- within Law Department Performance, Environment and Energy and Natural Resources topic(s)

- with readers working within the Technology industries

What is the Omnibus?

The EU has strategic initiatives including the EU Green Deal, the recently released Competitiveness Compass, and a Simpler and Faster Europe. Today's proposed Sustainability Omnibus Simplification Package draws from each.

The EU Commission is proposing significant changes to the Corporate Sustainability Reporting Directive (CSRD). The Omnibus, noted as a "first series" in its February 26, 2025, release outlines changes that amend a series of directives, delegated acts, and regulations that address sustainability.

This brief focuses on proposed changes to the CSRD. As a reminder, this brief covers the proposal. These changes are not immediately in effect. Adoption process and, in some cases, Member State transposition will be needed.

What Does the Omnibus Package Include?

– A proposal for a Directive amending the CSRD and the CSDDD

– A proposal postponing the application of all reporting requirements for CSRD and the transposition deadline of the CSDD.

– A draft Delegated Act amending the Taxonomy Disclosures and the Taxonomy Climate

– Proposed Environmental Delegated Acts subject to public consultation

– A proposal for a Regulation amending the Carbon Border Adjustment Mechanism Regulation

– A proposal for a Regulation amending the InvestEu Regulation

How would this Impact Compliance Thresholds?

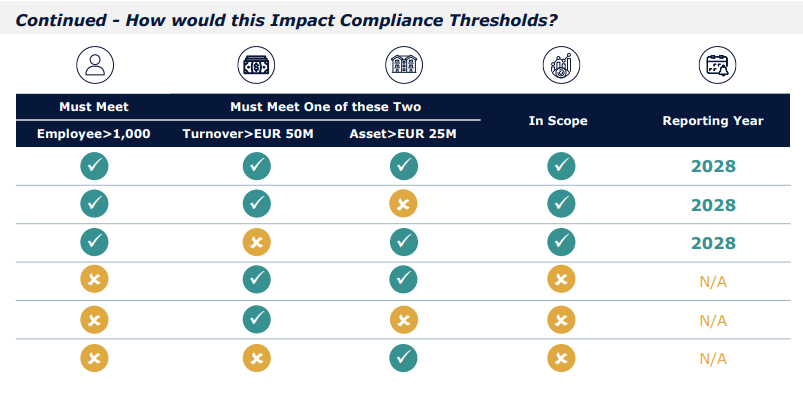

Under the proposed rules, applicability will continue to be considered at the EU entity level, but the definition of a "large undertaking" changes:

‒ Companies with less than 1,000 employees would become out of scope for CSRD

‒ A large undertaking or parent undertaking of a large group must have:

‒ An average of 1,000 or more employees

‒ Turnover above EUR 50 million OR a Balance Sheet above EUR 25 million

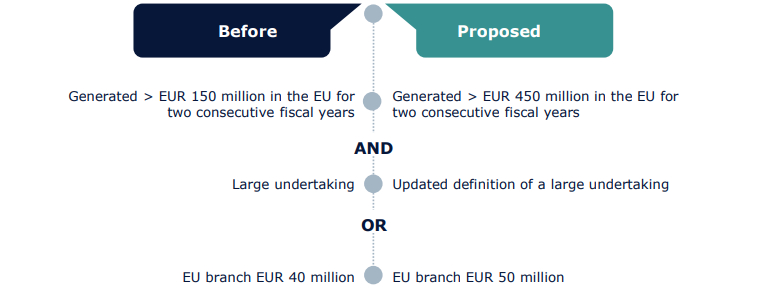

For non-EU companies with operations in Europe, the threshold for enterprise-wide reporting requirements increased from EUR 150 million to net EUR 450 million of turnover generated in the EU. The EU branch threshold also increased to EUR 50 million.

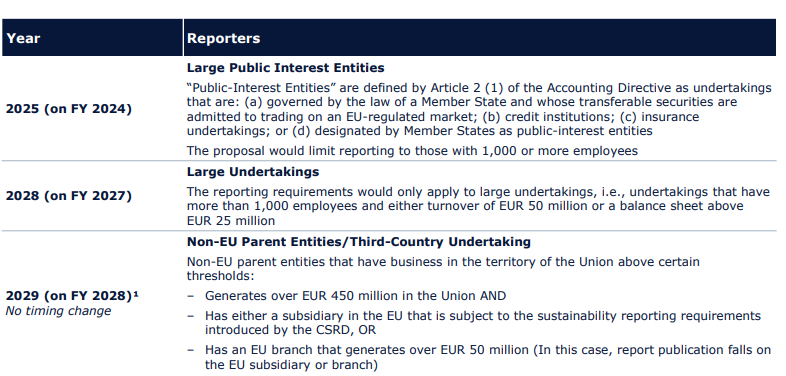

When will Reporting be Required?

The proposal delays reporting of CSRD and CSDDD by two years. The proposal postpones the application of all reporting requirements in the CSRD for companies that are due to report in 2026 (non-listed large EU undertakings in wave 2) and 2027 (listed SMEs in wave 3) only. The proposal aligns with the CSDDD timeline.

The proposal suggests the next wave of required reporting would begin on the fiscal year beginning on or after January 1, 2028, covering the prior fiscal year.

There are no proposed timing changes for non-EU companies' enterprise-wide reporting in 2029.

Proposed Reporting Timing, if the full proposal were adopted

Will Double Materiality Requirements Change?

The proposal reaffirms the principle of double materiality. This means companies must continue to report on both how sustainability risks affect their business (financial materiality) and their impacts on people and the environment (impact materiality).

How does this Impact EU Taxonomy Reporting?

Taxonomy reporting requirements now differ based on company size and the types of disclosures required

1 Those exempt from CSRD are exempt from the related EU Taxonomy reporting classifying sustainable economic activities.

2 Taxonomy reporting offers options for large undertakings or parent undertakings of a large group that have a net turnover of less than EUR 450 million:

– The company is exempt from reporting if no claims are made on activities aligned or partially aligned with the EU Taxonomy

– If claims are made on activities fully or partially associated with economic activities that qualify as environmentally sustainable under the Taxonomy, the company will report on turnover and CapEx (capital expenditures), related to those sustainability activities. Reporting OpEx (operational expenditures) KPIs for sustainability are optional (Opt-in)

3 Large undertakings or parent undertakings of a large group with net turnover of EUR 450 million or more will need to report to EU Taxonomy including turnover (revenue), CapEx, and OpEx KPIs related to sustainable activities

What Other Key Changes are Proposed?

Limited Assurance

The proposal would maintain limited assurance, removing the structure to eventually adopt reasonable assurance. Instead of adopting standards, the Commission would issue targeted assurance guidelines that clarify the necessary procedures that assurance providers are to perform as part of their limited assurance engagement. The guidelines are expected by October 2026.

Sector-specific Standards

Sector-specific reporting standards were eliminated, effectively putting sector-standards permanently on hold

Value Chain Reporting

The CSRD requires reporting on a company's own operations and their value chain. In the proposal, CSRD reporters would be limited to asking non-reporters in their value chain for sustainability information similar to that of the voluntary SME (VSME) standard.

A delegated act is expected to adopt the new voluntary reporting standard.

Will the ESRS Change?

The Commission commits to revising the European Sustainability Reporting Standards (ESRS) with aim to reduce complexity and provide clearer guidance. Changes are expected to revise the first set of ESRS, at the latest, six months after the proposal is effective.

The proposal describes several proposed changes aimed at reducing the number of mandatory data points that companies need to report:

– Removing less important/lower priority data

– Focusing on quantitative data rather than narrative descriptions

– Clearly defining mandatory and optional data requirements

An effort will be made to keep these rules compatible with global sustainability reporting standards. Revisions are expected to provide clearer guidance on how companies decide what information is material. As a result of the revision process, additional changes may be made to the ESRS if necessary.

How will the Proposed Change Impact the SFDR?

The EU approach to sustainable finance introduces an interconnectedness between EU Taxonomy, CSRD, and the Sustainable Finance Disclosure Regulation (SFDR). Companies subject to CSRD reporting also report specific metrics under the EU Taxonomy.

The proposed delay of CSRD reporting for certain companies will automatically postpone their EU Taxonomy reporting, slowing down the flow of sustainability data to financial institutions (e.g., banks and investors) that rely on it to meet their own SFDR reporting requirements.

What is Needed for the Proposal to be Adopted?

The changes captured in this brief are proposed, not final. Both level 1 and level 2 action will be needed to adopt these proposals, loosely similar to U.S. legislative and agency regulatory changes

There are two proposed Directives, one on timing and the other capturing the proposed changes to CSRD and CSDDD. These legislative proposals will be submitted to the European Parliament and the Council for their consideration and adoption. The changes on the CSRD, CSDDD, and CBAM will enter into force once the colegislators have agreed on the proposals and after their publication in the EU Official Journal. The Directive on timing requires EU Member State transposition by December 31, 2025, with the remainder of changes, including the CSDDD, would require transposition by July 26, 2027.

In line with the Communication on simplification and implementation, the Commission has requested that colegislators treat this omnibus package with priority, particularly the postponement of certain disclosures, as they aim to address key concerns identified by stakeholders.

The Commission will finalize changes to its Taxonomy Regulation after receiving public feedback. These changes will become official once the European Parliament and the Council have reviewed and approved them.

What's Next?

The proposal makes reference to several upcoming delegated acts and proposed amendments that will further address specific reporting requirements

– Voluntary Reporting – The Commission will adopt a voluntary reporting standard based on the voluntary standard for SMEs developed by EFRAG (VSME)

– ESRS – Revisions will follow within six months of the proposed changes going into effect. The Commission left space for additional changes following initial revisions

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.