The Government Accountability Office (GAO) has issued a report that raises serious issues about how participant rollovers are being handled. The report also suggests that plan sponsors and committees, in their roles as ERISA fiduciaries, may have duties regarding rollovers they have never considered. The report, issued in early April, entitled "401(k) PLANS: Labor and IRS Could Improve the Rollover Process for Participants," points out the lack of quality information and possible mis-information being given to participants by some providers. (As discussed later, this shouldn't be taken as a condemnation of all, or even most, providers.)

This bulletin summarizes parts of the GAO Report and discusses whether plan sponsors and committees may be obligated to monitor the IRA rollover services offered by their providers. The answer is that the law is not clear, and the cautious approach would be to proactively monitor the services.

Legal Analysis

While the report discusses a number of issues and recommends that the Internal Revenue Service and the Department of Labor provide clearer guidance and better educational materials, there is also a message to plan sponsors about the practices of some providers. As a part of the study, the GAO reviewed the practices and materials of selected plan providers and their IRA rollover services (e.g., call centers) and determined that, in some cases, participants were receiving biased information.

That raises the obvious issue of whether plan sponsors are responsible, in their capacity as fiduciaries, for the information being given to participants by the plan providers (e.g., recordkeepers) who are selected by the plan sponsors. Is it possible that plan sponsors could be viewed as "endorsing" or selecting the provider for that purpose and, therefore, be obligated to prudently select and monitor the IRA rollover services of their provider? Unfortunately, neither the courts nor the DOL have provided a clear answer to that question. As a result, the conservative answer is that plan sponsors should review the practices of their service providers and their communications with participants for these purposes.

An ERISA concept of plan sponsor "endorsement" of service providers has already been raised in DOL guidance. For example, in Interpretive Bulletin 96-1, the DOL attempted to provide a distinction between whether a provider was endorsed or not by explaining that an endorsement is "an inherently factual inquiry which depends on all the relevant facts and circumstances." The DOL went on to say that, if a plan sponsor uniformly provides office space or computer terminals for use by participants who have independently selected service providers, that would not be an endorsement. However, the negative implication is that, if plan sponsors limit the use of their facilities (for example, access to employees) to a particular provider, it could be viewed as an endorsement of that provider. And, as a practical matter, in most cases the only provider of rollover services who has been given access to the employees is the retirement plan recordkeeper.

To put the GAO report in context, it is important to note that many providers offer valuable rollover services to participants, helping them with rollovers to IRAs and investing for retirement. It is possible— perhaps even likely—that, because of these services, many participants have preserved their retirement benefits in tax-deferred vehicles that are well-invested.

As a result, the negative findings of the GAO should not be viewed as an overall condemnation of rollover services by providers...nor should they be viewed as necessarily reflecting industry-wide practices. Instead, a proper perspective might be that the GAO Report disclosed potential conflicts of interest that plan sponsors and committees should be aware of and should consider in light of the fiduciary duty to act in the best interests of the participants.

GAO Report

With that in mind, let's look at some of the GAO's concerns. (We have included quotes from the report, because they most clearly show the nature and depth of the concerns. To see the full GAO Report, please visit: http://fredreish.com/gao-report-on-ira-rollovers/.)

"Many experts told us that much of the information and assistance participants receive is through the marketing efforts of service providers touting the benefits of IRA rollovers and is not always objective. Plan participants are often subject to biased information and aggressive marketing of IRAs when seeking assistance and information regarding what to do with their 401(k) plan savings when they separate or have separated from employment with a plan sponsor. In many cases, such information and marketing come from plan service providers. As we have reported in the past, the opportunity for service providers to sell participants their own retail investment products and services, such as IRAs, may create an incentive for service providers to steer participants toward the purchase of such products and services even when they may not serve the participants' best interests."

The GAO's concern was not limited to biased information or aggressive sales practices. The report expressed similar concerns over "steering of participants into investment products that are managed by the recordkeeper or an affiliate." In this case, the issue is not mis-information... but instead it is limited information. In other words, the GAO appears to be concerned that, by providing information only about proprietary products, participants are not being educated on their alternatives and may not be aware of the conflicts of interest inherent in recommending proprietary investments or in only providing information about proprietary products. In that regard, the GAO stated:

"[P]articipants may interpret information about their plans providers' retail investment products contained in their plans' educational materials as suggestions or recommendations to choose those products. Research has shown that many individuals contributing to defined contribution plans or IRAs spend very little time scrutinizing disclosure statements.

As shown in figure 3, a provider's offer of their own retail IRA in a plan's distribution materials is one way to guide participants into their products.

Figure 3: One Example of a 401(k) Plan Service Provider Using Distribution Information as a Venue to Promote Their Own Retail IRA Product

Although many service providers said they do not promote their own investment products in interactions with plan participants of the plans they serve, we reviewed examples of educational materials that couple distribution information with information on the providers' retail IRA products. We also found several separation packets that emphasized the simplicity of rolling over to the service providers' IRAs, as opposed to the relative complexity of other providers' IRAs, and added flexibility regarding distributions and beneficiaries. Additionally, many of the providers that provided written responses to our questions indicated that the educational materials they give to participants include their firms' IRA products as examples. While some plan sponsors may attempt to limit such marketing activities, other sponsors are either unaware that they can negotiate a provider's ability to promote its products to plan participants or they do not have the resources to prepare their own materials in lieu of the materials offered by their providers."

The GAO is also concerned that participants may mis-interpret the rollover services of the provider as being unbiased investment advice and perhaps fiduciary recommendations. Since participants are told that the investment line-up in their plan is prudently selected and monitored by fiduciaries, it is possible that participants would view the rollover services as being part of, or perhaps consistent with, those plan-level services. In that case, participants might believe that they were receiving individualized and conflict-free recommendations of high-quality, reasonably priced investments. The GAO discussed these issues in some detail:

"The marketing of IRA products by providers is not limited to written materials but may also be pervasive in other interactions with participants. Participants can be steered toward IRA rollovers when receiving information from service providers, including via call centers. We were told by industry experts that

- participants think that they have received investment advice from their service providers that is solely in the participants' best interest, even though they may not actually be receiving such advice;

- service providers use their websites and call centers, including making outbound calls to plan participants, as a means of marketing their firms' retail IRA products and steering participants into them; and

- when taking a distribution participants may be steered first into a provider's IRA product, and if they opt out or decline that rollover option, they are then directed to a portal sponsored by the same provider where participants can access other companies' IRA platforms, for which the service provider receives some compensation if a participant chooses a company's IRA through that portal.

In addition to marketing their products, service providers may offer their call center representatives financial or other incentives for asset retention, when separating plan participants leave their assets in the plan or roll over to one of the providers' IRA products, which could lead to representatives promoting the providers' products over other options."

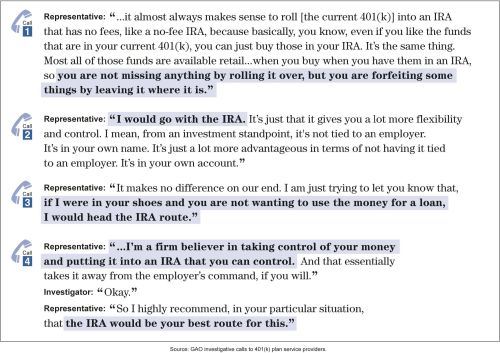

As mentioned earlier, the GAO expressed concerns about mis-information. The mis-information could be about any of several issues, for example, about fees and expenses, about the benefits (or lack thereof) of leaving the money in the current plan or rolling it over to the plan of a new employer, and so on. In that regard, the GAO made phone calls to the call centers of several providers and some of those conversations are the foundation of the GAO's concerns. The following examples were given in the GAO report:

Figure 4: Examples of 401(k) Plan Service Providers (Who May or May Not Be Fiduciaries) Giving a Potential Plan Participant Guidance Favoring IRAs

In the Report, the GAO noted that some providers are utilizing fairly aggressive practices while others are being very conservative. The GAO pointed, at least in part, to the lack of clear governmental guidance on the services and information that plans and their providers can give to participants.

"Service providers told us that the regulatory environment, specifically the lack of clarity between investment education and investment advice, creates challenges for them in providing information to participants. Experts said that, to limit liability, some service providers are very cautious when interacting with plan participants and discussing distribution options for fear that the information they provide may be construed as investment advice, which would trigger ERISA fiduciary liability. One sponsor noted that the materials provided to participants are dense and contain a lot of "legalese" in order to observe the regulations that govern a sponsor's interactions with participants. In addition, plans and service providers tend to provide participants with pre-packaged materials that are generic in nature in part to avoid crossing the line from providing investment education to investment advice."

Concluding Thoughts

Our experience is that, for the most part, recordkeepers and bundled providers are helping participants transfer their money into tax-sheltered IRAs and continue to investment their money in diversified portfolios, such as target date funds, balanced funds and managed accounts.

Nevertheless, there are valuable lessons to be learned from the GAO Report. First, plan sponsors should consider, for risk management purposes, reviewing and understanding the practices of the service providers that are allowed to access their employees. Without the plan sponsor's consent (or perhaps implied consent), the service providers would not be able to communicate with participants through corporate facilities, e.g., phones, computers, etc. While there is no clear guidance about whether plan sponsors are acting as fiduciaries for these purposes, there is at least a risk that they are. As a result, the cautious approach is to take charge of the situation and make sure it is operating properly.

Also, some plan sponsors will view this as a "best practices" issue. Those plan sponsors will want to ensure that their participants are receiving high-quality, unbiased information about their alternatives. The first level of information includes the broad alternatives of: IRA rollovers; leaving the money in the current plan; transferring the money to the plan of the successor employer; or taking the money and paying taxes. If a decision is made to rollover to an IRA—which many participants will choose because of the sense of control and perhaps in order to have all of their money in one location, the next "best practice" is to ensure that participants are receiving unbiased information about reasonably priced, high-quality investments, as well as disclosures of conflicts of interest.

With the aging of the baby boomers, and the impending retirement for many of them, this issue is going to gain increasing attention. Now is the time to review the practices of your providers.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.