- within Transport topic(s)

Looking Ahead to 2025

Regulators will likely continue to focus on junk fees and purported deceptive or nontransparent practices related to student loan servicing. We also anticipate there will be additional actions brought pursuant to the newly implemented Federal Trade Commission (FTC) Impersonation Rule.

Key Trends From 2024

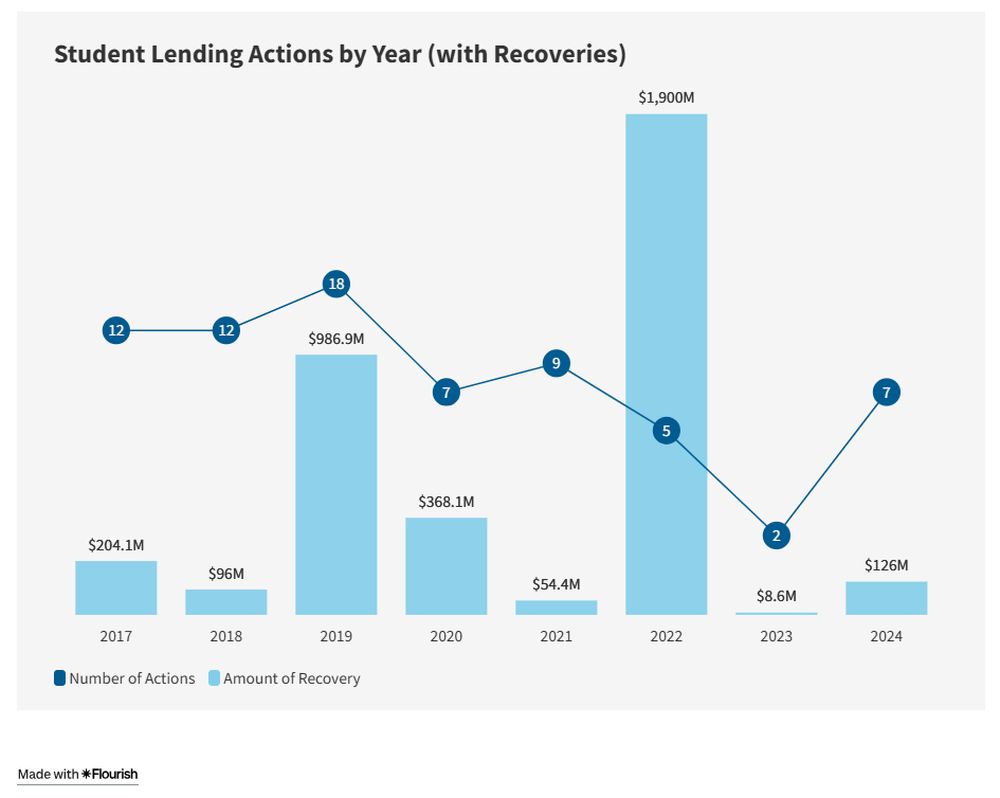

Goodwin tracked seven enforcement actions related to student lending in 2024, a more-than-threefold increase from the two enforcement actions Goodwin tracked in 2023 and a reverse in trend of decreasing volume in enforcement actions in each year from 2021 to 2023. As predicted, enforcement activity increased once the COVID-19-era moratoriums on student loan payments were lifted and payments were due again around October 2023. The tracked actions resulted in total recoveries of approximately $126 million (of which $120 million was recovered in a single settlement), representing a significant increase over the $8.6 million in recoveries tracked in 2023.

The Consumer Financial Protection Bureau (CFPB) was particularly active in 2024, bringing five enforcement actions against student loan servicers and providers. The CFPB has also urged for comprehensive reform of the student loan system, including through advocating for implementation of the Saving on a Valuable Education (SAVE) plan. However, the new administration will likely de-emphasize student loan reform and roll back certain relief programs implemented in the past few years, making it unlikely that the CFPB will continue to devote significant resources toward policing student loan servicers and providers.

In the News

In November 2024, the CFPB released its student loan ombudsman annual report, which analyzed consumer complaints concerning student loans and offered policy recommendations. The CFPB noted that it received more complaints in the one-year period reviewed in the report than in any other period in its history. The CFPB offered a variety of potential explanations for this increase, including consumer confusion and servicer error related to the expiration of COVID-19-era loan forgiveness and moratoriums; servicers' lack of compliance with federal consumer financial law and recent efforts at student loan reform; and consumer confusion and servicer errors surrounding legal challenges to the SAVE plan.

The report highlighted the following categories as representing the most persistent types of consumer complaints: servicer payment processing errors resulting in consumers unable to make timely payments; servicer failure to timely process consumer applications for certain federal programs; servicer delays in processing refunds owed to consumers; inaccurate and outdated credit reporting by servicers; poor communication from servicers and website access issues; and inaccurate billing statements and incomplete payment histories. The CFPB proposed a variety of potential reforms to address these consumer complaints, including requiring remediation be paid; holding harmless borrowers who were unable to timely pay loans due to servicer error; strengthening oversight of and penalties for student loan servicers that violate federal laws or regulations; considering whether the federal government should assume control of student loan servicing; issuing broader student loan cancellation programs, potentially by codifying the SAVE plan; and increasing the use of federal grants.

2024 Enforcement Highlights

CFPB Enters Into $120 Million Consent Order With Navient, Resulting in Navient's Exit From Federal Student Loan Servicing

In September, the CFPB announced that it had entered into a stipulated proposed order with Navient, one of the country's largest student loan servicers, resolving allegations that Navient forced borrowers into costly repayment options. Specifically, the CFPB accused Navient of steering borrowers into forbearance instead of income-driven repayment plans, which allegedly led to increased interest charges. Additionally, the CFPB accused Navient of allegedly failing to tell borrowers in income-driven repayment plans about annual recertification of enrollment in those plans; misallocating payments made by borrowers with multiple loans; harming the credit of disabled borrowers; failing to honor agreements that co-signers of private loans could be released; and failing to honor agreements to provide credit reporting relief if borrowers with defaulted loans completed a rehabilitation program. Under the proposed order, Navient agreed to cease its servicing of federal student loans and pay $100 million in redress to consumers and a $20 million civil penalty.

FTC Files First Action Against Student Loan Debt Relief Companies for Alleged Violation of Impersonation Rule

In June, the FTC announced that it had filed its first federal case under the newly implemented Impersonation Rule, effective as of April 2024. The FTC alleged that various student loan debt relief companies and their owners operated as a common enterprise and, after falsely claiming affiliation with the Department of Education, orchestrated a fraudulent student loan debt relief scheme that cost consumers more than $20.3 million. Specifically, the FTC contends in its complaint that the defendants falsely promised to assume consumers' student loan debt and provide nonexistent loan forgiveness. The FTC further alleges that by impersonating the Department of Education, the scheme's operators illicitly obtained consumers' bank or debit account information, resulting in the extraction of hundreds of thousands of dollars in illegal junk fees. In June, the U.S. District Court for the Central District of California issued a temporary restraining order against the defendants, freezing their assets and prohibiting them from engaging in the conduct alleged during the pendency of the action. The case remains pending as of the date of this publication.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.