Financial services firms are increasingly embracing artificial intelligence (AI) technologies to revolutionize their revenue generation, client experience and operations excellence. The financial sector's spending on AI is set to more than double by 2027, according to the International Monetary Fund citing IDC data.1

While institutions have identified key areas of opportunity to unlock value and competitive advantages with AI, issues can arise during the implementation of the solution, with potential failures due to challenges related to data, processes, organizational design and role alignment.

According to the 2024 Gartner® Tech CIO Insight: Adoption Rates for AI and GenAI Across Verticals report, "the ambition to adopt artificial intelligence within 12 months of the survey date has, since 2019, hovered between 17% and 25%. However, in the subsequent year to any given survey, the actual growth in adoption has never exceeded 5%."2

Based on our experience working on AI projects with financial services clients, we have identified a few common pitfalls, which generally fall in the following categories:

- Bad/poorly understood data or data limitations

AI models rely heavily on accurate, high quality data sets. Poor input training data can lead to issues such as data hallucinations, or in the case of simpler models, inconclusive or imprecise results. It also hinders transparency on quantitative and behavioral impact on AI outputs and complicates the ability to identify root causes for incorrect outputs, which is essential for addressing business and regulatory concerns about market manipulation and pricing inaccuracies.

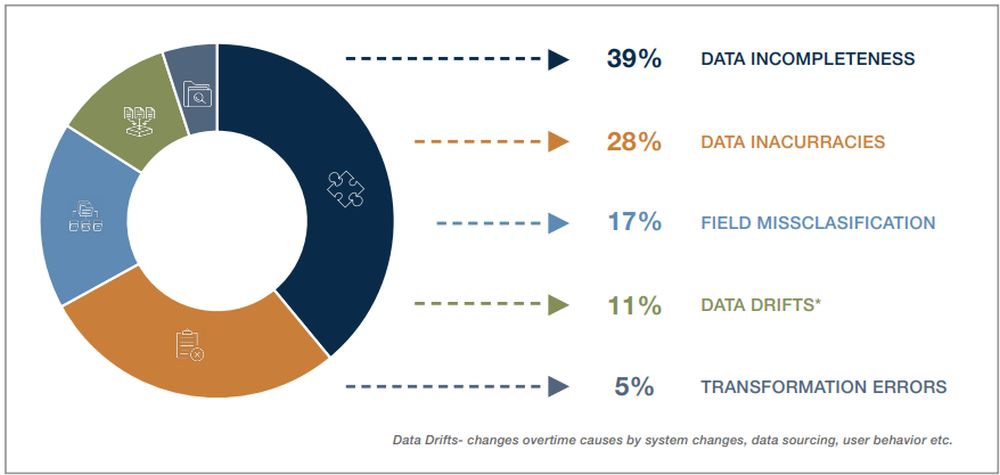

Typical issues that compromise the caliber of data include:

- Data discrepancies across systems – from a definition perspective, the same data can be labelled differently, or the element is labelled similarly but represents completely different or nuanced data values.

- Data history is incomplete and / or unclear – insufficient historical data or unclear logic and values in historical data sets.

- Poor data quality – caused by incorrect data value selection / population, inaccurate calculations and incomplete data sets.

Data Issues Preventing AI Adoption

Source: A&M analysis

- Legacy operating models and processes

AI use cases can also fail when existing processes and operating models are not refreshed or redesigned to incorporate AI outcomes into business-as-usual operations. This leads to underutilization or misuse of AI capabilities. Some common problems include:

- Insufficient or delayed evaluation of operating model – which often leads to misalignment between AI results and operational workflows.

- Redundant processes – that fail to integrate AI outputs to effectively streamline and enhance existing processes.

- Lack of integration of operating procedures into AI model feedback loops – as continuous improvement of AI models requires defined feedback pathways so review and enhancements can occur frequently.

- Unclear impact on organization and role design

AI implementation requires alignment on possibly impacted roles, organizational structure, and new day-to-day responsibilities. However, institutions often fail to recognize the importance of organizational and role design at an early stage, leading to challenges such as fear of role displacement among employees, reluctance to adopt new tools and underutilization of AI efforts.

Deploying AI tools can have a significant impact on the following organizational aspects:

- Changes in roles and responsibilities – where responsibilities are more streamlined, shifting towards automation, supervision, and providing contextual insights, allowing employees to focus on higher-value tasks that complement AI systems.

- Organizational structural changes – to focus more on cross functional placements between business and technology to enhance AI models, implement robust controls, etc.

- Controls and data focus competencies – increased shared responsibility for ensuring data integrity, with more direct ownership and enforcement of controls to maintain high-quality data and reliable AI outputs.

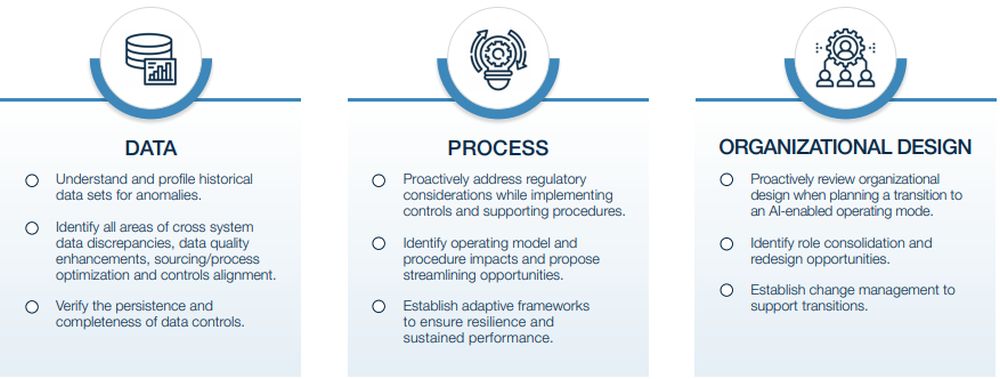

Key Tactical Steps

Addressing these foundational issues can significantly improve the success rate of AI use cases. In a recent survey conducted by the Bank of England, data-related risks comprised four out of the top five perceived risks of AI currently and in the next three years3 . Moreover, several identified risks aligned to operational process deficiencies (such as execution and process management and inappropriate uses of models) and organization design elements (such as change management and account and responsibility).

We have seen the following steps to be helpful in mitigating the challenges outline in the previous section:

In summary, issues around AI implementation are widespread and can occur because of challenges in data, operating models or organizational design. To fully realize the potential of AI, financial institutions must not only address these issues but do so with a strong coordinated approach between various business aspects. It is also essential for firms to identify and tackle specific use cases to maximize value rather than adopt a "pie in the sky" view.

Footnotes

1. AI's Reverberations across Finance

2. GartnerTech CEO Insight: Adoption rates for AI and GenAI across verticals, Whit Andrews, 11 March 2024 GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.

Originally published 01 July, 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.