- with Finance and Tax Executives

- in United States

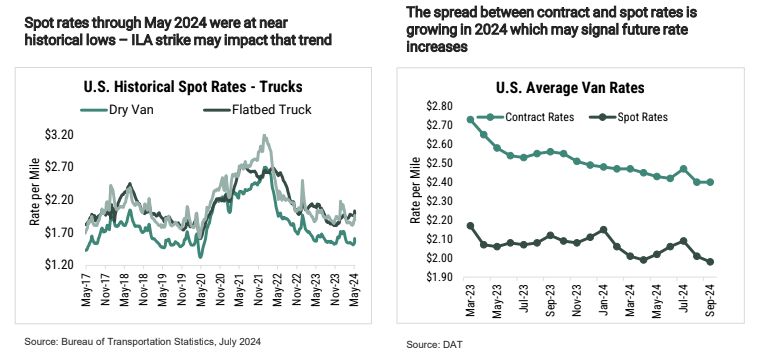

Shippers win in trucking...but for how long?

After weathering sharp increases in freight rates during COVID, rates that declined significantly in 2024 are starting to moderate or trend upwards

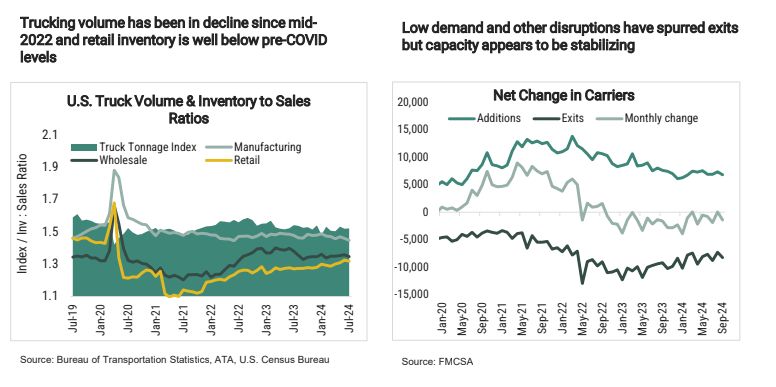

A rebound in trucking volume is yet to materialize in 2024 as supply continues to exceed demand

Key industry dynamics

The current freight cycle shifts power back to shippers, but this is temporary, and is closely tied to improvements in the U.S. Economy

Demand for freight services is likely to remain flat for the next 4-6 months.

- Businesses have cleared their COVID inventory buildup and are

managing inventory cautiously in anticipation of

sustained softness in consumer spending. - Interest rate relief may not come as quickly as hoped and

impacts on capacity will lag. Housing, construction and

manufacturing output will likely remain muted in the short to medium term. - Disruptions in the Suez and Panama Canals are not

expected to end soon, prolonging the slowdown in

international

shipping and its impact on domestic trucking. - While the threat of East and Gulf Coast port strikes is gone, international events may disrupt shipping and the already challenged trucking industry with over 88,000 carriers and 8,000 brokers shuttering operations in 2024.

The current overcapacity will diminish as more carriers right-size operations amid the sustained slowdown.

- Given the challenges noted in the industry, the remaining players have absorbed demand without a spike in rates.

- But prolonged low demand and already thin margins are ushering

in a more significant supply correction

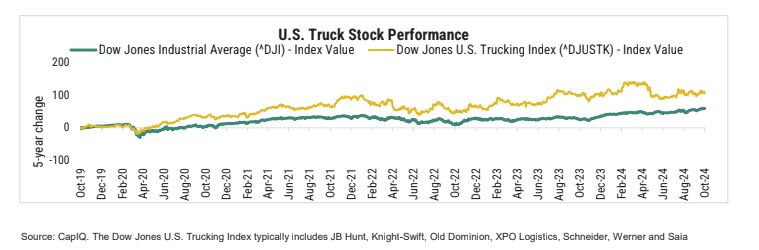

- Trucking stocks are significantly down YTD, with carriers such

as Werner seeing Q2 operating margins drop by as

much as 58% YOY. - Carriers are reorganizing to improve profitability, as seen with CH Robinson's decision to exit Europe.

- Trucking stocks are significantly down YTD, with carriers such

as Werner seeing Q2 operating margins drop by as

Industry disruptions create opportunities and challenges for shippers and truckers alike

- Brokers. Digital brokers play an increasingly

prominent role, bringing new capabilities relative to traditional

brokerage

models. Benefits include improved transportation efficiencies, pricing visibility and access to data. - Regulatory and Environmental Pressures. More

stringent emissions regulations force carriers to adopt

operational

changes and spending on fuel saving technologies to support fuel efficiency. - Industry Consolidations. Continued

consolidations, though at a slower pace, increase competitive

dynamics and help

rebalance supply and demand as smaller, more vulnerable carriers face exit risk. - Ecommerce. Ecommerce growth decreases demand

for larger store shipments and increases the need for smaller

shipments, shifting volume from FTL trucking to TL consolidation and LTL.

Shippers should hit the gas to seize on market opportunities

Ankura estimates there to be a limited, 6–8-month window

for shippers to capitalize on current market favorability.

Shippers should act quickly to establish a plan for a mix of

contract and spot rates. Key actions:

- Strategic Planning. Develop a freight allocations approach guiding the use of contract vs. spot rates.

- Rates. Stay on top of market fluctuations. Establish processes for regular rate benchmarking.

- Carriers. Build strong relationships with core carriers, while

also diversifying the carrier base and mix to avoid

overreliance on specific carriers. - Technology. Leverage technology and consider the role of the broker to bridge technology gaps.

- Contracts. Review contracts regularly as market and business

needs evolve. Negotiate volume flexibility and

previously-negotiated spot rates based on evolving market conditions. - Risk Management. Build hedging strategies and contingencies for periods of low capacity and rate volatility.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.