The tax rates and deduction amounts for the 2023 calendar year will be as follows.

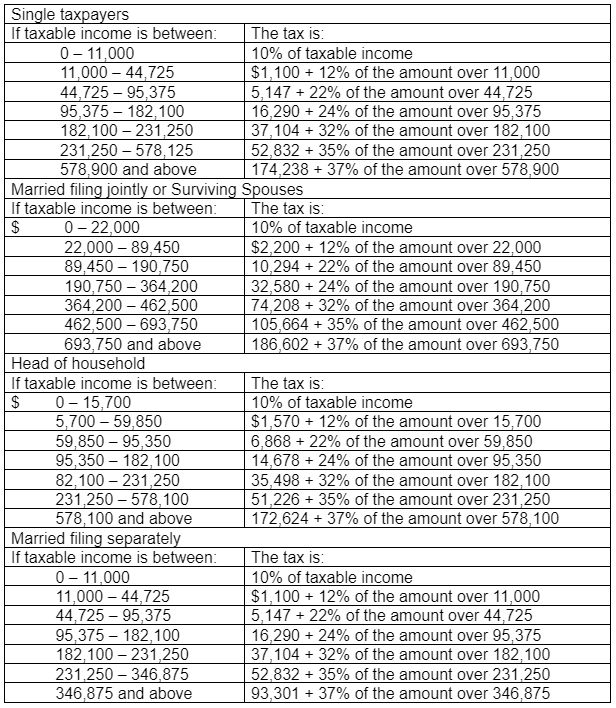

Federal ordinary income tax rates

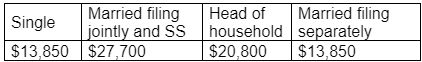

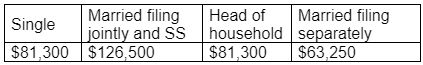

Basic standard deduction

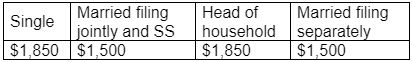

Each additional standard deduction (65 or over or blind):

Standard deduction for Dependents

For an individual who can be claimed as a dependent on another's return, the basic standard deduction for 2023 will be $1,250, or $400 plus the individual's earned income, whichever is greater. However, the standard deduction may not exceed the regular standard deduction for that individual.

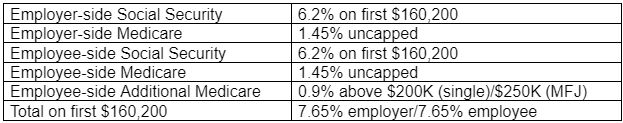

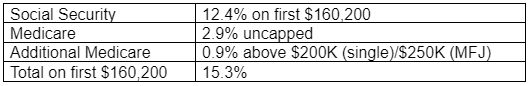

FICA (employment tax)

SECA (self-employment tax)

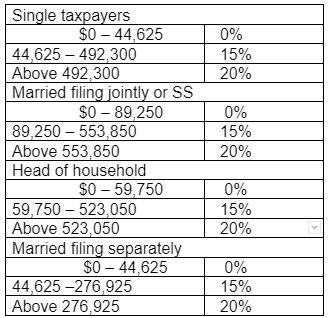

Capital Gains Rates

The tax rate is 0%, 15%, or 20% depending on the amount of adjusted net taxable gain as shown below.

Alternative Minimum Tax Exemption Amount

For 2023, a taxpayer's AMT is initially determined as the sum of 26% of the first $220,700 (or $110,350, in the case of married taxpayers filing separately) of alternative minimum tax income (AMTI) in excess of the allowable exemption amount and 28% of any additional AMTI.

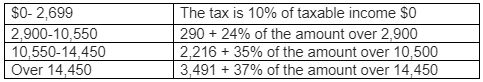

Estates and Trusts

Kiddie tax

The exemption from the kiddie tax for 2023 will be $2,500. A parent will be able to elect to include a child's income on the parent's return for 2023 if the child's income is more than $1,250 and less than $12,500.

AMT exemption for child subject to kiddie tax

Note that no special exemption amount applies through tax year 2025.

Income-based limitations on Sec. 199A qualified business income deduction .

For 2023, taxpayers with taxable income above $182,100 for single and head of household returns, $364,200 for joint filers, and $182,100 for married filing separate returns are subject to certain limitations on the Code Sec. 199A deduction. The 2022 amounts were $170,050, $340,100, and $170,050.

Modified Adjusted Gross Income (MAGI) for making deductible contributions by active plan participants to traditional IRAs

In general, an individual who isn't an active participant in certain employer-sponsored retirement plans, and whose spouse isn't an active participant, may make an annual deductible cash contribution to an IRA up to the lesser of: (1) an inflation-adjusted statutory dollar limit, or (2) 100% of the compensation that's includible in his or her gross income for that year. For 2023, the statutory dollar limit is $6,500, plus an additional $1,000 for those age 50 or older.

If the individual (or his or her spouse) is an active plan participant, the deduction phases out over a specified dollar range of MAGI. For taxpayers filing joint returns, the otherwise allowable deductible contribution will be phased out ratably for 2023 for MAGI between $116,000 and $136,000.

For 2023, for single taxpayers and heads of household, the otherwise allowable deductible contribution will be phased out ratably for MAGI between $73,000 and $83,000. For married taxpayers filing separate returns, the otherwise allowable deductible contribution will be phased out ratably for MAGI between $0 and $10,000.

For a married taxpayer who is not an active plan participant but whose spouse is such a participant, the otherwise allowable deductible contribution will be phased out ratably for 2023 for MAGI between $218,000 and $228,000.

MAGI limits for making contributions to Roth IRAs

Individuals may make nondeductible contributions to a Roth IRA, subject to the overall limit on IRA contributions.

The maximum annual contribution that can be made to a Roth IRA is phased out for taxpayers with MAGI over certain levels for the tax year. For taxpayers filing joint returns, the otherwise allowable contributions to a Roth IRA will be phased out ratably for 2023 for MAGI between $218,000 and $228,000.

For single taxpayers and heads of household, it will be phased out ratably for MAGI between $138,000 and $153,000. For married taxpayers filing separate returns, the otherwise allowable contribution will continue to be phased out ratably for MAGI between $0 and $10,000.

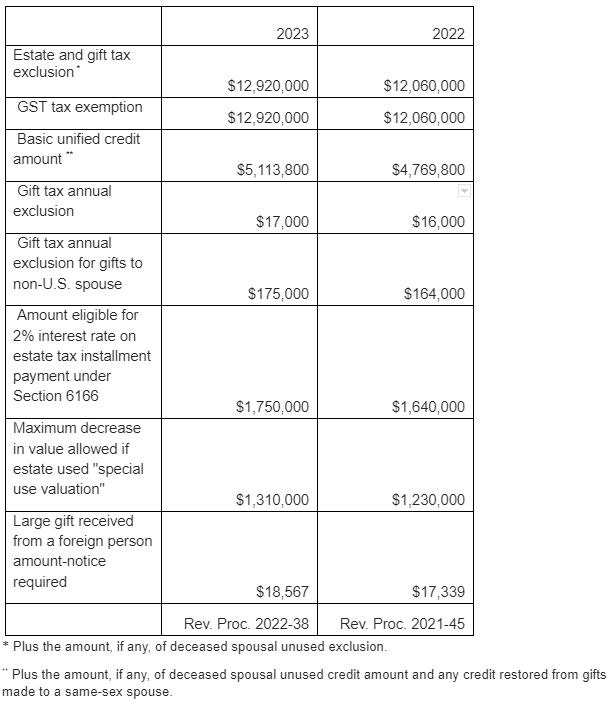

Estate, Gift and GST Tax

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.