- within Environment topic(s)

Note From the Editor

This year's M&A Report offers a detailed review of the M&A market and outlook, including a breakdown by various geographies and industry sectors. We examine what might be in store with antitrust and CFIUS under the Trump Administration, common purchase price adjustments in financial services transactions, and common takeover defenses.

We also look at considerations in conducting "dual track" M&A and IPO processes and the challenges associated with pursuing pre-IPO acquisitions. Finally, we review trends in VC-backed company M&A deal terms.

The following information is a snapshot of this year's report, we invite you to read the full report and our forthcoming IPO and Venture Capital Reports. Please stay in touch with us by subscribing to Material: WilmerHale's M&A blog and our mailing lists so you can stay up to date on the latest developments related to M&A.

— Joseph B. Conahan, Partner and Co-Chair, Mergers and Acquisitions Practice

M&A Activity

Market Review and Outlook

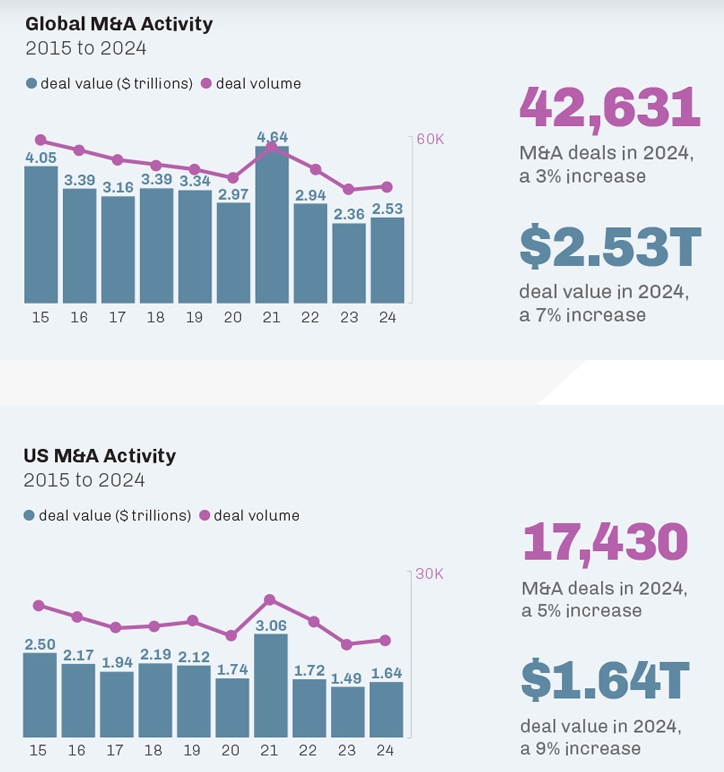

Entering 2024, the anticipation had been that the macroeconomic headwinds that prevailed since 2022 would begin to dissipate, and M&A activity would start to see a resurgence. Instead, continued high interest rates, economic uncertainty, heightened regulatory scrutiny, and the valuation gapbetween buyers and sellers prevailed throughout much of the year, resulting in only a modest M&Amarket recovery that fell meaningfully short of achieving recent historical levels.

Featured Articles

Antitrust and M&A: Is Everything Old New Again?

By Hartmut Schneider, Lauren Ige and John W. O'Toole

Excerpt: With every change in administration, businesses and practitioners wonder what the new administration will mean for antitrust enforcement in the United States. Speculation was at fever pitch four years ago, after Democratic officials expressed the view that antitrust enforcement had languished and needed revival. President Biden's antitrust triumvirate of Federal Trade Commission (FTC) Chair Lina Khan, Department of Justice (DOJ) Antitrust Division head Jonathan Kanter and White House Technology and Competition Policy Advisor Tim Wu promptly initiated aggressive policy proposals and enforcement steps. In the realm of M&A, a general sense that mergers were inherently "bad" seemed to prevail in the rhetoric of some antitrust officials.

CFIUS Under Trump 2.0: Continued Scrutiny of Cross-Border Deals

By Jason C. Chipman and Douglas W. Gates

Excerpt: In 2024, the Biden Administration substantially expanded executive branch power to monitor foreign investment into and out of the United States. First, the administration continued efforts to aggressively police compliance with rules established by the Committee on Foreign Investment in the United States (CFIUS or the Committee). Second, the administration created a new regime regulating certain American investments in Chinese quantum, microelectronic, and artificial intelligence companies. The Trump Administration is unlikely to roll back any of these developments. Indeed, it is more likely that the new Trump team will build on Biden's efforts to aggressively evaluate inbound and outbound investment, particularly with regard to China.

Purchase Price Adjustments in Financial Services M&A Transactions

By Stephanie C. Evans,Andrew P. Alin,and Connor McRory

Excerpt: In most M&A deals involving private targets (including the sales of divisions of publicly traded companies), the purchase agreement will include a baseline dollar value for the target, with several adjustments. Often, the parties will agree upon the enterprise value of the company, and the purchase agreement will provide for both a deduction for the indebtedness and an addition for the cash on hand of the target as of the closing. The agreement will also incorporate an adjustment upward or downward to the extent that the target's net working capital (i.e., current assets minus current liabilities) as of the closing is more or less than an agreed-upon, normalized level of working capital.

View the full 2025 M&A Report Online

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.