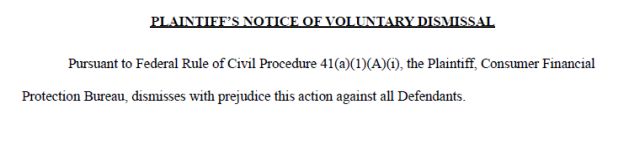

On Thursday, the Consumer Financial Protection Bureau (CFPB) dropped its high-profile enforcement action against Acima in Utah federal district court. This is yet another CFPB matter that has hit the dust following the administration change in January.

In the litigation, the CFPB had alleged that Acima's lease-to-own (LTO) business should be regulated as "credit" under the Consumer Financial Protection Act (CFPA), the Electronic Fund Transfer Act (EFTA), and the Truth in Lending Act (TILA). The CFPB argued that the practical realities of how Acima's LTO transactions allegedly functioned—despite the plain contract terms providing for lease transactions—was sufficient to justify regulating Acima as a credit provider. The CFPB was notably predicted to lose that lawsuit, especially because the outcome would have been contrary to another Utah district court's decision in CFPB v. Snap Finance, LLC, 2024 WL 3625007 (D. Utah Aug. 1, 2024). The LTO industry nonetheless will be relieved by the CFPB's voluntary dismissal of Acima.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.