- within Strategy topic(s)

In the SEC's latest environmental, social and governance (ESG) rulemaking salvo, the agency proposed two new ESG-focused rules aimed at the advisory and investment company space: 1) proposed amendments to the "Names Rule" under the Investment Company Act, with specific aspects geared toward investment companies with ESG-themed titles and 2) proposed amendments for investment advisers and funds to facilitate enhanced ESG-related disclosures. In today's part two, we analyze the SEC's proposed ESG-related disclosure rule for advisers and funds, titled "Enhanced Disclosures by Certain Investment Advisers and Investment Companies about Environmental, Social, and Governance Investment Practices" (ESG Disclosure Rule) and offer some key takeaways.

Current Landscape

Before addressing the proposed rule, it's helpful to set the stage by looking at the current ESG regulatory landscape for advisers and funds. One of the best starting points is a risk alert issued early last year by the SEC's Division of Examinations (Exam). On April 9, 2021, Exam issued a Risk Alert to highlight observations of control deficiencies and weaknesses from recent exams of investment advisers, registered investment companies and private funds offering ESG products and services.1In the alert, Exam - which has emphasized ESG as an examination priority for multiple years - highlighted certain alleged certain deficiencies and weaknesses:

- Portfolio Management:Exam claims that portfolio management practices were inconsistent with disclosures about ESG approaches in, for example, Forms ADV Part 2A and other client-facing documents. Interestingly, the staff noted that there was a "lack of adherence to global ESG frameworks where firms claimed such adherence . . . ."2

- Inadequate Controls to Maintain and Monitor ESG Directives or Ensure Accurate Disclosures:For this area, the staff focused on "negative screens" - prohibitions on investments in certain industries. Purportedly inadequate controls and procedures around these negative screens created a risk that improper and inconsistent investment could occur.3The staff later noted that some firms did not have adequate policies in place to test certain ESG claims and lacked adequate documentation to support certain public-facing claims.4

- Proxy Voting:The staff highlighted potential inconsistencies between public ESG-related proxy voting claims and internal procedures around proxy voting. In one example, the staff noted claims that clients could vote separately on ESG-related proposals when policies didn't exist to support such claims and clients weren't provided with said opportunities.5

- Potentially Misleading Statements:The staff observed "potentially misleading claims" regarding ESG investing, such as potential omissions around reimbursement arrangements with fund sponsors to inflate returns and "unsubstantiated claims by advisers regarding their substantial contributions to the development of specific ESG products . . . ."6

Upon review, the Exam risk alert reveals more based on what itdidn'tinclude: a lack of any specific ESG rules. Instead, Exam noted that such practices could potentially result in failure to comply with existing rules that are not ESG-specific around prohibited transactions and practices for investment advisers (Section 206 of the Advisers Act), required compliance policies and procedures (Advisers Act Rule 206(4)-7), and rules regarding marketing practices (Advisers Act Rule 206(4)-1).7This highlights the key takeaway, namely that regulated entities have traditionally considered ESG-related factors through the lens of materiality and broader disclosure and regulatory requirements.8

Proposed ESG Disclosures for Investment Advisers and Investment Companies

On May 25, 2022, the SEC proposed the ESG Disclosure Rule, which generally includes proposed amendments to rules and disclosure forms concerning the incorporation of various ESG factors by funds and advisers.9The ESG Disclosure Rule would cover much of the investment advisory landscape, including different applications to registered investment advisers (advisers), certain unregistered investment advisers, registered investment companies (funds) and business development companies (BDCs). The rules and form amendments include additional requirements concerning ESG strategies in fund prospectuses, annual reports and adviser brochures, with the amount and content of disclosure dictated by the relevant classification of how central ESG factors are to a fund's or adviser's strategy.

Key Fund Definitions

For all parties set to be impacted by the ESG Disclosure Rule, the gating issue for many of the proposed requirements ties back to the classification of different fund types. The ESG Disclosure Rule includes three types of funds:

- Integration Funds.Funds that integrate ESG factors alongside non-ESG factors in investment decisions but where those ESG factors are generally no more significant than other factors in the investment selection process.

- ESG-Focused Funds.Funds that focus on one or more ESG factors whereby such factors are a significant or main consideration in selecting investments or guiding the fund's engagement strategy with the companies in which they invest. This definition also explicitly includes:

- any fund that has a name that includes terms indicating that the fund's investment decisions incorporate one or more ESG factors

- any fund whose advertisements or sales literature indicates that the fund's investment decisions incorporate one or more ESG factors by using them as a significant or main consideration in selecting investments, and

- funds that track an ESG-focused index, apply certain screening criteria on investments based on ESG factors, and have a policy of voting their proxies or engaging with management of their portfolio companies to encourage ESG practices or outcomes10

- Impact Funds.A subset of ESG-Focused Funds that seek to achieve a particular ESG impact would also be required to disclose certain details and metrics on how they measure progress on their objective. For example, a fund that invests with the goal of seeking to advance the availability of clean water by investing in industrial water treatment and conservation portfolio companies would be considered an Impact Fund.11

Fund Prospectus Disclosure Requirements

Generally speaking, the more ESG factors weigh into a given fund's investment decisions, the more thorough the required disclosure.Integration Funds, as the least influenced by ESG-goals, would be required to provide a brief narrative or summary describing how ESG factors are incorporated in the fund's investment selection process, including what specific ESG factors are assessed.12This information would be included in either the summary section of the fund's prospectus (open-ended funds) or in the general description of the fund (closed-end funds).

Integration Funds would not be required to comply with more extensive disclosure requirements in the summary prospectus.13Instead, Integration Funds would adhere to a "layered" disclosure scheme, which requires a more detailed description of how ESG factors are incorporated in the selection process in an open-end fund's statutory prospectus or later in a closed-end fund's prospectus.14Further, if an Integration Fund considers greenhouse gas (GHG) emissions in the investment selection process, the fund must also "describe how the fund considers the GHG emissions of its portfolio holdings," including "a description of the methodology" that the fund uses in this consideration.15

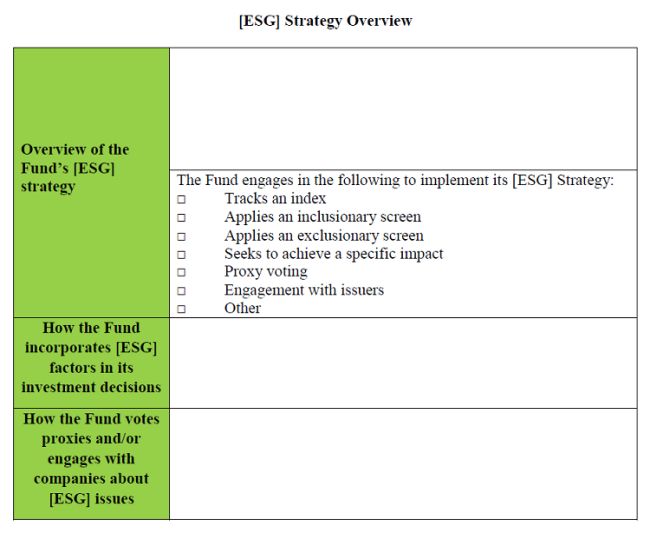

The next tier of ESG Disclosure Rule applies toESG-Focused FundsandImpact Funds. These groups of funds would have to include the following ESG Strategy Overview table at the beginning of its "risk/return" section (if an open-end fund) or at the start of the discussion of the fund's organization and operation (if a closed-end fund):16

In accordance with the layered disclosure approach, each row of the table would only contain a brief disclosure, with a more thorough discussion to be provided elsewhere in the prospectus.17

The initial overview (the first row of the table) provides space for a concise description of the major factor or factors that are central to the fund's ESG strategy.18Funds can then simply "check the box" as to what specific steps are taken to implement this strategy - and must generally do so if the strategy is relied upon inany way, no matter how insignificantly.19Although, if none of the "common" ESG strategies are utilized, the fund would select the "other" box.20

The second row provides space for the fund to describe how it actually incorporates the previously highlighted factors when evaluating, selecting or excluding potential investments.21Every box checked in the first row would have to be discussed.22Additionally, this section of the summary table would require explanation for the following designations: 1) use of inclusionary or exclusionary screens during the selection process; 2) use of an internal methodology, third-party data provider or a combination of the two, when assessing investments; 3) the identification of any tracked indexes and how the index utilizes ESG factors in determining its constituents; and 4) an overview of any third-party ESG frameworks followed by the fund in relation to the investment process.23Each of these designations would also need to be explained in greater depth elsewhere in the prospectus.24

Impact Fundswould also have to provide a general summary of the specific ESG impact or impacts that the fund wants to make and how those goals will be reached.25This would include: "(i) how the fund measures progress toward the specific impact, including the key performance indicators the fund analyzes, (ii) the time horizon the fund uses to analyze progress, and (iii) the relationship between the impact the fund is seeking to achieve and financial return(s)," each of which would require elaboration later in the prospectus.26

The third row of the overview table focuses on proxy voting and company engagement. Any fund that checks the "Proxy voting" or "Engagement with issuers" box would have to provide a separate narrative in this section. However, funds would only need to have made one of these selections if either choice could be considered a "significant means of implementing their ESG strategy."27While this determination is essentially based on a fund's individual characteristics, the SEC generally assumes a fund that regularly and proactively votes proxies or engages with issuers on ESG issues for the purpose of advancing a previously identified ESG goal would be considered "significant means."28If neither method was a "significant means" of implementing a fund's ESG engagement strategy, it must affirm this fact in this row, even if the proxy voting or engagement boxes had not been checked.29

As far as the narrative discussion itself, the fund would be required to identify whether it has specific or supplemental proxy voting policies that incorporate ESG considerations and, if so, describe those policies and procedures; disclose any means outside of proxy voting through which it engages with issuers on ESG matters; and in cases where the fund does not engage or expect to engage with issuers on ESG issues at all, disclosure to that effect.30Again, this narrative would provide a high-level discussion of any employed engagement strategy, and would need to be further expanded upon elsewhere in the prospectus.31

Fund Annual Reports

The ESG Disclosure Rule would also require additional ESG-related disclosures for registered funds (in the management's discussion of fund performance, or MDFP, section) and BDCs (in the management's discussion and analysis, or MD&A, section) in their annual reports. There are four main proposed disclosure requirements, with the applicability, extent and content dependent on fund classification: 1) ESG Impact Fund Disclosure; 2) ESG Proxy Voting Disclosure; 3) ESG Engagement Disclosure; and 4) GHG Emissions Metrics Disclosure.

ESG Impact Fund Disclosure

Impact Fundswould be required to include the following information: 1) discussion of key ESG factors that materially affect its ability to achieve its desired ESG impact and 2) if proxy voting and engagement with issuers are a "significant means" of implementing an ESG strategy, disclosure of certain information related to the implementation of these means.32Impact Funds would be required to describe ESG progress in "both qualitative and quantitative terms" and identify key factors that "materially affected" the fund's ability to achieve its desired impact.33The SEC claims that such requirements will "protect investors from exaggerated claims about ESG impacts" and allow investors to compare different funds "to the extent different Impact Funds use the same or similar key performance indicators . . . ."34

ESG Proxy Voting Disclosure

ForESG-Focused Fundswhere ESG proxy voting is a "significant means" of implementing strategy, they would have to disclose certain information regarding their proxy votes in particular ESG-related matters for their portfolio securities. Registered funds and BDCs would be required to disclose the percentage of ESG-related voting matters during the reported period where the fund voted on measures to further its ESG objectives, and refer investors to the fund's full voting record.35The SEC claims that such disclosure will complement the proposed prospectus disclosure for such funds whereby a corresponding disclosure will address how such funds use proxy voting to influence portfolio companies.36

ESG Engagement Disclosure

Similarly,ESG-Focused Fundsthat engage with issuers through "significant means" other than proxy voting would be required to disclose 1) the number or percentage of issuers with whom the fund held "ESG engagement meetings" and 2) the total number of "ESG engagement meetings" held.37The SEC proposed to define "ESG engagement meeting" as a substantive discussion with management of an issuer advocating for one or more specific ESG goals to be accomplished over a given time period, where such progress is measurable.38

GHG Emissions Disclosure

Citing a lack of consistent, comparable and decision-useful GHG-related data available to investors and dangers of potential "greenwashing," the ESG Disclosure Rule proposes highly specific and technical disclosures to purportedly standardize GHG-disclosures.39Notably,ESG-Focused Fundsthat affirmatively represent in their ESG Strategy Overview table that GHG emissions are not considered as part of their investment strategy would be exempt from these particular requirements.40But for those that consider GHG emissions, ESG-Focused Funds would have to disclose the carbon footprint - the economic measure of absolute GHG emissions the fund's portfolio finances - and the "weighted average carbon intensity" (WACI) (i.e., the tons of CO2e per million dollars of each portfolio company's total revenue) - of their portfolio in the MDFP (registered funds) or MD&A (BDCs) section of the fund's annual report.41Both metrics are determined through a complex a series of qualitative analyses and calculations.42Additionally, environmentally focused funds would be required to disclose Scope 3 emissions of its portfolio companies to the extent that Scope 3 emissions data is reported by those companies.43

Form ADV Disclosure Requirements

The ESG Disclosure Rule includes multiple proposed amendments to Parts 1A and 2A of Form ADV. Concerning Part 1A, the proposal seeks to amend the current requirements to collect additional ESG-related information for Items 5, 6 and 7 of Form ADV for different categories of advisers that consider ESG factors as part of one or more significant investment strategies.44For example, under Item 5.K, a registered investment adviser would need to disclose whether it incorporates "E," "S" or "G" factors into its separately managed account strategies and whether it follows third-party ESG frameworks.45This requirement would not apply to exempt reporting advisers.46

Conversely, both registered investment advisers and exempt reporting advisers would be required to disclose additional information in Items 6 and 7 of Form ADV concerning, among other things, 1) whether they conduct other business activities as an ESG provider or have related persons that are ESG providers; and 2) whether they employ an integration, ESG-focused or impact approach in their management of private funds.47

Additionally, the ESG Disclosure Rule contemplates additional disclosures for registered investments advisers that consider ESG factors in connection with their client-related advisory services. Specifically, Item 8 of Form ADV 2A will require an adviser to disclose varying levels of details depending on whether the adviser utilizes integration, ESG-focused or ESG-impact strategies.48Registered investment advisers would also be required to disclose material relationships or arrangements with any related persons that are ESG consultants or service providers (Item 10) and, for advisers with specific proxy voting policies or procedures, which ESG factors they consider and how they consider them (Item 17).49

Key Takeaways

- Amorphous Nature of ESG Terminology Leads to Significant Risk:The SEC has acknowledged that ESG is an "expansive" term that can have fluid meanings depending on a variety of factors. In fact, late last year, SEC Chair Gary Gensler implicitly acknowledged that popular ESG-focused terms are difficult to define:

Many funds use terms like 'green' or 'sustainable.' Even though those terms are a little less objective than 'fat-free' milk, still, those labels say a lot to investors. Which data and criteria are asset managers using to ensure they're meeting investors' targets - the people to whom they've marketed themselves as 'sustainable' or 'green'?50

The problem is that the amorphous nature of this term - and the individual E, S and G components that comprise it - means that adoption of the ESG Disclosure Rule in its current form would create massive regulatory, litigation and enforcement risk for advisers and funds. For example, would real estate funds that focus on investments in particular parts of the country be considered ESG-Focused given the possible social implications? What about funds that consider certain governance aspects, such as executive compensation ratios and past history of legal compliance, as "significant" factors? As long as these terms remain undefined and opaque, the risks remain significant.

- Uncertain Metrics Appear to Cut Against Aim of the Rule:The Commission has repeatedly touted the need for "consistent, comparable, and reliable" data points for investors to compare. However, it appears that the proposed rule includes a variety of subjective determinations and uncertain metrics that may result in the opposite result. For example, for the proposed ESG Engagement Disclosure, the SEC admits that the "level of subjectivity involved in determining whether a discussion meets the definition of an ESG engagement meeting could diminish the comparability across funds . . . ."51Similarly, for the proposed ESG Fund Impact Disclosure, funds would be required to discuss both undefined qualitative and quantitative terms, meaning that funds can - and likely will - use different metrics, cutting against consistent and comparable data. Additionally, concerning GHG emissions, if funds lack access to the Scope 1 and Scope 2 emissions of their portfolio companies, they are instead to provide a "good faith estimate," which inherently involve subjective assessments of quantity.52Moreover, firms disclosing GHG emissions figures are not expected to use a particular estimation method, meaning that investors would still need to engage in a separate assessment of each fund's methodology for these figures to engage in any type of meaningful comparison. These type of squishy metrics seem to add little - if any - value to investors and appear to cut against the stated goal of "consistent, comparable, and reliable" data.

- Similar Challenges to Prior ESG Rule Proposals: As previously discussed in our article covering the SEC's proposedClimate Change Rule, a requirement for organizations to report on climate- and emissions-related information across its "value chain" is a daunting, costly and potentially impossible task. Under the ESG Disclosure Rule, although this requirement would only apply to environmentally focused funds, gathering, processing and disclosing this information across their portfolio would be similarly challenging.

Additionally, the broad sweep of ESG Disclosure Rule will likely impact advisers and funds who do not consider themselves traditionally focused on ESG issues. As with theproposed Names Rule, when considering the ambiguity and breadth of the proposed requirements here, the planned one-year compliance date for funds and advisers is a tall mountain to climb. As noted in our prior post, "[g]iven the breadth of funds that would now fall under the Rule's ambit and the significant policy adjustments that would be necessary to ensure compliance, this time frame may prove unworkable."

- Implicit Policies and Procedures Requirements: Although the ESG Disclosure Rule includes more than 360 pages of details and analysis, only a few pages are dedicated specifically to adviser and fund policies and procedures. However, it would be a mistake to overlook the agency's not-so-subtle suggestions where advisers and funds "should" consider compliance-related activity.

Under both the Advisers Act and Investment Company Act compliance rules, registered advisers and registered funds must have, and annually review, policies and procedures reasonably designed to prevent violations of applicable laws. In the ESG Disclosure Rule, the SEC believes "it would be appropriate and beneficial to reaffirm existing obligations under the compliance rules when advisers and funds incorporate ESG factors." The agency highlighted a number of areas where advisers and funds can and should consider certain compliance safeguards, many of which touch on issues detailed in Exam's 2021 report discussed above. For example, if an adviser uses ESG-related positive and/or negative screens on client portfolios, the adviser "should" maintain adequate controls to maintain, monitor, implement and update those screens.

Additionally, the SEC highlighted the importance of certain documentation to support ESG-related claims. For example, for the proposed ESG Engagement Disclosure, the SEC notes that such ESG-Focused Funds "should" generally consider including in their compliance policies and procedures a requirement that employees memorialize the discussion of ESG issues to assure accurate reporting on the number of engagements.53Advisers and funds would do well to start considering the implementation of such policies and procedures now so that the narrow time window for implementation doesn't sneak up on them.

- Peirce's Most Scathing Rebuke Yet: Given her stinging and lengthy rebuke to the SEC's proposed climate change rule back in March, it comes as little surprise that Commissioner Hester Peirce was not in favor of the ESG Disclosure Rule. Anyone remotely familiar with the SEC's rulemaking avalanche during the last six months is familiar with Commissioner Peirce's detailed, insightful and often creative statements setting forth her reasons for voting against a proposal. However, her statements in response to this rule cut a little deeper. For example:

Regardless of what one generally thinks of the SEC mandating hyper-specific ESG disclosures, the proposals we are voting on today will fail of their purpose because they are not so much built on sand as they float on a cloud of smoke, false promises, and internal contradiction.

Given the expected composition of the Commission when a final version of this rule is ultimately voted on, her sharp rebuke may be simply a loud voice in the minority chorus of opposition. However, to have a sitting Commissioner not only disagree with the contours of a proposal but deride it as "float[ing] on a cloud of smoke, false promises, and internal contradiction," illustrates the divisiveness of this proposal.

As always, the discussion of regulatory developments within the securities space continues on the SECond Opinions Blog . If you need any additional information on this topic - or anything related to SEC enforcement or internal investigations - please contact the authors or another member of Holland & Knight's Securities Enforcement Defense Team .

Footnotes

1 Sec. & Exch. Comm'n,The Division of Examinations' Review of ESG Investing(April 9, 2021) (Risk Alert).

2 Id.at 2. The staff included a footnote highlighting some of the global frameworks available: "As part of an ESG strategy, an investment adviser may choose to adhere to one or more of these voluntary global ESG frameworks, principles, or standards for asset managers and financial institutions (see,e.g., the Equator Principles or the U.N.-sponsored Principles for Responsible Investment ('UNPRI') and Sustainable Development Goals ('SDGs'))."Id.at 3 n.6.

3 Id.at 4.

4 Id.at 5.

5 Id.at 4.

6 Id.at 4-5.

7 See generallyid.at 2-3.

8 For example, registered funds have typically had flexibility in assessing the material information to be included in its management's discussion of fund performance (MDFP) in its annual report.

9 See Sec. & Exch. Comm'n,Enhanced Disclosures by Certain Investment Advisers and Investment Companies about Environmental, Social, and Governance Investment Practices, (May 25, 2022).

10 Id.at 33-34.

11 Id.at 35

12 Id.at 25.

13 Id.at 26.

14 Id.at 27.

15 Id.at 27-28.

16 Id.at 35-36.

17 Id.at 37.

18 Id.at 41.

19 Id.at 41, 61.

20 Id.at 41.

21 Id.at 43.

22 Id.

23 Id.at 44-49.

24 Id.at 45, 44-49.

25 Id.at 56.

26 Id.

27 Id.at 61 (emphasis added).

28 Id.at 62.

29 Id.at 63-64.

30 Id.at 62-63.

31 Id.at 64. Funds and management investment companies are not the sole object of the ESG Disclosure Rule, as unit investment trusts (UITs) fall under the scope of the SEC's amendments as well. UITs are unmanaged investment companies that invest in a generally fixed portfolio of stocks, bonds and other securities.Id.at 67. As with funds, UITs would be required to explain how ESG factors weighed on their investment decisions, specifically in the selection of any securities chosen based on one or more ESG factors.Id.

32 Id.at 71.

33 Id.at 74.

34 Id.at 74-75.

35 Id.at 77-78.

36 Id. Additionally, for registered investment companies, a fund would be required to refer investors to the fund's full voting record filed on Form N-PX.

37 Id.at 80.

38 Id.at 81.

39 Id.at 86-87. Similar to the SEC's Proposed Climate Change Rule: 1) Scope 1 emissions would be defined as the direct GHG emissions from operations that are owned or controlled by a portfolio company; 2) Scope 2 emissions would be defined as indirect GHG emissions from the generation of purchased or acquired electricity, steam, heat or cooling that is consumed by operations owned or controlled by a portfolio company; and 3) Scope 3 emissions would be defined as all indirect GHG emissions not otherwise included in a portfolio company's Scope 2 emissions, which occur in the upstream and downstream activities of a portfolio company's value chain.Id.at 99 n.155.

40 Id.at 88-89.

41 Id.at 94.

42 See generallyid.94-109.

43 Id.at 108.

44 Id.at 148.

45 Id.at 155.

46 Id.at 154.

47 Id.at 154-55.

48 Seeid.at 129-32.

49 Seeid.at 133-35; Advisers to wrap fee programs would also be subject to additional requirements under Part 2A, Appendix 1. Seeid.141-46.

50 Gary Gensler, Chair of the Sec. & Exch. Comm'n,Prepared Remarks Before the Asset Management Advisory Committee(July 7, 2021).

51 Id.at 83.

52 Id.at 104.

53 Id. at 82.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.