- with readers working within the Metals & Mining industries

- within Antitrust/Competition Law, Intellectual Property and Real Estate and Construction topic(s)

In an environment ruled by disruption and uncertainty, M&A volume has soared, private equity firms are streamlining their portfolios, and major corporations are attempting to stabilize enterprise value.

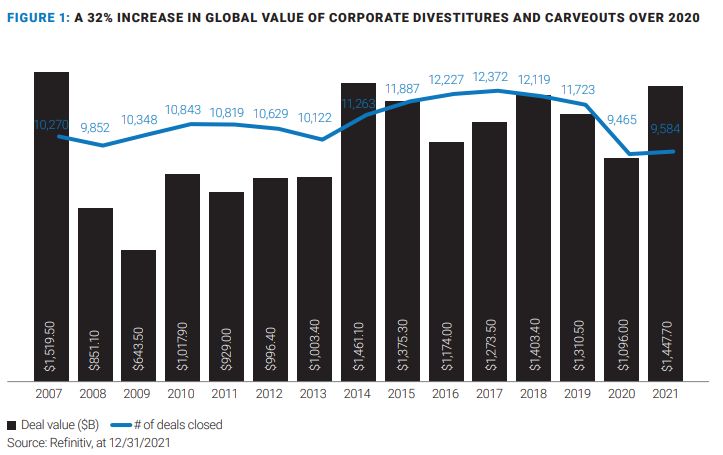

Within that context, we saw the global value of corporate divestitures and carveouts reach over $1.44 trillion in 2021, a 32% increase over 2020, and 2022 is already trending higher than last year

In this dynamic and uncertain market, one common element emerges: The need for speed.

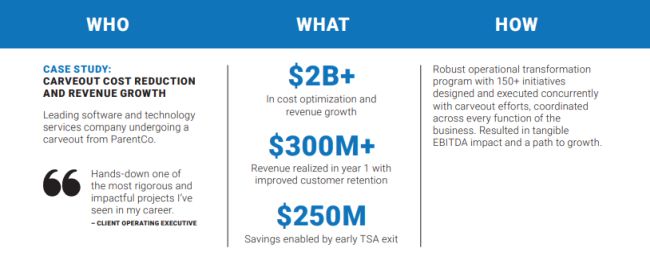

In this article, we highlight an assignment in which AlixPartners helped our client navigate a complex carveout, while simultaneously transforming the business to achieve competitive advantage and revenue growth.

Accelerated value creation in carveouts has become the defining element of their success.

As companies grapple with new realities and expectations framed by recent pandemic fallout, tougher financing, geopolitical instability, and market cautiousness, one thing is certain: accelerating value creation is critical. For both the new company and its investors, there stands a clear expectation for carveouts to emerge from a divestiture as a selfsustaining and formidable enterprise in a market framed by uncertainty. To this end, the modern carveout requires a new approach—one that is more rigorous, well-coordinated, and as rapid as possible.

To achieve acceleration, a successful carveout requires parallel processing of standing up the new company while defining opportunities to gain operational efficiency and effectiveness. This allows leadership to set a clear vision for the new entity while executing to a faster timeline.

When done right, carveouts often provide superior returns vs. standalone acquisitions. And many companies are getting this right by taking advantage of the transaction to proactively address operational inefficiencies and identify opportunities to enhance commercial effectiveness and growth. By taking a holistic approach and setting a clear vision early on, both cost optimization and revenue growth opportunities can be identified and achieved months faster than the competition, translating to significant captured value.

Case in point: A recent client pursuing a carveout: The leadership team of a $20 billion global software and technology services company with declining annual revenue was considering the daunting challenge of divesting from the parent company, standing up an independent business and taking on the seemingly insurmountable challenge of optimizing operations. A traditional approach of optimizing only after standing up the Newco would result in delayed realization of savings and hindered growth opportunities.

Case in point: Leadership decided to work with AlixPartners to define, align, and plan a holistic transformation of the business in parallel with pre-close planning, before Newco hit Day 1 operations. The teams worked closely together and within three months had identified over $800 million in potential efficiencies, and over $1.5 billion in accretive revenue opportunities. The detailed roadmap was in place and ready to execute by Day 1 operations of the standalone company.

Accelerating value creation requires an eye for the quick hits, or immediate opportunities to drive efficiency and effectiveness in the business. Every carveout strategy launched today must answer the question, how do we drive realized value in less than six months? Such 'no-regret' moves may include labor optimization, tactical structural changes, immediate application rationalization, and reorgs that may have been on hold during times of uncertainty. Equally important is an immediate focus on commercial effectiveness—winning companies use this opportunity to re-orient the company to growth.

The expected pace of organizational transformation is faster than ever as a result of bourgeoning digital enablement and operational visibility. Enabled by ever-improving digital and AI (artificial intelligence-based) toolsets, leadership teams can pivot quickly and proactively. What's more, by pursuing a tactical focus on commercial effectiveness and top-line improvements, tangible value can be realized early.

Case in point: When Day 1 of Newco arrived, teams were already mobilized and ready to execute quick hits. Key areas of value included: accelerated TSA exits saving the company over $50 million each month, immediate organizational shifts resulting in hundreds of millions in opex savings, improved renewal sales, and reduced customer churn resulting in several hundred million dollars of accretive revenue, all achieved within the first six months.

Case in point: AlixPartners worked closely with our client to define a tactical and rapid go-to-market strategy that included new pricing, distribution, marketing, sales, and loyalty organizations (enabled by the latest digital toolsets) to achieve early momentum on improved revenue growth. Concurrently, AlixPartners helped our client stand up a new business intelligence capability (a centralized Revenue Win Room approach) to monitor sales force engagement, efficacy of pricing and return on marketing dollars invested, and customer loyalty). Within the first year of standing up Newco, leadership successfully bent the curve on customer attrition, enhanced its customer acquisition, and has consistently exceeded growth expectations.

Today, carveouts are facing shorter timelines and higher expectations to emerge from a divestiture as a successful, self-sustaining enterprise.

Successful leadership teams can focus on several critical factors to make it happen:

- ALIGN LEADERSHIP AND COORDINATE Leadership can use the carveout as an opportunity to transform, and cement top-down executive sponsorship for change while utilizing a centralized transformation management office to coordinate all efforts

- INVEST IN PARALLEL PROCESSING Relating to the carveout planning with the transformation effort by aligning leadership to a shared vision of NewCo, and using this as an opportunity to create a roadmap of change before NewCo Day 1.

- RELENTLESSLY ATTACK TSAs And attack them again. Each month of TSAs translates to lost cash and continued dependency on the parent.

- MAKE COMMERCIAL EFFECTIVENESS A TOP PRIORITY Overcome reticence to disrupt your sales and marketing organizations and target tactical, achievable improvements in commercial effectiveness, such as marketing campaign spend effectiveness, brand awareness, sales productivity, and geo rationalization. All of which can be achieved tactically in well under a year.

- MAKE CUSTOMER SUCCESS A TOP PRIORITY Carveouts can be disruptive to customers, and investing proactively to enhance customer loyalty is a critical step. Deploying digital enablers to gain insight into customer sentiment, and launching targeted programs to reduce customer churn can immediately enhance revenue and stabilize growth.

- INVEST IN PRACTICAL DIGITAL Turn disruption into an advantage by bringing in the latest digital enablers to optimize your operations as you prepare to launch NewCo. Examples include AI tools that provide visibility into sales engagement and productivity, customer sentiment and propensity to churn, automated customer support, and business intelligence to give you better insights on company performance.

- BE BOLD Explore fundamental shifts in the organization, facilities, systems, and third-party spend to come out of this leaner and fit to grow. This is the prime opportunity to obtain assistance from investors and advisors to achieve real change.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]