The six guideposts

Today, companies around the world stand at the intersection between recession and recovery. Many executives have begun evaluating their business plans and revising their strategies with an eye toward a future that remains uncertain.

How have talent trends changed in the last few years? Has the great recession fundamentally changed the way executives must manage, develop, and engage their employees? What workforce strategies will separate the winners from the losers as we leave the recession behind and move into the new economy? Will an improving economy create a "resume tsunami" as employees seek new opportunities? Has the time come for companies to stop playing defense when it comes to talent and go on offense?

Throughout 2009, Deloitte and Forbes Insights conducted Managing Talent in a Turbulent Economy, a five-part longitudinal survey of high-ranking executives worldwide. This study tracked the way participating executives and talent managers adjusted their workforces and talent strategies to deal with shifting economic forces from the depths of the recession in January 2009 to the first hints of recovery that began to appear in December 2009. The survey series also included a September 2009 special report that surveyed employees and compared their responses to those of the executives. In all, the series surveyed more than 350 employees and collected over 1,600 responses from top executives and talent managers, representing industries across the world's three major economic regions (the Americas; Asia Pacific; and Europe, the Middle East, and Africa).

Based on a full year of in-depth research, Deloitte has identified six key guideposts for executives to consider in their efforts to map out their talent strategies as their companies accelerate into the recovery and confront the challenges of a new — reset — economy. We believe these guideposts can help companies better position themselves for the economic upturn and beyond as they implement strategies to retain their talent and develop the leaders necessary to drive their success.

"When the economy recovers, things won't return to normal — and a different mode of leadership will be required."

– Ronald Heifetz, Alexander Grashow, & Marty Linsky, Harvard Business Review1

1. The problem may look familiar, but the solutions are not

Many surveyed executives seem intent on returning to pre-recession strategies and talent programs — an approach some believe served them well following the 2001-2002 recession.

The results of Deloitte's survey series, along with an analysis of demographic trends in the workforce and technology advances, suggest that relying on old approaches to address new issues may be inadequate for the talent challenges companies face in today's global economy. However, most organizations seem to be playing from their old playbooks.

Today, competition is international, and a company's product development and manufacturing may take place across the globe, meaning companies that do not constantly innovate could be overtaken by competitors. Yet only 39% of executives surveyed report their companies have a talent plan aimed at driving innovation.2

"This was not just a deep economic slowdown that we can recover from and then blithely go back to our old ways....No, this great recession was something much more important. It was our warning heart attack." – Thomas Friedman, Hot, Flat and Crowded 2.03

Similarly, advances in technology have led to the development of ever-more sophisticated and robust workforce planning and analytic tools. Yet two out of three executives surveyed acknowledge that workforce planning is not being integrated at both the corporate and business unit levels when it comes to their annual business planning (69%), their contingency planning (69%), or even being updated as a result of shifting economic conditions (67%).4

Demographic trends, including the impending retirement of growing segments of the Baby Boom generation, are making it more crucial than ever for companies to develop high-potential talent and cultivate future leaders. While the recession may have put retention planning on hold, a significant 20% of executives surveyed acknowledge their companies have not updated their retention plans to take into account a changing economy.5

While some companies are revising their talent strategies coming out of this recession, many are not. Those that continue to look to the pre-recession playbook are failing to use new tools, including the extensive use of workforce planning and modeling. These companies are also missing opportunities to leverage talent to drive innovation and are not investing in leadership programs to build robust pipelines of emerging and senior leaders.

The bottom line: what got you here won't get you there.6

Key question for talent leaders: Have you reset your talent strategy to meet the challenges of today's global economy and to move up the recovery curve?

2. There is a paradox of scarcity amidst plenty

Throughout 2009, global unemployment rates rose dramatically and even reached historic highs, according to the United Nations.7 Given the significant number of people out of work, executives may be tempted to think the talent they need will be readily available when they need it. But Deloitte believes executives who are counting on a "jobless" recovery to fill their talent gaps risk being caught without the skills and leadership they will need to take full advantage of an improving economy.

In the United States, for example, despite 14.9 million unemployed workers,8 there are still approximately 2.5 million jobs for which employers are actively recruiting, but have been unable to fill.9 This skills gap — the gap between job-seeking workers and jobs that go unfilled — is likely to compound as the massive Baby Boom generation moves toward retirement.

For example, right now, approximately 8,000 American Baby Boomers turn 60 every day — an average of330 each hour.10 Many Baby Boom employees may have delayed retirement after watching their IRAs and 401(k)s shrink in value during the recession. The economic recovery promises to revive the trend of Baby Boomers leaving the active workforce — and taking their skills and knowledge with them.

Retirements are not the only potential drain on a company's workforce. Among the executives surveyed in July 2009, 65% expressed concern about losing high potential employees and critical talent to competitors in the year following the recession. Nearly half(46%) recall that voluntary turnover increased following the 2001- 2002 recession. Nevertheless, only 35% have an updated retention plan in place to keep hold of talent as the recovery strengthens.11

Over the last decade companies facing a skills shortage have been able to tap into the vast global talent markets such as China and India. But as Baby Boomers retire and skills grow scarce, there will be no additional Chinas or Indias coming online.

Key question for talent leaders: With Baby Boomer retirements rising and a looming resume tsunami, is your talent pipeline robust enough to deliver critical skills?

3. Companies using the recession as their retention strategy do so at their own risk

Many companies seem to believe their employees have few options in a weak economy — and may implicitly or explicitly communicate that employees should feel lucky to have a job. Rather than implementing a meaningful retention plan aimed at identifying, developing, and retaining key talent, some companies continue to use the recession as their primary retention strategy.

However, when the economy heats up, these companies risk a resume tsunami — where employees with a desire to switch jobs take increased confidence from better times and seek out new opportunities in the talent marketplace. Deloitte's special report on employee attitudes suggests one may be building now.

Among employees surveyed, nearly one-in-three (30%) are actively working the job market and nearly half(49%) are at least considering leaving their current jobs.12 Academic research indicates that 44% of these employees will actually act on these turnover intentions.13

Employers, on the other hand, hardly see what may be coming. For example, only 9% of surveyed executives expected voluntary turnover to increase significantly among Generation X employees in the 12 months following the recession.14

In fact, according to Deloitte's survey results, about one in- five surveyed Generation X employees (22%) have been actively job hunting over the last year and only 37% plan to remain with their current employers. Members of Generation Y also have their sights set on better opportunities, with less than half of those surveyed (44%) reporting they plan to stick with their jobs.15

Sinking morale brought on by layoffs and cost-cutting measures is also an early warning sign of a potential resume tsunami. Of the employees surveyed, 62% said morale had decreased due to cost-cutting measures. More than three out off our (76%) of surveyed employees who intend to leave their current jobs reported lower morale at their companies.16

Employee turnover intentions often lead to lost productivity with employees looking for new jobs, resulting in lower profitability. Voluntary turnover inevitably leads to turnover costs, which represent a significant but poorly understood burden for companies. In the July 2009 survey, 44% of executives reported they believe voluntary turnover actually improves profitability. The fact is, after taking into account the loss of intellectual capital, client relationships, productivity, experience, training investment, and other job skills, plus the cost of recruiting a new hire, we estimate companies can expect the total cost of replacing each lost employee to be two to three times that employee's annual salary.17

These costs may significantly undermine recovery efforts of individual companies desiring to grow, even as the broader economy improves. Moreover, the departure of key employees can create a cascading effect as others follow their lead, compounding costs and the loss of skills.

To counter this, employers must turn from a recession mindset focused on headcount reduction and stretching the current workforce to a proactive retention and strategic recruitment mindset. Employers need to examine how attractive they are to experienced hires as well as to new employees entering the workforce and ensure they are proactively enhancing their employer brand. Failure to do so risks losing critical talent to competitors.

Key question for talent leaders: What are the most effective ways to invest in talent in a world where the workforce is more mobile and quicker to pursue new career opportunities?

4. Understanding your people is as critical as understanding your customers

Deloitte's survey data revealed a striking "tale of two mindsets" when it comes to retention strategies and tactics. While both executives and employees believe that financial incentives are a critical component of any retention plan, the agreement stopped there.

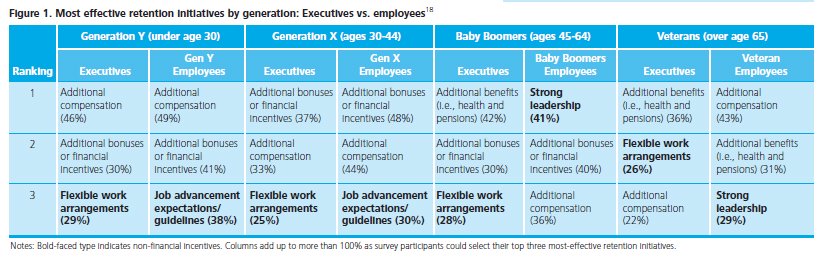

When asked to rank their top three retention tactics, in every instance, employees chose different non-financial incentives than the executives. Many surveyed executives also fail to grasp how different retention strategies appeal to different generations (Figure 1).

Interestingly, corporate leaders who participated in this survey series tended to discount the effectiveness of strong leadership as a retention tool, while both Baby Boomer and Veteran participants ranked leadership highly. Their younger colleagues in Generation X and Generation Y crave greater job advancement expectations and guidelines, but these tactics did not show up when executives were asked.

Understanding your employees' wants and needs is just half the battle. Employers also need to create an effective two-way communication pipeline between themselves and their employees. Survey results suggest many companies still have room for improvement. Engaging in an ongoing dialogue with their workforce can help employers determine which strategies and tools are most effective when it comes to retaining personnel.

Nearly half (48%) of employees surveyed complained that their companies had not communicated effectively about belt-tightening measures during the downturn. Among surveyed employees who intend to leave their job, these grievances were even more pronounced, with 62% citing a lack of communication from executives during the recession. 19 By the end of the survey series, only 35% of surveyed executives felt the need to increase the frequency of employee communication.20

Companies must understand what their employees really want, realign their retention strategies, tactics and priorities to match those goals, and then communicate effectively with their workforce. Companies that can do this effectively will be much better positioned to retain their high-potential employees and future leaders to help them to hit the ground running as the economy continues to recover.

Key question for talent leaders: Do you know what your employees really want and are you tailoring your strategies to address the generational and geographic diversities of your workforce?

5. Show me the money — but show me the love, too!

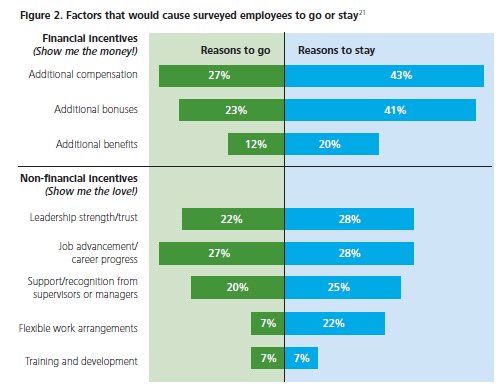

When it comes to keeping talent teams intact, money still talks. In the September 2009 special survey, Deloitte asked employees what top three retention initiatives would persuade them to stay with their current employers. Sure enough, financial factors led the way by a significant 15-point margin, with additional compensation at 43%, additional bonuses or financial incentives at 41%, followed by strong leadership and job advancement expectations at 28% (Figure 2).

However, when asked what factors would cause them to leave their current employers, employees ranked two nonfinancial factors among the top three. In fact, lack of job security (36%) was cited as the primary factor that might induce employees to seek new opportunities, followed by lack of career progress (27%) and lack of compensation increases (27%). Several other factors that employees cited as most effective were non-financial, including leadership strength/trust (22%) and support/recognition from supervisors/ managers (20%) (Figure 2).22

At first glance, this data may appear contradictory, but we believe what employees are saying is quite simple: Money is important, but greater compensation alone is not enough to keep them satisfied in their jobs.

This is particularly true during tough economic times when companies are trying to squeeze more out of their workforces and employees have reached the limit of their ability to take on more work — a reality borne out by Deloitte's survey series. One-in-five employees surveyed cited dissatisfaction with their supervisor or manager as a leading factor that would cause them to leave their jobs.

Others cited excessive workloads (15%) and poor employee treatment during the recession (18%).23 While many employees are crying "uncle," the pressure does not appear to be letting up as companies become addicted to productivity gains. According to our latest data, 36% of executives surveyed are increasingly restructuring jobs to increase efficiencies and 32% are looking for opportunities to redeploy workers to divisions and jobs in higher demand. All of this is taking place at a time when companies are trying to make do with less, with 35% of surveyed executives reporting that reducing headcount remains their top talent priority.24

Both financial and non-financial incentives will continue to be important well into the recovery. When the employees who currently intend to "stay with their employer" were asked what would prompt them to leave in the 12 months following the recession, a combination of both financial and non-financial issues were cited. More than one-third (34%) reported that new opportunities in the market could prompt them to depart, closely followed by a lack of compensation increases (33%). Nearly one quarter (24%) believed a lack of career progress after the recession would lead them to seek new jobs.25

We believe companies that see financial compensation as a "one-size-fits-all" retention strategy are underplaying their hands when it comes to non-financial incentives. Our survey series indicates there is ample opportunity for companies to differentiate themselves in the talent marketplace without significantly increasing overhead or adding to expenses.

Key question for talent leaders: What are you doing to show your employees both the money and the love going into the upturn?

6. Follow the market leaders

Deloitte's survey series revealed several trademark characteristics of talent market leaders. These companies are realigning their retention strategies for the new economy in order to hold onto critical talent, implementing worldclass leadership programs to develop the next generation of corporate leaders, adopting talent strategies that drive and support innovation, and utilizing a broad range of workforce planning tools to forecast talent demands as the economy recovers.

The dilemma: the survey series revealed there are far more followers than leaders.

Retention

A significant number of executives reported that their companies have not updated their retention plans to take into account current economic conditions. So how are those that did, the retention planning leaders in our survey, different from their competitors?

- 50% are stepping up leadership and management development compared to 38% without updated retention plans.

- 41% are implementing new talent programs compared to 19% without updated retention plans.

- 48% are improving on-boarding and orientation programs compared to 28% without updated retention plans.

- 40% are increasing compensation levels compared to 17% without updated plans.

- 35% are creating clear career path opportunities compared to 20% without updated plans.26

These companies are already reaping the benefits of their proactive strategies. Nearly four in ten (39%) report higher trust and confidence in company leadership compared to only 17% of those companies that have not updated their retention plans.27

Leadership

When it comes to leadership, only 10% of the executives surveyed described their development programs as "world class."28 It seems clear to us from the research data that other companies would do well to follow their lead.

While their counterparts are more focused on defensive measures such as further cost cuts or additional layoffs, companies that described their leadership programs as world class appear to be on a talent offensive, positioning themselves to take advantage of the opportunities brought on by an improving economy:

- Two-thirds (66%) are increasing compensation.

- More than half(53%) are opening up new career path opportunities.

- Nearly six in ten (59%) are expanding training and development programs for high-potential employees.

- Strong majorities boast robust senior leadership (85%) and emerging leadership (66%) pipelines.29

In addition to their internal development efforts, these firms are constantly searching the market for the best talent available, with 69% reporting they plan to step up recruitment of critical talent.30

The result? Companies that lead the pack on leadership are experiencing higher morale: 59% report an increase in morale compared to 21% at competing firms. Trust and confidence in corporate leadership is also rising faster — 53% to 21%.31

Innovation

While we believe nearly all companies agree on the need to foster innovation, 61% of the executives who participated in the survey report their firms either have no talent strategy in place to drive innovation or did not know if they had one.32 What strategies are surveyed executives whose firms have innovation plans in place following and how could other companies emulate them?

First, these talent and innovation leaders have identified the critical employees at their companies who drive innovation. Once identified, these employees are able to take advantage of specific innovation training programs and vie for bonuses and other financial incentives tied to innovation.

Talent and innovation leaders are also looking outside the organization by proactively recruiting critical leaders who can drive innovation at their companies. Perhaps most telling, talent and innovation leaders understand they need to "stay paranoid" or risk losing key talent. By nearly a 2:1 margin (22% to 12%), talent and innovation leaders have "very high" concerns about losing high-potential employees to their competitors compared to surveyed executives at companies without talent plans in place to drive innovation.33

Workforce planning and analytics

While nearly every company has been forced to adjust its talent needs to suit the changing economic environment, many companies are not using the most sophisticated tools available to reshape their workforces. According to Deloitte's survey data, only about half(49%) of executives surveyed reported their companies have used forecasting tools to project headcount demand and labor supply.34

In addition to helping companies align their recruiting and retention strategies with workforce trends, these planning tools and analytics can provide insights into other important talent issues. For example, 56% of companies surveyed that are employing workforce planning and analytics are highly (40%) or very highly (16%) concerned that competitors may try to poach high potential talent. Only 31% of those who do not use workforce planning tools have the same concern, with 25% reporting "high concern" and only 6% "very high concern."35

Of the surveyed executives whose companies utilize forecasting tools, 56% are concerned about losing key employees to competitors, compared to 31% at companies which do not use forecasting tools. Perhaps as a result, nearly four in ten (39%) of organizations relying on predictive modeling and other tools are ramping up recruitment of hard-to find leaders, compared to only 24% of companies that do not use forecasting tools.36

Key question for talent leaders: Do you know what it takes to stay ahead of your competitors in retaining critical talent, developing new leaders, implementing workforce planning, and driving innovation?

Most industries over the span of five to ten years go through a period of growth (hire, hire, hire) and then, when the economy turns, are forced to make large adjustments (fire, fire, fire). Th is yo-yo effect can have devastating consequences, not only to a company's balance sheet and morale, but, more important, to shareholder value.

– John Houston & Russell Clarke, Workforce Management37

Setting your sights on Talent 2020

We believe our full year's worth of survey results help point the way toward an effective talent strategy. Forward-thinking talent executives are going on offense, moving past the great recession and embracing talent plans that will position their companies for the challenges of a new economy. These plans include strategies tailored to different generations and include both financial and non-financial incentives closely aligned with the needs and desires of employees. We recommend companies consider our six guideposts in their efforts to map out their talent strategies and gain an edge in what promises to be an increasingly competitive talent market into the recovery and beyond.

Key questions for Talent 2020

Forward-thinking talent executives are focusing on both the immediate horizon and implementing strategies for the long term. We believe company leaders should answer the following key questions to help them reset their talent plans for the next year and into the next decade:

1. How will you take advantage of the continuing globalization of the talent market?

2. Do you know your critical leaders and most critical talent? Is your talent pipeline robust enough to deliver these critical skills?

3. What are the most effective ways to invest in talent in a world where the workforce is more mobile and quicker to pursue new career opportunities?

4. Do you know what your employees really want (are you asking them?) and are you tailoring your strategies to address the generational and geographic diversity of your workforce?

5. What are you doing to show your employees both the money and the love? Is your employer brand as clear to your employees as your product brand is to your customers?

6. Are you a talent management leader or laggard? Do you know what it takes to stay ahead of your competitors in retaining critical talent, developing new leaders, implementing workforce planning, and driving innovation?

7. Are you creating clear career paths for employees at all levels?

8. Have you aligned your leadership development programs with your long-term business goals?

9. Are your talent processes and technologies designed to grow and scale with your long-term business goals?

10. Do you know the real impact of talent retention and voluntary turnover on your bottom line? As the economy improves, will you be a victim or a beneficiary of the resume tsunami?

Footnotes

1 Heifetz, R.A., Grashow, A., & Linsky, M. Leadership in a (permanent) crisis, Harvard Business Review, July-August 2009.

2 Managing talent in a turbulent economy: Leaning into the recovery, November 2009, Deloitte Consulting LLP.

3 Friedman, T.L. Hot, flat, and crowded 2.0: Why we need a green revolution—and how it can renew America. 2nd ed. New York, NY: Picador, 2009.

4 Managing talent in a turbulent economy: Playing both offense and defense, February 2009, Deloitte Consulting LLP.

5 Managing talent in a turbulent economy: Clearing the hurdles to recovery, July 2009, Deloitte Consulting LLP.

6 Goldsmith, M. What got you here won't get you there. 1st ed. New York, NY: Time Warner Books, 2007.

7 "Global unemployment hits highest levels on record, warns UN labour agency." United Nations News Service, January 27, 2010.

8 U.S. Bureau of Labor Statistics, February 2010.

9 U.S. Bureau of Labor Statistics, December 2009.

10 Oldest Baby Boomers Turn 60!, U.S. Census Bureau, January 3, 2006.

11 Managing talent in a turbulent economy: Clearing the hurdles to recovery, July 2009, Deloitte Consulting LLP.

12 Managing talent in a turbulent economy: Keeping your team intact, September 2009, Deloitte Consulting LLP.

13 Griffeth, R.W., Horn, P.W., & Gaertner, S., A metaanalysis of antecedents and correlates of employee turnover: Update, moderator tests, and research implications for the next millennium. Journal of Management, 26, 2000.

14 Managing talent in a turbulent economy: Clearing the hurdles to recovery, July 2009, Deloitte Consulting LLP.

15 Managing talent in a turbulent economy: Keeping your team intact, September 2009, Deloitte Consulting LLP.

16 Ibid.

17 Ibid.

18 Ibid.

19 Ibid.

20 Managing talent in a turbulent economy: Where are you on the recovery curve?, January 2010, Deloitte Consulting LLP.

21 Managing talent in a turbulent economy: Keeping your team intact, September 2009, Deloitte Consulting LLP.

22 Ibid.

23 Ibid.

24 Managing talent in a turbulent economy: Where are you on the recovery curve?, January 2010, Deloitte Consulting LLP.

25 Managing talent in a turbulent economy: Keeping your team intact, September 2009, Deloitte Consulting LLP.

26 Managing talent in a turbulent economy: Clearing the hurdles to recovery, July 2009, Deloitte Consulting LLP.

27 Ibid.

28 Managing talent in a turbulent economy: Where are you on the recovery curve?, January 2010, Deloitte Consulting LLP.

29 Ibid.

30 Ibid.

31 Ibid.

32 Managing talent in a turbulent economy: Leaning into the recovery, November 2009, Deloitte Consulting LLP.

33 Ibid.

34 Managing talent in a turbulent economy: Playing both offense and defense, February 2009, Deloitte Consulting LLP.

35 Ibid.

36 Ibid.

37 Houston, J., & Clarke, R. Making the case for more effective workforce planning, Workforce Management, January 2010.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.