Secondary transactions led by a general partner (GP) have gained significant traction as an alternative liquidity solution for venture capital managers "managing out" their older vintage funds with valuable – but often illiquid – assets. Aside from commercial considerations of valuation and terms on fund economics, as well as having to navigate and manage for significant conflict of interest issues, which are obviously key considerations, venture capital managers must also take into account various structuring considerations to ensure limited partner (LP) alignment, while preserving the long-term value of the fund's assets. In addition, US tax considerations for a venture fund's LPs, which initially may be overlooked by non-US GPs, also play a critical role in determining a successful outcome for these transactions. We highlighted below a number of options GPs can consider when crafting a compelling proposition for existing LPs and attracting new investors to participate in a secondary transaction.

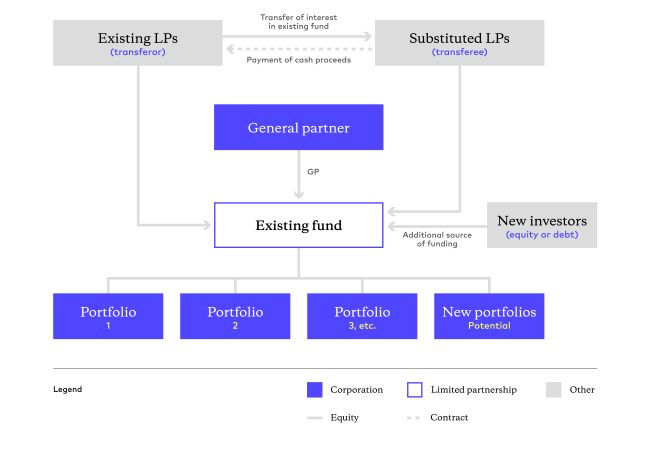

Option 1 – Restructuring through LP transfers

An LP transfer is the classic approach for funding secondary transactions – i.e., a buyer acquiring an existing LP's interest and assuming obligations to meet additional capital calls.

Illustrative structure chart for option 1

With the existing fund coming close to its term, the fund manager may offer liquidity solutions to its LPs, while holding on to the remaining assets of the fund for longer without forming a new fund vehicle, by doing the following:

- Causing the amendment of the existing fund's governing document to extend the fund term and reset fund economics (e.g., fee and carry structure), as appropriate.

- "Cashing out" existing LPs by facilitating transfers of fund interests, including through GP-led tender offers, and offering fund interests to new investors (optional).

- Continuing to manage the existing fund's remaining assets, making follow-on and/or new portfolio investments.

Key US tax considerations for option 1

- The transferor is treated as disposing of the partnership interest in a taxable transaction, recognizing gain or loss equal to the difference between the amount the transferee pays for the interest and the transferor's adjusted tax basis in the interest being sold (often referred to as "outside basis").

- The transferee's outside basis in the interest it acquires initially equals the price the transferee pays for the interest. The transferee inherits the transferor's book and tax capital accounts, as well as the transferor's share of the existing fund's tax basis in its assets (often referred to as "inside basis"). This almost always results in a disparity between the transferee's outside and inside basis.

- If the existing fund vehicle makes (or has previously made) an election under Section 754 of the Internal Revenue Code, the existing fund will make a special basis adjustment that is intended to eliminate the disparity between the transferee's outside and inside basis, which will generally be beneficial to the transferee.

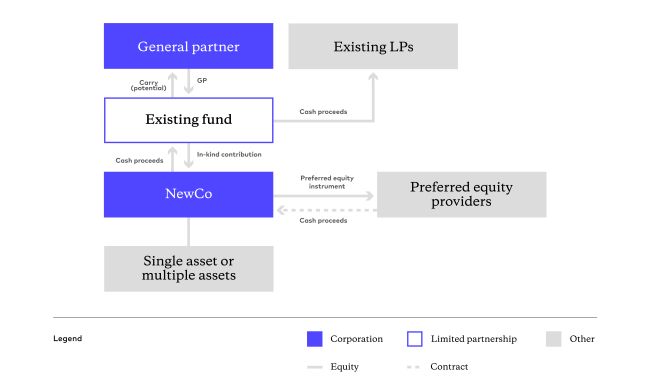

Option 2 – Restructuring through preferred equity

Restructuring through preferred equity could take place either at the portfolio company level or at the fund level.

First, let's examine portfolio company-level restructuring, which we'll label as option 2(a). Funding is provided to the underlying portfolio companies (and indirectly to the existing fund's investors) through preferred instruments that subordinate interests in common equity held by the LPs of the existing fund.

Illustrative structure chart for option 2(a)

The typical restructuring steps taken are as follows:

- In-kind contribution of a portion of the existing fund's assets to a newly established special purpose vehicle (NewCo) in exchange for equity interest in the NewCo. The underlying assets so transferred could be a "strip" (e.g., a particular percentage) of portfolio securities then held by the existing fund.

- Cash contribution by providers of liquidity in exchange for preferred equity interest in the NewCo, which could be achieved through the NewCo's adoption of a multi-tier distribution waterfall with preferred returns.

- The NewCo then distributes cash generated by the preferred equity instrument to the existing fund, achieving liquidity for its LPs. Compared to an outright strip sale of portfolio assets, by structuring the deal this way, the existing fund's LPs retain future upsides of the underlying assets held by the NewCo, so long as preferred return with respect to the providers of liquidity has been achieved.

Key US tax considerations for option 2(a)

- The contribution of cash by preferred equity providers and the existing fund's assets to the NewCo generally will be nontaxable to the NewCo, the preferred equity providers and the existing fund.

- The distribution of cash from the existing fund to an LP will be taxable to that existing LP to the extent the cash distributed exceeds the LP's outside basis and will reduce the existing LP's outside basis.

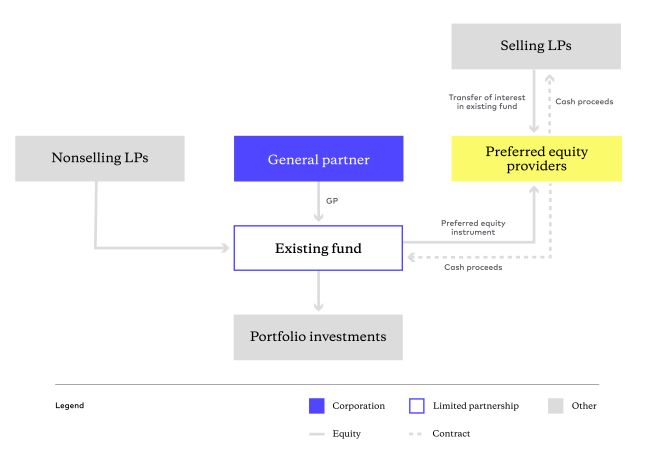

Now, let's examine a structuring alternative, option 2(b), for the preferred equity providers to fund the existing fund directly (which requires amendment of the existing fund's operating agreement/fund-level LP consents) and not through any intermediate vehicle.

Illustrative structure chart for option 2(b)

Under option 2(b), LPs of the existing fund will usually have multiple ways to participate in the fund restructuring, as follows:

- Selling its entire LP interest in the existing fund and being cashed out.

- Staying as an LP holding common equity interest in the existing fund and agreeing to the new fund economics (and governance terms, potentially).

- Subscribing for preferred equity interest in addition to its existing common equity portion.

Key US tax considerations for option 2(b)

- Selling LPs generally are treated the same as in option 1 – i.e., they would generally recognize capital gain or loss on the sale of their interest.

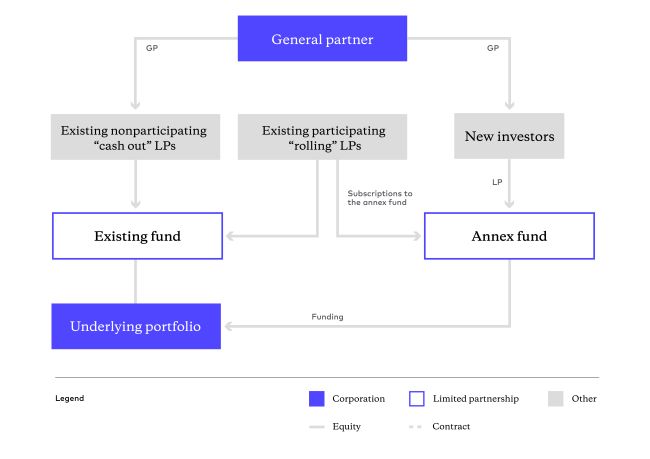

Option 3 – Restructuring through annex fund

The fund manager may establish a new fund vehicle to invest in portfolios of the existing fund. Existing LPs have the option to participate in the annex fund, or to remain invested in the existing fund without participating in the annex fund.

Illustrative structure chart for option 3

The main restructuring purpose here is to provide liquidity to the underlying portfolio of the existing fund, and the valuation of such portfolio is key to the transaction. Combined with GP-led secondary transactions (i.e., LP transfers to investors looking to subscribe into the annex fund), this option could also provide liquidity to existing nonparticipating LPs.

Key US tax considerations for option 3

- Contributions of cash by the existing participating LPs and new investors to the annex fund generally are nontaxable to the existing participating LPs, new investors and the annex fund.

- GP-led secondary transactions would generally give rise to the same tax consequences as in option 1 and option 2(b) – i.e., selling LPs would generally recognize capital gain or loss on the sale of their interest.

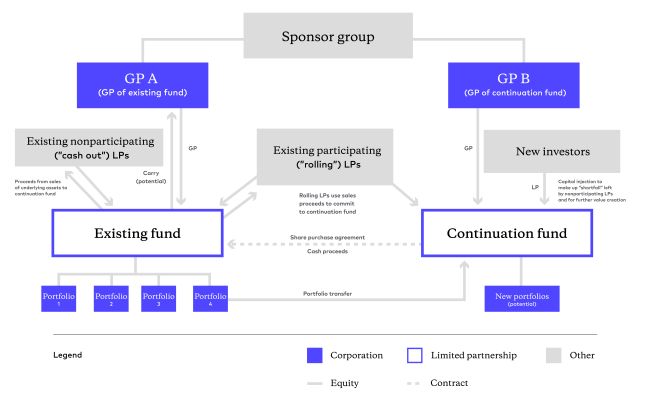

Option 4 – Restructuring through continuation fund

As a fund is coming close to its end of term, the fund manager usually looks around for (best) buyer bids available for liquidation of fund assets, which, in a market short of liquidity or in the event that the fund manager believes that the value of certain portfolio assets have not been fully extracted, could lead to the formation of a continuation vehicle, often managed by the same fund manager or its affiliates.

Illustrative structure chart for option 4

- Formation/fundraising of a continuation vehicle and purchase of the existing fund's underlying assets by the continuation vehicle usually take place in parallel.

- To provide additional liquidity and flexibility, LP transfers may be combined with the offering of an annex fund, and preferred equity may also be combined with GP-led secondary transactions (e.g., acquisition of continuation fund interest by a preferred equity provider, or the transfer of continuation fund interests to the existing fund in partial consideration for the existing fund's assets, followed by a distribution of those interests to the rolling LPs).

- Depending on negotiation leverage, a fund manager may be able to structure the offering of its continuation vehicle concurrently with a new fund raised by such fund manager – i.e., a stapled transaction (especially given the liquidity its existing LPs are about to obtain through the secondary deal).

Key US tax considerations for option 4

- Depending on the structure of the transaction, transfer of existing fund assets to the continuation fund is generally treated as a partnership merger in which the existing fund LPs may recognize gain or loss.

- The rolling LPs' contribution of cash to the continuation fund for continuation fund interests (or receipt of continuation fund interests distributed by the existing fund) is generally nontaxable to the rolling LPs and the continuation fund.

Conclusion

GP-led secondary transactions are highly tailor-made, as the facts and circumstances of each particular fund and its portfolio will dictate the proper structure and terms of any GP-led secondary deal. With that said, no matter what structure is used, one of the key transactional goals and concerns is to minimize tax leakage. Also, it is more often than not the case that the restructuring plans give rise to material conflict of interest concerns and require the fund manager to obtain approval from the LP advisory committee and/or the LPs. If you are thinking about doing a GP-led secondary deal or forming a continuation fund, please feel free to reach out to Cooley's fund formation and tax lawyers who focus on this field.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.