- within Real Estate and Construction and Law Practice Management topic(s)

- with readers working within the Accounting & Consultancy industries

Key Takeaways:

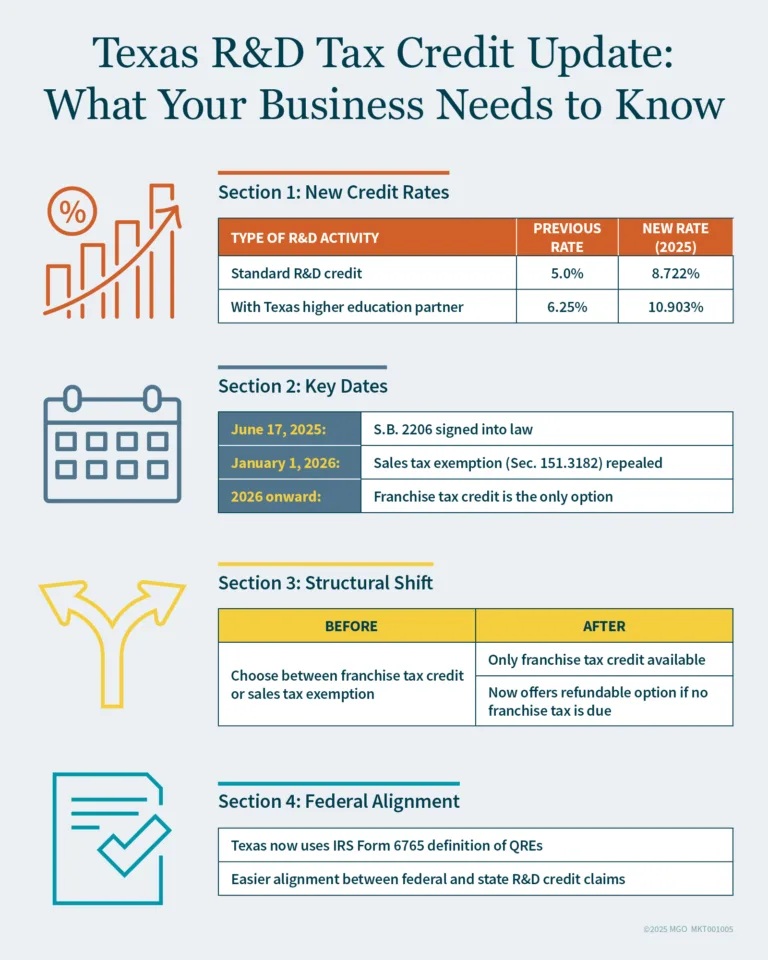

- Texas R&D tax credit rates rise to 8.722%, or 10.903% for research with universities, offering bigger returns for companies investing in innovation.

- The franchise tax credit is now permanent, and the sales tax exemption for R&D assets will expire January 1, 2026, simplifying state tax planning.

- Businesses with no Texas franchise tax due may now qualify for a refundable R&D credit, boosting liquidity for startups and pre-revenue firms.

If your business operates in Texas and conducts research and development (R&D) in biotech, manufacturing, or technology, there's a new opportunity to improve your tax position. S.B. 2206, signed into law on June 17, 2025, overhauls the Texas R&D tax incentive program, ultimately raising credit rates, aligning with federal standards, and introducing the potential for refundable credits, even if your company owes no franchise tax.

This article outlines the key updates, how they impact your operations, and what strategic steps your team can take to maximize the enhanced R&D tax credit in Texas.

Background: Why This Matters Now

Texas aims to stay competitive as a national leader in innovation. Sectors like biotech, technology, life sciences, and advanced manufacturing are driving job creation and economic growth. The newly passed S.B. 2206 positions the state's R&D tax framework to better support these industries with more predictable, flexible, and valuable incentives.

Previously, businesses had to choose between a franchise tax credit and a sales tax exemption under Section 151.3182 of the Texas Tax Code. As of January 1, 2026, that sales tax exemption will be repealed, streamlining options and focusing support through an improved R&D franchise tax credit.

What's New in the Texas R&D Tax Credit?

1. A Permanent Franchise Tax Credit – The Texas R&D tax credit is no longer set to expire. Your business can now rely on this long-term tax incentive for ongoing innovation and strategic planning.

2. Higher Credit Rates -Texas-based businesses can now claim:

- 8.722% of qualified research expenses (QREs), up from 5%

- 10.903% for research conducted in partnership with a Texas higher education institution

This creates a strong incentive for industry-academic collaboration in Texas.

3. Federal Alignment with Form 6765 -Texas's definition of "qualified research expenses" now matches the federal standard under IRS Form 6765. If your company is already claiming the federal R&D credit, aligning your Texas claims will be easier and more consistent. Learn more about federal R&D credits.

4. Refund Potential for Zero-Tax Businesses – A major win for startups and pre-revenue firms: if your business owes no Texas franchise tax, you may still be eligible for a refundable R&D credit — a significant improvement that enhances cash flow and makes early-stage innovation more viable.

5. Sales Tax Exemption Phase-Out -The current sales and use tax exemption for R&D property (Section 151.3182) will sunset on January 1, 2026. From that date forward, businesses will only use the franchise tax credit path, removing the need to choose between two conflicting benefits.

What It Means for Your Texas Business

Whether you're a CFO at a tech startup, a tax leader in a life sciences company, or running operations for a mid-market manufacturer, these changes directly affect your 2025 and 2026 tax strategies.

- Biotech firms working with Texas universities can earn a higher credit and gain access to academic IP, talent, and lab facilities.

- Manufacturers modernizing production processes may find simplified rules improve ROI on automation and product improvements.

What You Should Do Now

- Reevaluate your R&D activities to identify additional expenses eligible for the Texas credit under the new definition.

- Model scenarios using both current and post-2026 rules to optimize credit use in light of the sales tax exemption repeal.

- Explore partnerships with Texas universities or colleges to unlock the higher 10.903% rate.

- Work with your tax advisor or our team to ensure your federal and Texas filings align efficiently and maximize credit potential.

MGO Provides Support for Navigating Texas's R&D Tax Changes

MGO supports mid-market companies across sectors in navigating complex state and federal R&D tax credit programs. Our team delivers targeted tax consulting and compliance support, from identifying qualified research activities to managing multi-state credit opportunities and preparing for audits. We also advise on refundable credit strategies, particularly relevant under the updated Texas franchise tax credit framework.

With deep knowledge of Texas-specific tax law, our professionals can help you assess eligibility, document expenses, and fine-tune claims across both the federal and state levels. Contact us to discuss how your business can take advantage of the enhanced Texas R&D tax credit and improve your overall tax position.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.