- within Food, Drugs, Healthcare and Life Sciences topic(s)

- in United States

- within Compliance and Insurance topic(s)

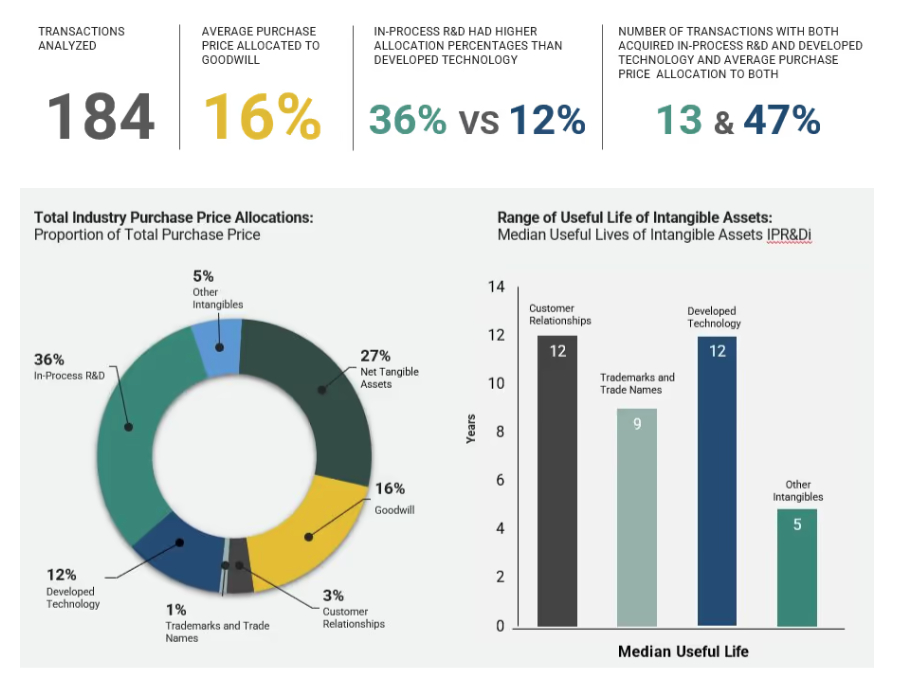

Ankura is pleased to present the findings of our analysis of the allocation of the purchase price for transactions involving Pharmaceutical, Biotechnology, and other Life Sciences companies from 2021 through 2024 by U.S.-based acquirers. Key takeaways are as follows:

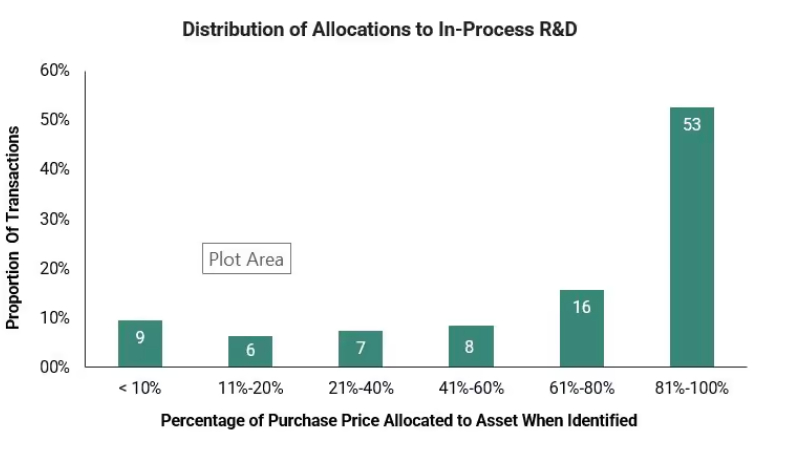

As noted below, for the period 2021 through 2024, nearly 70% of the transactions analyzed allocated between 61% and 100% of the purchase price to In-Process R&D, while 21% of the transactions allocated between 11% and 60% of the purchase price to In-Process R&D, and the remaining 9% of the transactions allocated less than 10% of the purchase price to In-Process R&D. Per accounting guidance, useful lives of In-Process R&D intangibles were classified as an indefinite-lived.

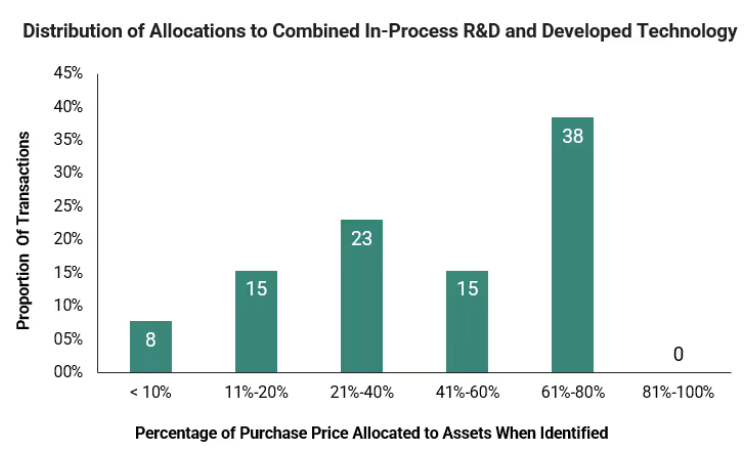

For the period 2021 through 2024, where both In-Process R&D and Developed Technology were identified, nearly 38% of the transactions analyzed allocated between 61% and 100% of the purchase price to both assets combined, while 53% of the transactions allocated between 11% and 60% of the purchase price to both In-Process R&D and Developed Technology, and the remaining 8% of the transactions allocated less than 10% of the purchase price to In-Process R&D and Developed Technology combined.

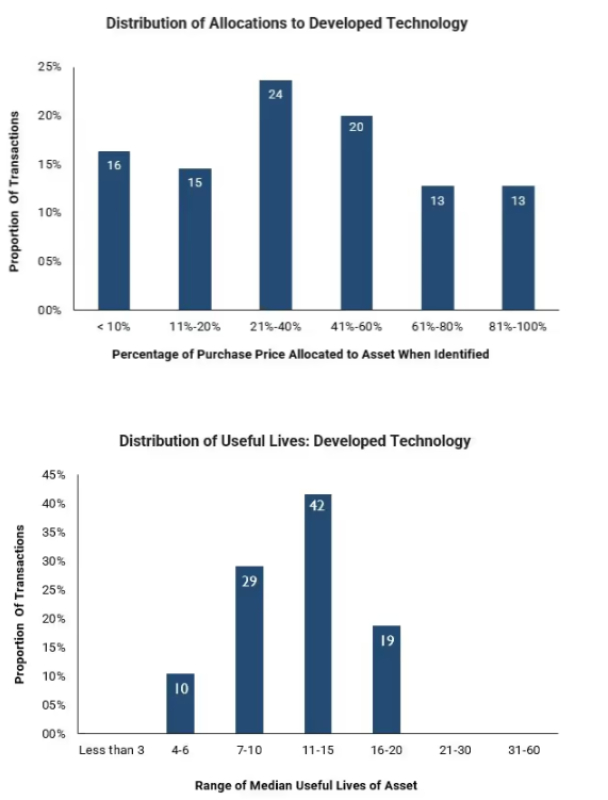

The below chart shows that, for the period 2021 through 2024, 26% of the transactions analyzed allocated between 61% and 100% of the purchase price to Developed Technology, while 60% of the transactions allocated between 11% and 60% of the purchase price to Developed Technology, and the remaining 16% of the transactions allocated less than 10% of the purchase price to Developed Technology. Further, useful lives of Developed Technology intangibles ranged between four and 20 years, with most falling between 11 and 15 years.

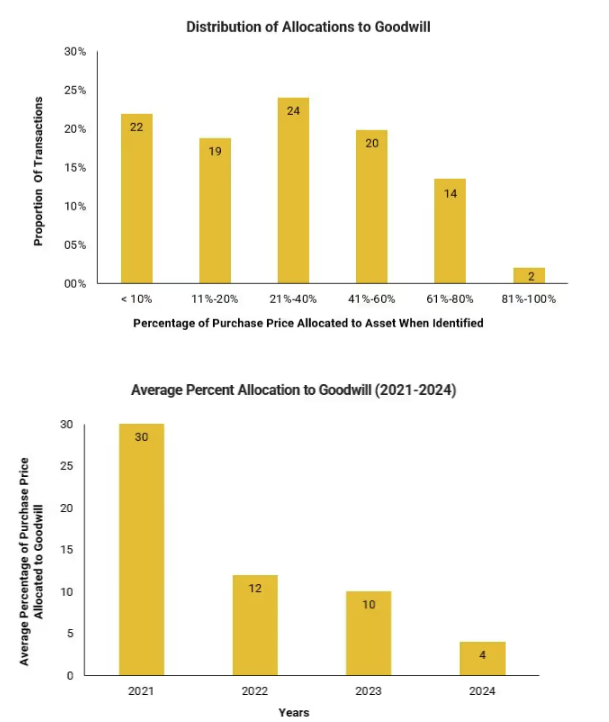

For the period 2021 through 2024, 16% of the transactions analyzed allocated between 61% and 100% of the purchase price to Goodwill, while 63% of the transactions allocated between 11% and 60% of the purchase price to Goodwill, and the remaining 22% of the transactions allocated less than 10% of the purchase price to Goodwill. Further, the average allocation to Goodwill has declined from 30% to 4% annually over the period 2021 through 2024.

How Ankura Can Help

The Ankura Life Sciencescapabilities extend across a wide range of multi-disciplinary specialties. Ankura professionals leverage the deep expertise across the firm to bring the appropriate specialized resources to deliver solutions to complex problems. Our Life Sciences Transaction Advisory Servicesblend in-depth analysis with unmatched responsiveness and client service to provide our clients with sound and thoughtful decision support. We have a unique combination of both industry and transaction advisory experience that sets us apart in the industry.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.