- within Compliance topic(s)

Executive Summary

The 2024 holiday shopping season presents a complex landscape for omni-channel retailers. This whitepaper, also featured exclusively in Chain Store Age, examines key trends in consumer sentiment, shopping behaviors, and generational differences, offering actionable insights for retail professionals. Although overall economic sentiment has improved, challenges remain, especially among younger consumers. Early shopping, online preferences, and evolving payment methods are transforming the retail environment, requiring retailers to adopt adaptive strategies.

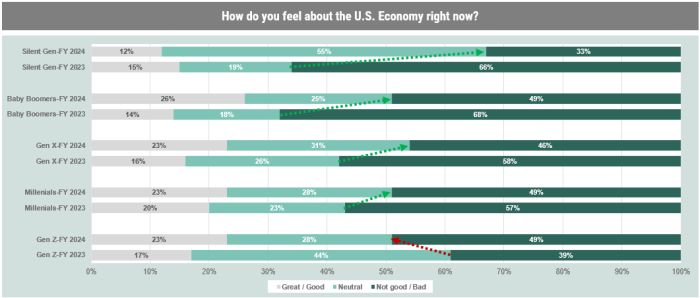

The Economic Pulse: Decoding Consumer Confidence Across Generations

The economic outlook for the 2024 holiday season shows a significant improvement in consumer sentiment compared to previous years. However, this optimism is not uniform across all demographic groups, with notable generational differences emerging. While overall confidence in the economy has risen, retailers must be mindful of the nuanced perspectives held by different age groups, particularly the growing pessimism among Gen Z consumers.

- Consumer sentiment about the U.S. economy has improved, with positive perceptions rising to 24% from 17% in 2023, and negative sentiment decreasing from 59% to 48%.

- Among older shoppers, pessimism has notably decreased. Boomers have shown a reduction in negative sentiment from 68% to 49%, while the Silent Generation's pessimism has dropped significantly from 66% to 33% since 2023.

- Contrary to these trends, Gen Z (ages 18-27) is becoming more pessimistic about the economy, with their negative sentiment rising to 49% from 39% in 2023.

- This growing pessimism among Gen Z could potentially affect their contribution to retail sales, which accounts for over 5% during the holiday season.

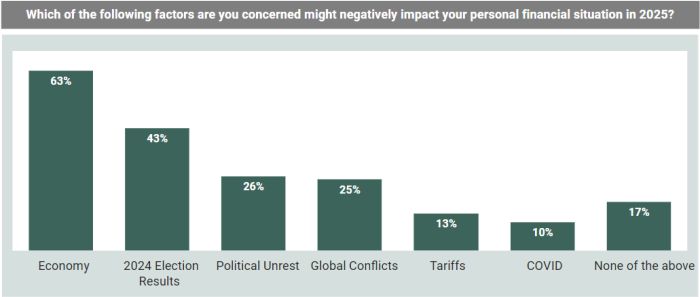

Generational Divide: Understanding Personal Financial Outlooks

Perceptions of personal economic situations have also improved, with fewer people reporting financial difficulties compared to the previous year. However, a generational divide persists, with Gen Z once again deviating from the trend towards optimism.

- Fewer people now report that their family economic situation has worsened, with this figure decreasing to 29% from 47% in 2023.

- Expectations for personal economic situations over the next 12 months have significantly improved, with optimism rising to 37% from 26% in 2023.

- Gen Z stands out as an exception, with their outlook becoming more negative, increasing to 37% from 28% in 2023.

- Additionally, 43% of respondents are concerned that the results of the 2024 election will negatively impact their personal finances. When considering potential leaders, 46% believe their financial situation would worsen under Harris, compared to 33% under Trump.

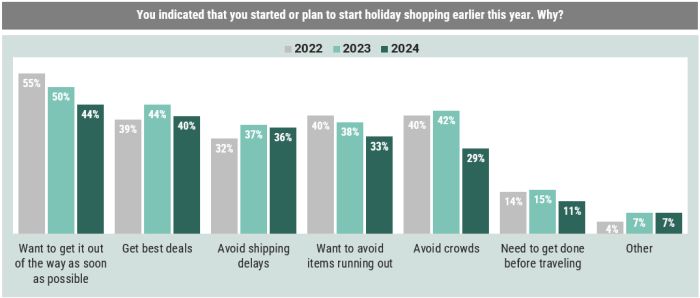

Embracing Shifting Trends: Early Shopping and Digital Dominate

The 2024 holiday shopping season is marked by a shift towards earlier shopping and a strong preference for online platforms. This trend, especially pronounced among younger generations, requires retailers to be prepared with promotions and inventory earlier in the year.

Consumers are increasingly motivated by deals and the desire to avoid shipping delays, rather than traditional factors like crowd avoidance. This change in behavior presents both opportunities and challenges for retailers, who must adapt their strategies to meet these evolving consumer preferences.

- 24% of consumers have already started holiday shopping as of early October.

- 98% expect to start before mid-December, consistent with 2023 patterns.

- Younger generations (Gen Z and Millennials) are trending towards earlier shopping compared to last year.

Key Shopping Days: Redefining Retail Milestones

The landscape of major shopping events is evolving, with online-centric days gaining prominence over traditional in-store events. This shift highlights the growing importance of e-commerce strategies and the need for retailers to balance their focus between online and offline channels.

- Amazon Prime Day has become the most popular shopping event, with 49% of shoppers participating, surpassing Black Friday, which attracts 46%.

- Cyber Monday is also a major event, closely following with 43% of shoppers taking part.

- Among online shoppers, Amazon Prime Day is particularly favored, with 56% showing a strong preference for it. In contrast, in-store shoppers are less inclined to participate in these peak holiday shopping days.

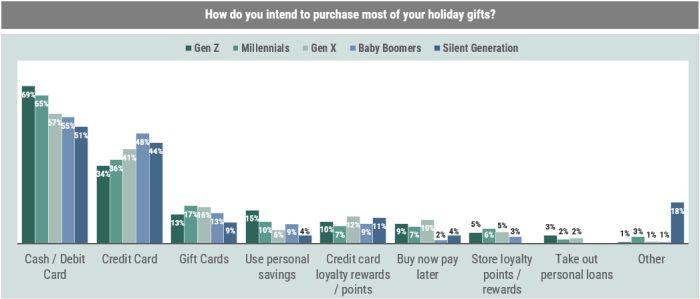

Spending Patterns and Payment Preferences

Consumer spending intentions for the 2024 holiday season indicate a more optimistic outlook compared to previous years. However, this optimism is tempered by ongoing economic concerns and varies significantly across different age groups. Payment preferences are also evolving, with a noticeable shift towards digital and alternative payment methods, especially among younger consumers.

- Only 23% of people plan to spend less this holiday season, a decrease from 31% in 2023, while 58% intend to maintain their spending at the same level as last year.

- Younger generations, particularly Gen Z, are more inclined to increase their spending this season.

- When it comes to payment methods, 60% plan to use cash or debit cards for holiday purchases, while 41% intend to use credit cards.

- Gen Z and Millennials show a strong preference for cash and debit options, with 69% and 65% respectively choosing these methods.

- Additionally, buy-now-pay-later services are gaining popularity among younger generations, with 47% of Gen Z and 40% of Millennials expecting to increase their usage of these services.

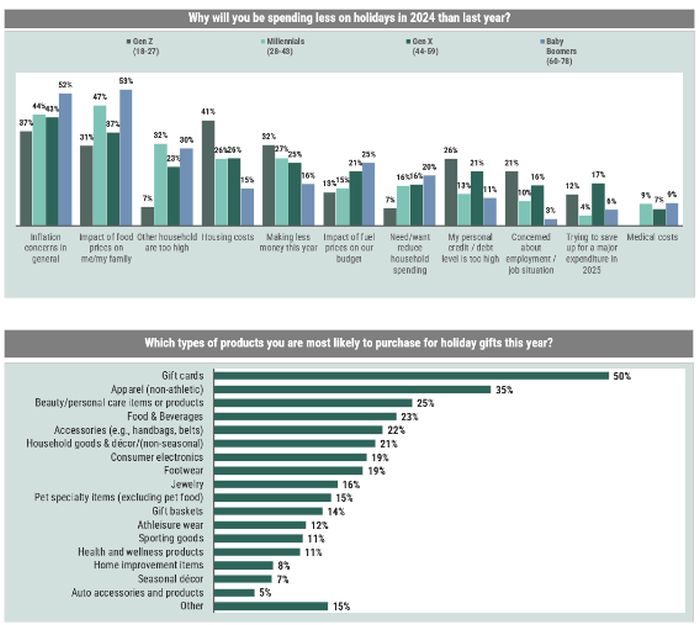

Unpacking Consumer Caution: Inflation and its Ripple Effects

Despite the overall positive spending outlook, certain economic factors continue to influence consumers' decisions to reduce their holiday spending. Understanding these factors can help retailers tailor their offerings and marketing strategies to address consumer concerns.

- Inflation continues to be the main reason for those planning to reduce their spending.

- Food prices remain a significant concern, though the impact of fuel prices has lessened.

- Among Gen Z, housing costs are the top concern at 41%, followed by inflation at 37% and reduced income at 32%.

Omni-Channel Excellence: Winning the Retail Race with Seamless Experiences

The retail landscape continues to be dominated by major players excelling in both online and offline channels. Consumer preferences are increasingly leaning towards retailers that offer seamless omni-channel experiences, competitive pricing, and efficient delivery options. This trend highlights the importance of a well-integrated retail strategy that caters to both digital and physical shopping preferences.

While the overall split between online and in-store shopping remains stable, the motivations driving online shopping have evolved. Retailers need to focus on key factors like convenience, free shipping, and competitive pricing to attract and retain online shoppers.

- Amazon, Walmart, and Target remain the dominant preferred retailers for consumers.

- These retailers also lead in shopping app popularity, highlighting the importance of providing omni-channel experiences.

- The balance between online and in-store shopping has stayed consistent with last year.

- Key drivers for choosing online shopping include overall convenience (46%), the appeal of free shipping, which has increased to 45% from 39%, and the attraction of lower prices, which have risen to 36% from 31%.

The Delivery Dilemma: Balancing Cost Efficiency and Customer Satisfaction

A significant shift in delivery preferences is observed, with consumers increasingly opting for cost-effective options. This trend, along with earlier shopping habits, suggests a strategic approach by consumers to balance cost savings with timely delivery.

- There is a notable increase in consumers choosing

cost-effective delivery options:

- There has been a notable increase in consumers selecting the cheapest option, rising to 40% from 26% in 2023.

- Meanwhile, the preference for home delivery has declined to 39%, down from 58% in 2023.

- This trend, combined with early shopping, indicates a consumer strategy aimed at avoiding delays while also saving money by choosing the least expensive delivery options.

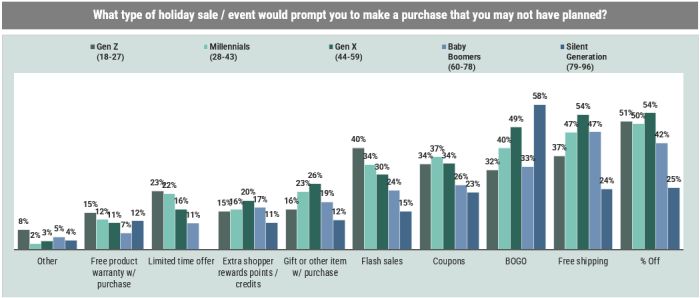

Crafting the Perfect Pitch: Targeted Strategies for Diverse Generations

Effective marketing and promotional strategies for the 2024 holiday season require a nuanced approach that considers changing consumer behaviors and preferences. While traditional discounts remain powerful motivators, the influence of social media is evolving, and loyalty programs continue to play a crucial role in consumer decision-making. Retailers must develop targeted strategies that resonate with different generational groups, particularly the digitally-native Gen Z.

- The influence of social media on holiday purchases has slightly decreased, with 27% affected in 2024 compared to 34% in 2023.

- Percentage-off discounts continue to be the most motivating factor for unplanned purchases.

- Free shipping and buy-one-get-one (BOGO) offers are also highly effective in encouraging spontaneous buying.

Different generations respond to marketing tactics in varying ways, with Gen Z showing a particular affinity for time-sensitive offers. Retailers should tailor their marketing approaches to effectively target different age groups.

- Gen Z is especially responsive to flash sales and limited-time offers, more so than older generations.

Loyalty programs remain a significant factor in consumers' decision-making processes across all age groups. Retailers should focus on enhancing and promoting their loyalty programs to attract and retain customers during the competitive holiday season.

- 65% of shoppers are influenced by loyalty programs when choosing where to buy gifts.

- Loyalty programs are generally influential across all age groups, including Baby Boomers, but are less motivating for the Silent Generation.

Conclusion and Recommendations: Positioning for Success in the 2024 Retail Landscape

The 2024 holiday retail landscape presents both opportunities and challenges for omni-channel retailers. While overall economic sentiment has improved, the pessimism among Gen Z shoppers necessitates targeted strategies. The shift towards earlier shopping, a preference for online platforms, and evolving payment methods require a flexible and adaptive approach from retailers. By focusing on seamless omni-channel experiences, competitive pricing, efficient delivery options, and targeted marketing strategies, retailers can position themselves for success in this dynamic environment.

Key recommendations for retailers include:

- Optimize early shopping experiences and promotions.

- Enhance online platforms with competitive pricing and efficient delivery options.

- Develop targeted marketing strategies for different generational groups, particularly Gen Z.

- Strengthen loyalty programs across all age demographics.

- Balance traditional percentage-off discounts with innovative, time-sensitive offers.

- Ensure a seamless omni-channel experience, recognizing the continued dominance of major retailers like Amazon, Walmart, and Target.

By adapting to these trends and consumer preferences, retailers can navigate the complexities of the 2024 holiday shopping season and capitalize on the opportunities it presents.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.