- within Finance and Banking and Information Technology and Telecoms topic(s)

- with readers working within the Automotive, Banking & Credit and Securities & Investment industries

The Bottom Line

- Subscription traps, insufficient pricing disclosures and hidden fees are top of mind for both the FTC and state regulators.

- Subscription-based businesses, especially those using ancillary practices such as algorithmic pricing, are particularly vulnerable to challenge. Companies should carefully consider if their personalization practices trigger disclosure requirements in New York or elsewhere.

- A/B and experimental testing can impact a company's risk exposure – particularly if advertisers use them to prioritize conversion over compliance.

- Advertisers across all industries should expect increased scrutiny of pricing and billing practices and act now to ensure compliance. That includes fully auditing all e-commerce practices, including initial advertised offers, disclosures made to consumers, affirmative consent mechanisms, cancellation flows and retention "save" flows.

Federal and state regulators are kicking off 2026 with momentum against subscription traps, hidden fees and misleading pricing practices.

The Federal Trade Commission (FTC) has filed suit against JustAnswer LLC and its CEO, alleging that the company misled consumers into costly recurring subscriptions without making the appropriate clear and conspicuous disclosures regarding the terms of the automatic renewal program and obtaining consumers' affirmative consent to those terms.

According to the complaint, JustAnswer promoted a nominal "join" fee – often between $1 and $5 – but when consumers believe they were making a one-time purchase, they were immediately enrolled in monthly plans costing $28 to $125. The FTC claims these practices violate the Restore Online Shoppers' Confidence Act (ROSCA) and the FTC Act and have caused "rampant consumer injury."

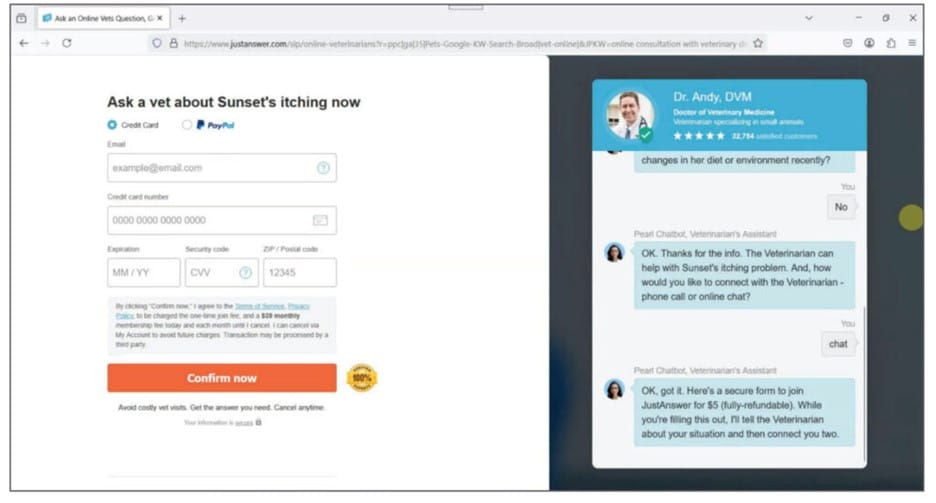

FTC's Example of a Misleading Enrollment Flow

In several enrollment flows cited in the FTC's complaint, consumers interacted with a website chatbot that told consumers it would send them a registration form where they could join the service for $5. The chat was then displayed simultaneously with the registration page.

Source: FTC's JustAnswer Complaint, Figure F

Although the registration form did actually disclose the recurring fee in a short disclosure paragraph above the "Confirm Now" button, the FTC alleges that a consumer would still be unlikely to understand that they were signing up for a recurring subscription program. Therefore, the consumer would not have been able to provide affirmative, informed consent to the automatic renewal terms or to the timing of the first subscription fee. The complaint notes that the disclosure was smaller and less prominent than any other material information on the page, and that when displayed alongside the chat promoting a one-time join fee at the crucial moment of purchase, consumers would be more likely to believe that was the only fee being charged.

The FTC also noted that while the full Terms of Service included information regarding billing, consumers were not required to review or read those terms to proceed with the purchase. Even if they did, the FTC alleged the terms were dense, lengthy and unlikely to be clear to consumers.

A More Aggressive FTC Approach to Subscription Enforcement

This action signals an increasingly aggressive approach from the FTC. Regulators are becoming more nuanced in their challenges to subscription-based businesses – expanding their focus beyond missing disclosures to also address placement, prominence, timing and context.

As more subscription-based businesses engage with tools such as chatbots and agentic AI, and more consumers rely on these tools for key purchase information, the totality of information provided to consumers and its role in the consumer journey will need to be carefully reviewed.

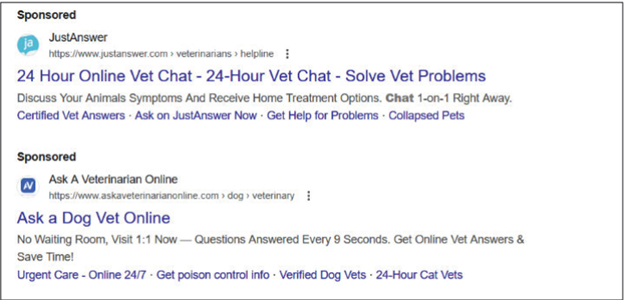

In addition, businesses would be wise to disclose their fee structures as early as possible in the consumer journey – perhaps as early as in a search advertisement with the initial offer. While ROSCA does not expressly require subscription disclosures to appear as early as in a search ad, the FTC noted in its complaint that JustAnswer did not disclose its fee structure in its search advertisements. This indicates an expansive view of what constitutes a company's "initial offer" to consumers, such that subscription disclosures should be included at that time.

Source: FTC's JustAnswer Complaint, Figure A

Finally, in targeting JustAnswer's CEO, Andrew Kurtzig, in his personal capacity, the FTC pointed to the fact that Kurtzig directly participated in the challenged acts and practices with actual knowledge that they were misleading. According to the complaint, Kurtzig's involvement included:

- declining proposed website content changes,

- rolling back clearer versions of the disclosures,

- requesting and opining on testing and market research related to pricing representations, and

- reviewing internal feedback regarding customer complaints

Further, the FTC noted in its complaint that Kurtzig and the company were aware of the requirements of the FTC Act and ROSCA and had previously faced government scrutiny into the company's practices.

While the FTC's "Click to Cancel" Rule may be revived — comments to the petition to resuscitate were submitted by January 2, 2026 — the agency has made it clear that it will not wait for new rulemaking to target others in the industry it views as "bad actors."

A Broader Enforcement Landscape: New York's Crackdown on Subscriptions, Pricing Disclosures and "Junk Fees"

New York regulators are also stepping up. Earlier this month, NYC leadership announced new measures to combat "junk fees" and subscription traps, signaling a return to aggressive consumer protection enforcement. At the state level, Attorney General Letitia James recently took aim at Instacart's algorithmic pricing practices, alleging that it's disclosures may not comply with New York's new Algorithmic Pricing Disclosure Act.

The Act requires companies to clearly and conspicuously disclose to consumers when their personal data is being used to affect dynamic pricing, in proximity to the advertised price (i.e., THIS PRICE WAS SET BY AN ALGORITHM USING YOUR PERSONAL DATA).

Instacart is required to produce additional documents to the Attorney General by January 29, including retail partner agreements, detailed descriptions of all price experiments, and additional information about the pricing and promotion tools it uses.

NYC's new consumer protection leadership signals a return to aggressive advertising enforcement.

What's Next?

All e-commerce and retail businesses should immediately revisit their enrollment flows, pricing disclosures, and consent and cancellation mechanisms. Federal and state regulators continue to ramp up enforcement and will be scouring similar companies' websites and mobile applications to detect similar issues. All businesses in the space should look at their consumer journeys through the eyes of a regulator.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.