Executive Summary

Part II of the Biden Administration's rules on surprise medical bills adds more requirements for insurers and providers. Our Health Care Group takes a deep dive into the brave new world created by the regulations under the No Surprises Act.

- Health plans and providers subject to the interim final rule

- Federal independent dispute resolution process

- Good faith estimates for uninsured and self-pay individuals

- Good faith estimate: patient–provider dispute resolution

Starting in 2022, the No Surprises Act imposes a variety of new requirements on health care providers, facilities, plans, and insurers designed to keep patients from receiving "surprise" medical bills. A new second interim final rule with comment period (IFC) implementing certain provisions of the No Surprises Act was issued by the Departments of Health and Human Services (HHS), Labor, and Treasury (the "Departments") on September 30, 2021 (published October 7, 2021). Significantly, this IFC (sometimes referred to as "Part II" of the surprise billing regulations) sets forth: (1) the independent dispute resolution (IDR) process to resolve disputes between providers and health plans; (2) requirements pertaining to the provision of a "good faith estimate" of expected charges to uninsured and self-pay patients; (3) a provider-patient dispute resolution process for uninsured and self-pay patients; and (4) regulations implementing an external review process for adverse determinations as it relates to surprise billing protections, including application of this process to grandfathered health plans.

Previous rulemaking issued in July ("Part I" of the surprise billing regulations) implements other key elements of the No Surprises Act, which protects individuals with health plan coverage from surprise bills from out-of-network (OON) providers in the case of emergency services, certain nonemergency services at an in-network facility unless notice and consent requirements have been satisfied, and air ambulance services. Issues addressed in this rule include: (1) the "recognized amount," used to calculate an individual's cost sharing for items and services subject to the surprise billing protections; (2) the "qualifying payment amount" (QPA) methodology, which will be the most common method for determining the recognized amount and is relevant for the IDR process; (3) requirements for written notice and consent that must be satisfied before balance billing an individual for certain nonemergency OON services; (4) parameters for initial payments or denial of payments by health plans to providers; (5) the prohibition on balance billing by providers for services subject to the surprise billing protections; and (6) a consumer complaints process for violations of the surprise billing protections.

Several other provisions of the No Surprises Act remain on the regulatory agenda, including rulemaking to implement plan and issuer drug price reporting and implementation of the good faith estimate process and advanced explanation of benefits (AEOB) for insured individuals. FAQs issued by the Departments provided an enforcement delay for certain requirements for which guidance will not be issued before the effective date. For other requirements for which guidance will not be issued before the effective date, plans are expected to use a "good-faith, reasonable" interpretation of the law. The FAQs also provide guidance on this standard, including for particular requirements of the No Surprises Act.

The IFC became effective October 7, 2021. The surprise billing protections take effect January 1, 2022. The certified IDR entity application process opened September 30, 2021. Comments on the IFC are due December 6, 2021.

Health Plans and Providers Subject to the IFC

Applicability to providers/facilities

The surprise billing protections apply to several types of providers/facilities, depending on the situation. In contrast, the requirement to provide a good faith estimate of expected charges for uninsured and self-pay patients applies to all health care providers and all health care facilities, without apparent limitation.

Applicability of surprise billing protections

Overall, the key nexus of applicability for the surprise billing provisions—including the dispute resolution process set forth in the IFC—is facility type. For example, the emergency services protections apply when a patient receives emergency care in a hospital emergency department or independent freestanding emergency department (regardless of network status of the facility). The emergency services surprise billing protections continue to apply beyond the emergency department. For example, if a participant, beneficiary, or enrollee of a group health plan or coverage offered by a health insurance issuer receives emergency services in an OON hospital emergency department and is transferred to a different department of the hospital, any services rendered by any provider during such visit would be subject to the surprise billing protections. The protections continue until the visit ends or the notice and consent requirements are satisfied.

Similarly, the nonemergency services protections apply when a participant, beneficiary, or enrollee of a group health plan or coverage offered by a health insurance issuer receives care at an in-networkhospital, outpatient hospital department, critical access hospital, or ambulatory surgical center. Any care rendered during such a visit by any provider is limited to in-network cost sharing, unless several criteria are met (generally relating to notice, consent, and availability of in-network alternative providers). The Departments sought input in Part I of the surprise billing regulations into whether to expand the types of facilities the nonemergency services protections apply to, including urgent care centers.

Lastly, the surprise billing protections for air ambulance services apply to all providers of air ambulance services (both fixed-wing and rotary-wing) when furnishing such services to a participant, beneficiary, or enrollee with air ambulance benefits under a group health plan or health insurance offered by a health insurance issuer that has a network. Part I of the surprise billing regulations specifies that the surprise billing provisions apply when a plan or coverage that includes air ambulance benefits generally has a network of participating providers, even if the plan or coverage does not have in its network any providers of air ambulance services (which will often be the case).

Of note, the surprise billing regulations apply only to items and services rendered at or in connection with the facility types discussed above (and air ambulances), and only to participants, beneficiaries, and enrollees of a group health plan or with coverage offered by a health insurance issuer. For example, surprise billing protections do not apply when a provider furnishes services in a nonfacility context, such as an outpatient mental health provider or a physician in a private-practice setting. The required disclosures of surprise billing protections also do not apply to providers in situations where surprise billing protections would not apply.

Applicability of good faith estimate requirement for uninsured or self-pay patients

As set forth in the IFC, the requirement to provide good faith estimates of expected charges for items and services to uninsured and self-pay patients applies to all health care providers and health care facilities, so long as the provider/facility is licensed, certified, or approved by the state (as applicable):

- A health care provider is defined as "a physician or other health care provider who is acting within the scope of practice of that provider's license or certification under applicable State law, including a provider of air ambulance services."

- A health care facility is defined as "an institution (such as a hospital or hospital outpatient department, critical access hospital, ambulatory surgical center, rural health center, federally qualified health center, laboratory, or imaging center) in any State in which State or applicable local law provides for the licensing of such an institution, that is licensed as such an institution pursuant to such law or is approved by the agency of such State or locality responsible for licensing such institution as meeting the standards established for such licensing."

Unlike other provisions of the surprise billing regulations, which apply only to the situations and facilities described above, the requirement to provide a good faith estimate of expected charges appears virtually unlimited. Any health care provider or health care facility subject to state licensure, upon scheduling an item or service or upon request, must provide a good faith estimate of expected charges within specified timeframes. Further, unlike other surprise billing regulations that only apply to patients with health plan coverage, the requirement to provide a good faith estimate extends to uninsured and self-pay individuals as well. (Note that the good faith estimate requirements that apply to patients who plan to submit claims have not yet been promulgated.)

Functionally, the requirement to provide a good faith estimate of expected charges will be limited to providers/facilities that bill for services. However, this requirement will apply to providers/facilities that are often otherwise excluded from significant federal health care regulatory schemes. For example, this requirement is not contingent upon Medicare enrollment nor engagement in standard transactions for the electronic exchange of health care data, making the regulated class of providers/facilities effectively broader than Medicare participation and the Health Insurance Portability and Accountability Act (HIPAA), respectively. Further, the Departments specifically note that they expect items and services related to dental health, vision, substance use disorders, and mental health to be included in good faith estimates, indicating that dentists, optometrists, and mental health providers will be subject to the rules.

To some extent, the outer bounds of providers/facilities subject to the good faith estimate requirement may already operate in a manner that comports with the requirement. For example, a private-pay concierge medical practice may routinely provide cost information before furnishing services. Nonetheless, the scope of these requirements—and their attendant enforcement through patient–provider dispute resolution—may be unexpected for many providers.

Applicability to plans and issuers

Generally, the surprise billing regulations apply to group health plans and health insurance issuers offering group or individual health insurance coverage, including grandfathered plans. "Group health plan" includes: both insured and self-insured group health plans, private employment-based group health plans subject to the Employee Retirement Income Security Act of 1974 (ERISA), non-federal government plans (such as plans sponsored by states and local governments) subject to the Public Health Service Act, and church plans subject to the Internal Revenue Code. Individual health insurance coverage includes coverage offered in the individual market, through or outside an exchange, and student health insurance coverage. The surprise billing regulations do not apply to plans or insurance providing only excepted benefits (such as dental or vision coverage, specified disease coverage, accident coverage, or disability coverage benefits), health reimbursement arrangements, or short-term, limited duration insurance. Parallel regulations in the IFC also apply the surprise billing dispute resolution process to Federal Employees Health Benefits (FEHB) carriers.

Federal Independent Dispute Resolution Process

The IFC sets forth the details of an IDR process to be used by nonparticipating providers/facilities and plans/issuers if an agreement is not reached through the 30-business-day negotiation period to determine the OON reimbursement amount as defined under the Part I regulations. If the parties have not reached an agreement on the amount for the OON rate by the last day of the open negotiation period, either party may start the federal IDR process during the four-business-day period starting on the thirty-first business day after the open negotiation period began. The IDR process does not apply if the OON rate is determined through an applicable "specified state law" (a state surprise billing law that provides a method for determining OON rates) or an All-Payer Model Agreement under Section 1115A of the Social Security Act. An applicable state process applies to fully insured plans, as well as self-funded ERISA plans that opt in, where permitted. For 2022, the certified IDR entity fee range is $200–$500 for single determinations and $268–$670 for batched determinations.

Process and timing

To start the federal IDR process, a party must submit a notice to the other party and to the Departments through the federal IDR portal on the same day. Either party may initiate this process. The Notice of IDR Initiation must include:

- Information sufficient to identify the qualified IDR items or services (and whether the qualified IDR items or services are designated as batched items and services), including the dates and location of the items or services, the type of qualified IDR items or services (such as emergency services, post-stabilization services, professional services, hospital-based services), corresponding service and place-of-service codes, the amount of cost sharing allowed, and the amount of the initial payment made by the plan or issuer for the qualified IDR items or services, if applicable.

- Names and contact information of the parties involved, including email addresses, phone numbers, and mailing addresses.

- State where the qualified IDR items or services were furnished.

- Commencement date of the open negotiation period.

- Initiating party's preferred certified IDR entity.

- An attestation that the items or services are qualified IDR items and services within the scope of the federal IDR process.

- The QPA.

- Certain information about the data used to calculate the QPA.

- General information describing the federal IDR process.

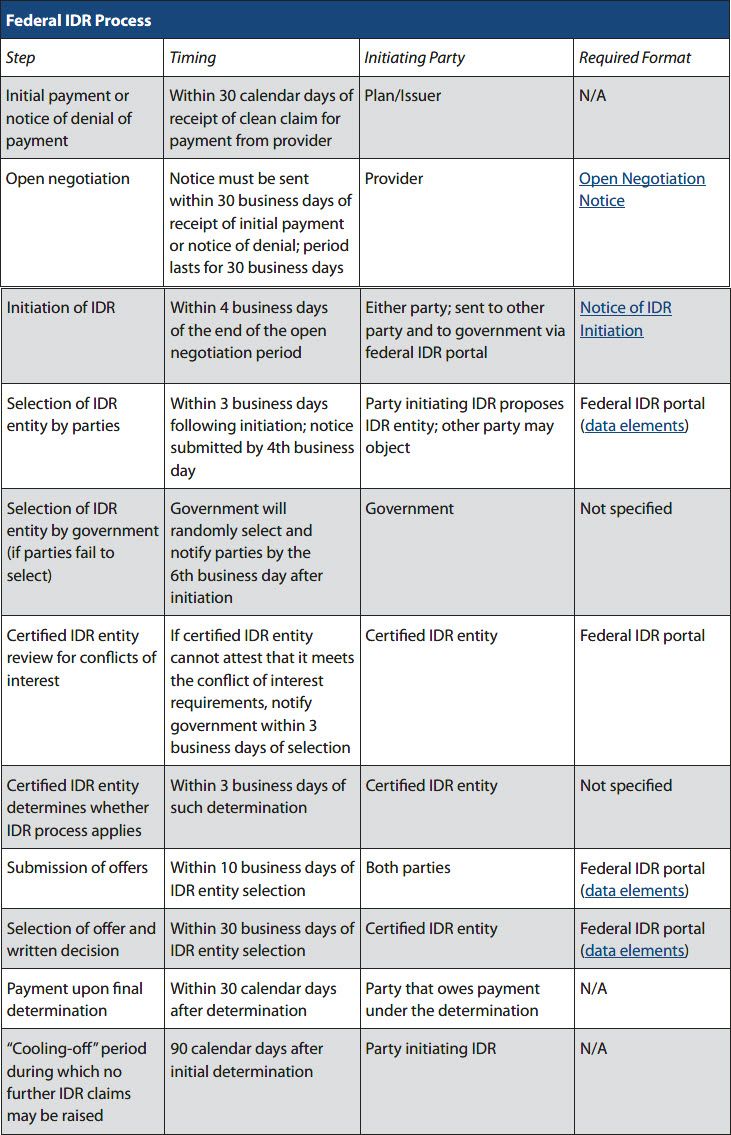

The steps and timeframes in the IDR process are set forth in the table below.

OON payment rate determination

Generally, the IDR process is structured as a "baseball-style" arbitration, where each party offers a payment amount and the IDR entity selects one amount or the other. Each party will submit to the IDR entity an offer for a payment amount for the item or service in dispute, along with certain information related to the offer, within 10 business days of selection of the IDR entity.

Under the IFC, the IDR entity must begin with the presumption that the QPA is the appropriate OON rate for the item or service. The QPA, which was defined in the Part I rule, is generally the plan's or issuer's median in-network rate. The IDR entity must select the offer closest to the QPA unless the IDR entity determines that credible information submitted by either party clearly demonstrates that the QPA is materially different from the appropriate OON rate, based on several other factors. "Material difference" is defined in the IFC as a "substantial likelihood that a reasonable person with the training and qualifications of a certified IDR entity making a payment determination would consider the submitted information significant in determining the [OON] rate and would view the information as showing that the [QPA] is not the appropriate [OON] rate." In these cases, or when the offers are equally distant from the QPA but in opposite directions, the IDR entity must select the offer that it determines best represents the value of the items or services.

The presumption under the rule that the QPA is appropriate has drawn scrutiny from some lawmakers. Of note, Representatives Richard Neal (D-MA) and Kevin Brady (R-TX), chairman and ranking member of the House Ways & Means Committee, issued a letter on October 4, 2021 to the Departments expressing concerns about the regulatory implementation of the No Surprises Act. Specifically, the Congressmen wrote that "the law Congress enacted directs the arbiter to consider all of the factors without giving preference or priority to any one factor—that is the express result of substantial negotiation and deliberation among those Committees of jurisdiction, and reflects Congress's intent to design an IDR process that does not become a de facto benchmark." The letter argues that the September 30, 2021 IFC deviates from this design and "essentially tips the scale for the median contracted rate being the default appropriate payment amount." Conversely, other lawmakers have expressed support for the IFC. In an October 7 press release, Senator Patty Murray (D-WA) and Representative Frank Pallone (D-NJ) stated that "today's rule implements the No Surprises Act just as we intended."

The No Surprises Act does not specifically direct the Departments to weight the QPA over other permissible factors. However, the Departments noted in the IFC that, while they considered permitting consideration of all permissible factors equally, that this would "disregard[ ] the weight that the No Surprises Act places on the QPA." The Departments also explain that the requirement to report how the OON rates compare to the QPA suggests that Congress saw it as an appropriate analogue for the OON rate, and that "starting with the QPA as the rebuttable presumption for the appropriate payment amount will increase the predictability of dispute resolution outcomes, ... will aid in reducing prices that may have been inflated due to the practice of surprise billing prior to the No Surprises Act," and "will protect participants, beneficiaries, and enrollees from excessive costs, either through reduced costs for items and services or through decreased premiums."

The QPA is the presumptive factor in determining the OON rate under the IFC. Consistent with the factors in the No Surprises Act, the IFC specifies other factors that may be considered if credible information submitted by the parties regarding such factors clearly demonstrates that the QPA is not the appropriate OON rate. Further, as set forth in the statute, the regulations exclude certain factors from consideration.

Additional factors that may be considered in determining the appropriate OON rate:

- The level of training, experience, and quality and outcomes measurements of the provider/facility that furnished the item or service.

- The market share held by the provider/facility or that of the plan or issuer in the geographic region where the item or service was provided.

- The acuity of the patient receiving the item or service, or the complexity of furnishing the item or service to the patient.

- The teaching status, case mix, and scope of services of the facility that furnished the item or service.

- Demonstration of good-faith efforts (or lack thereof) made by the provider/facility or the plan or issuer to enter into network agreements with each other, and, if applicable, contracted rates between the parties during the previous four plan years.

- Additional information submitted by a party, provided the information is credible and relates to the offer submitted by either party and does not include information on excluded factors.

Factors that cannot be considered in determining the appropriate OON rate:

- Usual and customary charges.

- The amount that would have been billed by the provider/facility.

- Any public payor payment or reimbursement rates (including Medicare, Medicaid, CHIP, and TRICARE).

Items and services may be batched for the IDR process in certain circumstances. Specifically, the items and services must be the same or similar items or services, billed by the same provider, provider group, or facility (by national provider identifier (NPI) or taxpayer identification number (TIN)), involving the same plan or issuer, and occurring within the same 30-business-day period.

The determination of the IDR entity is binding on the parties and is not subject to judicial review except in narrow circumstances, such as fraud. The costs of the IDR process are borne by the unsuccessful party. When the IDR entity makes a determination, the party that submitted the initial notification cannot submit a subsequent notification involving the same party for the same or similar item or service for 90 calendar days following the determination. The timeframes specified in the IFC can be extended for extenuating circumstances at the Departments' discretion. Requests will be submitted through the federal IDR portal on a standard form, and determinations will be made on a case-by-case basis.

IDR entity certification

The IFC also contains detailed information about the certification of IDR entities, conflict-of-interest determinations, petitions for denial of IDR entity certification, and requirements for recordkeeping and reporting of IDR proceedings.

IDR entities must satisfy several criteria, including: having sufficient arbitration and claims administration of health care services, managed care, billing and coding, and medical and legal expertise to make its determinations; carrying out responsibilities in compliance with the surprise billing regulations; meeting appropriate measures of fiscal integrity; maintaining the confidentiality of individually identifiable health information obtained while conducting determinations; complying with conflict-of-interest requirements; and maintaining current accreditation. As defined in the regulations, it would be a per se conflict of interest for an IDR entity to be a health plan or issuer; provider, facility, or air ambulance provider; professional trade association; or affiliate or subsidiary of any such entities. IDR entities select the applicable service areas for which they will conduct payment determinations under the federal IDR process and may choose to apply to all states or only a subset.

IDR entities are certified for a five-year period. Individuals, providers, facilities, air ambulance providers, plans, and issuers may petition the HHS Secretary for a denial or revocation of an IDR entity's certification.

Special rules for air ambulance OON payment rate determination

Under the IFC, OON rates for air ambulance services may be determined through an open negotiation or IDR process in essentially the same manner that applies for other services. Air ambulance services are distinct from other health care services in how the certified IDR entity is required to select an offer.

For air ambulance services, the certified IDR entity must consider whether the training, experience, and quality of medical personal that furnished the services illustrates that the QPA is materially different from the appropriate OON rate. The certified IDR must also consider whether the credible information about the ambulance vehicle type, the population density at the point of pickup, and the demonstration of good-faith efforts demonstrate that the QPA is materially different from the appropriate OON rate.

Air ambulance services are distinct from other health care services when the certified IDR entity reports information about the federal IDR process. The Departments are also considering whether to require IDR entities to have personnel with knowledge of airspace law to make determinations related to air ambulance cases.

Good Faith Estimates for Uninsured and Self-Pay Individuals

Statutory requirement

Section 112 of the No Surprises Act requires providers/facilities to provide a notice of the good faith estimate of expected charges for an item or service (including any items or services reasonably expected to be provided in conjunction with such item or service) upon request from the patient or when the service is scheduled. "Items or services" means all encounters, procedures, medical tests, supplies, prescription drugs, durable medical equipment, and fees (including facility fees) provided or assessed in connection with the provision of health care. "Expected charges" are defined to mean the cash pay rate or rate established by a provider/facility for an uninsured or self-pay individual, including discounts. This good faith estimate must be provided to the patient's plan or insurer, or to the patient if the patient is uninsured or does not intend to submit a claim for coverage ("self-pay"). Upon receipt of the good faith estimate from a provider, the plan or issuer must provide an AEOB to the patient within one to three days, depending on the circumstances.

Regulatory implementation and enforcement discretion

The IFC sets forth requirements for good faith estimates only when provided to uninsured and self-pay patients; it does not address the process by which a good faith estimate will be provided to insured patients, which will be addressed in rulemaking at a later date. FAQs issued on August 20, 2021 by the Departments effectively delayed the plan and issuer compliance date to provide an AEOB. This guidance also delayed the provider requirement for the good faith estimate, but only for insured patients who plan to submit claims for coverage. Compliance with the requirement to provide a good faith estimate to uninsured and self-pay patients begins January 1, 2022, with enforcement discretion related to co-providers / co-facilities as noted below.

Applicability

For the purposes of the good faith estimate and patient–provider dispute resolution, the IFC defines an uninsured or self-pay individual as an individual who does not have benefits for an item or service under a group health plan, group or individual health insurance coverage offered by a health insurance issuer, a federal or state health care program, or the FEHB program or an individual who has such benefits but does not seek to have a claim for such item or service submitted to such plan or coverage. Uninsured or self-pay individuals also include those enrolled in short-term, limited duration insurance without those benefits. HHS notes in the IFC preamble that an insured individual who requests a good faith estimate to compare costs would be considered self-pay for purposes of providing the good faith estimate; if such an insured individual ultimately decides to submit a claim to a plan or issuer, the individual would no longer be considered self-pay and would not be eligible to use the patient–provider dispute resolution process.

The good faith estimate requirement applies to a broader set of "health care facilities" than other surprise billing protections. A "health care facility" is defined as "an institution (such as a hospital or hospital outpatient department, critical access hospital, ambulatory surgical center, rural health center, federally qualified health center, laboratory, or imaging center) in any State in which State or applicable local law provides for the licensing of such an institution, that is licensed as such an institution pursuant to such law or is approved by the agency of such State or locality responsible for licensing such institution as meeting the standards established for such licensing." A "health care provider" is a "physician or other health care provider who is acting within the scope of practice of that provider's license or certification under applicable State law, including a provider of air ambulance services."

Notice of good faith estimate availability to uninsured and self-pay patients

The IFC requires a provider/facility that receives an initial request for a good faith estimate and is responsible for scheduling the primary item or service (the "convening provider" or "convening facility") to inquire about the patient's insurance status and whether the patient intends to submit a claim for coverage. If the patient is uninsured or self-pay, the provider/facility must inform the patient of the availability of a good faith estimate of expected charges upon scheduling an item or service or upon request. Notification of the availability of estimates must be prominently displayed on the convening provider/facility's website (and easily searchable from a public search engine), in the office, and on-site where scheduling or questions about the cost of items or services occur. Additionally, such notice must be provided orally during scheduling or when discussing costs of items and services. Notice of the good faith estimate must be made available in accessible formats and languages. Convening providers/facilities are required to consider any discussion or inquiry about the potential costs of items or services under consideration as a request for a good faith estimate.

Coordination between convening providers/facilities and co-providers / co-facilities

The IFC requires coordination among providers/facilities to develop a single good faith estimate that includes expected charges from all providers/facilities that are reasonably expected to furnish the items or services that would be billed to the uninsured or self-pay individual. Providers/facilities other than the convening provider that furnish items and services customarily provided in conjunction with a primary item or service are termed "co-providers" and "co-facilities." In the IFC, the Departments state that between January 1, 2022 and December 31, 2022, HHS will exercise enforcement discretion if a good faith estimate does not include expected charges for items and services from a co-provider / co-facility. This is in recognition of the time that may be necessary to establish systems and processes for coordination between convening providers/facilities and co-providers / co-facilities.

Under the IFC, when a convening provider/facility schedules an item or service at least three days in advance for an uninsured or self-pay individual or receives a request for a good faith estimate from such an individual, the convening provider/facility must contact all co-providers / co-facilities that are reasonably expected to provide items or services in conjunction with the primary item or service within one business day. The co-provider / co-facility must provide, and the convening provider/facility must receive, good faith estimate information within one business day of the co-provider / co-facility receiving the convening provider/facility's request. The convening provider/facility must include the information received from co-providers / co-facilities in a single, combined good faith estimate and provide it to the uninsured or self-pay individual.

Deadlines for good faith estimates

Good faith estimates must be provided to uninsured or self-pay patients within the following timeframes:

- If the item or service is scheduled at least 10 business days in advance, not later than three business days after the date of scheduling.

- If the item or service is scheduled at least three business days in advance, not later than one business day after the date of scheduling.

- If the individual requests such information, not later than three business days after the date of the request.

- Note: though an individual may still request a good faith estimate, no estimate requirement is triggered upon scheduling less than three business days before the appointment.

Given the inconsistency between the one-day turnaround for a good faith estimate pursuant to an item or service scheduled three to nine days in advance and the two-day turnaround for a good faith estimate that incorporates the required information from co-providers / co-facilities, it is unclear from the rule how convening providers could comply once the enforcement discretion for inclusion of co-provider / co-facility information ends.

Changes in expected scope of services represented in a good faith estimate must be communicated to the patient through a new good faith estimate provided to the patient no later than one business day before the scheduled services. If any changes in expected providers/facilities represented in a good faith estimate occur less than one business day before the item or service is scheduled to be furnished, the replacement provider/facility must accept as its good faith estimate that of the replaced provider/facility. If a good faith estimate was provided to an uninsured or self-pay individual upon request, a new good faith estimate must be provided upon subsequent scheduling. A convening provider/facility may issue a single good faith estimate for recurring primary items or services if certain requirements are met.

The good faith estimate must be provided in either paper or electronic form as requested. If provided electronically, the format must be such that the patient can both save and print. Good faith estimates are considered part of the patient's medical record and must be maintained in the same manner.

Content of good faith estimate

The convening provider/facility must provide a good faith estimate to uninsured and self-pay patients containing the following information:

- Patient name and date of birth.

- Description of the primary item or service in clear and understandable language (and date of service, if applicable).

- Itemized list of items or services, grouped by each provider/facility, reasonably expected to be furnished for the primary item or service and items or services reasonably expected to be furnished in conjunction with the primary item or service for that period of care, including those provided by the convening provider/facility and any co-providers / co-facilities.

- Applicable diagnosis codes, expected service codes, and expected charges associated with each listed item or service.

- Name, NPI, and TIN of each provider/facility represented in the good faith estimate and the states and office or facility locations where the items or services are expected to be furnished.

- List of items or services that the convening provider/facility anticipates will require separate scheduling and that are expected to occur before or after the expected period of care for the primary item or service.

- Disclaimers regarding additional items or services that are recommended that must be scheduled or requested separately, that the good faith estimate is only an estimate and that actual charges may differ, that the patient has the right to initiate the patient–provider dispute resolution process if the actual billed charges substantially exceed the expected charges in the good faith estimate, and that the good faith estimate is not a contract and does not obligate the patient to obtain the items or services from any of the providers identified in the good faith estimate.

Co-providers / co-facilities must provide the following good faith estimate information to the convening provider/facility:

- Patient name and date of birth.

- Itemized list of items or services expected to be provided by the co-provider / co-facility that are reasonably expected to be furnished in conjunction with the primary item or service for the period of care.

- Applicable diagnosis codes, expected service codes, and expected charges associated with each listed item or service.

- Name, NPI, and TIN of the co-provider / co-facility and the states and office or facility locations where the items or services are expected to be furnished.

- List of items or services that the convening provider/facility anticipates will require separate scheduling and that are expected to occur before or after the expected period of care for the primary item or service.

- A disclaimer that the good faith estimate is not a contract and does not obligate the patient to obtain the items or services from any of the co-providers / co-facilities identified in the good faith estimate.

Good Faith Estimate: Patient–Provider Dispute Resolution

The IFC also creates a process for patients to dispute provider charges that substantially exceed a good faith estimate.

An item or service provided by a convening provider/facility or co-provider / co-facility is eligible for the patient–provider dispute resolution process if the total billed charges (by particular convening provider/facility or co-provider / co-facility listed in the good faith estimate) substantially exceed the total expected charges for that specific provider/facility listed on the good faith estimate. The IFC defines substantially exceed to be a billed amount that is at least $400 more than the total amount of expected charges described in the good faith estimate. HHS intends to establish an online portal as well as provide paper formats for patients initiating this process through an "initiation notice." The patient will submit an administrative fee as determined by the Secretary of HHS (no more than $25), which will be deducted from the amount that the patient must pay if the patient prevails in the dispute resolution process. Patients are protected from collections while the patient–provider dispute resolution process is pending.

Selected dispute resolution entity certification and selection

The Secretary will assign selected dispute resolution (SDR) entities to adjudicate patient–provider disputes. Similar to IDR entities, SDR entities must satisfy several criteria, including: having sufficient arbitration and claims administration of health care services, managed care, billing and coding, and medical and legal expertise to make its determinations; carrying out its responsibilities in compliance with the surprise billing regulations; meeting appropriate measures of fiscal integrity; maintaining the confidentiality of individually identifiable health information obtained while conducting determinations; complying with conflict-of-interest requirements; and maintaining current accreditation. As defined in the IFC and consistent with the IDR certification criteria, it would be a per se conflict of interest for an SDR to be a health plan or issuer; provider, facility, or air ambulance provider; professional trade association; or affiliate or subsidiary of any such entities.

The role of SDR entities is limited to the patient–provider dispute resolution process. HHS will only certify SDR entities when it believes SDR entities are needed to resolve the number of patient–provider disputes rather than follow an open process in which all entities that meet IDR entity requirements will be certified to resolve plan-provider disputes. Further, unlike IDR entities, SDR entities will operate nationwide, rather than in geographic regions.

Process and timing

- The patient may initiate the process within 120 days of

receiving the initial bill containing charges that are at least

$400 more than the good faith estimate. The initiation notice must

include the administrative fee ($25) and the following information:

- The item or service under dispute, the date furnished, and a description of the item or service.

- A copy of the billed charges.

- A copy of the good faith estimate.

- Contact information of the provider (if not included on the good faith estimate).

- The state where items or services were furnished.

- The uninsured or self-pay individual's communication preference.

- The SDR entity will be selected by HHS. Upon selection, the SDR entity will notify the patient and the provider/facility that a patient–provider dispute resolution request has been received and is under review.

- The SDR entity will validate the initiation notice and notify the patient of the outcome of the review. If the initiation notice is determined to be incomplete or ineligible for dispute resolution, the patient will have 21 days to submit supplemental information.

- The SDR entity will notify the patient and the provider/facility when an item or service has been determined eligible for dispute resolution.

- The SDR entity will request the following information from the

provider/facility within 10 business days:

- A copy of the good faith estimate.

- A copy of the billed charges.

- If available, documentation demonstrating that the difference between the billed charges and expected charges reflect the cost of a medically necessary item or service and is based on unforeseen circumstances that could not have been reasonably anticipated by the provider/facility when the good faith estimate was provided.

- The SDR entity will make a determination of the payment amount within 30 days of receiving the above information from the provider/facility.

Payment determinations

The SDR entity will review any documentation submitted by the patient and provider/facility and make a separate determination for each unique item or service charged of whether the provider/facility has provided credible information to demonstrate that the difference between the billed charge and the expected charge for the item or service in the good faith estimate reflects the cost of a medically necessary item or service and is based on unforeseen circumstances that could not have been reasonably anticipated by the provider/facility when the good faith estimate was provided (referenced below as "justified" for simplicity).

For items or services on the good faith estimate:

- If the billed charge is equal to or less than the expected charge, the payment amount is the billed charge.

- If the billed charge is greater than the expected charge and the difference is not justified, the payment amount is the expected charge.

- If the billed charge is greater than the expected charge and

the difference is justified, the payment amount is the lesser of:

- The billed charge.

- The median payment amount paid by a plan or issuer for the same or similar service by the same or similar provider.

For items or services not on the good faith estimate (new items or services):

- If the billed charge is not justified, the payment amount is $0.

- If the billed charge is justified, the payment amount is the

lesser of:

- The billed charge.

- The median payment amount paid by a plan or issuer for the same or similar service by the same or similar provider.

The parties may also agree to settle the payment amount during the dispute resolution process before a payment amount determination is made. The provider/facility must notify the SDR entity within three business days of the agreement. Finally, the Secretary of HHS may determine that a state-law dispute resolution process meets or exceeds the requirements for dispute resolution and defer to the state process.

Complaint process for good faith estimates regarding providers/facilities

Part I of the surprise billing regulations implemented processes to submit complaints to the Departments against (1) plans and issuers for surprise medical bills; and (2) health care providers/facilities for balance billing. The IFC expands the complaint process for health care providers/facilities to include complaints about good faith estimates. Individuals will be able to submit complaints to HHS about a provider/facility that is potentially violating good faith estimate requirements, such as failure to provide a good faith estimate or intentionally inflating the good faith estimate. This complaint process is also available to providers/facilities that experience other providers' or facilities' failures to comply with the good faith estimate requirements. Upon the basis of such complaints, HHS may initiate an investigation or enforcement action.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.