- within Antitrust/Competition Law, Intellectual Property and Real Estate and Construction topic(s)

- with readers working within the Retail & Leisure industries

There is reason for optimism as the mining industry transitions into a new era. Major demand drivers such as data center proliferation, the expected acceleration of the energy transition, and a push for new infrastructure are expected to boost metal demand in enduring and unprecedented ways.

A swirl of volatility, however, directly impacted miners and the health of their capital markets. Among others, we have seen:

- Key transition metals, such as lithium, have seen significant price drops, copper has been range-bound for years;

- Concentrated geopolitical risk is upending markets (China in steel and iron ore, Indonesia in nickel);

- Major capital project costs are twice the original statements to the market; and

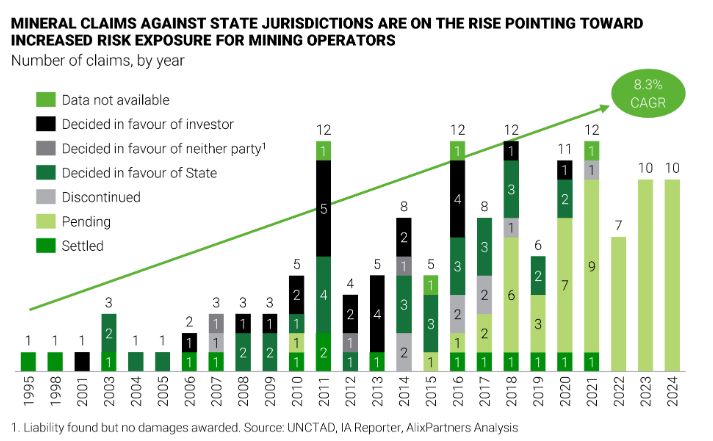

- Mineral claims are on the rise underscoring the cost of jurisdictional risk.

Taken together, this volatility has called into question strategic plans and dampened investor confidence. As a result, investors and operators must focus more than ever on capital stewardship, controlling operating costs, and building capability to reset Tier-2 and Tier-3 resources into higher performing portfolio contributors. We see five focus areas as critical to the reset:

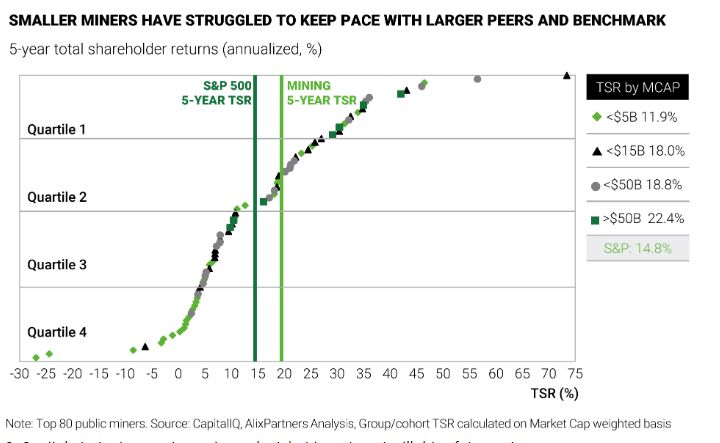

1. Smaller miners must remake business plans and directly address their underperformance with shareholders:

While mid-tier and major miners have fared well over the last five years, shares of mining companies below a $5 billion market cap have significantly underperformed their industry peers. To us, Tier-1 assets, predominantly owned by larger miners, have provided leverage and returns. In addition major miners are leading the way on ESG pathways and capital stewardship.

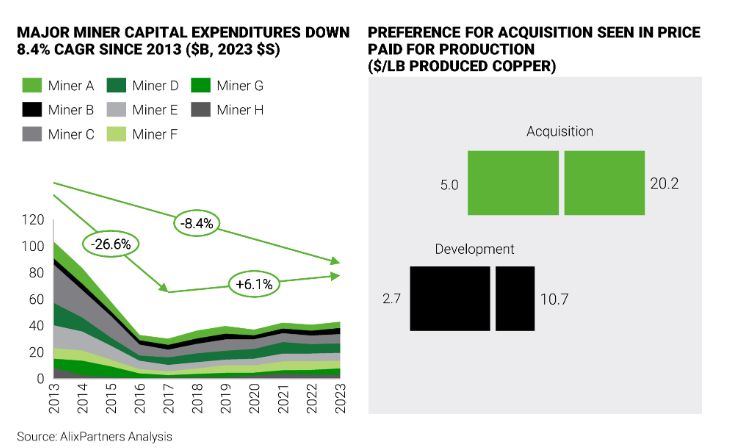

2. Capital strategies must remain prudent, but investment will drive future returns

Two market trends are shaping how miners must sharpen their focus on capital execution:

Capital budgets have been reduced and have yet to return to historic levels (down over 50% from a decade ago), and

Despite inflation and cost increases, building assets can be significantly more efficient per produced unit than acquiring equivalent production (using copper as an example).

Taken together, miners must work to de-risk and excel through project development to continue to drive total shareholder return and efficiency. Tier-1 assets are hard to get and are expensive, potentially dampening future acquisition activity across key commodity sectors (such as copper).

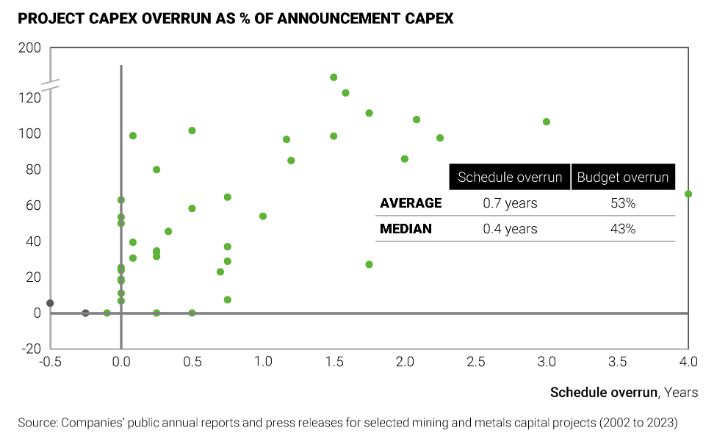

3. Strengthen project execution

Project execution capability, or lack thereof, risks eroding the upside from development (relative to acquisition). We assessed major mining projects globally against schedule and cost performance relative to time of announcement. With average mega project budget overruns above 50%, and schedule overruns over 6-months, it's clear that lookback IRR has suffered meaningfully for builders. To ensure development maintains its edge over acquisition, miners must assess and execute strategic capital plans across three dimensions:

- Defining and investing in the right projects,

- Designing projects 'the best way', and

- Delivering projects efficiently and effectively.

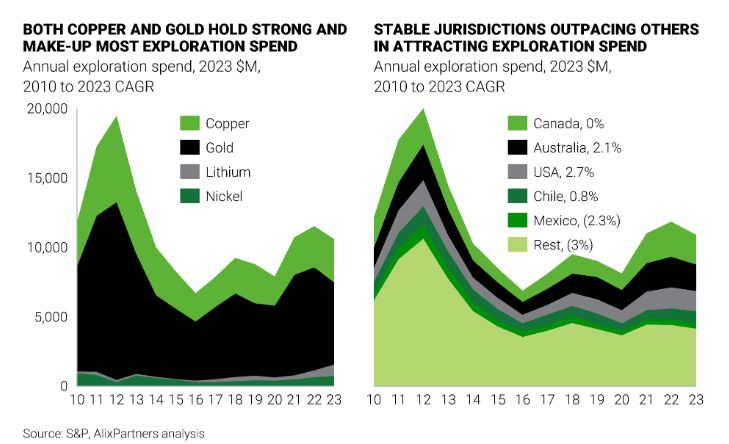

4. Position portfolios against exploration spending for capital access and cost advantage

Exploration spending is also declining. Stable jurisdictions, meanwhile, continue to edge out others in the race for exploration share. These imbalances raise concerns about future disruption in supply and demand, and will continue to progress industry capability in selected locations.

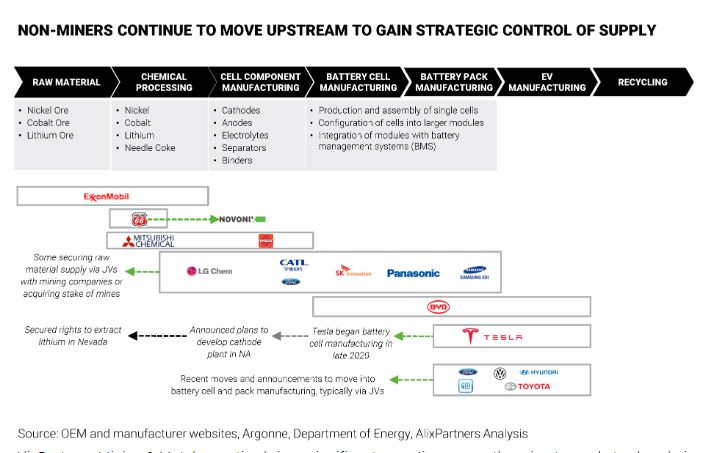

5. Be ready to partner and manage risk

The mining landscape is increasingly seeing its share of new entrants. From automotive to metals processing, the move upstream generates press, excitement, and stands to remake supply chains and commercial arrangements governing the sector. As this trend plays out, miners will need a robust approach to stakeholder/shareholder management and governance. Doing so successfully will require updated operating models and, often, new capabilities to manage changing sector dynamics.

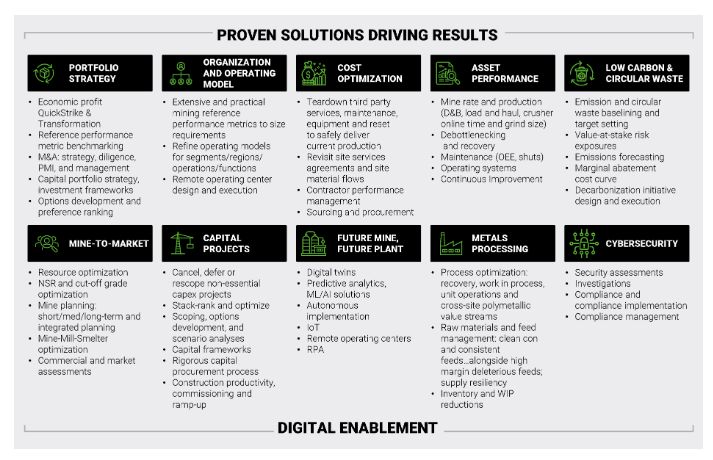

AlixPartners Mining & Metals practice brings significant expertise across the mine-to-market value chain. Our one-firm-firm supports our mining clients across performance improvement and advisory, transaction and restructuring, and risk, in addition to our dedicated services such as digital, cyber, and ESG. We meet your needs globally – when it really matters.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.