- within Law Department Performance topic(s)

- with readers working within the Insurance industries

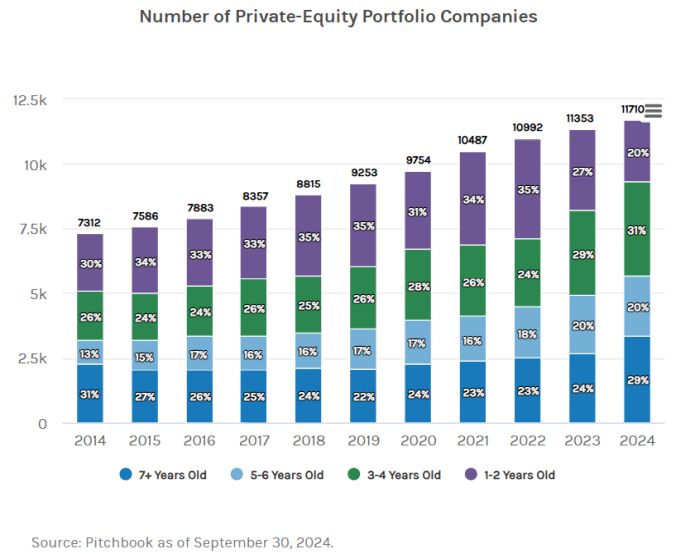

The Pitchbook chart below illustrates that approximately half of all private equity portfolio companies are over five years old, an increase from 44% in 2014.

While this trend toward lengthening hold periods is notable, the focus should be on the number of deals, which has increased from 3,224 in 2014 to 5,709, representing a 77% increase!

Increased hold periods occur for numerous reasons, including lower asset quality, cyclical trends, pandemic impacts that needed to stabilize, or increased interest rates that affected the ideal exit price economics.

When looking at deal and hold period trends within the private equity sector, the ultimate questions will be:

- Will valuations hold up when these deals come to market?

- How much longer can PEG hold onto these assets as LPs are demanding liquidity?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.