The U.S. power system is under pressure. Surging electricity demand, driven by AI, industrial growth and electrification, is overwhelming planning timelines and clean energy deployment. States face a painful tradeoff: build new gas capacity now or risk missed investment and reliability failures. But defaulting to long-lived fossil plants could strand assets and put decarbonization targets out of reach for decades to come.

The Clean Bridge power purchase agreement (PPA) offers a third path: a flexible contracting framework that allows fast deployment of firm power today, while embedding a governed transition to zero-carbon operation tomorrow. This article builds directly on Alvarez & Marsal's Power to Compete framework, which laid out the risk of economic stagnation and climate backsliding absent new public-private mechanisms.1 Developed by A&M, the Clean Bridge PPA model aligns investor returns with public climate goals, making it a pragmatic tool for navigating the era of AI-powered load growth.

The Power Crossroads: Meeting Demand While Honoring Climate Commitments

In states like Virginia, Georgia and Arizona, data center and industrial expansion plans are placing enormous strain on the grid. Dominion Energy, for instance, reported in late 2024 that contracted data center load in northern Virginia had surged past 40 gigawatts, more than doubling in less than two years. In Arizona, new semiconductor fabs are requesting hundreds of megawatts each, with tight timelines and 24/7 reliability requirements. These aren't edge cases; they are early signals of a structural shift. The pace of this shift isn't fully certain — debates continue about the ultimate magnitude of energy new data centers will require, for example — but the direction of travel is clear

This transformation presents both a generational opportunity and a looming crisis. The states that can deliver reliable, competitively priced and clean electricity will win the race for next-generation economic development. But many are caught in a bind: They've set ambitious decarbonization targets, yet lack firm, scalable, clean capacity options that can be deployed quickly. In the absence of new approaches, they risk falling back on uncoordinated or carbon-intensive stopgap measures — or worse, watching critical investments move elsewhere.

The market is already reacting. Consider four recent announcements:

- Meta is investing $10 billion in a data center in Louisiana, with Entergy planning to initially meet expected demand with natural gas and ultimately add 1,500 MW of new renewables and explore advanced nuclear options to achieve a virtual zero-carbon outcome.2

- The Homer City site in Pennsylvania is being redeveloped into a $10 billion natural gas–powered AI data center campus, expected to deliver up to 4.5 GW of new capacity, the largest gas buildout in the U.S. in decades.3

- Google, in partnership with Intersect Power and TPG Rise Climate, will invest $20 billion in co-located data centers and a portfolio of renewables, storage and gas engines in West Texas.4

- Microsoft has signed a 20-year deal to support the $1.6 billion restart of the Three Mile Island Unit 1 nuclear reactor, closed since 2019, to secure carbon-free baseload power for its data operations.5

These disparate approaches underscore a broader reality: Meeting the dual challenges of explosive load growth and accelerating climate impacts will require more creative and innovative state involvement in energy infrastructure development. States can no longer rely solely on market forces or federal policy to align investment with climate goals. They must become active participants in structuring the transition. The Clean Bridge PPA represents one such innovation: a state-enabled mechanism that harnesses private capital and market efficiency while ensuring public climate commitments are met.

The Clean Bridge Framework: A Practical Bargain for the Energy Transition

At its heart, the Clean Bridge PPA represents a fundamentally new bargain between investors, energy users and climate goals. Rather than forcing an impossible choice between reliable power today and decarbonization tomorrow, it creates a governed pathway that delivers both.

The Core Exchange: Returns for Decision Rights

The Clean Bridge PPA begins with a straightforward trade-off that rebalances the traditional power development model. Investors receive financial certainty through contractual return guarantees, typically a 6–8 percent IRR over the project life, in exchange for relinquishing control over the facility's future once financial targets are met.

This simple but powerful realignment is the foundation of the entire framework. Instead of developers maintaining perpetual control over assets, potentially operating fossil plants for decades regardless of climate impacts, the Clean Bridge model sets clear conditions for transition from the outset.

How the Clean Bridge PPA Unfolds: A Practical Timeline

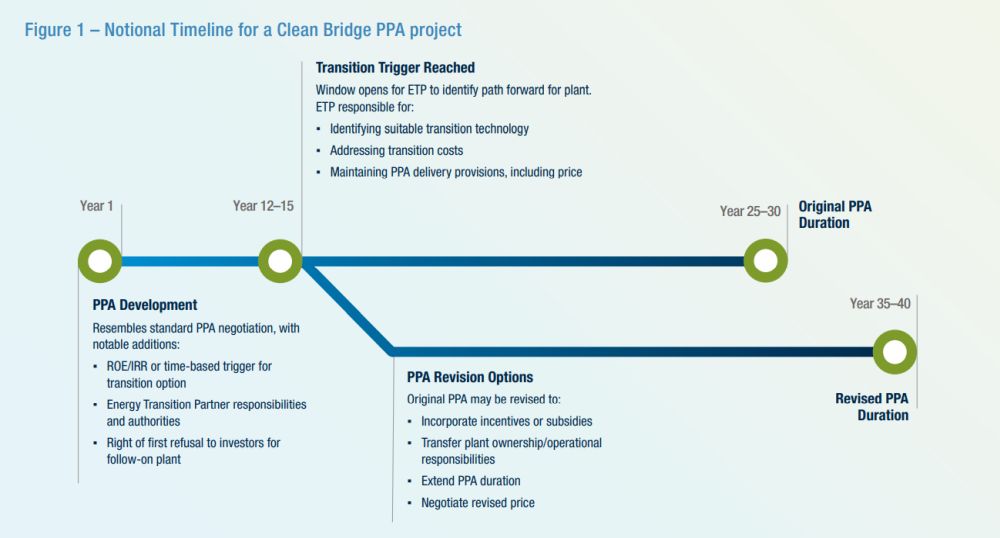

How the Clean Bridge PPA Unfolds: A Practical Timeline The Clean Bridge PPA essentially creates a call option — the option to buy an asset under specified conditions — for an Energy Transition Partner (ETP). The lifecycle of a Clean Bridge project would follow a predictable path:

- Initial development and financing: A natural gas plant (or other dispatchable generation) is built to meet immediate grid needs. The project secures financing based on the contractual certainty of the Clean Bridge PPA, which includes specific provisions for minimum returns and transition governance.

- Operational period: During regular operation, the facility provides dispatchable energy and reliable capacity while generating returns for investors. The plant operates normally, meeting grid needs while tracking financial performance against the agreed-upon return thresholds.

- Trigger activation: After financial return thresholds are met, decision rights transfer to an ETP. This entity, which may be a state agency, public-private partnership or even the off-taker, now controls the facility's decarbonization pathway

- Transition implementation: Once decision rights are activated, the ETP has the authority and responsibility for selecting and securing project finance for the clean replacement, including transition costs.

Throughout this process, all parties maintain the certainty they need: Investors receive their expected returns, off-takers get reliable power, and the public interest in decarbonization is contractually protected.

Governance: Making the Transition Real

The effectiveness of the Clean Bridge PPA framework depends on the presence of a credible, capable institutional entity: the Energy Transition Partner (ETP). This entity plays a central role in ensuring that the transition from fossil to clean generation occurs in accordance with the contractual terms. The ETP monitors project financial performance, activates transition rights when specified triggers are met, and oversees the planning and implementation of the replacement clean resource. Its function is not to operate assets, but to provide the governance, accountability and coordination needed to make the Clean Bridge model operational in practice.

What the ETP Does

At its core, the ETP is a steward of public interest, investor accountability and decarbonization integrity. It ensures that once investors have received their agreed return (typically a 6–8 percent IRR), the project transitions — on time and on terms that preserve reliability and cost-effectiveness. The ETP's mandate spans three phases:

- Oversight and Monitoring: Tracks project financials and performance to determine when return-based or time-based triggers are hit

- Transition Execution: Initiates the decarbonization process, selects replacement technologies, structures new procurement and secures funding

- Governance and Compliance: Manages disputes, verifies technology performance and enforces climate-aligned conversion within fiduciary and operational guardrails

The ETP does not need to build or own the new assets; it governs the transition process, ensuring that it aligns with public goals and market conditions.

Who Can Be an ETP?

There's no one-size-fits-all model. What matters is institutional capability, credibility and staying power. Proven structures already exist:

- State Energy Authorities like NYSERDA and the Connecticut Green Bank bring regulatory experience, market insight and financial sophistication.

- Hybrid Models such as the Colorado Clean Energy Fund or Michigan's Energy Independence Fund blend public mandates with private-sector investment discipline

- Regulated Utility Subsidiaries can serve as ring-fenced ETPs when properly governed and incentivized.

- Multistate or RTO-linked Entities may serve broader regions where grid operations are shared.

Even hyperscale energy buyers, like Microsoft, Meta or Google, could serve as ETPs for projects tied to their own infrastructure growth. With internal energy expertise, capital and long-term stakes in performance, these firms are already functioning as de facto grid planners. In some cases, they may be best positioned to manage the decarbonization timeline and procurement strategy.

Where no suitable entity exists, states can stand up a dedicated ETP through legislation, a public-private partnership, or as an affiliate of an existing finance or infrastructure agency.

Governance Principles That Matter

To maintain market confidence and ensure outcomes, the ETP must operate under strong governance. That includes:

- Independent technical boards to vet replacement technologies

- Transparent audits and reporting on fund performance and project milestones

- Stakeholder governance that includes utilities, developers, regulators and communities

- Stakeholder governance that includes utilities, developers, regulators and communities

- Clear dispute resolution processes and escalation paths when transition terms are contested

The ETP is not just a financial middleman; it's the backbone that ensures decarbonization actually happens, under terms that are operationally sound and fiscally responsible.

Done right, the ETP transforms the Clean Bridge PPA from a clever contract into an enforceable public-private architecture for climate-aligned infrastructure.

Financial Mechanisms That Make It Work

The Clean Bridge PPA is an adaptable construct. It could accommodate several different financial structures, while retaining the core bargain that ensures both bankability and accountability:

- Trigger mechanism: As envisioned, the Clean Bridge PPA would have a return-based mechanism for determining when an ETP takes control of a project's decarbonization pathway. Independent verification would determine when investors have achieved their minimum agreed return (typically 6–8 percent IRR), initiating the transition window. However, the ETP and investor/developers could also specify a fixed backstop date, a predetermined timeline (often 10–15 years post-commercial operation) that ensures transition planning begins regardless of financial performance (but still carrying the lifetime IRR guarantee).

- Flexible financing for the transition: When triggers are

activated, the ETP can utilize various approaches to finance the

clean replacement: − Competitive solicitations or auctions

for replacement technologies

- Bond issuances or budget allocations if public sector involvement is needed

- Market-based mechanisms such as cap and trade to generate funding

- Public-private partnerships to leverage multiple funding sources

- Optional elements that can be

incorporated:

- Capacity payments for reliability services, if the original plant is a gas-peaker, reciprocating engine or diesel backup generator

- Energy price floors or ceiling to manage volatility

- Carbon price pass-through provisions to accelerate transition if emissions costs rise

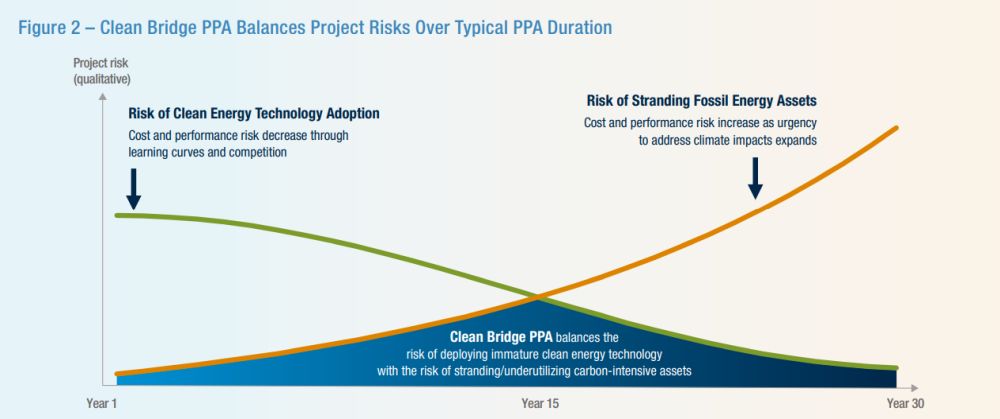

This framework balances project risks inherent to new gas projects, creating the financial certainty that infrastructure investors demand, while providing the governable transition pathway that climate goals require.

To view the full article, click here.

Footnotes

1. Gary Leatherman et al, "Power to Compete: A Framework for Clean Economic Development," Alvarez & Marsal, March 4, 2025, https://www.alvarezandmarsal.com/insights/power-compete-framework-clean-economic-development

2. "Meta Selects Entergy, Northeast Louisiana as Site of $10B Data Center." Entergynewsroom.com, 4 Dec. 2024, www.entergynewsroom.com/news/meta-selects-northeast-louisiana-as-site-10-billion-data-center/.

3. Howland, Ethan. "Largest US Gas-Fired Power Plant Planned for Data Centers in Pennsylvania." Utility Dive, 3 Apr. 2025, www.utilitydive.com/news/homer-city-gas-fired-power-station-data-center-firstenergy/744

4. "Intersect Power Forms Strategic Partnership with Google and TPG Rise Climate to Co-Locate Data Center Load and Clean Power Generation." Intersect Power, 10 Dec. 2024, www. intersectpower.com/intersect-power-forms-strategic-partnership-with-google-and-tpg-rise-climate-to-co-locate-data-center-load-and-clean-power-generation/.

5. "Microsoft Deal Propels Three Mile Island Restart, with Key Permits Still Needed." Reuters, 20 Sept. 2024, www.reuters.com/markets/deals/constellation-inks-power-supply-deal-with-microsoft-2024-09-20

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.