- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

Introduction

New AlixPartners consumer research pulls back the curtain on the value perception challenge for traditional grocery, and our team of experts examines what the new consumer reality means for longstanding industry practices.

Responses to this year's consumer survey of more than 1,600 primary shoppers surfaced three macro trends that continue to challenge traditional grocers:

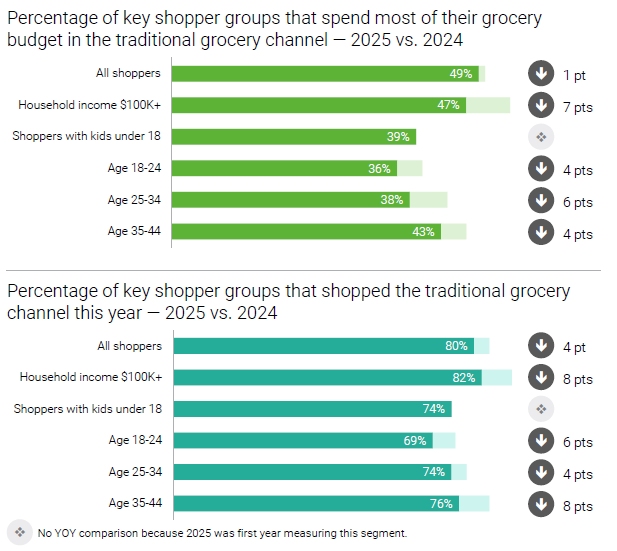

- Younger shoppers, more affluent households, and families with children increasingly spend most of their grocery budgets in other channels.

- Many consumers continue to exercise greater discipline with their budgets even as their confidence has increased and the rate of inflation has eased.

- Tried-and-true pricing and promotion tactics aren't engaging and compelling shoppers like they once did.

All these shifts proceed from the simple fact that consumers at large don't think about groceries the same way they did five years ago. The rules of the game have changed, yet many traditional grocers are still relying on an old playbook.

Market share erosion

The clearest sign consumer preferences have evolved —and that traditional grocery has not followed their lead —is the erosion of market share, particularly among desirable groups including younger shoppers, more affluent households, and families with children.

The data shows that not only are smaller percentages of those groups shopping a traditional grocer as the primary store but that the same holds true overall.

Conversely, channels seeing growth in overall engagement —meaning a greater percentage of consumers visited them in 2025 versus 2024 —include club (from 39% in 2024 to 41% in 2025); discount (38% to 43%); natural (16% to 25%); ethnic and specialty (7% to 11%); and digital retailers (17% to 26%).

Problematic "best practices"

The reason traditional grocery's share continues to decline is that many traditional grocers persist in three strategic decisions that, as the competitive landscape has changed, have contributed to a significant perception disadvantage for the channel.

| Hi-lo Pricing | Private Brand as a Side Project | Marketing Focused on Price |

| Overreliance on promotions as a way to offset high everyday prices creates a dynamic in which, on any given day, a traditional grocer will be exposed as out of touch with the market on hundreds, or even thousands, of items. | While clubs, discounters and specialty stores use private brand to differentiate assortment and create more favorable "apples to oranges" comparisons, traditional grocers too often have little to offer that's unique. | Most traditional grocers can't credibly claim low prices, as the huge global retailers have that market cornered. Yet prices — rather than fresh, quality, service or other attributes — continue to be the centerpiece of most marketing. |

These practices rose to prominence in a different competitive landscape. EDLP players weren't nearly as prevalent, and they tended to be one-trick ponies, with price their strongest selling point by far. All of that has changed, and traditional grocers who want to stay competitive need to change, too.

Consumer priorities

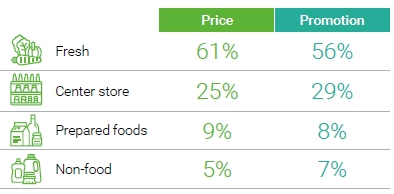

Both for everyday prices and for promotions, fresh is first in the minds of shoppers, with center store a distant second.

What's ahead

In this report, we provide a closer look at how consumer perceptions of price, promotion and value have changed; the variables that have informed those shifts; and the moves consumers are making to maximize value as their spending power remains considerably diminished compared to just a few years ago.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]