- within Insolvency/Bankruptcy/Re-Structuring, Criminal Law and Law Practice Management topic(s)

With funds no longer able to ride the wave of multiple expansion and abundant capital, and new headwinds such as tariffs adding complexity, the pursuit of portfolio company (PortCo) value creation has become a matter of survival for the private equity (PE) industry.

Earlier this year, Alvarez & Marsal (A&M) conducted its annual PE survey across key developed markets, including the US, Europe and Australia, to investigate how the thinking around value creation is changing in this post-boom era.

The survey findings offer a clear picture of that evolution: value creation is no longer about isolated, incremental improvements, often limited to cost-cutting in specific functions. Instead, business-wide transformation – driving change in all aspects of a PortCo's strategy and operations – has become the primary route to PE returns.

FROM PIECEMEAL FIXES TO STRATEGIC RESET

This shift aligns with what A&M's Private Equity team is seeing on the ground. PE funds across developed markets are increasingly pursuing full-scale transformation programmes that combine topline, cost optimisation and working capital initiatives, often powered by AI and data to accelerate execution and impact.

The focus has shifted from piecemeal fixes to strategic reset, where every part of the business, from pricing and product to working capital and service delivery, contributes to bottom-line value creation.

This change in tack is a response to one of the toughest environments for PE funds in recent history. After a half-century of meteoric growth, the industry's challenges keep piling up: attractive takeover targets are scarce, long-held assets are struggling with deteriorating margins and leverage, exits remain harder to come by, and pressure from investors to return capital is intensifying, affecting fundraising.

2025 MID-POINT VIEW: LIFE AFTER TARIFFS

Since we published our value creation reports, the PE landscape has changed slightly. At the height of US tariff uncertainty, prospects for an M&A and exit recovery appeared far more subdued than what they do today.

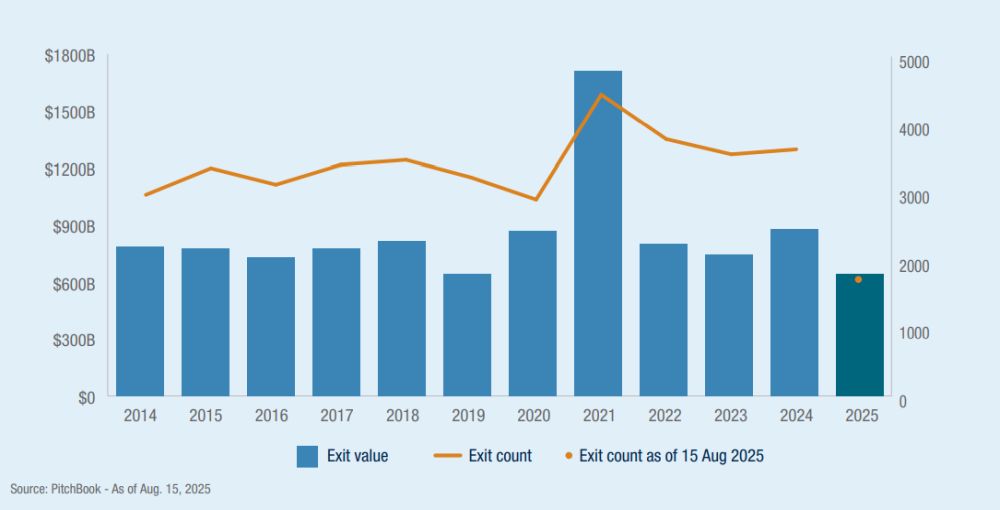

In recent months, exit markets long frozen by macro volatility have started to show signs of life, particularly in North America. So far in 2025, global PE exits have reached $644.4 billion, equivalent to 73% of 2024's full-year total, buoyed by a reopened IPO market and surging public equity valuations in the US. While deal value figures indicate momentum, volume tells a more sobering story, with exit deal count less than half of last year's, and an overall more sluggish IPO picture in Europe.1

M&A activity has also seen improvements, with several big-ticket, sponsor-led transactions injecting greater confidence in the market. However, away from landmark deals, the M&A environment for smaller companies – often less equipped or slower to adjust to macro challenges such as tariffs – remains challenging.

Global PE exits rebound

STRANDED ASSETS REMAIN A CONCERN

Despite these green shoots, PE funds still have a huge backlog of ageing and unsold assets that must be addressed. Many of these PortCos were acquired at premium valuations and with high leverage during the frenzied Covid deal cycle. Since then, they have confronted heavy macro headwinds with little balance sheet cushion, compressing valuations and complicating their path to exit.

In addition, a growing number of PE firms are using continuation vehicles to extend ownership of existing assets, allowing more time for performance improvement, growth, and ultimately, value recovery. Therefore we're seeing General Partners (GPs) on both sides of the pond having to work harder on every line of their PortCo's P&L to find new corners of outperformance. According to our surveys, here's how they are achieving this:

- Transformation at scale: Marginal efficiency

efforts or quick cost take-outs will not solve the profound issues

affecting portfolio companies today: trade shocks, supply chain and

manufacturing disruptions, the rise of AI, to name just a few.

These require business-wide transformation combining high-impact

top line initiatives (e.g. commercial excellence, customer

experience, pricing) alongside cost-out and working capital

optimisation measures. Our survey confirms this trend, with most PE

funds across markets now expanding value creation scopes to include

more comprehensive operational transformation.

Operational transformation is now a priority, with most US and European firms pursuing business-wide initiatives to drive returns.

Revenue growth and cost reduction go hand-in-hand in value creation, cited by 57% of US funds and 46% in Europe as joint top priorities. - Working capital to fund growth: PE firms are intensifying working capital optimisation programmes as a way to self-fund the transformation agenda within their portfolio companies. Through targeted measures – including liquidity account, accounts payable and inventory optimisation, factoring, and sale and lease back – they are releasing trapped cash within the business and reinvesting this capital into initiatives that drive transformation. That approach allows PortCos to generate momentum early in their transformation journeys and deliver results sooner.

- Focus on organic growth: Traditional cost-out programmes are still essential within value creation, but no longer the sole focus of PE firms. They are now focusing on larger scale operational transformations, AI efficiency opportunities, and revenue generation initiatives (pricing, service growth). The increasing importance of organic expansion in light of higher interest rates and challenging exit valuations is consistent across markets, from the US to Australia. Some of the growth-oriented initiatives being commonly pursued include marketing and customer acquisition, pricing optimisation, cross- and up-sell opportunities, and entry into new markets.

- Digital, AI to scale and accelerate results:

Our 2025 surveys show that funds are becoming bolder in how they

deploy technology to drive business value creation. Across

geographies, and particularly in the more mature markets of the US

and Europe, the use of AI in post-acquisition value creation plans

has grown significantly compared to previous surveys, with use

cases expanding beyond back-office efficiency to more strategic

areas such as customer experience, pricing, and product portfolio

strategies.

Notably, data and AI are being leveraged to accelerate large, operational transformations. One example is the analysis of large pools of data combined with prediction models to identify operational improvement opportunities faster and with greater precision. This accelerated "data-to-insight" process is enabling a new generation of transformation programmes that are more targeted, responsive, and scalable across portfolios.

And while many firms are still experimenting, sophisticated use cases within value creation are emerging. In our work with leading PE funds across markets, we are helping clients apply AI tools to reimagine customer journeys, enhance pricing decisions, and boost sales team productivity.

45% of US and 41% of European funds report using AI in value creation, with even higher uptake among large-cap players.

Most common AI applications include data analytics, operational efficiency and customer experience. - Operating partners as catalysts for change:

Another clear insight from our annual surveys is the growing

importance of operating partners in executing value creation plans,

particularly as these become more ambitious. In the US, this model

has reached maturity, with an overwhelming majority of operating

teams directly involved in planning and executing value creation.

Similarly, in Australia, 70% of funds surveyed see operating

partners as the drivers of such programmes.

Operating PE teams ensure that growth plans are realistic and achievable. They bring together the various pieces of the transformation puzzle, ensuring resources are deployed at the right place and at the right time. Their operational expertise to implement change on the ground complements the commercial focus of deal teams. Finally, we observe funds more likely to rely on operating partners than before, as management teams suffer from decision fatigue in a more challenging economic environment.

Footnote

1. https://pitchbook.com/news/articles/5-charts-are-PE-exits-reopening

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.