- within Finance and Banking topic(s)

- in United States

- with readers working within the Banking & Credit, Media & Information and Retail & Leisure industries

- within Finance and Banking, Media, Telecoms, IT, Entertainment and Law Department Performance topic(s)

- with Finance and Tax Executives

SMART SUMMARY

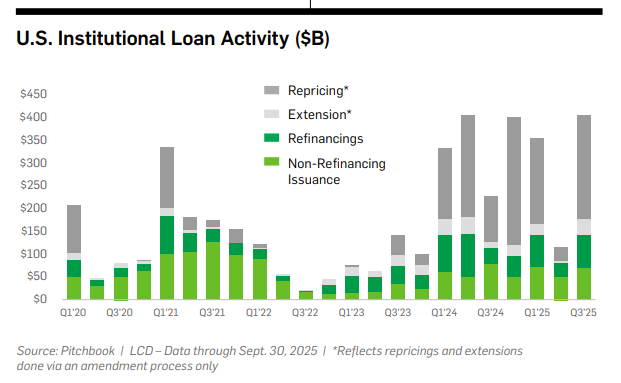

- After Q2'25 disruption, the leveraged loan market rebounded in Q3'25 culminating in the highest quarterly total for syndicated loan activity in Q3'25.

- Refinancings, repricings and extensions lead the leveraged loan market, with new money issuance remaining at low levels.

- The high-yield bond market continued to set new records in Q3'25, with the highest quarterly volume since Q2'21, the busiest September ever and the third highest monthly volume on record.

Q2'2025 Recap

The U.S. leveraged loan market rebounded slightly in the latter half Q2'25 after a sharp drop in early April while the U.S. high-yield bond market made a rapid recovery in May and June. For 15 consecutive days in April, no broadly syndicated loan transactions launched in the United States, representing the longest period of inactivity since early 2020.1 However, by the end of Q2'25, leveraged loan prices were up 80 bps and June marked a 4-month high for total issuance with $73.5 billion recorded.2 Similarly, the high-yield bond market started Q2'25 with the lowest month of issuance since 2008 in April – representing about a third of the issuance in Q2'24 – but was able to end the quarter with the busiest June since 2021.3 Despite this, year-todate issuance of leveraged loans and high-yield bonds still trailed Q2'24 by 23% and 11%, respectively, and total loan volume for Q2'25 was just $113 billion, the lowest since Q4'23, and total high-yield bond volume was $25.5 billion, about half of the Q2'24 volume.4

Both sponsor-backed and corporate M&A transactions declined in Q2'25 from the levels we saw in Q1'25.5 However, LBO volume for Q2'25 was still 24% higher than in Q2'24. June and July sparked increased loan repricing activity. After only a single repricing transaction in April, 29 followed in June.6 Notably, the Q2'25 repricing group had a higher overall credit quality than those who repriced in Q1'25.7

U.S. Leveraged Loan and High-Yield Bond Markets

From Freeze to Frenzy: Leveraged Loans Rebound Over Q3'25

When trade policy suddenly took center stage in April with the so-called "Liberation Day" tariff package, risk markets were jolted, leaving investors sitting on hung deals.8 New supply dried up and borrowers hit pause on refinancing plans as the market digested the policy uncertainty.9

By July, activity was rebounding. Investors and issuers were focused on rebuilding confidence after the April tariff shock and loan prices continued to rise, reflecting renewed optimism.10 Companies and sponsors moved quickly to refinance existing debt and reduce funding costs, leading to a surge in primary activity.11 July became a record month for broadly syndicated leveraged loans, with $224 billion in primary issuance – including $30.4 billion in refinancing alone.12 By mid-month, more than half of outstanding loans were trading at or above par, underscoring the strength of market sentiment.13

This refinancing wave drove a spike in repayment activity as borrowers shifted out of more expensive private credit into a more favorable syndicated market.14 August followed with a moderation in pace but not in strength: primary issuance declined to $52 billion from July's record $224 billion, yet it still marked the busiest August on record.15 August was marked by a surge in refinancing activity, with 82% of Q3'25 activity resulting from repricings, extensions and refinancings.16

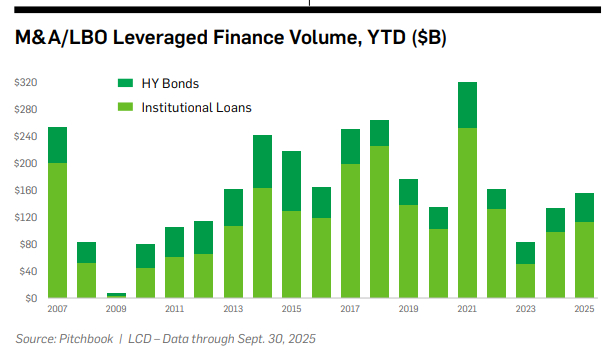

Beyond repricings, new issuance also picked up. August saw $14 billion in non-refinancing deals – the highest for any August since 201717, pointing to renewed appetite for expansion and M&A-driven financing. By the end of Q3'25, M&A activity has further improved, totaling $114 billion year to date and up 15% year over year.18

Meanwhile, secondary loan prices, which had been shaky in Q2'25, held firm through the summer, further reinforcing the market's recovery and investor confidence.19 Reflecting this confidence, by the end of July, 47% of loans were priced at par or above.20 Dividend recapitalizations are also expected to remain active this year as sponsors take advantage of borrower-friendly conditions to extract value and realize partial exits from portfolio companies.21

On September 17, the Federal Reserve lowered the funds-rate target by 25 bps (to 4.00–4.25%), an anticipated easing after nearly two years of holding steady.22 The implications are nuanced: lower base rates reduce overall borrowing costs, which adds momentum to repricing and refinancing activity. However, while spreads on new issues have tightened, the rate cut also reduces the all-in coupon investors receive, and if the Fed continues to ease, nominal yields could fall further.23 With base rates drifting lower and spreads already compressed, future loan returns will increasingly depend on whether spreads widen enough to offset lost carry. As we head into Q4, both investors and issuers in the U.S. loan market will be focused on extending the post-April rally, recovering ground lost earlier in Q2'25 and navigating the shift to a lower-rate environment.

Record Setting Continues in the High-Yield Bond Market

The high-yield bond market ended Q3'25 with a volume of $118 billion, the highest mark since Q2'21 when $137 billion cleared amid record-low funding costs, which marks a furious comeback after a 17-year low in April.24 In September alone, $55.3 billion of high-yield notes were issued – the busiest September ever and the third highest monthly total on record.25 Further, global high-yield bond issuances had the busiest Q3 on record with issuances soaring to $158.1 billion in Q3'25 up from $121.8 billion in Q2'25.26 The global highyield bond market, as we've been predicting throughout 2025, continued to see increased levels of "reverse Yankee" deals – where U.S. issuers raise money in the euro-dominated bond markets – with $26.5 billion issued in Q3'25 (up from $13.9 billion in Q3'24), bringing the total issuances year-to-date as of September 30th to $108.7 billion (up from $83.1 billion in 2024).27

As of the end of Q3'25, approximately 6% of the high-yield bonds issued year-to-date – or $14.3 billion – were for dividend recapitalization transactions, the highest of all annual shares since 2013, with the combined leveraged loans and high-yield bonds issued for such purpose sitting at $76.5 billion – not far from the peak total of $78 billion in 2021.28 However, as of the end of Q3'25 refinancings have constituted nearly 73% of all high-yield bonds issued this year – higher than the 70% at this point in 2024 and a high since recession-era 2009 when 75.5% of the bonds issued were for refinancing purposes.29

As we predicted last quarter, an uptick in high-yield bond issuances continued into Q3'25. As of September 30, total high-yield bond issuance yearto-date in the United States reached $263 billion, up 12% from the same period in 2024, representing a furious comeback from the year-to-date issuances as of April 2025, which trailed 2024's pace by 10%.30 Despite the resurgence of high-yield bond issuances during Q3'25, issuers rated triple-C or lower continued to only represent approximately 2% of high-yield bonds issued in 2025 – half of the 2024 share and significantly lower than the 16% cleared with triple-C ratings in 2022 and 10% in 2021.31

M&A Activity Shows Signs of Heating Up

M&A leveraged loan activity slowly picked up during Q3'25 as pipelines were still recovering from Q2'25 disruptions.32 By the end of Q3'25, M&A issuance of leveraged loans had risen 8% since Q2'25, though volume was still 28% less than in Q3'24.33 However, year-to-date high-yield bonds issued for M&A and LBOs was $42 billion – the most since $77.8 billion were issued to back acquisition in 2021 – bringing the leveraged financing issued for acquisitions (including both leveraged loans and high-yield bonds) to $156 billion yearto-date, a three year high.34 Though new issuance to support M&A has yet to reach a peak, the stabilization of market conditions in recent months has led to a gradual rebound, with an uptick in repayments driven by corporate M&A transactions.35

APAC Leveraged Loan and High Yield Market

As of mid-2025, the APAC leveraged finance market continues to be impacted by a reduced number of new money financings due to the low levels of M&A and private equity activity in 2023, 2024 and 2025. Therefore, loan volume in the Asia-Pacific region has continued to see a slowdown compared to other global markets with APAC loan volume down 20% yearon-year, in contrast to growth in the Americas and EMEA regions.36

There were however some bright spots through Q3 as private equity activity increased across the region and is likely to drive future loan issuance, particularly in markets like Japan, India and Australasia as we move into Q4. Furthermore, the continued growth of private credit with ever more compelling solutions for the unique nature of APAC markets has created greater competition in the region between syndicated loan markets and direct lenders. In fact, private credit AUM targeting APAC has outpaced other regions in the last few years, growing at 19.5% from 2020 to 2023 compared with the global average, and notwithstanding that investor sentiment has fluctuated in 2024 and 2025, the longer-term trend appears to show meaningful commitment to APAC allocation.37

High yield issuance in APAC has been marked by a recovery in 2025 and overall financing volumes are steady as the market is rebalancing away from the historically dominant Chinese real estate sector towards greater diversification.38 Similar to other markets that faced prolonged periods of distress and oversold conditions, the Asian high yield market has made a remarkable recovery, returning a robust +15.2% in US dollar terms so far in 2025.39 This significant improvement is attributed to both a more diversified market structure, reduced dependence on any single sector (particularly Chinese real estate) as well as what appears to be the end of the Asian default cycle, providing a more stable environment for investors.

Q4'25 Outlook

If the global trade landscape becomes clearer, volatility may ease, making way for a more reliable new issue market and normalized pricing behavior. Tariffs themselves may not be the core issue as borrowers and lenders can adapt and price accordingly, but uncertainty must recede for investor confidence to return, even if spreads stay elevated. Bond issuances are expected to slow down as we move into Q4'25, as is typical but intensified. Additionally, as predicted last quarter, we anticipate that most issuers will finance any M&A transactions entered into in Q4'25 in 2026 (rather than the remainder of 2025).

The continued diversification away from Chinese real estate, coupled with strong investor demand for private credit and improved high-yield fundamentals, provides a constructive outlook for the broader Asian credit market. After several subdued years, analysts anticipate a rebound in debt-financed merger and acquisition (M&A) activity in the latter half of 2025, driven by easing interest rates, and default rates are expected to remain low in Asia high yield (excluding real estate). In addition, Asia sponsors and issuers continue to take proactive early measures to refinance upcoming debt maturities or securing bank facilities to refinance them. As such, market sentiment is that default rates outside of the real estate sector will remain low for the rest of 2025.

However the region will continue to encounter challenges in light of the ongoing geopolitical risks, trade policy volatility, and sector-specific pressures (such as lingering issues in real estate) which could still impact market sentiment and pricing. Analysts highlight the importance of strong risk management and selective credit underwriting as key strategies for navigating the market, given the potential for higher performance dispersion among lower-quality borrowers.

In the leveraged loan and M&A market, the Federal Reserve's rate cut in September may further boost new issuance and buyout activity by reducing borrowing costs. Lower rates enable private equity firms to increase leverage, decreasing the equity capital they need to deploy for acquisitions. So far, high capital costs and a valuation gap between buyers and sellers have kept M&A and buyout activity muted in 2025, but easing financial conditions could help narrow this divide and spur more deals in Q4'25.40

While historically government shutdowns generally have had little to no impact on capital markets, some speculate that this shutdown may have different impacts.41 Currently, US corporate bonds are trading at their highest valuations in decades with bond spreads near their tightest in decades and rallying leveraged loans, which some suggest is a result of government dysfunction and rising risk for US Treasuries along with strong demand for company debt.42 However, some companies have not seen strong demand and are facing challenges raising money in light of debt investors' growing concerns that artificial intelligence poses a risk that such companies will become obsolete.43

Footnotes

1 Credit Markets Quarterly Wrap (Pitchbook, July 31, 2025)

2 Credit Markets Quarterly Wrap (Pitchbook, July 31, 2025)

3 US Credit Markets Quarterly Wrap: Highyield borrowers ride rapid recovery in eye of tariff storm (PitchBook, July 1, 2025).

4 Credit Markets Quarterly Wrap (Pitchbook, July 31, 2025); US Credit Markets Quarterly Wrap: High-yield borrowers ride rapid recovery in eye of tariff storm (PitchBook, July 1, 2025).

5 Credit Markets Quarterly Wrap (Pitchbook, July 31, 2025)

6 Credit Markets Quarterly Wrap (Pitchbook, July 31, 2025)

7 Credit Markets Quarterly Wrap (Pitchbook, July 31, 2025)

8 US Leveraged-Loan Sales Soar to New High in Record-Breaking July (Bloomberg, August 1, 2025)

9 US Leveraged-Loan Sales Soar to New High in Record-Breaking July (Bloomberg, August 1, 2025)

10 July Wrap: Borrower-friendly market spurs loan activity to new record (Pitchbook, August 1, 2025)

11 US Leveraged-Loan Sales Soar to New High in Record-Breaking July (Bloomberg, August 1, 2025)

12 July Wrap: Borrower-friendly market spurs loan activity to new record (Pitchbook, August 1, 2025)

13 July syndicated loan market wrap: Returns hold steady amid record activity (Pitchbook, August 5, 2025)

14 US Leveraged-Loan Sales Soar to New High in Record-Breaking July (Bloomberg, August 1, 2025)

15 August Wrap: Loan rally hits speed bump even as repayments set record (Pitchbook, September 2, 2025)

16 Credit Markets Quarterly Wrap (Pitchbook, September 30, 2025)

17 August Wrap: Loan rally hits speed bump even as repayments set record (Pitchbook, September 2, 2025)

18 Credit Markets Quarterly Wrap (Pitchbook, September 30, 2025)

19 Credit Markets Update Q2 2025 (KPMG, June 30, 2025)

20 July Wrap: Borrower-friendly market spurs loan activity to new record (Pitchbook, August 1, 2025)

21 2025 Midyear Outlook: US Leveraged Loan & Private Credit (Pitchbook, July 22, 2025)

22 Federal Reserve issues FOMC statement (Federal Reserve Press Release, September 17, 2025)

23 Rate cuts to lower already tight borrowing costs (LSEG, September 18, 2025)

24 US Credit Markets Quarterly Wrap: Highyield issuance rockets to 17-quarter high (PitchBook, September 30, 2025).

25 US High-Yield Bond Weekly Wrap: Highyield primary market: Low yields, strong demand (PitchBook, October 2, 2025); US Credit Markets Quarterly Wrap: Highyield issuance rockets to 17-quarter high (PitchBook, September 30, 2025).

26 US Credit Markets Quarterly Wrap: Global leveraged finance refinancing runs hot in Q3 (PitchBook, September 30, 2025); US Credit Markets Quarterly Wrap: Bond issuance booms on both sides of the Atlantic (PitchBook, July 1, 2025).

27 Timothy Rahill and Marine Leleux, US Dollar Credit Supply (ING Group, October 7, 2025).

28 US Credit Markets Quarterly Wrap: Highyield issuance rockets to 17-quarter high (PitchBook, September 30, 2025).

29 US Credit Markets Quarterly Wrap: Highyield issuance rockets to 17-quarter high (PitchBook, September 30, 2025).

30 US Credit Markets Quarterly Wrap: Highyield issuance rockets to 17-quarter high (PitchBook, September 30, 2025).

31 US Credit Markets Quarterly Wrap: Highyield issuance rockets to 17-quarter high (PitchBook, September 30, 2025).

32 Credit Markets Quarterly Wrap (Pitchbook, September 30, 2025)

33 Credit Markets Quarterly Wrap (Pitchbook, September 30, 2025)

34 Timothy Rahill and Marine Leleux, US Dollar Credit Supply (ING Group, October 7, 2025).

35 July Wrap: Borrower-friendly market spurs loan activity to new record (Pitchbook, August 1, 2025)

36 Q4 2024 APAC syndicated loans market overview (BLOOMBERG, January 2025).

37 Private debt in APAC (Preqin 2025 Global Report: Private Debt).

38 APAC Private Credit in 2025: Shedding Light on the Year of the Snake (ADM Capital Asia Pacific Direct Lending, January 2025).

39 Asia credit market on the recovery path (UBS Asian Fixed Income, February 2025)

40 Rate cuts to lower already tight borrowing costs (LSEG, September 18, 2025)

41 Chloe Taylor and Tasmin Lockwood, How a U.S. government shutdown could impact global markets (CNBC, October 1, 2025).

42 Caleb Mutua and Victor Swezey, Corporate Debt Is Benefiting as US Looks More Like an Emerging Market: Credit Weekly (Bloomberg, October 11, 2025); Rachel Graf and Dorothy Ma, Debt Investors Grow More Worried About Firms Vulnerable to AI (Bloomberg, October 10, 2025).

43 Rachel Graf and Dorothy Ma, Debt Investors Grow More Worried About Firms Vulnerable to AI (Bloomberg, October 10, 2025).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.