Yes, that's plural.

It's that time of year again! The holidays are over, the kids are back in school, the New Year has begun, and California has (once again) raised the state minimum wage. Fun times indeed!

As you may know, in 2016, California passed a law setting a schedule for a yearly increase to the state's minimum wage. The first increase occurred on January 1, 2017, and the last increase will occur on January 1, 2023, ending in a state minimum age of $15 an hour.

But enough about that. So what is the new California minimum wage as of January 1, 2019? For employers with 25 or fewer employees, the minimum wage is $11 an hour. For employers with 26 or more employees, the minimum wage has increased to $12 per hour. Additional information concerning the new minimum wage increase for California can be found on the State of California Department of Industrial Relations website.

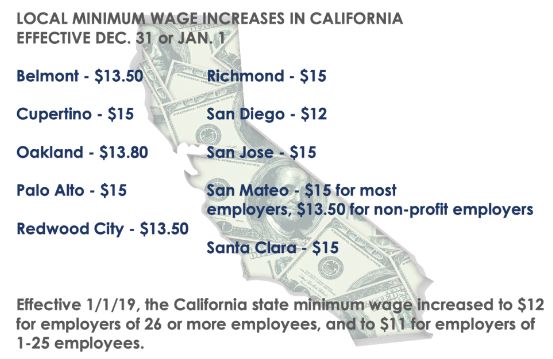

Not wanting to be left out, a number of California localities have ordinances requiring minimum wages that are higher than the state's minimum wage. Here are the rest of the local minimum wage changes that took effect recently:

What should employers with employees in California do now? Obviously, they should ensure that they are paying non-exempt employees in accordance with the new minimum wage laws. However, the fun does not stop there. Employers should review the salaries of their exempt workforce to ensure that are receiving the minimum salary required to be exempt from overtime pay. To satisfy the "salary basis test" for the white-collar exemptions under California wage and hour law, the employee must earn a monthly salary of at least twice the state minimum wage for full-time employment. For employers with 25 or fewer employees, the minimum salary for exempt employees is $3,813.33 a month. For employers with 26 or more employees, the minimum salary for exempt employees is $4,160 per month.

The salary basis test is determined by the state minimum wage and not a higher minimum wage that may apply in certain cities or counties.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.