- within Government and Public Sector topic(s)

- in United States

- with readers working within the Business & Consumer Services, Property and Retail & Leisure industries

- within Government, Public Sector, Criminal Law and Technology topic(s)

Key Takeaways:

- Infrastructure projects funded with federal dollars are subject to complex rules under the Build America, Buy America Act and the Davis-Bacon and Related Acts.

- Common compliance gaps include missing contractor certifications, lack of traceability for materials, and misapplied wage rules.

- Proactive planning, clear supporting documentation, internal and external training, and documented policies and procedures are key to protecting your funding — and your reputation.

—

Federal infrastructure funding has created new opportunities for growth in communities and industries throughout the country — but it has also introduced new levels of risk and scrutiny. Projects ranging from construction of affordable housing to water and sewer system replacements and enhancements to broadband installation have generated benefits to the public. But, while delivering those benefits, governments must comply with laws like the Build America, Buy America Act (BABA) and prevailing wage requirements under Davis-Bacon and Related Acts (DBRA), which result in a much more closely regulated environment.

These rules are not just check-the-box exercises. They come with high stakes: missed documentation or unclear procedures can delay reimbursements, require restitution payments to contract employees, trigger investigations and audits, or even jeopardize your funding altogether. We have seen agencies caught off guard — including one client whose federal funding was delayed due to a single oversight in a contractor's BABA compliance process, which in turn could have resulted in the loss of federal grant eligibility. We have also observed and are assisting a government to quantify, report, and monitor wage restitutions for apprentices and journeyman while re-engineering processes to align with recent DBRA-related regulatory changes.

To help you stay ahead of the risk — financial and otherwise — here is a look at the most common compliance pitfalls and a checklist you can use to assess your readiness.

Watch Out for These 5 Common Compliance Risks

Here are risks we see most often when reviewing infrastructure projects supported by federal funding:

1. Contractors Without Required BABA Certifications

If your project uses federal infrastructure funds, BABA likely applies. This means contractors must certify that 100% of the iron and steel used in your project is domestically sourced — and that certification needs to come from a third party. Your project may also be subject to additional BABA requirements for other products used in construction, such as manufactured goods and construction materials.

We recently worked with a client who was unaware of this requirement. By the time it came to light, they were at risk of losing a substantial portion of their funding. If your contracts do not explicitly require this certification, you could be exposed to the same risk.

What you can do: Make sure contractors understand the certification requirement — and that you have a process for collecting and storing this documentation before any reimbursement requests

2. Missing Traceability for Construction Materials

BABA does not just require certification — it demands traceability. Auditors want to see clear documentation showing where your project materials came from and how much of each qualifies as U.S.-sourced.

Too often, we see governments lacking a centralized log or worksheet that tracks this information. Without it, your records may fall short in an audit or grant review.

What you can do: Develop or adopt a worksheet that tracks every material subject to BABA rules, noting the country of origin and percentage of U.S. content.

3. Lack of or Inadequate Policies and Procedures

Having clear internal policies and standard operating procedures (SOPs) is critical for consistent compliance. Without them, your team may be applying rules inconsistently — or missing them entirely.

We have found that many governments have not yet updated their internal guidance to reflect BABA and DBRA requirements. This increases risk across procurement, payroll, and contractor oversight. Further, policies and procedures often address Davis-Bacon prevailing wage requirements, but fail to address appeal requirements, mandatory reporting, contract flow-down provisions, and other statutory matters that are equally important as DBRA. The result: unknown or otherwise inadequately managed risks.

What you can do: Create or revise policies and SOPs that address federal construction compliance — and train your team on how to apply them.

4. Misapplying Prevailing Wage Rules

If your project includes both state and federal funding, you may be subject to multiple prevailing wage laws, rules, and regulations. But applying only one wage schedule — or assuming they are interchangeable — can result in underpayment and violations. Further, recent decisions in federal court impact how prevailing wage requirements are to be managed. These matters require assessment and training.

This is a common trap. In some cases, governments use state wage rates without realizing federal requirements apply as well.

What you can do: Review each project's funding sources and make sure the correct wage schedules are applied to every worker classification. If in doubt, seek clarification before issuing payments.

5. Unreported Labor or "Off-the-Books" Payroll

Another risk area is unreported labor — where subcontractors fail to report all workers or pay wages off the books. This not only violates Davis-Bacon requirements, but it also exposes your agency to serious reputational and legal consequences. Furthermore, when certain individuals serve as both owners and certifying officials, the risk of self-certification may invalidate certified payrolls — exposing your agency, as well as the contractor or subcontractor, to potential liability.

Certified payroll reports must be complete and accurate. If they are not, your agency is ultimately responsible for noncompliance — even if the issue originates with a subcontractor.

What you can do: Conduct regular desk reviews or site visits to verify certified payrolls match actual work on the ground and conduct expected interviews of construction crews and payroll staff.

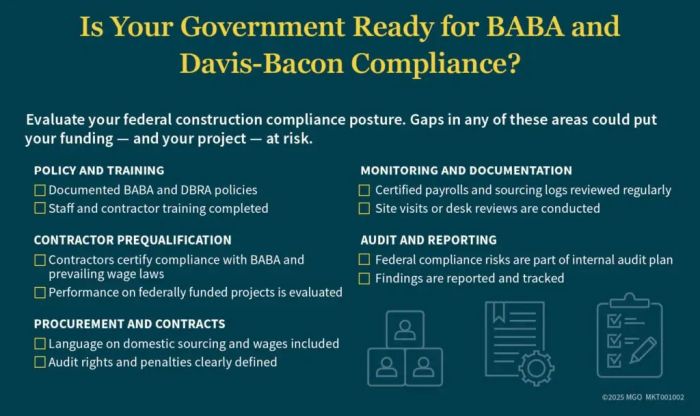

Federal Compliance Readiness Checklist

Use this checklist to evaluate how prepared your government is to meet BABA and DBRA requirements:

Policy and Training

- Do you have documented policies addressing BABA and DBRA compliance?

- Have staff and contractors been trained on these federal rules?

Contractor Prequalification

- Are contractors required to certify compliance with BABA and prevailing wage rules?

- Do you review their prior performance on federally funded projects?

Procurement and Contract Language

- Do your contracts include clauses on domestic preference, applicable sourcing requirements, and prevailing wage requirements?

- Are there audit rights and penalties outlined for noncompliance?

Monitoring and Documentation

- Is there a process for reviewing certified payrolls and source documentation?

- Are fringe benefit certifications accurate and supported?

- Do you conduct site visits or internal desk reviews to validate compliance?

Audit and Reporting

- Are BABA and DBRA risks included in your internal audit plan?

- Do you report findings to leadership and track corrective actions?

- How are underpayments documented, reported, and resolved?

If you answered "no" to any of the above, it may be time to revisit your compliance program and close those gaps before they result in funding delays or audit findings.

Staying Ahead of Federal Risk

As federal scrutiny increases, proactive compliance is not just a best practice — it's a necessity. By strengthening internal controls and contractor oversight, your government entity can mitigate risks and protect the integrity of its federally funded infrastructure projects.

How MGO Can Help

We work with state and local governments across the country to assess and strengthen federal construction project compliance. Whether you need to update policies, verify contractor compliance, or build a tailored monitoring framework, our team can help you stay on track with federal mandates like BABA and DBRA — and keep your projects moving forward.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.