Key Points

- The SEC and the FCA each publish annual reports, which can offer a useful insight into their enforcement actions.

- The data in the reports only represents a snapshot of the regulators' activities, but is nevertheless helpful for identifying trends, themes and priorities in the regulators' approach to enforcement.

- The FCA opened more cases this year compared to the previous year, whilst the SEC opened fewer cases this year than it opened last year. The SEC imposed a much larger quantum of penalties compared to the FCA. Investigations continue to take a very long time to be resolved.

- Both regulators continue to open investigations in a wide variety of areas, although misconduct remains focused in the same core categories as previous years. This includes matters involving unauthorised business, insider dealing, the retail sector, crypto assets and investment advisors.

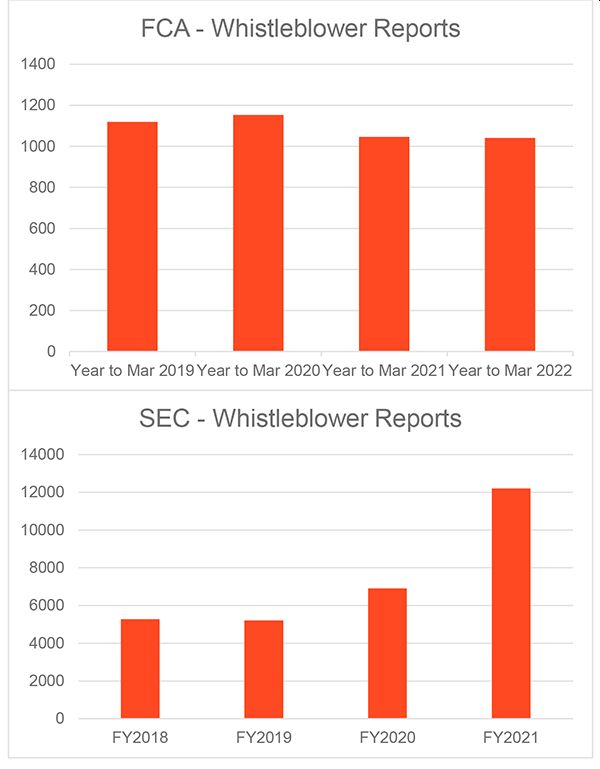

- The data shows that both regulators are increasingly active in terms of dealing with 'referrals' and monitoring the market. The SEC in particular is focusing on its whistleblower program to boost its efficiency in this area, which has led to record whistleblower payouts for consecutive years. The FCA does not appear to place the same strategic importance on its own whistleblower program, instead seemingly to prefer to concentrate on its market monitoring and surveillance.

Introduction

As competent authorities of financial markets in their respective jurisdictions, the U.S. Securities and Exchange Commission (SEC) and UK's Financial Conduct Authority (FCA) have huge influence over the businesses and individuals they regulate. Their wide remit includes powers of investigation, the ability to suspend businesses that don't comply with their instructions and the capacity to impose large fines.

Given the potential impact they can have on the operation of a business, it can be helpful to identify trends, themes and priorities in the regulators' approach to enforcement.

On the face of the annual statistics, the SEC again appears to be the more active regulator compared to the FCA. It once again imposed a much larger quantum of fines and opened significantly more cases than did the FCA. However, a closer look at the data reveals a less straightforward picture.

The Data and Time Period Covered

Information obtained from the SEC for the purposes of this report covers the Fiscal Year (FY) 1 October 2020 – 30 September 2021. Information obtained from the FCA for this report covers the year 1 April 2021 – 31 March 2022.

Monitoring, Surveillance and Whistleblowing

FCA

Especially since the start of the COVID-19 pandemic, protecting consumers from scams and unregulated firms has been a priority of the FCA.1 This stated focus has been borne out by the data: in 2021, the FCA issued over 1,400 alerts on its website relating to firms performing regulated activities without FCA authorisation. This was up by approximately 18 per cent over the number of alerts in the previous year (1,196).2

Between April 2021 and March 2022, the FCA received 1,041 whistleblower reports and 2,114 separate allegations.3 This remains consistent with the 1,046 whistleblower reports received by the regulator in the year prior.4 Three of these reports resulted in the FCA taking significant action against those who were the subject of the report, as well as 96 other cases where direct action was taken by the FCA.5 There were 141 cases where no direct action was taken; and the remaining 801 reported cases are still under investigation.6

The FCA continues to focus on its monitoring and surveillance. The FCA has reported that in 2021 its assessment of data regarding market cleanliness improved against all three metrics that it uses, as compared to the previous year.7 For 2021, the 'market cleanliness measure' was 7.7 per cent (down from approximately 22 per cent in 2020), the 'abnormal trading volume' measure was 7.1 per cent (compared to 8 per cent in 2020) and the 'potentially anomalous trading ratio' was 6.1 per cent (down from 6.9 per cent in 2020).8 Whilst the FCA advises that this data must be approached with some caution as it does not provide a "complete picture of market abuse", the FCA states that this data supports a view that "the UK market was resilient to market abuse despite navigating significant market events".9

SEC

The SEC examined 16 per cent of the investment advisors and 47 per cent of the broker dealers it oversees in FY 2021, amounting to more than 3,000 separate examinations.10 Notably, this was an increase in the number of examinations which had been planned.11 This represents a marginal increase compared to FY 2020, when 15 per cent of investment advisors and 45 per cent of broker dealers were examined.12

In its 2021 Annual Report to Congress regarding the Whistleblower Program, the SEC notes that it received over 12,200 whistleblower tips in FY 2021, which is the largest number of whistleblower tips it has received in a financial year, and approximately a 76% increase over the number of tips received in the previous FY 2020 (6,911).13 The SEC notes that since it first collected data on whistleblowing tips in 2012, the number of tips has grown by approximately 300%.14 Approximately a quarter of the whistleblowing tips were in relation to manipulation, with the next most numerous categories being offering fraud and trading and pricing. Approximately 6% of the tips related to initial coin offerings and cryptocurrencies.15

FY 2021 saw the SEC making three of the largest awards in the history of the whistleblower program, and the three awards in aggregate amounted to more than a quarter of a billion dollars.16 By contrast, in FY 2020, the top three whistleblowing awards amounted to approximately $107 million.17 In total, in FY 2021, in connection with 86 covered actions, the SEC ordered approximately $564 million to be paid to 108 individuals.18 This is a fairly dramatic increase over FY 2020, in which the SEC awarded approximately $175 million to 39 individuals, and at that time the SEC noted that the 39 individuals figure was three times higher compared to the next highest fiscal years (FY 2016 and FY 2018).19

Comparison

Based on the above statistics, it is clear that both regulators are maintaining a high level of activity in relation to the whistleblower reports received and monitoring the market in general. The SEC has placed growing importance on its whistleblower program as a valuable source of information in recent years, and this led to record amounts being paid out to whistleblowers on consecutive years in FY 2020 and FY 2021. Given the SEC's intention to continue focusing on this area, this upward trend is likely to continue for the foreseeable future. By contrast, the FCA does not seem to have invested as heavily in its whistleblower program, and this is reflected by its largely unchanged year-on-year figures for whistleblower reports. The FCA does not appear inclined to dedicate more resources to its whistleblower program in the near term given its continued reliance on its own monitoring and surveillance initiatives to detect and act against market abuse.20

Number, Type and Duration of Cases

FCA

As of 31 March 2022, the FCA had 603 open cases relating to 230 separate investigations.21In 2021/22, the FCA opened 194 enforcement cases.22 This represents a significant increase in the number of cases opened compared to 2020/21 when 125 cases were opened, though this was potentially artificially low on account of the COVID-19 pandemic, since in 2019/20 the FCA opened 316 cases.23 It is also notable that fewer cases were closed in 2021/22 compared to 2020/21: 160 FCA enforcement cases were closed in 2021/22, being 27 fewer cases closed than the 187 cases closed in 2020/21.24

As to the subjects of investigations, the FCA opened 108 enforcement cases against individuals,25 and also closed this number,26 meaning that the number of open cases against individuals remained the same at the beginning and end of the reporting year. By contrast, the FCA opened 86 cases against firms,27 and closed 52,28 meaning that there is a net increase of open cases against firms across the year the year.

As to the types of cases opened by the FCA, in 2021/22, the majority of cases opened were in relation to unauthorised business, with 95 cases featuring in this category.29 After unauthorised business cases, the next highest number of cases opened in 2021-22 were in relation to insider dealing investigations (25 cases opened) and then retail conduct (23 cases opened).30 This follows the same pattern as 2020/21 where unauthorised business investigations were the most common type of investigation opened (41 cases commenced), insider dealing was second (33 cases) and cases relating to retail conduct were again the third most common (28 cases).31 Based on this data, we can see that there has been a significant increase in unauthorised business investigations over the past year, whilst investigations into insider dealing and retail conduct remained relatively steady.

This year in its Operating Service Metrics, the FCA appears to have given less detail than last year about how long it has taken the FCA to reach a resolution in different enforcement cases. This year, the FCA has simply given the figures broken down in four categories: regulatory (average 33 months to case closure in 2021/22), dual track (27 months), criminal (30 months) and civil (36 months).32 One comparable statistic from the 2020/21 enforcement data was the average length of all criminal cases was 29.2 months, which shows that the figure to be largely stable.33

Another figure about length of time that the FCA provides is in relation to decisions of the Regulatory Decisions Committee (RDC). The RDC is a quasi-independent committee of the FCA board which decides some of the more complex or significant enforcement or supervisory actions taken by the FCA, and its remit has been narrowed in the past year. At least in part as a result of this narrowing of remit, the number of cases which were decided by the RDC reduced from 371 (in 2020/21) to 132 (in 2021/22).34 The length of time it has taken for the RDC to complete its decision making increased or remained the same as the preceding year: 10.6 months (up from 6.6 months in 2020/21) for panel Enforcement cases; 14.2 months (up from 4.9 months) for partly contested cases; 4.3 months (the same as last year) for supervisory cases; and 3.3 months (up from 2.4 months) for authorisations cases.

It might be noted that it does appear that the Enforcement and Market Oversight section of the FCA appears to be getting smaller: whilst the FCA notes that, because of a restructure, staff numbers at divisional level are not directly comparable year on year, it still seems potentially of note that the average number of staff in Enforcement and Market Oversight in 2020 was listed as 729,35 whereas in the 2021/22 Annual Report, the average number of staff for Enforcement and Market Oversight for 2022 is given as 625.36 Whilst necessary to treat this with care, on its face this would appear to be a significant decrease.

SEC

The SEC's data for FY 2021 shows that 697 enforcement actions were filed, a slight decrease from the 715 enforcement actions filed in FY 2020.37 This is smaller drop than from FY 2020 to FY 2019 (862 enforcement actions were filed in FY 2019), but it is the first time fewer than 700 cases have been filed since at least FY 2016.38 This said, it should be noted that of the cases filed in FY 2021, 434 were for standalone enforcement actions, which represents an increase compared to the 405 standalone enforcement actions filed in 2020, whilst there were reductions in the number of follow-on proceedings and delinquent filings made.39

As was the case in FY 2020, the majority of the SEC's civil and standalone actions in FY 2021 were in relation to securities offerings (33% of those cases, compared to 32% of standalone cases in FY 2020), cases against investment advisers and investment companies (28% of civil and standalone cases, compared to 21% of standalone cases in FY 2020), and issuer reporting/audit and accounting cases (12% of civil and standalone cases, compared to 10% of standalone cases in FY 2020).40

Despite the overall fall in the SEC's enforcement actions, the amount of resources the regulator spent on the enforcement program increased. The net cost for the SEC's enforcement program in FY 2020 was $963,248; but in FY 2021 this increased to $1,081,600.41 The SEC does not appear to have published data on the length of time taken by the SEC to conclude its enforcement actions in FY 2021.

Comparison

It is interesting that the trend of the SEC reducing the total number of its enforcement actions has continued post-COVID-19, especially in light of the fact its net costs for enforcement have increased. This may be explained, at least in part, however, with the increased number of standalone cases. On the other hand, the FCA has gone against this trend, significantly increasing the number of cases it opened in 2021/22. In previous years, the FCA has reported its average costs in bringing a case, although this data does not appear to have been produced this time around.

There were no huge changes in terms of the types of case dealt with by the regulators during the past year, as the bulk of cases remained under the category of unauthorised businesses, and securities offerings/investment advisors, respectively. Both regulators published increases in cases opened under these categories, with smaller variations for other categories of cases.

Both regulators seem to have a growing interest in bringing cases relating to crypto-assets. The SEC's Agency Financial Report noted that it had opened several enforcement actions against crypto-trading platforms in FY 2021, as well as bringing its first case involving DeFi (Decentralized Finance) technology.42 The FCA also appears to be taking a more strident approach to crypto-trading firms. The FCA 2021/22 Annual Report suggested that of the 270 registration applications under the money laundering regulations which were received from crypto-firms prior to 31 April 2022, over 80 per cent were either refused authorisation or withdrew their applications as a result of the FCA's scrutiny.43

Financial Penalties, Including Disgorgement and Redress

FCA

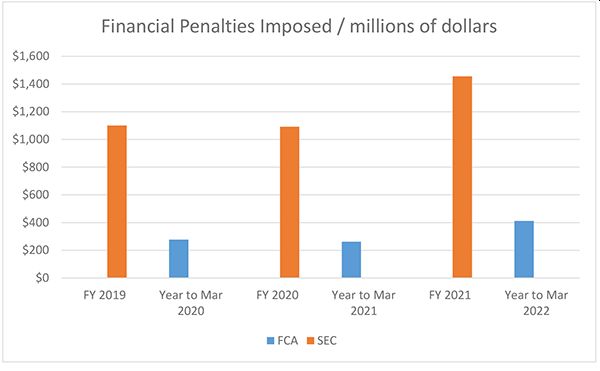

2021/22 saw an increase in the value of financial penalties imposed by the FCA compared to recent years. Fines were imposed by the FCA in 11 separate cases during this period, with eight fines being handed to firms and three fines issued to individuals.44 The total value of the fines imposed was £313 million, which is a significant increase from the total fines of £189.8 million imposed in 2020/21 and £224.4 million in 2019/20.45 In addition, firms paid out £23.5 million of voluntary redress (i.e. voluntary compensation paid following an FCA investigation) in 2021/22, whilst $200 million of debt relief was also agreed.46

The single largest penalty imposed by the FCA in 2021/22 was a £147 million penalty imposed on Credit Suisse, in relation to its failures in establishing, implementing and maintaining adequate systems and controls to counter the risk of the firm being used to further financial crime.47 Other significant penalties imposed by the FCA this year and highlighted in the FCA's reports include fines imposed on Lloyds Banking Group (£90 million) and GAM International (£9 million). It is worth noting that NatWest was also fined £264.8 million following three convictions of failing to comply with the Money Laundering Regulations 2007; however, as this was a criminal case, this figure doesn't count towards the total value of fines imposed by the FCA (due to the fine being imposed by the court).48

SEC

In FY 2021 the SEC imposed $1,456 million worth of penalties, a substantial increase from the $1,091 million imposed by the SEC in FY 2020 and the FY 2019 figure of $1,101 million.49 Regarding disgorgement, however, there was a significant decrease in the amount ordered by the SEC: in FY 2021, $2,396 million of disgorgement was ordered, compared to $3,589 million in FY 2020 and $3,248 million in FY 2019.50 As a result, the total ordered to be paid in FY 2021 was $3,852 million, some $800 million less than the $4,680 million ordered in FY 2020.51

There was also a fall in the overall amount of money distributed to harmed investors, though this figure has fluctuated fairly significantly in the last few years: in FY 2021, $521 million was distributed, and in FY 2020 $602 million, whereas in FY 2019 a recent maximum of $1,197 million was distributed, and in FY 2016 only $140 million.52

Comparison

As is typical, the value of penalties imposed by the SEC is greater than those imposed by the FCA. On the face of it, this may seem surprising, as the FCA regulates more businesses (around 50,000 firms54) than its US neighbour (that regulates the activities of around 28,000 entities55).

There are a number of reasons for these disparities, however, including the types of firms that are regulated and monitored. Further, the FCA and SEC operate in unique legal cultures, and this accounts for the disparity between the regulators' figures: in general, legal awards in the United States (including in other areas of the law, such as torts) tend to be higher than in the United Kingdom. As discussed in last year's analysis, there are differences in the regulators' obligations to consider an individual/entities' ability to pay any penalties imposed.56 The FCA regularly reduces its penalties where there is a claim of financial hardship, whereas the SEC has no such obligation (it does have some discretion on this issue, but this is rarely exercised). Further, history shows that while the SEC tends to impose a larger amount of fines than the FCA, it usually has more trouble recovering those fines. This trouble in recovering may account for the lower amount of money distributed to investors by the SEC in FY 2021, despite the significant increase in penalties (though not disgorgement) seen in FY 2021. The difference between the regulators' figures is often not, therefore, as significant as it initially seems.

Conclusion

It is clear from the data that both regulators continue to remain active and are still in the process of adjusting their operations following the COVID-19 pandemic. Whilst there is a slight disparity in terms of growth in the pace at which new cases are being opened, it is evident that both the SEC and FCA continue to take firm action against a wide range of entities and individuals. It is also evident that both regulators believe crypto-trading platforms are likely to account for a growing proportion of penalties going forward, with both regulators once again highlighting such platforms as a growing area of concern.

Statistics can never provide a full picture of the activities of a regulator and are merely a snapshot of their activities at a given point in time. Therefore, regardless of what the data may indicate about the activity of the FCA and SEC, it is important for firms to be aware of their positive duty to be open and transparent where misconduct is identified. Being mindful of this duty will help to promote positive relationships with the regulator, which can be a significant mitigating factor when the activity of a business or individual does come under scrutiny.

Footnotes

1 .See, for example, https://www.fca.org.uk/news/news-stories/avoid-coronavirus-scams.

2. FCA Annual Report, 2021/22, https://www.fca.org.uk/publication/annual-reports/2021-22.pdf, page 19.

3. FCA Annual Report, 2021/22, https://www.fca.org.uk/publication/annual-reports/2021-22.pdf, page 22.

4. FCA Annual Report, 2021/22, https://www.fca.org.uk/publication/annual-reports/2021-22.pdf, page 22.

5. FCA Annual Report, 2021/22, https://www.fca.org.uk/publication/annual-reports/2021-22.pdf, page 22.

6. FCA Annual Report, 2021/22, https://www.fca.org.uk/publication/annual-reports/2021-22.pdf, page 22.

7. FCA Annual Report, 2021/22, https://www.fca.org.uk/publication/annual-reports/2021-22.pdf, page 50.

8. FCA Market Cleanliness Statistics 2021/22, https://www.fca.org.uk/data/market-cleanliness-statistics-2021-22.

9.FCA Annual Report, 2021/22, https://www.fca.org.uk/publication/annual-reports/2021-22.pdf, page 50.

10. SEC Fiscal Year 2021: Agency Financial Report, https://www.sec.gov/files/sec-2021-agency-financial-report.pdf, internal pages 36-37.

11. SEC Fiscal Year 2021: Agency Financial Report, https://www.sec.gov/files/sec-2021-agency-financial-report.pdf, internal pages 36.

12. SEC Fiscal Year 2021: Agency Financial Report, https://www.sec.gov/files/sec-2021-agency-financial-report.pdf, internal page 36.

13. U.S. Securities and Exchange Commission Annual Whistleblower Program Report to Congress FY 2021, https://www.sec.gov/files/2021_ow_ar_508.pdf, page 28.

14. U.S. Securities and Exchange Commission Annual Whistleblower Program Report to Congress FY 2021, https://www.sec.gov/files/2021_ow_ar_508.pdf, page 28.

15. U.S. Securities and Exchange Commission Annual Whistleblower Program Report to Congress FY 2021, https://www.sec.gov/files/2021_ow_ar_508.pdf, page 29.

16 .U.S. Securities and Exchange Commission Annual Whistleblower Program Report to Congress FY 2021, https://www.sec.gov/files/2021_ow_ar_508.pdf, page 10.

17. U.S. Securities and Exchange Commission Annual Whistleblower Program Report to Congress FY 2020, https://www.sec.gov/files/2020_owb_annual_report.pdf, page 10.

18. U.S. Securities and Exchange Commission Annual Whistleblower Program Report to Congress FY 2021, https://www.sec.gov/files/2021_ow_ar_508.pdf, page 10.

19. U.S. Securities and Exchange Commission Annual Whistleblower Program Report to Congress FY 2020, https://www.sec.gov/files/2020_owb_annual_report.pdf, page 9.

20. Chart data: SEC Annual Whistleblower Progam Report to Congress, FY 2021, https://www.sec.gov/files/2021_ow_ar_508.pdf, page 28; FCA Annual Report 2018-19, https://www.fca.org.uk/publication/annual-reports/annual-report-2018-19.pdf, page 16; FCA Annual Report and Accounts 2019/20, https://www.fca.org.uk/publication/annual-reports/annual-report-2019-20.pdf, page 30; FCA Annual Report and Accounts 2020/21, https://www.fca.org.uk/publication/annual-reports/annual-report-2020-21.pdf, page 9; FCA Annual Report and Accounts: 2021/22, https://www.fca.org.uk/publication/annual-reports/2021-22.pdf, page 22.

21. FCA Operating Service Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, section 6.4.

22. FCA Operating Service Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, section 6.4.

23. FCA Operating Service Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Figure 12.

24. FCA Operating Service Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Figure 13.

25. FCA Operating Service Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Table 5.

26. FCA Operating Service Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Figure 14.

27. FCA Operating Service Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Table 5.

28. FCA Operating Service Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Figure 14.

29. FCA Operating Service Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Table 6.

30. FCA Operating Service Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Figure 6.

31. FCA Enforcement Data Annual Report 2020/21, https://www.fca.org.uk/data/enforcement-data-annual-report-2020-21, Table 6.

32. FCA Operating Service Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Figure 17.

33. FCA Enforcement Data Annual Report 2020/21, https://www.fca.org.uk/data/enforcement-data-annual-report-2020-21, Table 4.

34. FCA Annual Report and Accounts: 2021/22, https://www.fca.org.uk/publication/annual-reports/2021-22.pdf, page 190.

35. FCA Annual Report and Accounts 2020/21, https://www.fca.org.uk/publication/annual-reports/annual-report-2020-21.pdf, page 69, Table 2.

36. FCA Annual Report and Accounts: 2021/22, https://www.fca.org.uk/publication/annual-reports/2021-22.pdf, page 91, Table 2.

37. SEC Addendum: FY21 Enforcement Statistics, https://www.sec.gov/files/2021-238-addendum.pdf, page 2.

38. SEC Addendum: FY21 Enforcement Statistics, https://www.sec.gov/files/2021-238-addendum.pdf, page 2.

39. SEC Addendum: FY21 Enforcement Statistics, https://www.sec.gov/files/2021-238-addendum.pdf, page 2.

40. SEC Addendum: FY21 Enforcement Statistics, https://www.sec.gov/files/2021-238-addendum.pdf, page 1, and SEC Division of Enforcement 2020 Annual Report, https://www.sec.gov/files/enforcement-annual-report-2020.pdf, page 20.

41. SEC 2021 Agency Financial Report, https://www.sec.gov/files/sec-2021-agency-financial-report.pdf, page 68.

42. SEC 2021 Agency Financial Report, https://www.sec.gov/files/sec-2021-agency-financial-report.pdf, page 43.

43. FCA Annual Report and Accounts: 2021/22, https://www.fca.org.uk/publication/annual-reports/2021-22.pdf, page 12 and page 52.

44. FCA Operating Services Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Table 7.

45. FCA Operating Services Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Figure 18.

46. FCA Operating Services Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Section 6.6.

47. FCA Operating Services Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Section 6.5.

48. FCA Operating Services Metrics 2021/22, https://www.fca.org.uk/data/fca-operating-service-metrics-2021-22, Section 6.5.

49. SEC Addendum: FY21 Enforcement Statistics, https://www.sec.gov/files/2021-238-addendum.pdf, page 2.

50. SEC Addendum: FY21 Enforcement Statistics, https://www.sec.gov/files/2021-238-addendum.pdf, page 2.

51. SEC Addendum: FY21 Enforcement Statistics, https://www.sec.gov/files/2021-238-addendum.pdf, page 2.

52. SEC Addendum: FY21 Enforcement Statistics, https://www.sec.gov/files/2021-238-addendum.pdf, page 2.

53. FCA aggregate financial penalties converted to USD at the prevailing Bank of England exchange rate at 31 March of the relevant year.

54. FCA: About the FCA, https://www.fca.org.uk/about/what-we-do/the-fca#:~:text=We%20work%20to%20ensure%20that,conduct%20of%20around%2050%2C000%20businesses.

55. SEC: What we do, https://www.sec.gov/about/what-we-do.

56. Akin Gump, The FCA and SEC Annual Reports – a Statistical Comparison 2021, https://www.akingump.com/en/news-insights/the-fca-and-sec-annual-reports-a-statistical-comparison.html.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.