- within Insurance topic(s)

Key Takeaways

- Deal activity: While deal count is down 5% on a YTD basis compared to 2024, dealmakers believe the market is improving and transaction activity has the potential to accelerate over the coming months.

- Liquidity: Liquidity remains a key challenge in the private equity industry, with low distributions and extended holding periods. Exits are improving compared to last year but will need to meaningfully increase to work through the current backlog of portfolio companies.

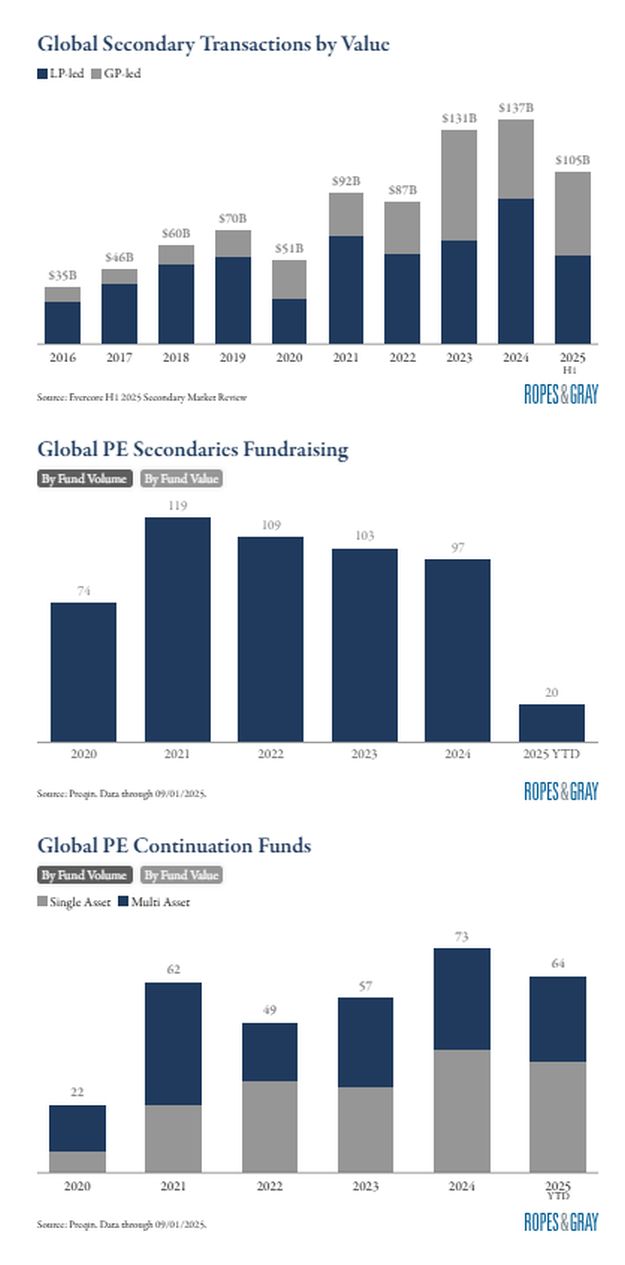

- Secondaries: The secondaries market is off to a record-breaking start, already eclipsing $100B in aggregate transaction value through H1 2025. Growth is expected to continue in the second half of the year, driven by the rising demand for liquidity.

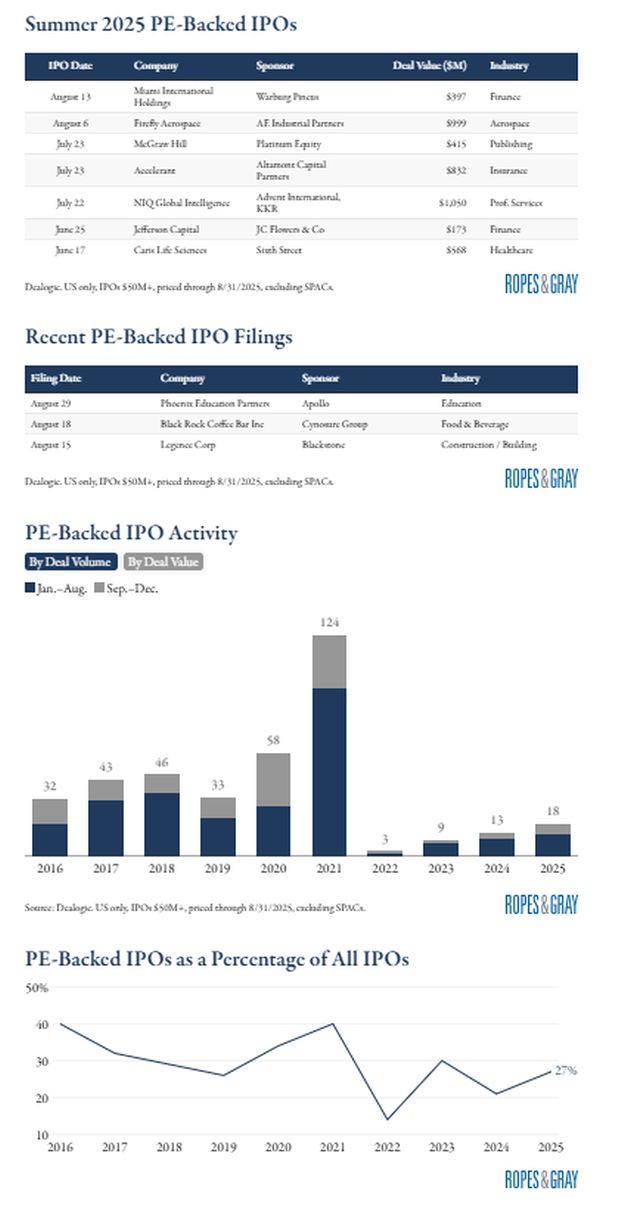

- IPOs: The IPO market had a strong summer and entered fall with a solid pipeline. The private equity-backed IPO market is gaining momentum but still remains below pre-pandemic levels.

U.S. PE Deal Activity

- August activity: U.S. PE deal counts declined for the second consecutive month in August. However, deal values jumped following two months of lower announced values.

- Deal value: Deal value is up 30% YTD through the end of August compared to last year. Over the last few years, the proportion of US PE deals over $1B has been steadily increasing and the number deals with a disclosed deal value over $1B has reached almost 40% in 2025 YTD.

Liquidity

- Distributions: Data shows five-year DPI is the lowest in over a decade, as LPs are waiting longer for capital to be returned.

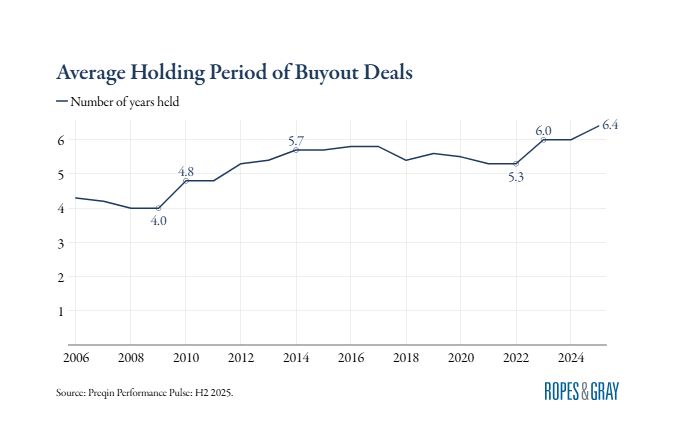

- Holding periods: Average holding periods for buyout deals reached 6.4 years in 2025, reflecting sponsors' preference to delay exits rather than exit at lower valuations.

- Exits: Exits are ticking up compared to last year, but a significant rebound will be needed to return capital and reduce the backlog of portfolio companies awaiting liquidity events.

Secondaries

- Transactions: The secondary market has experienced unprecedented growth in the first half of 2025, with total deal value growing by 42% compared to H1 2024.

- Fundraising: Despite a lower fund count, PE secondaries fundraising is on pace to exceed last year's total.

- Continuation funds: Capital raised for continuation vehicles has already surpassed full year 2024 with both single and multi asset funds experiencing growth.

IPOs

- Summer activity: The summer months between June and August saw seven PE-Backed IPOs across a range of industries.

- Fall pipeline: At the end of August, three PE-backed companies had filed to IPO: Phoenix Education Partners, Black Rock Coffee and Legence.

- IPO market: The PE-backed IPO market is showing strong momentum, though activity remains far below pre-pandemic norms.

Fundraising Trends

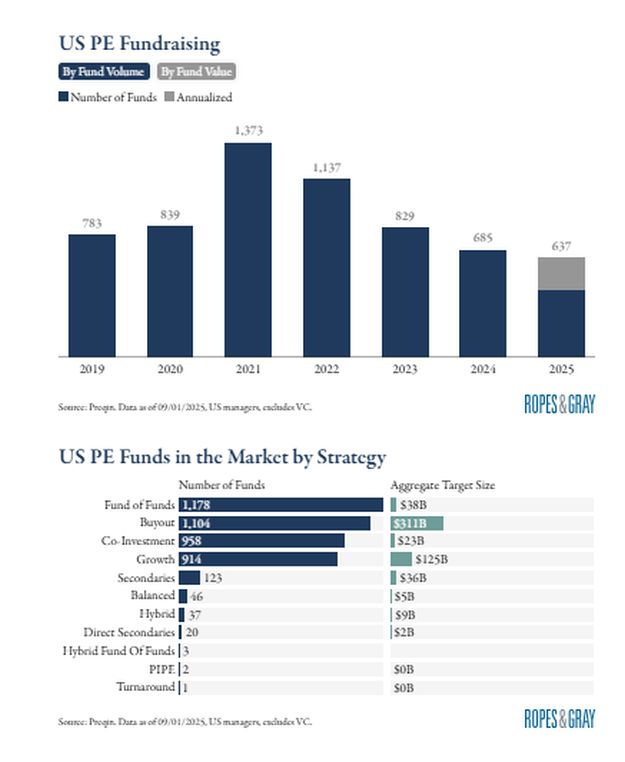

- PE fundraising: US PE capital raised is on track to finish 4% up compared to 2024, while the number of funds closed is on track to finish 7% below last year.

- Funds in the Market: Buyout funds account for 57% of the capital being raised in the market, the largest amount of the sub-strategies, followed by growth funds at 23% of the capital being raised. Secondaries strategies have the largest average fund target size.

Q2 Earnings Recap

- Sentiment: While acknowledging recent market headwinds and volatility, public PE executives expressed confidence on Q2 earnings calls, pointing to various megatrends expected to drive growth and forecasting a pickup in transaction activity.

Growth Drivers

Brookfield

"This opportunity set is large and compelling and is driven by three powerful themes, which we have discussed for years with you: digitalization, decarbonization, and deglobalization. These three Ds are more relevant today than ever before. They have expanded and are converging in ways that are accelerating demand for capital at a global scale."

– James Flatt, CEO

Blackstone

"Our deployment has emphasized areas benefiting from long-term secular megatrends, such as digital and energy infrastructure, digital commerce, private credit, life sciences, and India. These areas have also been among the largest drivers of appreciation in our funds. In particular, the enormous need for debt and equity capital to build the infrastructure powering the artificial intelligence revolution has created extremely positive dynamics for our business."

– Stephen Schwarzman, Chairman, CEO and Co-Founder

EQT

"Mid to long-term, though, the secular growth trajectory remains very much intact...The largest share of the expected growth in absolute terms will continue to come from institutional investors. But the most rapid relative growth will come from the Private Wealth segment."

– Per Franzén, CEO and Managing Partner

Outlook

Blackstone

"Looking forward, importantly, we believe the dealmaking pause is behind us...The environment we see emerging of lower short-term interest rates, less uncertainty, and continued economic growth, combined with a pent-up desire to transact, is the right recipe to reignite M&A and IPO activity. For Blackstone, we have the largest forward IPO pipeline since 2021. These trends should be very favorable for dispositions exiting this year and into next year."

– Jon Gray, President and COO

Ares

"With the potential for lower short-term rates in the US and lower rates already reflected in Europe, coupled with record amounts of private equity dry powder, we're optimistic that transaction activity could accelerate further in the second half of the year. For example, our global pipeline of investment opportunities across all of our investment groups and strategies is at the highest level in over a year."

– Michael Arougheti, Co-Founder, CEO, and Director

A Look Ahead

- Fall IPO window: Several high-profile IPOs are in the pipeline heading into the post-Labor Day fall listing window, including PE-backed companies. Strong sentiment toward the US IPO market is expected to continue through the remainder of 2025 and into 2026.

- Ongoing liquidity crunch: The PE

industry's liquidity bottleneck will likely continue to play

out over the next several years.

- Hugh MacArthur, Global Private Equity Practice Chairman at Bain & Co., commented on this challenge: "We're talking about a 5+ year problem as the GFC was, in order to process all of this liquidity. This is not going to go away in 2025 or 2026. It's going to be continued pressure on the institutional LPs for liquidity over the course of the next several years."

- Wealth / 401k: The August executive order

calling for expanded access to private equity for 401(k) plans and

participants has compounded on ongoing industry initiatives to

increase private wealth offerings and grow retail investor

exposure.

- Firms are seeing growth in fund offerings across asset classes, particularly credit, private equity, and infrastructure funds.

- Industry consolidation: Executives at large PE

firms anticipate a wave of industry consolidation, with scale and

product breadth allowing big players to dominate as smaller firms

risk being squeezed out.

- Consolidation may also play out inorganically through acquisitions, as asset management M&A accelerates, and LPs show strong appetite for GP stakes strategies.

- Regional preference: Several PE firms

including Apollo, CVC, and KKR are optimistic about opportunities

in Europe.

- Europe is boasting attractive underlying deal economics. The lower base rates and spreads in Europe are facilitating access to cheaper and higher levels of debt financing. Buyout multiples in Europe also remain more attractive than in the U.S.

- A recent Preqin survey on investor sentiment showed Western Europe attracting the most investor interest over the last six months, seeing a 12-ppt jump in the proportion of respondents citing it among markets offering the best opportunities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.