withholding Tax for 2014, and BIR Form No. 2307 – Certificate of Creditable Tax Withheld at Source.

The CTA First Division found that the taxpayer was able to partially substantiate its claim for tax refund. The CIR appealed the ruling to the CTA En Banc, claiming that the taxpayer failed to substantiate its claim for tax refund of excess CWT because it did not show proof that the taxes withheld were actually remitted by the withholding agent to the BIR.

The CTA En Banc ruled that proof of the actual remittance of the taxes withheld is not necessary to substantiate a claim for refund of excess CWT. It ruled that "[t]he Certificates of Creditable Tax Withheld at Source issued by the withholding agents of the government are prima facie proof of actual payment by [the taxpayer] to the government." In addition, under Sections 57 and 58 of the Tax Code, the responsibility to remit taxes lies with the income payor, who is the withholding agent of the government. The CTA En Banc emphasized that the withholding agents hold the taxes in trust for the government, and in the event of fraud or the withholding agent's failure to remit the taxes, the income payee should not be prejudiced by the acts or inactions of the withholding agent.

6. In input VAT refund cases, when should the 30-day period to file a judicial claim for refund start to run?

The thirty (30)-day period to file a judicial claim for input VAT refund is counted from receipt of an adverse decision rendered within the ninety (90)-day period for the BIR to decide the claim, or within thirty (30) days after the lapse of such ninety (90)-day period, whichever comes earlier.

In Nippon Express Philippines Corporation v. CIR (CTA E.B. Case No. 2506, February 15, 2023), the CTA En Banc ruled that the taxpayer failed to file its judicial claim for input VAT refund on time because it reckoned the thirty (30)-day period from its receipt of the adverse decision on its input VAT refund claim, which was already beyond the ninety (90)-day period for the BIR to decide on the claim.

In this case, on March 29, 2019, the taxpayer filed with the BIR an administrative claim for refund of its unutilized input VAT for all four quarters of the calendar year ending 2017. On June 11, 2019, the taxpayer received a letter-denial from Ms. Teresita M. Dizon, OIC Assistant Commissioner of Large Taxpayer Service ("OIC Dizon"), prompting the taxpayer to file a request for reconsideration with the CIR on July 10, 2019. However, the request was likewise denied by the CIR through a letter, which the taxpayer received on December 11, 2019.

The taxpayer then filed a judicial claim for input VAT refund on January 10, 2020, but the CTA First Division dismissed the claim for having been belatedly filed. The taxpayer sought reconsideration, but the CTA First Division likewise denied the same. The taxpayer then filed a petition for review with the CTA En Banc, arguing that it had thirty (30) days from December 11, 2019 (which is the date of its receipt of the CIR's letter denying its request for reconsideration), or until January 10, 2020, to file its judicial claim. The taxpayer further argued that the thirty (30)-day period cannot be counted from its receipt of OIC Dizon's letter-denial because her decision is not appealable to the CTA Division.

The CTA En Banc ruled that the taxpayer's judicial claim for input VAT refund was not filed on time because "[t]o validly seek redress before the Court in Division, the taxpayer must file a Petition for Review, within thirty (30) days from the receipt of an adverse decision rendered within said ninety (90)- day period, or within thirty (30) days after the lapse of such ninety (90)-day period, whichever comes earlier."

Citing Silicon Philippines, Inc. v. CIR (G.R. 182737, March 2, 2016), the CTA En Banc ruled that the judicial claim for input VAT refund must be filed within thirty (30) days from receipt of an adverse decision rendered within the then one hundred twenty (120)-day period for the BIR to decide the claim, or within thirty (30) days after the lapse of such then One hundred twenty (120)-day period, whichever comes earlier.

The CTA En Banc found that the ninety (90)-day period for the BIR to decide on the taxpayer's claim for input VAT refund ended on June 27, 2019. The taxpayer received OIC Dizon's letter-denial on June 11, 2019, which was within the ninety (90)-day period for the BIR to decide on the refund claim. Thus, the taxpayer had thirty (30) days from that date, or until July 11, 2019, to file its judicial claim with the CTA. However, in this case, the taxpayer belatedly filed its judicial claim on January 10, 2020.

The CTA En Banc further ruled that the thirty (30)-day period cannot be counted from the date the taxpayer received the CIR's denial of its request for reconsideration (i.e., on December 11, 2019) because it was already beyond the ninety (90)-day period. Further, the CTA En Banc held that OIC Dizon's letter-denial is the decision appealable to the CTA because OIC Dizon is duly authorized under the Tax Code to rule on taxpayer's input VAT refund claim. Section 7 of the Tax Code allows the CIR to delegate powers, not otherwise prohibited by law, to his or her subordinates. Here, BIR RMC No. 17-18 delegated to Assistant Commissioners the power to deny administrative claims for input VAT refunds.

SyCipLaw TIP 6:

While Section 112 (C) of the Tax Code, as amended by the

TRAIN Law, is silent on when the thirty (30)-day period to file a

judicial claim shall run if the official, agent, or employee of the

BIR fails to act on the refund application of the taxpayer within

the ninety (90)-day period, the CTA En Banc decision in Nippon

Express clarified that the thirty (30)-day period should run after

the lapse of the ninety (90)-day period.

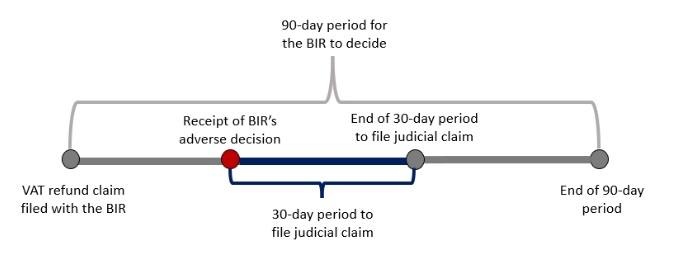

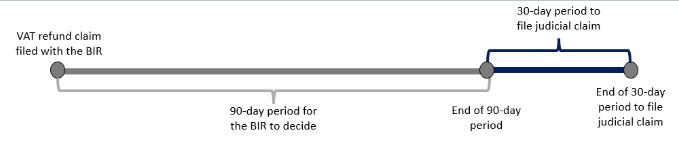

To illustrate the reckoning point of the thirty (30)-day period within which to file the judicial claim for input VAT refund, please see the diagram below:

- If the taxpayer receives the BIR's decision within the ninety (90)-day period for the BIR to decide on the administrative claim for refund, the judicial claim must be filed within thirty (30) days from receipt of the BIR's decision:

- If the taxpayer does not receive the BIR's decision within the ninety (90)-day period for the BIR to decide on the administrative claim for refund, the judicial claim must be filed within thirty (30) days from the end of such ninety (90)-day period:

A motion for reconsideration of the decision is currently pending.

CTA decisions, while persuasive, do not become part of the law of the land, unlike decisions of the SC.

7. What are the classifications of One-Time Transactions ("ONETT") and the corresponding processing times of each classification for the issuance of the Electronic Certificate Authorizing Registration ("eCAR")?

In RMC No. 23-2023, the BIR amended the provisions of RMC No. 48-2018, assigned the classifications for each ONETT, and set out the corresponding processing time for the issuance of ONETT Computation Sheet ("OCS") and eCAR for each transaction, in order to align with the BIR's 2023 Citizen's Charter.

The ONETT transactions referred to in RMC No. 23-2023 are the following:

- Sale of real property or shares of stock;

- Donation of properties; and

- Settlement of estate of a decedent

RMC No. 23-2023 classified the processing and issuance of the OCS or the eCAR for each ONETT transaction as complex or highly technical as shown below:

ONETT Transaction |

Classification |

|

Processing and issuance of the OCS for (i) the sale of real property or shares of stock or (ii) donation of properties |

Complex |

|

Processing and issuance of the eCAR for (i) the sale of real property or shares of stock or (ii) donation of properties |

Complex |

|

Processing and issuance of the OCS for the estate of a decedent |

Highly technical |

|

Processing and issuance of the eCAR for the estate of a decedent |

Complex |

The total processing time for the issuance of eCARs as well as the

OCS for transactions that have been classified as complex is seven

(7) working days per document, or a total of fourteen (14) working

days for both documents.

On the other hand, the processing time for the issuance of the OCS for highly technical transactions is twenty (20) working days.

SyCipLaw TIP 7:

While RMC No. 23-2023 provides guidelines on the

processing time for ONETT transactions, such processing time is

merely an estimated period for the processing and issuance of the

OCS or the eCAR. In practice, the processing time may take shorter

or longer, depending on the volume of applications and complexity

of the transactions handled by the BIR. Taxpayers should manage

their expectations and submit complete documents based on the

BIR's checklist of requirements to help minimize delays in the

issuance of the eCAR.

8. What is the base of the penalty due to non-compliance by Registered Business Enterprise ("RBE") in the Information Technology-Business Process Management ("IT-BPM") sector of the work-from-home ("WFH") threshold pursuant to Fiscal Incentives Review Board ("FIRB") Resolution No. 17-22, as extended by FIRB Resolution No. 26-22?

The base is the total income for the non-complying month. The FIRB issued Advisory No. 3-2023 in relation to FIRB Resolution No. 17- 2022, as extended by Resolution No. 26-2022. Under FIRB Resolution No. 17-22, RBEs in the IT-BPM sector adopting a WFH arrangement that exceeded the allowable thirty percent (30%) threshold were not entitled to avail themselves of the fiscal and non-fiscal incentives for the said month of non-compliance. The FIRB noted that PEZA Memorandum Circular No. 74-2022 stating that the penalty upon non-compliant RBEs is the payment of the regular corporate income tax ("RCIT") and local business tax on the taxable income in excess of the 30% WHF threshold is inconsistent with WFH policies issued under FIRB advisories and the BIR's memorandum circulars.

FIRB Advisory No. 3-2023 clarified that the base for the imposition of the RCIT as penalty is 100% of the net taxable income of the non-compliant RBE for each month of non-compliance, and not just the excess of the 30% threshold.

Under RMC Nos. 23-2022, 39-2022, and 120-2022, RBEs that fail to comply with the WFH threshold shall continue to file and pay their income tax due, and if the non-compliant RBE is subject to the 5% tax Gross Income Tax ("GIT")/Special Corporate Income Tax ("SCIT"), the penalty shall be determined by computing the difference between the RCIT and the 5% GIT/SCIT.

The FIRB Advisory also provides a reminder that the RBEs in the IT-BPM sector in the economic or freeport zone may no longer adopt WFH arrangements beginning January 1, 2023 unless registered with the Board of Investments ("BOI") not later than January 31, 2023 pursuant to FIRB Resolution No. 33-22. Only those registered with BOI on or before 31 January 31, 2023 may adopt up to 100% WFH arrangements without adverse effects on their incentives.

SyCipLaw TIP 8:

RBEs in the IT-BPM sector which adopted a WFH arrangement

exceeding the thirty percent (30%) threshold until December 31,

2022 must apply the penalty on 100% or the entirety of RCIT due for

each month of non-compliance, and not merely on the excess from

thirty percent (30%). Beginning January 1, 2023, RBEs in the IT-BPM

sector in the economic or freeport zone are no longer allowed to

adopt WFH arrangements unless the RBE was able to transfer its

registration from PEZA to the BOI by January 31, 2023; otherwise,

the RBE will have to pay the RCIT rate on its net taxable

income.

9. What are the qualifications for an ELSE to qualify for VAT zero-rating incentives?

- What is an Ecozone Logistics Service Enterprise

("ELSE")?

An ELSE is defined under RMC No. 24-2023 as "a registered business enterprise (RBE) supplying production-related raw materials and equipment that caters exclusively to the requirements of export manufacturing enterprises which are registered with the PEZA, Clark Development Corporation, Subic Bay Metropolitan Authority, Authority of the Freeport Area of Bataan, or other special economic zones/freeports outside the administration of PEZA." RMC No. 24-2023 further provides that an ELSE provides "critical support, particularly to export manufacturing companies with their requirements for logistics support to facilitate their import and export shipments, sourcing of raw materials, inventory management, just-in-time deliveries, localization, and process customization". An ELSE was formerly known as an "Ecozone Facilities Enterprise Engaging in Warehouse Operations" under relevant PEZA resolutions.

- If the enterprise only engages in trucking and delivery

services, will it qualify to be registered as an ELSE?

No. The definition of an RBE under Section 293(M) of the Tax Code excludes certain service enterprises, such as those engagedin trucking or forwarding services.

Additionally, under BOI MC No. 2023-001, the only type of logistic service that will qualify for registration as an ELSE is an entity undertaking BOTH of the following activities:

- Establishment of a warehouse storage facility;

and

- Importation or procurement from local sources and/or from other

registered enterprises of goods for resale, or for packing/covering

(including marking, labeling), cutting, or altering to

customers' specification, mounting and/or packaging into kits

or marketable lots thereof for subsequent sale, transfer or

disposition for export.

- Establishment of a warehouse storage facility;

and

- Can an ELSE be considered as an "export

enterprise" under the Corporate Recovery and Tax Incentives

for Enterprises ("CREATE")

Act?

Yes. An ELSE that renders at least 70% of its output/services to another registered export enterprise is covered by the definition of "export enterprise" under Section 293(E) of the Tax Code and as clarified in BOI MC No. 2023-001. - Will the ELSE's purchases from the customs

territory be considered VAT zero-rated?

The local purchases of registered ELSEs from VAT-registered suppliers are subject to VAT at zero-rate but only if the goods and/or services purchased are directly and exclusively used in the registered project or activity of the ELSE. Suppliers of an ELSE must submit a VAT zero-rating application to the BIR to apply the VAT zero-rating on the ELSE's local purchase of goods and services that are directly and exclusively used in the ELSE's registered project/activity. The supplier's VAT zero-rating application must include the following documents as attachments:

- the ELSE's Certificate of Registration and VAT

Certification issued by the concerned Investment Promotion

Agency;

- A sworn affidavit executed by the ELSE stating that the goods

and/or services bought are directly and exclusively used for the

production of goods and/or completion of services to be exported or

for utilities and other similar costs, the percentage of allocation

of such purchases which are directly and exclusively used for the

production of goods and/or completion of services to be exported;

and

- Other documents to corroborate entitlement to VAT zero-rating,

such as but not limited to duly certified copies of the valid

purchase order, job order or service agreement, sales invoices

and/or official receipts, delivery receipts, or similar documents

to prove the existence and legitimacy of the transaction.

- the ELSE's Certificate of Registration and VAT

Certification issued by the concerned Investment Promotion

Agency;

Other details on the availment of VAT zero-rating incentives under the CREATE Act are provided in RMC No. 24-2022 and its subsequent amendments.

SyCipLaw TIP 9:

In order to be considered an "export enterprise" that may

avail itself of the VAT zero-rating incentive under the CREATE Act,

a registered ELSE must render at least 70% of its output/services

to another registered export enterprise. Their purchases of goods

and services from VAT-registered suppliers will be entitled to VAT

zero-rating if such goods and services are directly and exclusively

used in the registered project or activity of the ELSE and provided

that the suppliers apply for, and are granted, VAT zero-rating with

the BIR.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.