Just when it seemed that financial markets finally got religion in early 2022, investors decided it was time for a summer bender. After turning in a miserable first-half performance — the worst in several decades by some measures1 — markets were enjoying a sizzling summer rally, pushing a bear market rout back into mere correction territory. The S&P 500 recovered more than one half of its 1H22 losses by mid-August.

This has been a reliable script for more than a decade, with nearly every notable market pullback ultimately proving to be a buying opportunity for investors. Leveraged credit markets got in on the rally too, with new issuance volumes picking up and market yields contracting by 100 bps or more following a huge widening of spreads in 1H22. But the rallies came to a screeching halt on August 26, when Chair of the Federal Reserve Jerome Powell gave a brief, nine-minute speech at a Fed-sponsored economic symposium at Jackson Hole, Wyoming. Financial markets fell by 2.0%-3.0% across the board that day and have been grinding lower ever since, approaching their first-half lows once again.

What was the awful news that abruptly ended the summer rally? Chair Powell remarked that the U.S. economy "[c]ontinues to show strong underlying momentum", acknowledged that "[r]estoring price stability will take some time" and said that "[r]educing inflation is likely to require a sustained period of below-trend growth" and "higher interest rates, slower growth, and softer labor market conditions ... will also bring some pain to households and businesses."2 These were hardly surprising comments for those with an informed sense of the moment and any familiarity with the United States' previous battle against high inflation from 1979 to 1982, but it was unsettling news for those accustomed to a markets-friendly Fed and conditioned to expect quick and painless financial fixes for every economic challenge. Several other high-ranking Fed officials have since made comments consistent with Powell's remarks that reducing inflation to its 2.0% target rate is the Fed's highest priority3 and that accomplishing this objective might take longer and entail more pain than markets were anticipating. Treasury note yields have stayed firmly above 3.0% since Chair Powell's speech, while equity markets continue to sell off as investors reluctantly come to the realization that "the Fed Put" is dead now that inflation runs amok.

For more than a month prior to Chair Powell's comments at Jackson Hole, an increasingly popular narrative that gained traction in financial markets was that the Fed's two jumbo rate hikes (and perhaps one more in September) would quickly take the fight to inflation and set the stage for rate cuts to begin in 2023, despite little evidence for such sentiment and a Fed dot plot showing expected hikes in the Fed Funds rate toward 4.0% through the end of next year. There also was growing chatter that inflation was peaking, based on a very slight monthly downtick in July's CPI Index that was entirely attributable to easing gas prices. More broadly, risk-on investors were likely skeptical that a Fed chair who had participated in or overseen the largest monetary expansion in U.S. modern history — thereby boosting financial markets time and again — would commit to such a policy about-face for very long if markets convulsed, but Chair Powell's tough talk on inflation and resolute tone signaled otherwise to Wall Street.

Chair Powell cautioned against inflation becoming embedded in the United States economy, at which point it can become prolonged and self-reinforcing, and he suggested that an economic slowdown would be preferable to an environment of persistently elevated inflation expectations by economic decisionmakers. Chair Powell's comments spooked markets, making it clear that the fight to tame inflation would be a long slog, while the ability to slow the economy without inducing a contraction (the so-called "soft landing") is the Fed's objective but not necessarily an outcome fully within its control.

Why is taming inflation such a daunting challenge? Consider the following:

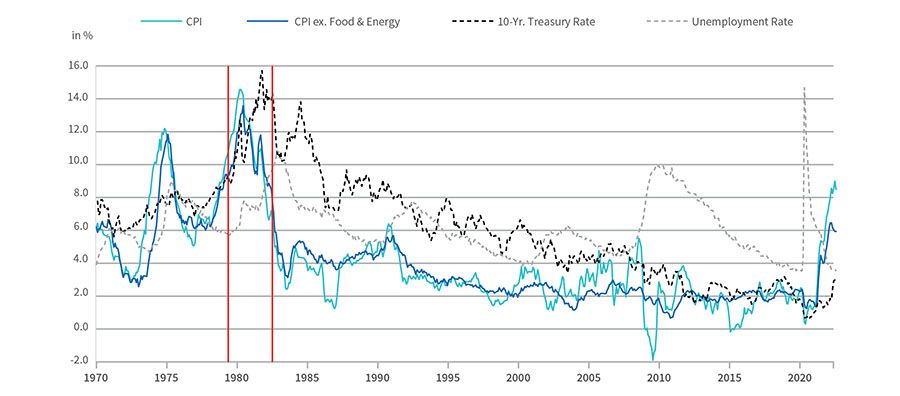

History says beating inflation takes time and tough medicine: The only relevant reference point available regarding domestic inflation is the experience of the late 1970s, which was far worse than today's episode. Inflation was chronic throughout the entirety of the 1970s but threatened to become runaway late in the decade. Former Fed Chair Paul Volcker took off the gloves in late 1979 and the U.S. economy was in recession for more than two years, during which time the unemployment rate jumped from 6% to nearly 11% while U.S. Treasury bond yields spiked from 9% to 16% (Exhibit 1). Economic growth did not resume until mid-1982, which coincided with the start of a major bull market for U.S. stocks once inflation was under control. That Fed playbook is not today's playbook, and one shouldn't draw parallels other than to say that once inflation expectations take root, they are hard to sever and require more severe measures.

Historically, inflation is almost always a monetary phenomenon, and some of the unprecedented liquidity injected into the U.S. financial system over the last several years must be drained before the U.S. can expect inflation to abate meaningfully. In layman's terms, there is just too much money sloshing around every corner of the economy. Addressing this problem will entail monetary contraction, more restrictive credit availability and higher interest rates across the board as the Fed undertakes to shrink its balance sheet by up to $95 billion monthly starting in September4 — doubling its previous target since June.

This inflation experience is both demand- and supply-driven: High inflation that has its roots in monetary causes typically results in excess aggregate demand, which central banks are equipped to address. However, today's global struggle with inflation is also driven by supply disruptions attributable to the wider effects of the war in Ukraine and related sanctions, extreme weather conditions, and transportation and logistics bottlenecks. Many industrialized nations are experiencing anemic economic growth yet still are contending with high inflation due to these supply effects, which blunts the ability of central banks to remedy with policy responses, as these causes originate outside their national borders. The economic history of inflation has always been country-specific or regional, which makes the current global struggle with rising prices so unique.

Talk of peaking inflation is premature: Consumer inflation decelerated ever so slightly in July on a consecutive monthly basis, convincing some investors and pundits that U.S. inflation was peaking based on that tiny wiggle. Not so fast. Gasoline prices fell by more than 10% in July, which itself should have reduced the CPI Index by more than it changed, meaning that prices of other major items in the consumer spending basket continue to increase or have yet to see price declines. Gas prices declined again in August, and this should help relieve headline inflation again, but the inflation story goes far beyond high gas prices. Moreover, lower gas prices this summer have been aided greatly by drawdowns of one million barrels of oil per day from the Strategic Petroleum Reserve (SPR), a Biden Administration move that is scheduled to end in October — at which time the SPR is expected to be at a 40-year low. Some experts are predicting recent gas price relief will be short lived.5

The U.S. economy is still too strong despite Fed measures taken to date: The U.S. economy is running hot notwithstanding two consecutive quarters of slight GDP contraction. This strength mostly refers to a labor market that continues to outperform and threatens to become too much of a good thing if it begins to fuel inflation. More than 11 million job openings in July outnumbered the unemployed by nearly a 2-to-1 margin, a sign of a tight labor market, while worker wage increases remain in the 5.5% (YOY) range, below the rate of inflation but well above historical norms. For those workers changing jobs (and there are plenty of them — more than four million monthly in 2022 and a job quit rate at or near an all-time high), wage bumps are considerably higher than that, as most employers are aware, and this has knock-on potential for all workers' compensation down the road. The unemployment rate remains near historic lows despite its recent uptick, which was caused by Americans coming off the sidelines to rejoin the labor force as they searched for jobs. The hot labor market is an impediment to slowing the economy and potentially could set off a harmful wage-price spiral, much like the one that fed inflation for much of the 1970s. It is the scenario that Fed Chair Powell strives to avoid. To the certain disappointment of most Americans, the U.S. labor market must cool off one way or another.

The housing market remains overheated: The housing market has been one of the biggest beneficiaries of extreme Fed policies in recent years, with mortgage rates dropping to an all-time low of just under 3.0% in 2021, causing outsized home price appreciation for several years. Those days are over. Rising mortgage rates this year have caused the monthly payment on a new 30-year fixed rate mortgage to increase by about one-third, all else unchanged, yet the nation's housing market remains surprisingly resilient, with nearly record-high home prices in much of the country despite the larger monthly payment burden imposed on homebuyers. Buyer traffic and unit sales volumes are declining, but sellers are slow to lower asking prices so far in 2022, with many choosing to take their homes off the market rather than drop prices, keeping the market tight and prices high. There is a time lag at work here and home prices are poised to cool off; so far, however, all the U.S. has seen nationally is a slowing of home price increases rather than outright price declines, with the S&P CoreLogic Case-Shiller National Home Price Index still registering mid-teen rate price gains (YoY) through June [Exhibit 2], with only six of 20 major markets showing home price declines.6

Before the housing market crash of 2008, there were plenty of pundits warning about a housing bubble well before its peak, but today there are hardly any specific references to "a bubble" with respect to housing despite home price appreciation since 2019 far outpacing gains from 2004 to 2007. The S&P Case-Shiller National Home Price Index has increased by 46% since mid-2019 compared to a 30% gain in the three-year period preceding the 2007 housing peak.

New housing starts are declining and homebuilder sentiment is fading, but the national market for existing homes remains stubbornly strong, much to the disappointment of aspiring homebuyers waiting for an overdue correction. The housing market eventually will cool off, especially if mortgage rates drift higher as interest rates rise generally, but home prices have yet to decline nationally, and it remains to be seen how much longer the housing market can withstand a meaningful correction. With mortgage rates having nearly doubled off their record lows and likely to move higher, a housing correction seems inevitable but has yet to begin in earnest. Meanwhile, the wealth effect of record-high home prices is contributing to robust consumer spending and inflationary pressures.

None of this bodes favorably for the corporate sector in the months ahead, though there are no indications of an unraveling either. The immediate risks to corporate earnings are the effects of high inflation on customer demand and supply costs combined with the impacts of rising interest rates. The three-month LIBOR rate has soared above 3.0% in 2022 compared to 0.2% at year end, and this means higher interest rates for all borrowers with leveraged loans.

Speculative-grade borrowers have opted for floating-rate leveraged loans over fixed-rate high-yield bonds in recent years, with U.S. large syndicated institutional term loans outstanding topping $1.4 trillion currently compared to $1.0 trillion in 2018, and the ascendance of private credit adding significantly more to this total. Upward rate adjustments on these loans are in the vicinity of 200 bps so far, assuming existing LIBOR floors in the range of 50-100 bps. Consequently, a borrower leveraged at 6x EBITDA will see its interest coverage ratio decline by more than one turn due solely to LIBOR-based rate adjustments, with operating performance also likely to come under pressure.

Restructuring activity strictly by the numbers continues to pick up gradually, but it remains frustratingly tame given the deteriorating economic backdrop and still trails 2021 totals through August. However, softer signs of stress and distress, such as inbound calls, peer conversations and informal pitch opportunities, are more indicative of bubbling under the surface. There is no tidal wave of activity on the horizon, but increasingly it seems that so much more can go wrong than right for the leveraged corporate sector.

The Modern History of U.S. Inflation

Exhibit 1, Source: FRED, The St. Louis Fed

S&P CoreLogic Case-Shiller National Home Price Index

Exhibit 2, Source: Bloomberg and S&P Global

Footnotes

1. ABC News, July 7, 2022, https://abcnews.go.com/Business/stock-market-rest-2022-experts/story?id=86063588

2. "Reassessing Constraints on the Economy and Policy," remarks by Jerome H. Powell, Chair, Board of Governors of the Federal Reserve System, Jackson Hole, Wyoming, August 26, 2022, https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm.

3. CNBC, September 7, 2022, https://www.msn.com/en-us/money/markets/fed-vice-chair-brainard-vows-we-are-in-this-for-as-long-as-it-takes-to-stop-inflation/ar-AA11zxIU?fromMaestro=true

4. Reuters, July 14, 2022, https://www.reuters.com/markets/us/fed-staff-say-balance-sheet-runoff-could-strain-treasury-market-2022-07-14/

5. Charles Kennedy, "U.S. Strategic Petroleum Reserve Falls to 35-Year Low," OilPrice.com, August 22, 2022, https://oilprice.com/Latest-Energy-News/World-News/US-Strategic-Petroleum-Reserve-Falls-To-35-Year-Low.html.

6. CNBC.com, August 30, 2022, https://www.msn.com/en-us/money/realestate/home-prices-weakened-in-june-but-were-still-much-higher-than-a-year-ago-says-s-26p-case-shiller/ar-AA11hd2n?fromMaestro=true

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.