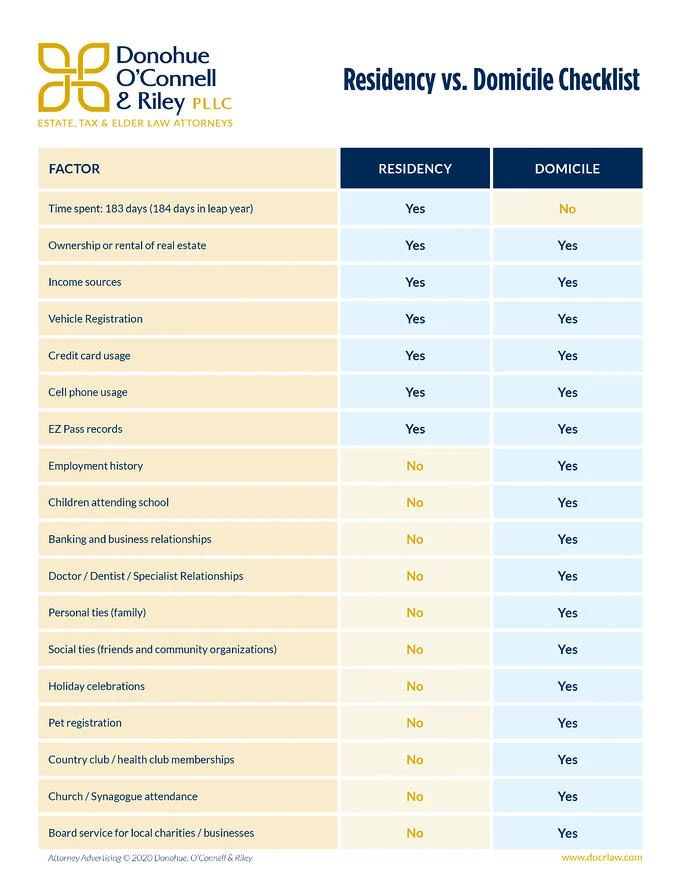

It is crucial to understand the difference between "domicile" and "residency." "Domicile" refers to a taxpayer's primary and permanent home, of which a tax payer can only have one, and which is considered for estate tax purposes. However, a taxpayer can have more than one "residence" as they may have homes in more than one state.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.