- within Compliance topic(s)

- in Australia

- with readers working within the Aerospace & Defence, Banking & Credit and Business & Consumer Services industries

- within Compliance topic(s)

- in Australia

- with readers working within the Banking & Credit and Retail & Leisure industries

- within Compliance and Antitrust/Competition Law topic(s)

Key Highlights

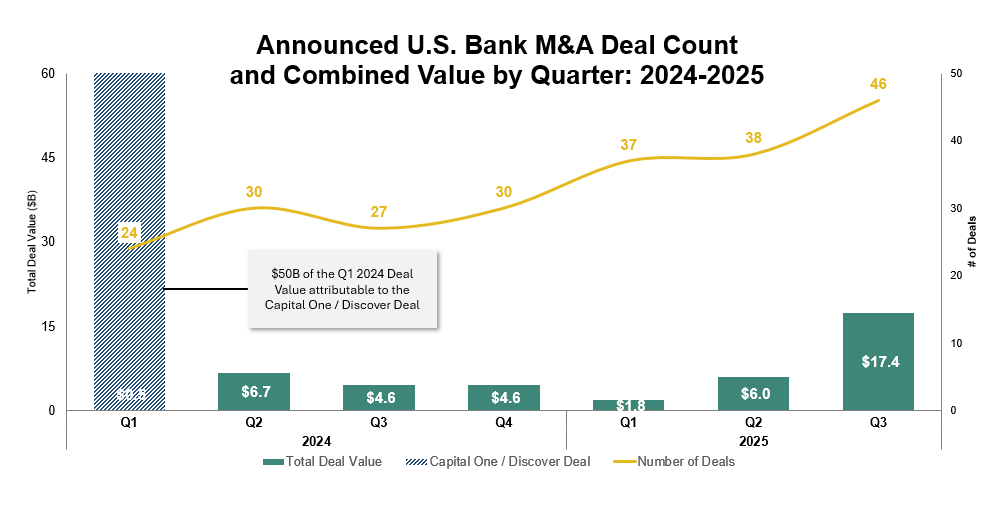

Active Q3: U.S. bank combinations continue to accelerate with 46 transactions announced in Q3 totaling $17.4 billion in total deal value.

Year-over-Year Comparison: Deal activity through September 2025 has surpassed the prior three years' levels both in number of deals and total transaction value (excluding Capital One-Discover).

Market Influences: Macroeconomic tailwinds such as the recent and anticipated future rate cuts from the Federal Reserve System are expected to further boost confidence and ease the valuation challenges that have created friction in the past. Also, a relaxed regulatory environment is expected to help deal fundamentals and execution.

Positive Outlook: The current pace of U.S. banking mergers and acquisitions (M&A) suggests a sustained period of activity. Pro-growth regulatory policies and a more consolidation-friendly environment suggest favorable conditions for a strong finish to the year.

Notable Q3 Transactions

Q3 2025 has seen some significant transactions announced, including:

| Deal Overview |

| Pinnacle Financial Partners and Synovus Financial Corp. combination: Announced on August 21, this $8.6 billion all-stock merger of equals is the largest bank-on-bank deal of 2025. The transaction is set to create a combined entity with over $140 billion in assets, solidifying its position as a leading regional bank in the Southeast. The deal is strategically important for Pinnacle, providing significant scale and a diverse platform to compete more effectively with larger national institutions. For Synovus, the merger offers shareholders a 10% premium and a significant 48.5% ownership stake in the new company, allowing them to participate in its future growth, with CEO Kevin Blair being tapped as president and CEO of the combined entity. |

| PNC acquiring FirstBank: Announced on Sept. 8, this $4.1 billion cash-and-stock deal will significantly expand PNC's presence in high-growth western markets, particularly Colorado and Arizona. The acquisition of FirstBank, a privately held bank with $26.8 billion in assets and 95 branches, is a strategic move for PNC to become the number one bank in Denver in terms of retail deposit and branch share. The deal will more than triple PNC's branch network in Colorado to 120 and increase its Arizona branches to over 70. This transaction is part of PNC's broader strategy to grow its national franchise through both organic expansion and strategic acquisitions, following its 2021 purchase of BBVA's U.S. operations. The deal is expected to close in early 2026. |

| Huntington Bancshares Inc. acquiring Veritex Holdings, Inc.: On July 15, Huntington announced a $1.9 billion definitive agreement to acquire Veritex. This deal is focused on expanding Huntington's presence in high-growth, business-friendly markets in Texas, particularly in Dallas, Fort Worth, and Houston, and is a clear example of strategic geographic expansion. |

| TowneBank acquiring Dogwood State Bank: Announced in early August, TowneBank's approximately $476.2 million acquisition of Dogwood State Bank will expand its presence in North Carolina and provide a platform for further growth in key metropolitan areas. |

| Prosperity Bancshares, Inc. acquiring American Bank Holding Corp.: This $321.5 million deal, announced on July 18, is a strategic move for Houston-based Prosperity Bancshares to enhance its footprint in the Texas and Oklahoma markets by acquiring a bank with a strong commercial lending portfolio and a complementary branch network. |

Themes

M&A Dominates Q2 Earnings Calls

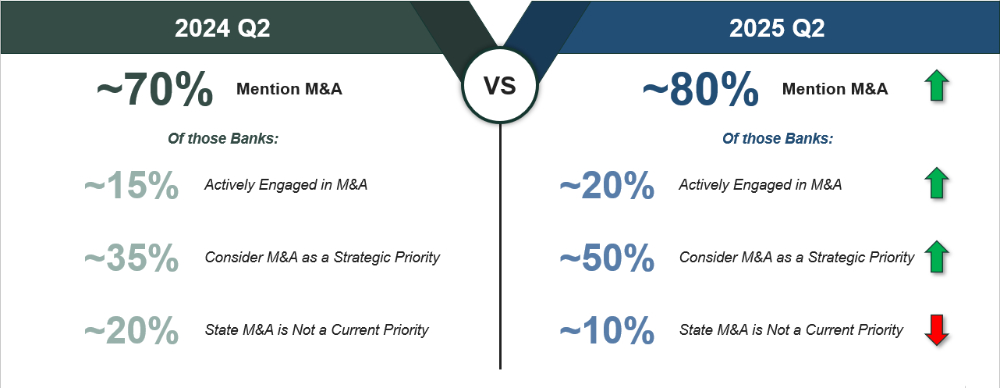

The conversation around banking M&A has undergone a notable change over the past year, shifting from a peripheral topic to a strategic priority for much of the U.S. banking sector. An analysis of Q2 2025 earnings call transcripts from over 100 banks confirms this trend, revealing a significant change in strategic intent compared to Q2 2024.

While the number of banks mentioning M&A rose from 70% to 80%, the more telling metric is the increase in commitment. The proportion of banks explicitly identifying M&A as a strategic priority jumped from 35% to 50%, signaling a decisive move from passive consideration to active planning. At the same time, the share of institutions dismissing M&A as a growth lever was cut in half, falling from 20% to just 10%. This reduction underscores the diminishing reluctance to pursue inorganic strategies.

The decisive shift in sentiment demonstrates that M&A is now a fundamental strategy across the industry. With deal volume increasing, pressure is mounting on banks to either join the consolidation or risk being outmaneuvered.

Two Geographic Strategies Begin to Emerge

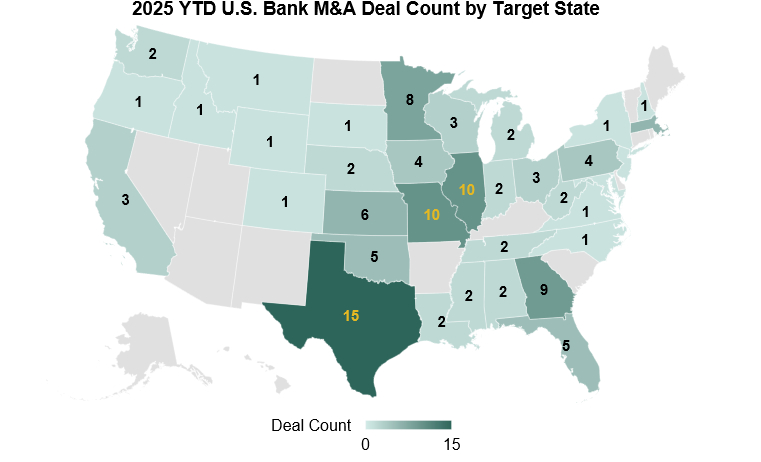

Geographically, U.S. banking M&A activity in 2025 has been concentrated in a few key regions, particularly in the Midwest. Two trends dominate the landscape:

- Larger players buying into high-growth markets, and

- Community banks consolidating for scale.

Texas remains the clear leader with 15 announced deals year to date, with notable activity from larger out-of-state acquirers like Huntington and Glacier Bank seeking a geographic foothold in one of the nation's most attractive, high-growth economies.

In contrast, Illinois and Missouri are examples of markets where community banks are more focused on consolidation for scale. In Illinois, eight of the 10 deals have been in-state, signaling a maturing market where banks are merging to create efficiencies. Missouri's 10 deals all involved community banks under $10 billion, underscoring the pressure on smaller institutions to partner up to remain competitive.

The concentration of activity in Texas and the Midwest underscores the two afore-mentioned strategies: growth-driven expansion in booming regions and efficiency-driven consolidation in mature ones. Looking ahead, we expect these dynamics to persist, with high-growth states continuing to attract out-of-market buyers and community bank mergers accelerating in regions facing cost and technology pressures.

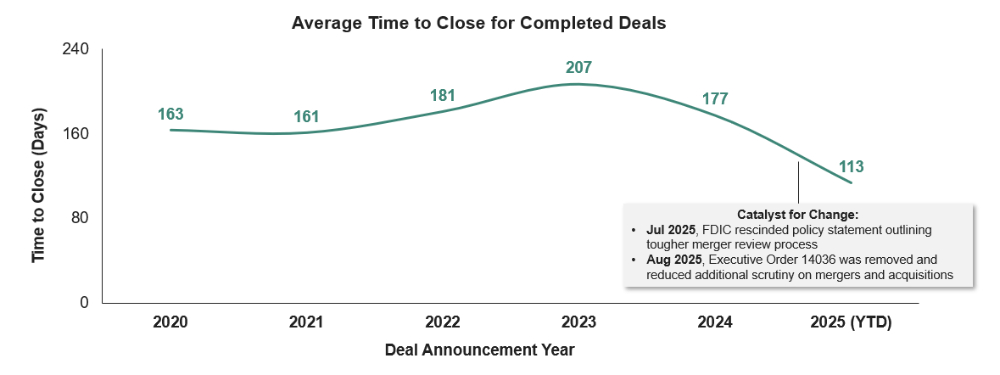

Deregulatory Shift Expedites Closing Timelines

A pivotal shift in bank M&A regulation marked the third quarter of 2025. Key policy reversals have created a more predictable framework, directly accelerating transaction closing times.

In July, the Federal Deposit Insurance Corporation (FDIC) formally rescinded their 2024 policy statement that had outlined a tougher review process for bank mergers and reinstated the more transparent 1998 guidelines. Shortly thereafter, the revocation of Executive Order 14036 signaled an end to the aggressive "whole-of-government" stance against corporate consolidation in favor of traditional antitrust principles. Together with a Congressional Review Act resolution overturning a similar Office of the Comptroller of the Currency (OCC) rule, these policy changes mark a return to a more transparent, principle-based evaluation of bank mergers by the primary regulators.

These recent regulatory adjustments have not only clarified the regulatory framework but also contributed to shortened deal execution timelines. Following a peak in 2023 with increasing delays, there has been a dramatic acceleration in deal closing times. The average time to close for deals announced in 2024 decreased by 30 days compared to 2023. This trend has continued, with the average time at 117 days as of October 2025 — 64 days shorter than the 2024 average. A clearer regulatory environment is boosting dealmaker confidence and restoring predictability and efficiency to the M&A process.

New Wave of Non-Traditional Competitors

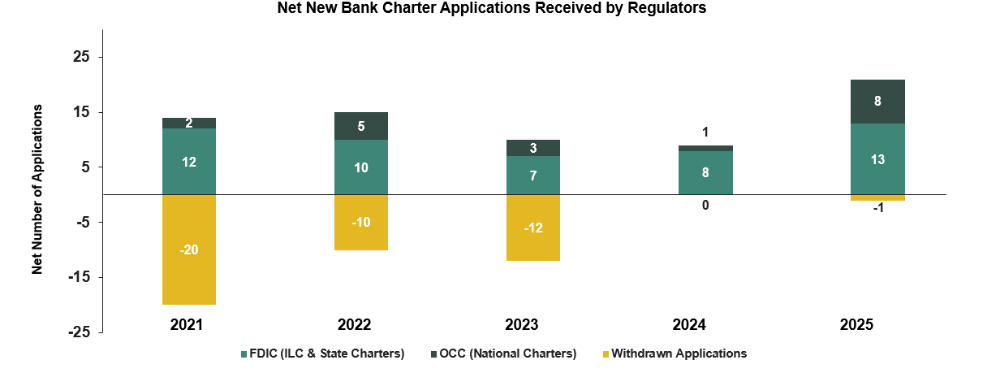

While recent regulatory changes have accelerated M&A activity by reinstating clarity and predictability, they have also opened the door for a new wave of non-traditional competitors to enter the regulated banking system.

From 2021 to 2023, withdrawn charter applications averaged 13 per year, signaling a challenging approval process. As a result, many FinTechs turned to back-door entry by acquiring small banks, such as LendingClub's acquisition of Radius Bank in 2020 or SoFi's acquisition of Golden Pacific Bank in 2022.

The GENIUS Act of 2025 changed this dynamic by creating a clearer path to bank charters and encouraging new entrants into the market. In 2025 so far, there has been one withdrawn application, 21 new filings, and the highest level of OCC national charter activity in four years. FinTechs and other digital-first firms are leveraging the new framework to gain direct access to the federal banking system, rather than relying on acquisitive entry strategies.

Over time, this could slow FinTech-on-bank M&A activity, but it also sets the stage for a more competitive landscape. As these tech-savvy entrants scale, they are likely to become larger and more formidable M&A targets for traditional banks, increasing competitive pressures and influencing future deal strategies across the industry.

Completed Deals

27 deals closed in Q3. A detailed list of these deals, along with primary and secondary reasons, is provided below:

| Ann. Date | Comp. Date | Buyer Name | Target Name | Primary Reason | Secondary Reason |

| 5/29/2025 | 9/5/2025 | The Farmers State Bank of Oakley, Kansas | Kaw Valley State Bank | Geographic Expansion & Market Share Increase | Enhanced Product / Service Offerings & Capabilities |

| 5/28/2025 | 8/15/2025 | PSB Financial Shares, Inc. | First Community Bank | Geographic Expansion & Market Share Increase | |

| 5/16/2025 | 8/6/2025 | First National Bank | Wyoming Bank & Trust | Geographic Expansion & Market Share Increase | |

| 5/12/2025 | 8/27/2025 | Worthington Federal Savings Bank, FSB | Jackson Federal Savings & Loan Association | Geographic Expansion & Market Share Increase | Scale & Efficiency |

| 4/25/2025 | 7/1/2025 | Cadence Bank | Industry Bancshares, Inc. | Geographic Expansion & Market Share Increase | Scale & Efficiency |

| 4/23/2025 | 8/31/2025 | Columbia Banking System, Inc. | Pacific Premier Bancorp, Inc. | Strategic Positioning / Diversification | Scale & Efficiency |

| 4/15/2025 | 9/2/2025 | City National Bank of Colorado City | Citizens Bank NA | Geographic Expansion & Market Share Increase | |

| 4/3/2025 | 9/1/2025 | TowneBank | Old Point Financial Corporation | Geographic Expansion & Market Share Increase | |

| 4/2/2025 | 7/3/2025 | Equity Bancshares, Inc. | NBC Corp. of Oklahoma | Geographic Expansion & Market Share Increase | Strategic Positioning / Diversification |

| 3/31/2025 | 7/1/2025 | FB Financial Corporation | Southern States Bancshares, Inc. | Strategic Positioning / Diversification | Scale & Efficiency |

| 3/31/2025 | 9/2/2025 | Mechanics Bank | HomeStreet, Inc. | Strategic Positioning / Diversification | Geographic Expansion & Market Share Increase |

| 3/21/2025 | 7/1/2025 | BankFirst Capital Corporation | The Magnolia State Corporation | Geographic Expansion & Market Share Increase | |

| 3/13/2025 | 7/16/2025 | Orion Bancorporation, Inc. | Mechanicsville Bancshares, Inc. | Geographic Expansion & Market Share Increase | |

| 3/11/2025 | 7/31/2025 | Bar Harbor Bankshares | Guaranty Bancorp, Inc. | Geographic Expansion & Market Share Increase | Scale & Efficiency |

| 2/27/2025 | 7/11/2025 | Seacoast Banking Corporation of Florida | Heartland Bancshares, Inc. | Geographic Expansion & Market Share Increase | |

| 2/25/2025 | 7/1/2025 | Old Second Bancorp, Inc. | Bancorp Financial, Inc. | Scale & Efficiency | |

| 1/31/2025 | 8/1/2025 | One Community Bank | Intercity State Bank | Geographic Expansion & Market Share Increase | |

| 1/29/2025 | 7/1/2025 | Plumas Bancorp | Cornerstone Community Bancorp | Geographic Expansion & Market Share Increase | |

| 1/18/2025 | 7/18/2025 | Dieterich Bank | Community Bank of Trenton | Geographic Expansion & Market Share Increase | Enhanced Product / Service Offerings & Capabilities |

| 1/10/2025 | 7/23/2025 | CNB Financial Corporation | ESSA Bancorp, Inc. | Geographic Expansion & Market Share Increase | Scale & Efficiency |

| 12/17/2024 | 7/25/2025 | Northwest Bancshares, Inc. | Penns Woods Bancorp, Inc. | Geographic Expansion & Market Share Increase | Scale & Efficiency |

| 12/16/2024 | 9/1/2025 | Berkshire Hills Bancorp, Inc. | Brookline Bancorp, Inc. | Scale & Efficiency | Strategic Positioning / Diversification |

| 12/13/2024 | 8/16/2025 | Heritage Bancshares, Inc. | Fidelity State Bank and Trust Company | Geographic Expansion & Market Share Increase | Scale & Efficiency |

| 12/9/2024 | 7/1/2025 | Independent Bank Corp. | Enterprise Bancorp, Inc. | Geographic Expansion & Market Share Increase | Enhanced Product / Service Offerings & Capabilities |

| 11/27/2024 | 7/1/2025 | The Guilford Savings Bank | Eastern Connecticut Savings Bank | Scale & Efficiency | Geographic Expansion & Market Share Increase |

| 10/23/2024 | 7/1/2025 | Y-12 Federal Credit Union | First State Bank of The Southeast, Inc | Strategic Positioning / Diversification | Geographic Expansion & Market Share Increase |

| 9/25/2024 | 8/1/2025 | Mifflinburg Bancorp, Inc. | Northumberland Bancorp | Scale & Efficiency | Geographic Expansion & Market Share Increase |

Looking Ahead

The U.S. banking M&A market has continued its positive momentum through Q3. The combination of a definitive, more accommodating regulatory environment and the announcement of several multi-billion dollar deals in Q3 suggests a period of sustained and robust activity. The underlying drivers of consolidation remain strong, as institutions seek to acquire scale to compete with larger players, invest in technology, and achieve efficiency gains.

While macroeconomic factors like sustained high interest rates may continue to influence deal valuations, the clarity provided by regulators in Q3 has instilled greater confidence among potential buyers and sellers. This shift, coupled with the strategic imperative to grow and adapt to the digital age, points to a continued healthy environment for bank M&A through the end of 2025 and into 2026. We anticipate that strategic combinations will remain a key growth lever as institutions navigate a dynamic market.

How Ankura Can Help

Ankura plays a crucial role in this process by providing expert guidance and tailored solutions throughout the M&A lifecycle. With deep industry knowledge and experience, our experts assist banks in identifying strategic opportunities, conducting thorough due diligence, and managing post-merger integrations. Our comprehensive approach ensures that banks can maximize synergies, mitigate risks, and achieve desired outcomes, ultimately driving successful M&A transactions that align with their long-term strategic objectives.

Methodology/Data Sources

The M&A transaction data presented in this report is compiled through extensive research of publicly available information. Our dataset includes transactions where either: 1) banks are acquiring other banks; or 2) banks are being acquired by non-bank financial institutions.

Our primary data sources for identifying and verifying these transactions include:

- Public Announcements and Press Releases: We monitor newswires and company-specific press releases for official announcements of M&A agreements.

- Regulatory Filings: Key regulatory bodies provide valuable public information. This includes, but is not limited to, filings with the Securities and Exchange Commission (SEC) for public companies. For financial institutions, we also consult filings with the FDIC, the Federal Reserve, and other relevant state and federal banking regulators.

- Financial News Outlets and Industry Publications: Reputable financial news services and banking industry-specific publications are monitored for reported transactions and market intelligence, which are then cross-referenced with official sources.

- Proprietary Databases and Aggregators: While the core data is derived from public sources, we also leverage and cross-reference information from commercial M&A databases and data aggregators that synthesize publicly available financial and transaction data to ensure comprehensive coverage and accuracy.

Each identified transaction is carefully reviewed to confirm its nature, deal value, participants, and announcement/completion dates, ensuring the integrity of our M&A transaction dataset.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.