- within Environment topic(s)

As alternative lenders scale, most will move from corporate facilities and overdrafts on bank standard forms to consider a "specialty finance" facility.

These facilities offer non-bank lenders their first taste of asset-backed lending and are a valuable tool in the early stages of a specialty lending business.

However, as specialty lending business grow even further, the logical next step is often to "jump" to a securitised warehouse structure (while noting that, for some originators, increasing existing borrowing (by utilising accordion features, bringing in additional senior lenders or new mezzanine lenders) may be more appropriate).

These securitised warehouse facilities are more scalable products offering favourable pricing and providing access to a new market of lenders looking to gain exposure to the originator's products.

This article sets out ten key points of difference between specialty finance and securitised warehouse structures. We hope that it is helpful to those looking to make the jump.

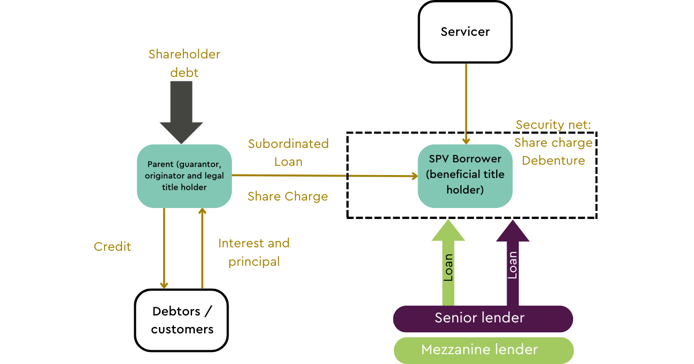

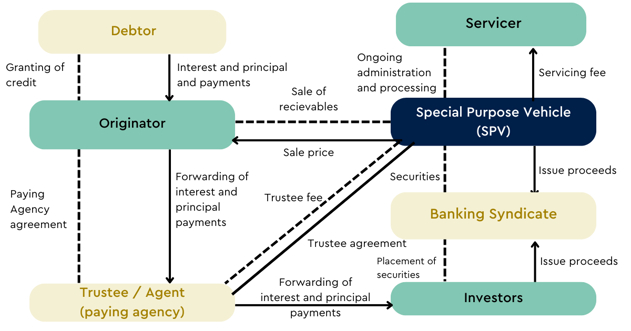

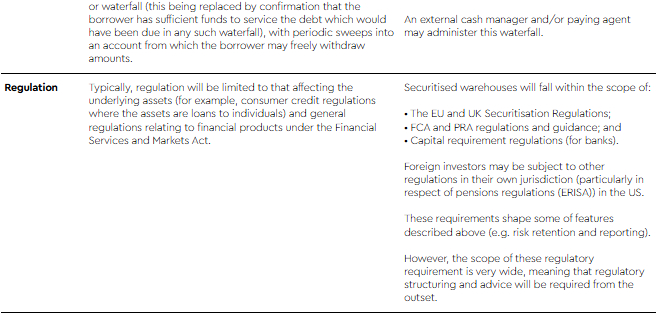

Figure 1: Specialty finance (top) vs securitised warehouse structures (bottom)

Specialty Finance

Securitised warehouse structures

Structure of a typical securitised warehouse

- · As in some (but not all) specialty finance transactions, assets (typically being the beneficial title to loans, with the ability of the transferee to require the transfer of legal title to it) are transferred to a special purpose vehicle ("SPV") that in turn issues notes and/or borrows loan finance from lenders/investors to purchase those assets from the originator.

- The SPV is a standalone entity outside of the originator group. This is a key part of securitisations and ensures that the borrower is 'insolvency remote', meaning that investor returns are wholly dependent on the performance of the receivables.

- The loans/notes issued by the SPV are in different 'tranches', often from senior to junior. These tranches govern the order of payment of receipts from the underlying assets. Each tranche may pay a fixed or floating rate of interest. Often the junior notes are retained by the originator or a member of its group (see further below).

- A trustee and other service providers are engaged to manage the cashflow from the assets and payments to investors, and to hold the portfolio on trust as security for the lenders/noteholders.

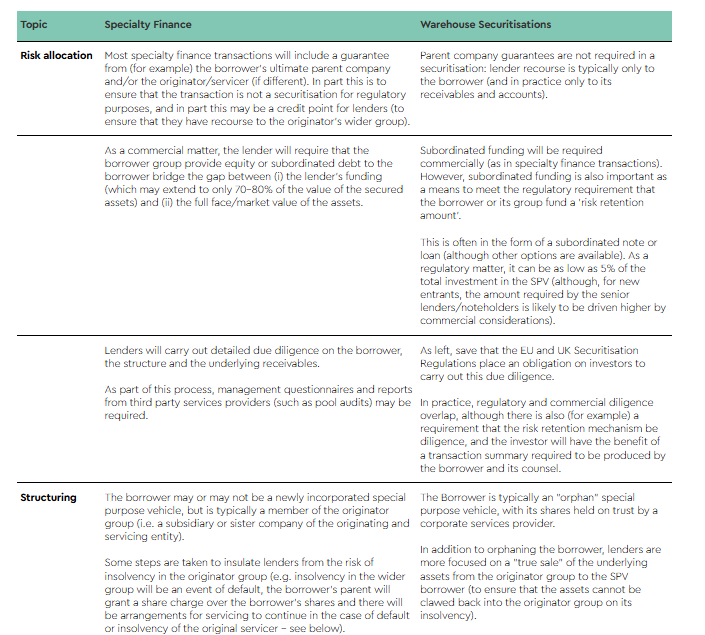

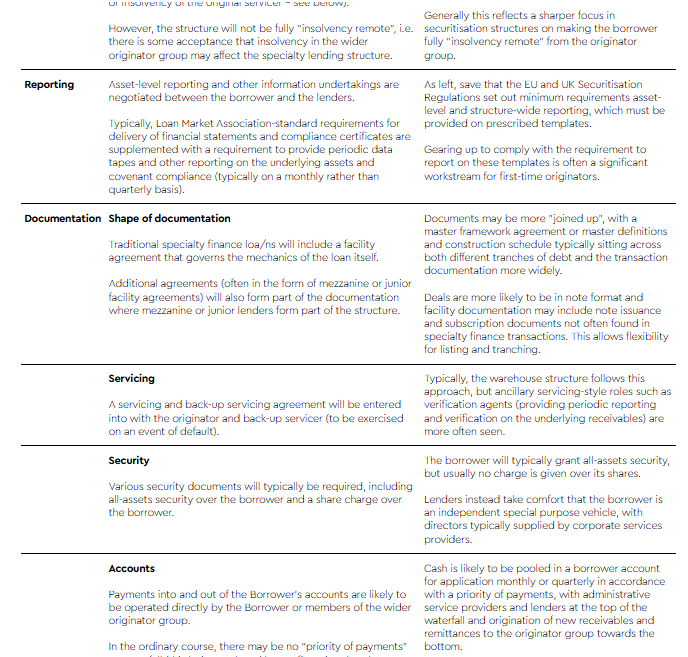

Key differences between specialty finance facilities and warehouse securitisations

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]