- within Compliance and Insurance topic(s)

Ankura is pleased to present the findings of our analysis of the allocation of the purchase price for transactions involving software and IT services companies during 2022 by U.S.-based acquirers.

The study reviews the treatment of developed technology, customer relationships, trademarks and trade names, and goodwill.

Key Takeaways

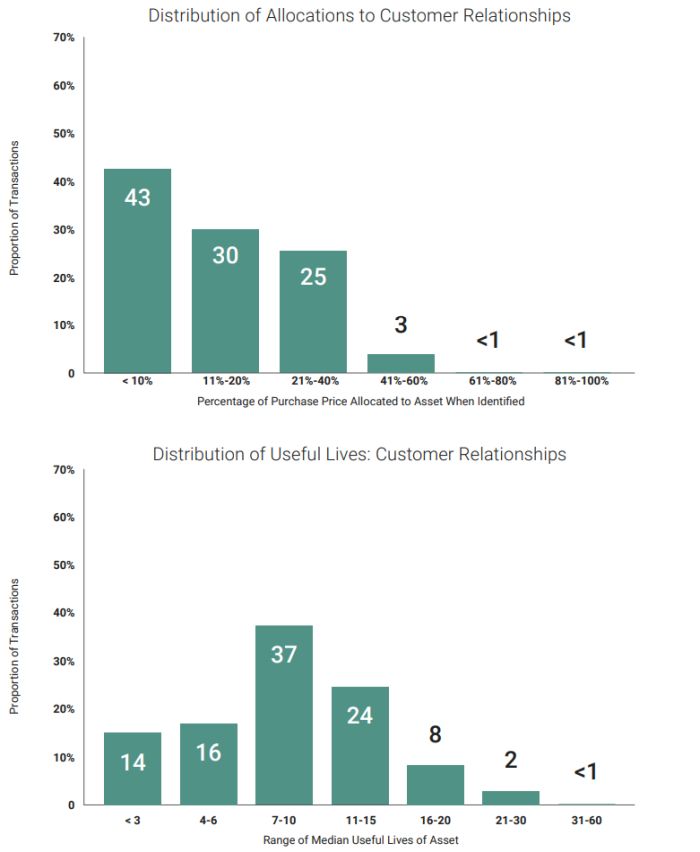

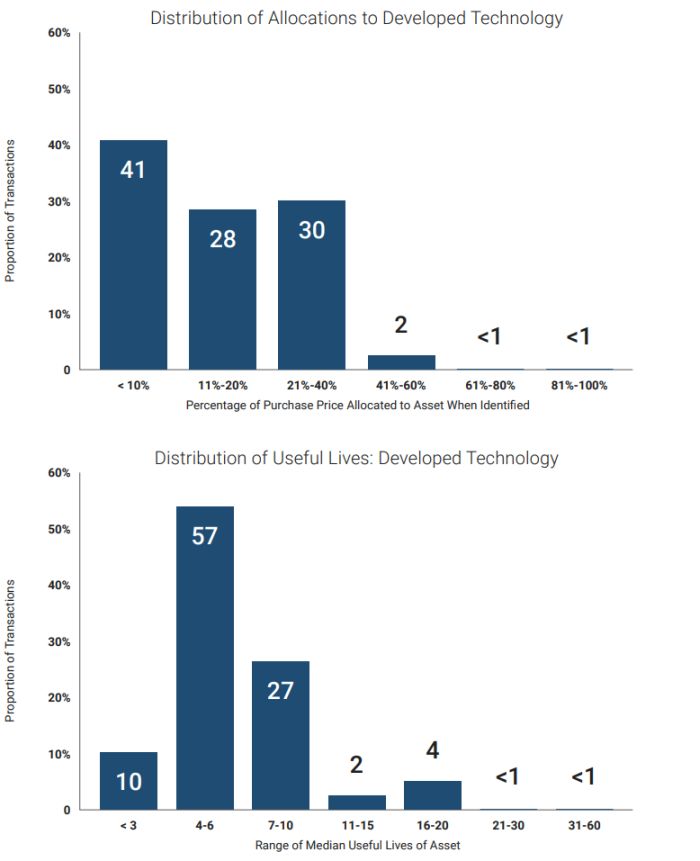

As noted below, close to half of 2022 transactions allocated less than 10% of the purchase price to Customer Relationships. Conversely, it was rare that more than 40% of the purchase price was allocated to Customer Relationships. Further, most Customer Relationship lives fell between 7 - 15 years with the longer-lived Customer Relationships representing transactions where a higher portion of the purchase price was allocated to Customer Relationships.

As noted below, similar to Customer Relationships, over one-third of 2022 transactions allocated less than 10% of the purchase price to Developed Technology. It was also rare that more than 40% of the purchase price was allocated to Developed Technology. While useful lives ranged between 2 - 17 years, most fell between 4 - 10 years.

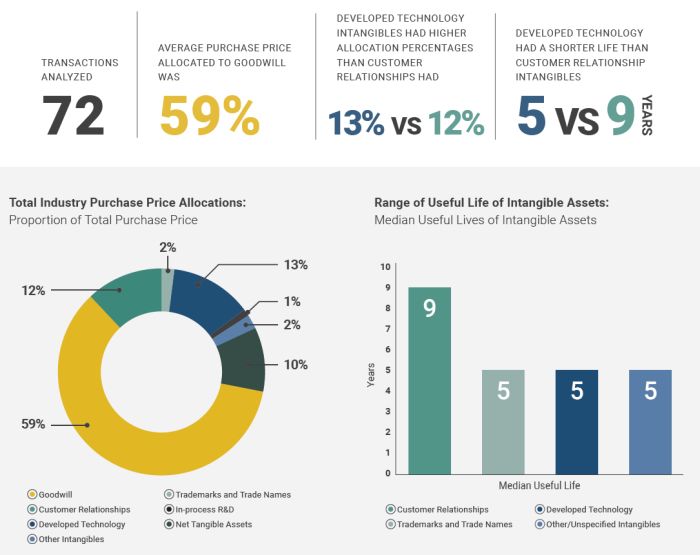

For 2022, over two-thirds of the transactions analyzed allocated between 41% - 80% of the purchase price to Goodwill. Since 2018, the average allocation to Goodwill has ranged from 58% to 64% annually. For 2022, in addition to the 72 transactions analyzed, the charts below include an additional 26 transactions wherein the disclosures did not identify specific intangible assets other than goodwill.

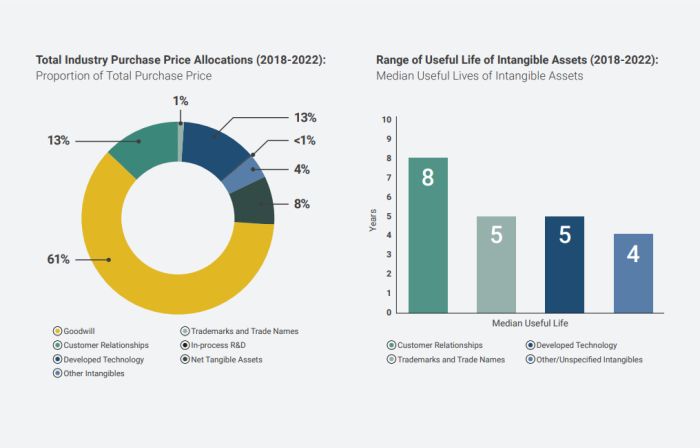

Ankura also analyzed 396 transactions during 2018 through 2022 and observed results similar to 2022. The average purchase price allocated to Goodwill was 61% and the average allocation to both Customer Relationships and Developed Technology was 13% and 13%, respectively. The median useful life for Customer Relationships, Trademarks and Trade Names, and Developed Technology over the period from 2018 to 2022 was 8 years, 5 years, and 5 years, respectively.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.