- within Technology, Finance and Banking and Corporate/Commercial Law topic(s)

- in United States

Introduction – Is there momentum for a federal payments framework?

- A federal charter for nonbanks engaged in payments activities has been on the policy agenda since the first Trump administration and has garnered support from policymakers on both sides of the aisle. New technologies that can be used to conduct payments activities, such as stablecoins, have been the subject of similar regulatory debates.

- A history of bipartisan support suggests that federal action in

this area may be possible.

- U.S. Treasury Under Secretary for Domestic Finance Nellie Liang delivered a speech in October 2024 that builds on a 2022 Treasury Report that recommended that the United States should establish a federal regulatory framework for domestic payments.

- Acting Comptroller Michael Hsu also endorsed calls for a federal payments charter, citing a "regulatory gap" in the oversight of digital payments companies.

- A federal regulatory framework could address policy issues

including:

- state-by-state regulations that exist today;

- access to federal backstops like Federal Deposit Insurance Corporation (FDIC) insurance and Federal Reserve services for nonbanks;

- regulatory clarity regarding new forms of money such as stablecoins; and

- standards for interoperability or use of customer data

- In anticipation of this debate reemerging, this deck reviews the policy and legal history surrounding these issues

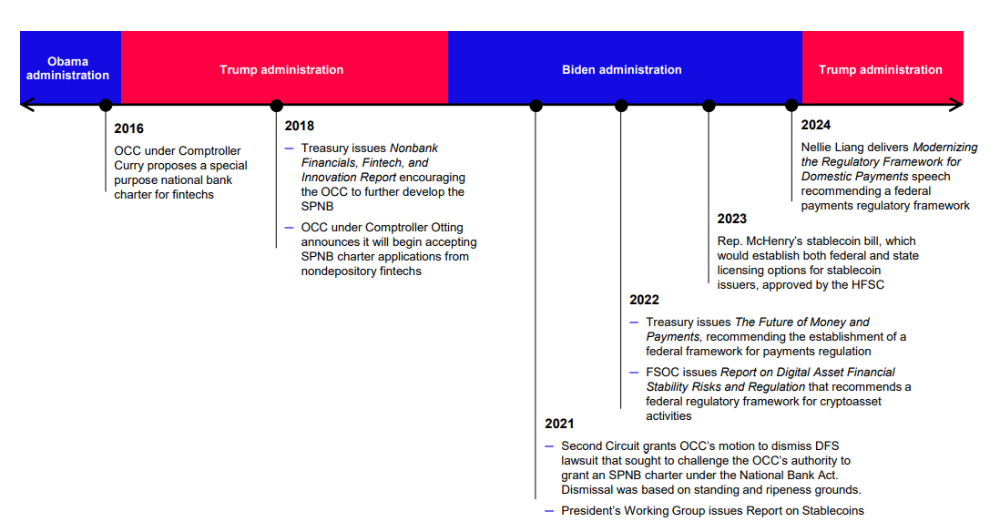

Timeline of key events

The OCC and the special purpose national bank

charter

With the landscape of payments and banking rapidly changing, the

Office of the Comptroller of the Currency (OCC), which regulates

and supervises national banks, was the first federal financial

regulator to invite nonbank fintech companies under its regulatory

perimeter.

- Following a series of innovation initiatives, the OCC released

a framework for establishing a special purpose national bank

charter (SPNB charter) in December 2016 under

former Comptroller Thomas Curry. Here is our client update that

discussed the potential benefits, uncertainties and regulatory

pitfalls of the SPNB charter. In particular, we explained why the

SPNB charter would be of limited practical utility to businesses

that engage in deposit-taking activity.

- Charter holders would have to engage in receiving deposits, paying checks and/or lending money.

- The OCC would consider tailoring some requirements that apply to a full-service national bank to address the business model of SPNB applicants, including adapting capital requirements for a fintech applicant.

- Fintech applicants that propose to accept deposits other than trust funds would still be required to apply for deposit insurance and receive approval from the FDIC. Definition of deposit is quite broad: "[T]he unpaid balance of money or its equivalent received or held by a bank or savings association in the usual course of business and for which it has given or is obligated to give credit, either conditionally or unconditionally . . . ."

The OCC and the special purpose national bank charter

- If the SPNB had been successfully implemented, companies

providing payment services would have essentially had three

choices:

- state-by-state licensing;

- structuring their business to avoid needing a license; or

- opting for the SPNB, which would have preempted state licensing requirements and state usury laws, and potentially provided access to Federal Reserve services through membership in the Federal Reserve System; however, the parent company and affiliates could have become subject to the Bank Holding Company Act, including its restrictions on mixing of banking and commerce, if the applicant proposed accepting deposits, and any applicant would have been subject to litigation risk as a result of resistance from state regulators and community banks.

- We discuss each of these three issues (i.e., membership in the Federal Reserve System, bank holding company status and litigation risk) on the following slides.

Membership in the Federal Reserve System

- One of the potential benefits of an SPNB charter would have

been access to Federal Reserve services through membership in the

Federal Reserve System, including:

- Access to master accounts at a Federal Reserve Bank

- Direct access to Federal Reserve-operated financial market utilities (FMUs)

- Discount window access

- National banks, including insured and uninsured trust banks and other special purpose national banks, are required to be members of the Federal Reserve System.

- However, at the time, the Federal Reserve did not decide whether or how access to the discount window and payment systems would work for SPNB charter holders..

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.